RIA Margins: How Does Your Firm’s Margin Affect Its Value?

An RIA’s margin is a simple, easily observable figure that encompasses a range of underlying considerations about a firm that are more difficult to measure, resulting in a convenient shorthand for how well the firm is doing. Does a firm have the right people in the right roles? Is the firm charging enough for the services it is providing? Does the firm have enough—but not too much—overhead for its size? The answers to all of these questions (and more) are condensed into the firm’s margin.

What Is a “Typical Margin”?

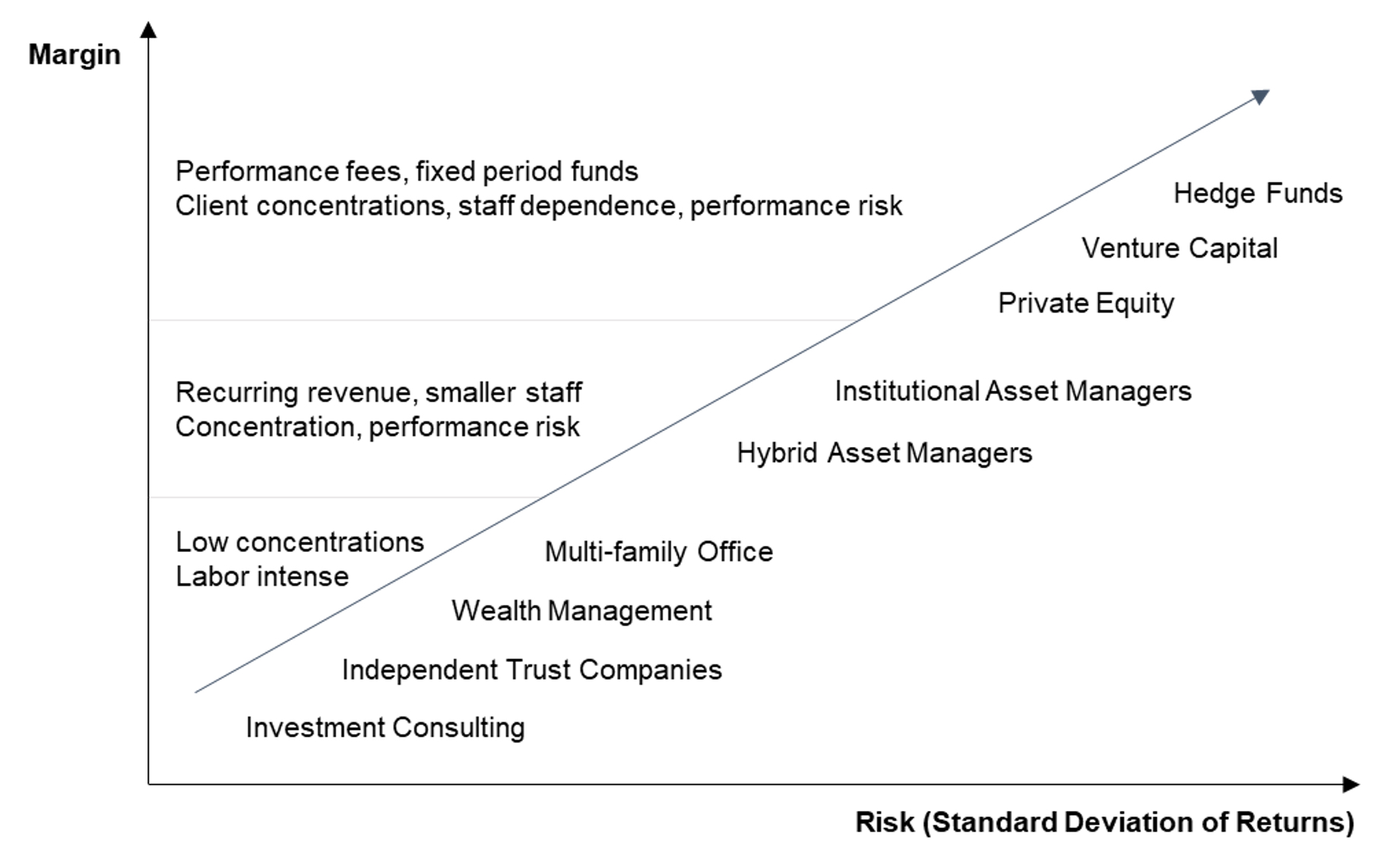

We’ve seen a wide range of margins for RIAs. Smaller firms with too much overhead and not enough scale might see no profitability or even negative margins—particularly during periods when market conditions weigh on performance (see Hot Inflation and Cold Markets). On the other hand, an asset manager with rapidly growing AUM and largely fixed compensation expenses might see margins of 50% or more. The “typical” margin for RIAs depends on the context. As the chart below illustrates, different segments of the investment management industry typically have different margins based on the risk of the business model (among other factors).

At one end of the spectrum are hedge funds, venture capital firms, and private equity managers. The high fees these companies generate per dollar invested can support very high margins, but the risk of client concentrations, underperformance, and key staff dependence is significant.

Traditional institutional asset managers are somewhere in the middle of the spectrum. When these companies get it right, institutional money can flock in rapidly. A successful institutional asset manager may find themselves managing billions more in assets while staffing remains virtually unchanged. The additional fees flow straight to the bottom line, and margins can be quite healthy as a result. But the risks are significant. Institutional money can leave just as quickly as it came if the manager’s asset class falls out of favor or if there is a protracted period of underperformance.

At the lower end of the spectrum are more labor-intensive disciplines like wealth management and independent trust companies. For these businesses, bringing on additional clients translates directly into increased workload for staff, which will ultimately translate into higher staffing levels and compensation expense as the business grows. While margins are lower, the risk is less. Key person risk is less, because an individual’s impact is generally limited to the clients they manage, and not the entire firm’s investment strategy. Client concentration is less, because wealth management firms tend to have a large number of HNW clients rather than a few large institutional clients. Individual clients tend to be stickier than institutional clients, and performance risk is generally less of a concern as well.

Does a Firm’s Margin Affect What It’s Worth?

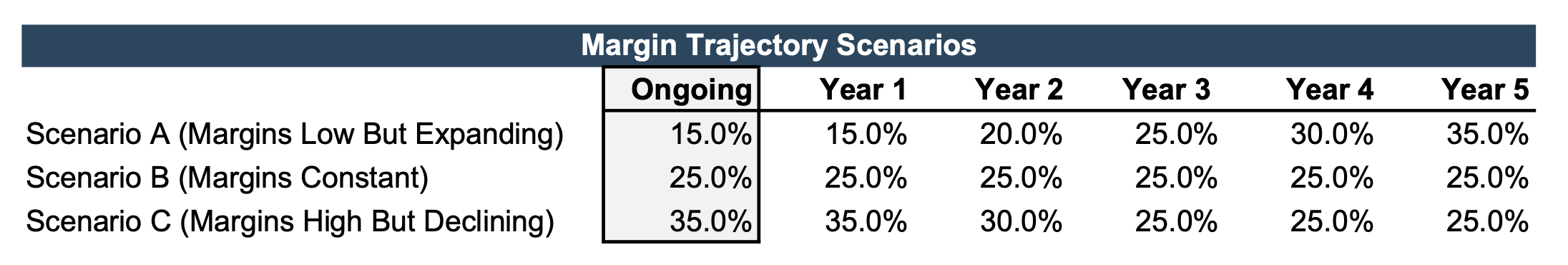

A high margin conveys that a firm is doing something right. But what really matters from a buyer’s perspective is not what the margin is now, but what it will be in the future. Consider the three scenarios below. In Scenario A, the EBITDA margin starts relatively low (15%), but improves over time. In Scenario B, the margin starts at a higher level (25%) but remains constant. In Scenario C, the margin starts at 35% but declines over time.

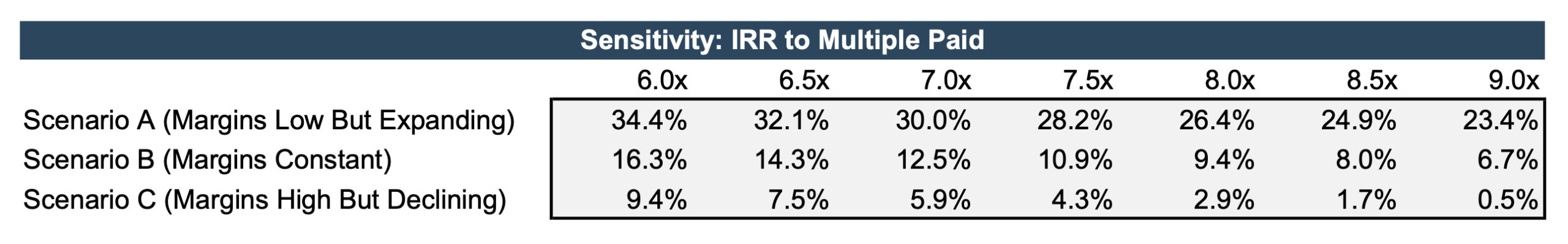

The sensitivity table below shows the buyer’s IRR in each scenario as a function of the multiple paid.1 For a given multiple, the IRR is highest in Scenario A (margins low but expanding) and lowest in Scenario C (margins high but declining). In Scenario A, the buyer can afford to pay a higher multiple and still generate an attractive rate of return (a 9.0x multiple results in an IRR of 23.4%). In Scenarios B and C, however, the buyer must pay a lower multiple in order to generate the same IRR, even though the initial margin is higher.

The implication of the analysis above is that the prospect for future margins is much more important than the current margin when determining the appropriate multiple for an RIA. The market for different segments of the investment management industry tends to reflect this. Institutional asset managers – while they can have very high margins – tend to command lower multiples than HNW wealth managers, which often have lower margins. The reasons for this are many: asset managers are more exposed to fee pressure, trends towards passive investing, and client concentrations, among other factors. These factors suggest an increased likelihood for lower margins in the future for asset managers. HNW wealth managers, on the other hand, often have lower but more robust margins due to their relatively sticky client base, growing client demographic (HNW individuals), and insulation from fee pressure that has affected other areas of the industry.

Margin and Value

High margins are desirable, but what really matters to a buyer is how durable those margins are. There are a variety of factors that affect this, some of which are within the firm’s control and some of which or not. Where the firm operates within the investment management industry (asset manager, HNW wealth manager, PE fund, etc.) is one factor that can affect revenue and margin variability.

While a firm can’t easily change which segment of the industry it operates in, there are other steps that these businesses can take to protect their margins. For example, designing the firm’s compensation structure such that it varies with revenue/profitability is one way to protect margins in the event that revenue declines. See Compensation Structures for RIAs (Part I and Part II).

Firms can also critically evaluate their growth efforts to ensure that additional infrastructure and overhead investments don’t outweigh gains in revenue. By structuring the expense base in a way that protects the firm’s margin if revenue falls and developing growth initiatives designed to support profitable growth, RIAs can generate stable to improving margins in most market environments—and realize higher multiples when the firm is eventually sold.

About Mercer Capital

We are a valuation firm that is organized according to industry specialization. Our Investment Management Team provides valuation, transaction, litigation, and consulting services to a client base consisting of asset managers, wealth managers, independent trust companies, broker-dealers, PE firms and alternative managers, and related investment consultancies.

1 Other variables are held constant across scenarios. For simplicity, a discussion of these assumptions is omitted here.

RIA Valuation Insights

RIA Valuation Insights