RIA M&A Q4 Transaction Update

Aggregators Continue to Drive Deal Volume in 2021

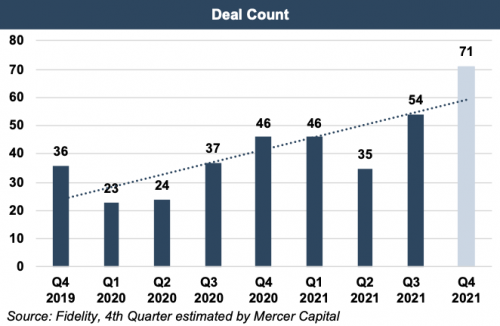

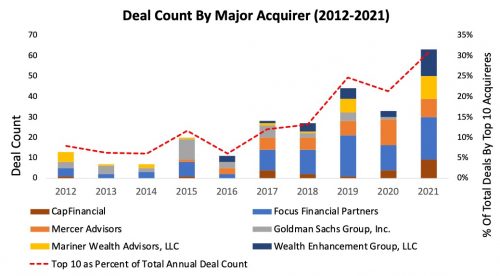

Deal count is projected to reach new highs in the fourth quarter of 2021 as market activity continues to gain momentum, likely rounding out another record-breaking year for the RIA industry. In keeping with the rest of 2021, deal volume was driven by secular trends and supportive capital markets. As market activity remains robust, competition for deals continues to favor RIA aggregators such as Mercer Advisors, Mariner Wealth Advisors, Wealth Enhancement Group, and Focus Financial Partners (FOCS), to name a few.

The RIA aggregator model largely developed in the wake of the RIA boom after the Great Recession and has since culminated into nearly a dozen firms, each with their own vision of how to marry the independence and client experience of an RIA with a national brand. Over the past couple of years, aggregators have gained private equity sponsors which have fueled their dealmaking capabilities. As we discussed in last quarter’s RIA M&A Transaction Update, this trend has only gained momentum in 2021, with private equity capital infusions at all-time highs.

Aside from branding, industry consensus suggests some legitimate tailwinds encouraging consolidation in the RIA industry, which likewise supports the aggregator model. One such trend is a lack of succession planning by RIA founders, which we have written about extensively in prior posts. With immense experience and resources, aggregators offer a streamlined deal process and post deal integration, making many aggregators a convenient solution for principles looking to exit.

While all aggregators offer liquidity solutions, each aggregator offers a slightly different value proposition to potential sellers. Consolidators such as Mercer Advisors, Wealth Enhancement Group, Mariner Wealth Advisors, and Goldman Sachs would largely be considered strategic buyers. Strategic buyers acquire firms in order to unlock value through synergy. Systemic issues such as fee compression in the asset management space or the growing cost of operational platforms and overhead in the wealth management space are solved by scale. Integrating with any one of the aforementioned firms should theoretically unlock value for buyers through higher profit margins and growth, but a strategic buyer may be a poor fit for a seller looking for a clean exit. Firms such as Focus Financial Partners lean towards the financial acquirer category in which acquisitions are primarily financially motivated investments. However, even aggregators like Focus provide many in-house back-office solutions and additional service offerings to their partners.

Leading RIA Aggregators

Below are a handful of RIA aggregators that have led M&A activity in 2021.

Mercer Advisors. Mercer Advisors was founded in 1985 as a planning-focused RIA and in the last ten years has become an industry leader in the trend towards consolidation, acquiring a total of 45 firms and nine in 2021 alone. Mercer Advisors looks to integrate partnering firms intimately within the Mercer Advisors ecosystem to provide a homogeneous wealth management platform to clients. The Mercer Advisors deal team is led by David Barton, JD – former CEO and current Vice Chairman. Mr. Barton’s transition in 2017 highlights the firm’s aggressive M&A strategy and has since culminated in the majority of the firm’s acquisitions to date. The firm’s sale to private equity group, Oak Hill Capital, in 2019 has further bolstered the firm’s dealmaking activity.

Mariner Wealth Advisors. In April 2021, Mariner sold a minority stake to private equity group, Leonard Green & Partners, which has since propelled the firm into 11 acquisitions. Similar to Mercer Advisors, Mariner seeks to integrate investment teams within a larger ecosystem, potentially allowing partners to exit entirely over time. In 2020, CEO Marty Bicknell announced a partnership with Dynasty Financial Partners creating Mariner Platform Solutions which looks to onboard advisors seeking independence from wirehouses and larger RIAs as well as partner with existing wealth management firms. Back-office services such as marketing, technology, compliance, and administrative support are handled by Dynasty Partners.

Wealth Enhancement Group. On July 31, 2019, Wealth Enhancement Group was acquired by private equity firm, TA Associates, which has resulted in 13 acquisitions in 2021 alone. Wealth Enhancement Group offers a full suite of wealth management services across a single platform, much like Mariner and Mercer Advisors.

Goldman Sachs Personal Financial Management (PFM). While Goldman Sachs did not make any direct RIA acquisitions in 2021, speculation remains high regarding the investment bank’s intentions to move into the wealth management market at scale. The purchase of United Capital in 2019, an RIA aggregator with 34 direct acquisitions to date, marked Goldman’s interest to become a leading RIA acquirer. Since the acquisition, Goldman Sachs has not leaned into the aggregator model as many had anticipated, but speculation rebounded in 2021 when Goldman hired former TD Ameritrade executive, Craig Cintron. The move suggests further development of Goldman’s burgeoning custodian services. Goldman Sachs’ historic brand and scale would make the firm a formidable competitor if it should choose to enter the RIA M&A ecosystem.

Focus Financial Partners (NASDAQ: FOCS). The Focus umbrella includes over 80 partner firms (550+ principals) and over $300 billion in assets under management, making it the largest RIA aggregator by any metric. Focus self-proclaims to “preserve the autonomy of every partner firm who joins the Focus team,” and as such, would likely be a poor fit for principals looking for a clean exit. For those looking to remain post-acquisition, Focus provides a pay-out along with an operational scale for partners seeking to grow their firm or perhaps make acquisitions of their own. Accordingly, more partners who have joined Focus have made an acquisition than those who have not.

In 2021 alone, Focus Financial Partners made 21 acquisitions, nearly double its deal count in 2020. Looking forward, Focus’s future is seemingly tied to its ability to continue to make deals upon more favorable or convenient terms than anyone else, and its prospects are tied to the backdrop of continued deal availability, pricing improvement, or entry into international markets.

Implications for Growing Consolidation in the RIA M&A Market

The arms race for deals, catalyzed and perpetuated by RIA aggregators, favors experienced buyers who have dedicated deal teams and capital backing. For perspective, the typical advisor operates with eight employees and approximately $341 million in AUM compared to Focus’s +$300 billion in AUM and staff of +4,000. Focus currently staffs a team of about 80 transaction-related professionals responsible for fielding acquisition targets and for integrating RIAs within the Focus Financial Partners ecosystem. Nearly all aggregators have extensive capital backing, either through private equity sponsorship, public capital markets, or both.

As aggregators continue to bid up multiples, the sustainability of current M&A trends remains in question. While scale might favor a buyer’s ability to make deals, the verdict is still out on whether the RIA industry benefits from economies of scale. Despite consistent increases in M&A activity over the past decade, the number of RIA firms continues to grow, a fact that perhaps generally contradicts the aggregator investment thesis. However, the ever-increasing number of RIAs may continue to add fuel to current deal volume over the near future.

RIA Valuation Insights

RIA Valuation Insights