RIA Performance Metrics: Keep an Eye on Your Dashboard

Series III Jaguar XJ6 – a cat that used at least one of my nine lives

A persistent truth about investment management is that no analyst ever saw a piece of information he or she didn’t want. Professional investors are, by their very nature, research hounds – digging deep into a prospective investment’s operating model, financials, competitive landscape, management biographies, and whatever else might be relevant to try to evaluate the relative merit of buying into one idea instead of another. This same diligence doesn’t always extend to practice management, though, and we are not infrequently surprised at how little attention management teams at RIAs devote to studying their own companies.

I was pondering this vexing irony recently during a long family road trip. My older daughter is sixteen and wanted to do her part of the driving, which her mom and I were happy to oblige. That said, sitting in the passenger seat is somewhat unnatural for me, and I couldn’t stop nervously looking over at the speedometer as it crept five, seven, ten, twelve miles per hour over the speed limit. It didn’t help knowing that my daughter is related to me.

When I was sixteen, a friend of my parents came over for dinner in his new Jaguar XJ6. It was British Racing Green, with biscuit leather seats and wool carpet that smelled like the countryside west of London where Wilton sheep still graze among stone-circles built by Druids. This was the 1980s, and there weren’t many fast cars made at the time – especially sedans. The Jaguar had four doors, but it also had the same motor derived from the XK series of the 1950s and 60s, a low center of gravity, and a set of Pirelli racing tires. I was enthralled. “Wanna drive?” He didn’t have to ask twice.

Off we went into the Georgia summer evening, looking for uninhabited roads with long straight-ways. “You can wind her out some if you want to; she stays pretty stable at speed.” She did, and before long we were approaching triple digits. I couldn’t stop staring at the speedometer, pondering my good fortune at knowing an enabling adult with a new Jaguar – my dream (or at least one of them). The XJ6 could do about 135 mph, but we topped out just shy of 120 before a reasonably sharp curve and a bridge appeared in front of us, and I had to back off the right pedal. “We’ll do this again sometime when you can really open her up,” I was told. Good thing that never happened, and also good that another friend of my parents, who drove a Ferrari, never offered the same.

Looking back on my first experience with speed I’m struck by two things: 1) my parents’ friend was remarkably calm given the circumstance, and, 2) I was far too fixated on the dashboard instead of the road. Most XJ6 owners are well served to keep an eye on the engine temperature gauge, but anyone traveling north of 100 mph only needs to be looking at one thing: the road ahead.

RIA teams, by contrast, seem inclined to the opposite. If the “road ahead” for an RIA is the financial markets, and the dashboard offers a read on the firm’s internal performance, it seems like many investment managers never look down.

Gauging performance for an RIA is often thought of in terms of the portfolio, particularly for product companies that specialize in particular strategies. But even though performance, in theory, should drive AUM flows, capital markets are fickle, and so can be customer behavior. So we prefer to start with a decomposition of AUM history, and then explore the “why” from there.

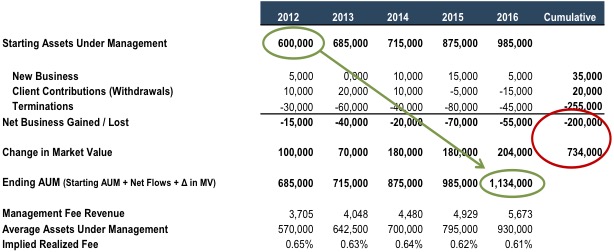

Consider the following dashboard that breaks down the revenue growth of an example RIA. Over a five year period, this RIA boasted aggregate revenue growth of more than 50%, increasing from $3.7 million to $5.7 million. AUM growth was even more substantial, nearly doubling from $600 million to over $1.1 billion.

Looking deeper, though, we notice a couple of unsettling trends. The five year period of measurement, 2012 through 2016, represent a bull market from which this RIA likely benefited substantially. Cumulative gains from market value were over $700 million, more than the total growth in AUM and masking the loss of clients over the period examined. Markets cannot always be counted on for RIA growth, so client terminations, totaling $285 million over the five year period or nearly half that of beginning AUM in 2012, is cause for concern. This subject RIA only developed $35 million in new accounts over five years, and we notice what appears to be an accelerating trend of withdrawals from remaining clients.

Further, there appears to be loss in value of the firm to the marketplace. Realized fees declined four basis points over five years. Had the fee scheduled been sustained, this RIA would have booked another $372 thousand in revenue in 2016, all of which would have dropped to the bottom line. Pre-tax margins would have been almost seven percentage points higher. Small changes in model dynamics have an outsized impact on profitability in asset management firms, thanks to the inherent operating leverage of the model. But the materiality of these “nuances” can be lost in more superficial analysis of changes in revenue.

So, we would ask, what’s going on? Did this RIA simply ride a rising market while neglecting marketing? Are clients concerned about something that is causing them to leave? Does this RIA suffer from more elderly client demographics that accounts for the runoff in AUM? If the RIA handles large institutional clients, did some of those clients rebalance away from this strategy after a period of outperformance? Is their realized fee schedule actually declining, or is it not? Is the firm negotiating fees with new or existing clients to get the business? Did a particularly lucrative client leave? What is happening to the fee mix going forward?

Decomposing changes in revenue for an investment management firm can prompt a lot of questions which say more about the performance of the firm than simply the growth in revenue or AUM. Yet when we ask for this information from new clients, it isn’t unusual for us to hear that they don’t compile that data. All should. Some teenage drivers pay too much attention to the dashboard, some RIA managers not enough. The risk to both is the same: ending up in the ditch.

RIA Valuation Insights

RIA Valuation Insights