RIA M&A Q3 Transaction Update

RIA M&A Activity Continues to Reach Record Highs

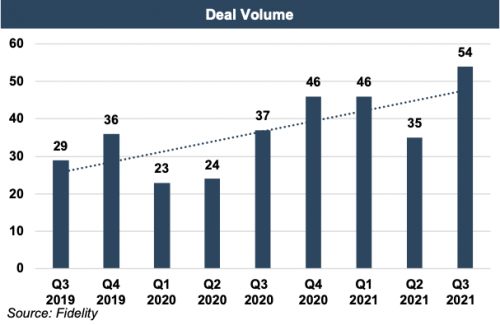

Despite the dip in the second quarter of 2021, RIA M&A activity continues to reach record highs putting the sector on track for its ninth consecutive year of record annual deal volume.

The same three demand drivers discussed last quarter persisted throughout the third quarter of 2021: (1) secular trends, (2) supportive capital markets, and (3) looming potential changes in the tax code. While fee pressure in the asset management space and a lack of succession planning by many wealth managers continues to drive consolidation, looming proposals to increase the capital gains tax rate has accelerated some M&A activity in the short-term as sellers seek to realize gains at current rates. Increased funding availability in the space has further propelled deal activity as acquisitions by consolidators and direct private equity investments increased significantly as a percentage of total deals during the recent quarter.

Private Equity Drives RIA M&A

We’ve written extensively on the prominence of acquisitions by private equity backed consolidators in the RIA industry. Over a decade of rapid growth and persistent profitability has established a class of RIAs with institutional scale as well as an influx of new entrants. According to a recent study by McKinsey, in 2020 there were 15 retail-oriented RIAs eclipsing $20 billion in AUM while approximately 700 new RIAs were started annually over the past five years. This dynamic of a handful of large, financially mature firms surrounded by a highly fragmented market has attracted immense buying activity from private equity sponsors looking to leverage the number of established firms with expertise and scale available to acquire lower valuation, high growth RIA firms in the earlier stages of development.

… a handful of large, financially mature firms surrounded by a highly fragmented market has attracted immense buying activity from private equity sponsors

Three-quarters of Barron’s 2020 top 20 RIAs are owned by private equity firms or other financial institutions. Notable examples such as Focus Financial (backed by Stone Point Capital prior to IPO), HighTower Advisors (Thomas H. Lee Partners), Wealth Enhancement Group (TA Associates), and Mercer Advisors (Oak Hill Capital Partners) accounted for an outsized share of total deal volume during the third quarter of 2021, and the percentage of total acquisitions made by consolidators increased from 50% to over 70% of all transactions in the past quarter. Direct investments in the third quarter also reached an all-time high for a total of 12 transactions. Such interest from private equity backed buyers continues to support high valuation multiples.

2021 RIA-to-RIA transactions as a percentage of total deal volume is expected to be at a ten-year low largely due to the increase in acquisitions made by consolidators and private equity direct investments. Increased competition for deals favors consolidators who have dedicated deal teams, capital backing, and experience to win larger transactions, and even multiple large transactions simultaneously. The trend is evidenced by increased AUM size per deal, which is on track to reach a record high for the fourth consecutive year. While this is partially a result of increased AUM due to strong market performance, Echelon Partners notes that the persistent increase is also likely due to the deep pocketed supply of capital by sophisticated buyers which has caused demand for acquisitions to outpace the supply of firms looking to sell.

While systemic factors continue to be a primary driver of RIA deal activity, the surge in acquisitions made by financial buyers has led some to question the sustainability of recent M&A highs. Notably, while deal volume increased to record levels in September 2021, investor sentiment for RIA consolidators was mixed during the same period as investors have expressed concern about rising competition for deals and high leverage which may limit the ability of these firms to continue to source attractive deals in the future. Private equity buyers, and consolidators acting as private equity portfolio companies, are motivated by investment opportunity. As financial buyers flock to opportunities, they drive up valuations and simultaneously diminish IRR. Recent private equity and consolidator interest in the UK market exemplifies the saturated valuations in the U.S. market as buyers have begun to seek out cheaper entry points abroad.

The RIA industry remains highly fragmented and growing.

While deal volume has continued to reach new highs for nearly a decade now, there continues to be ample supply of potential acquisition targets (although not all of these firms are actively looking to sell today). The RIA industry remains highly fragmented and growing with over 13,000 registered firms and more money managers and advisors who are capable of setting up independent shops. Systemic trends and strong buyer demand will likely continue to bring sellers to market, and for now, there are no signs that momentum in deal activity is stalling anytime soon.

What Does This Mean for Your RIA Firm?

- If you are planning to grow through strategic acquisitions, the price may be higher, and the deal terms will likely favor the seller, leaving you more exposed to underperformance. That said, a long-term investment horizon is the greatest hedge against valuation risks. As discussed in our recent post, RIAs continue to be the ultimate growth and yield strategy for strategic buyers looking to grow their practice or investors capable of long-term holding periods. RIAs will likely continue to benefit from higher profitability and growth compared to broker-dealer counterparts and other diversified financial institutions.

- If you are considering an internal transition, there are many financing options to consider for buy outs. A seller-financed note has traditionally been one of the primary ways to transition ownership to the next generation of owners (and in some instances may still be the best option), but bank financing can provide the selling partners with more immediate liquidity and potentially offer the next-gen cheaper financing costs.

- If you are an RIA considering selling, valuations stand at or near historic highs with ample demand from buyers. That said, it is important to have a clear vision of your firm, its value, and what kind of partner you want before you go to market. A strategic buyer will likely be interested in acquiring a controlling position in your firm with some form of contingent consideration to incentivize the selling owners to transition the business smoothly after closing. Alternatively, a sale to a patient capital provider can allow your firm to retain its independence and continue operating with minimal outside interference. Sellers looking to leverage the scale and expertise of a strategic partner after the transaction may have many buyers to choose from.

RIA Valuation Insights

RIA Valuation Insights