RIAs Suffer Worst Quarter Since the Financial Crisis

Most RIA Stocks are Now in Bear Market Territory

Last quarter we blogged about how great 2019 was for the RIA industry. Recent events have rendered that blog post largely irrelevant, as discussions in the industry are now centered on how the COVID-19 global pandemic has impaired RIA valuations. You can tune into Matt Crow and Mindy Diamond’s podcast for a more in-depth discussion on COVID’s impact on the industry, but this post summarizes the effect it has likely had on RIA valuations.

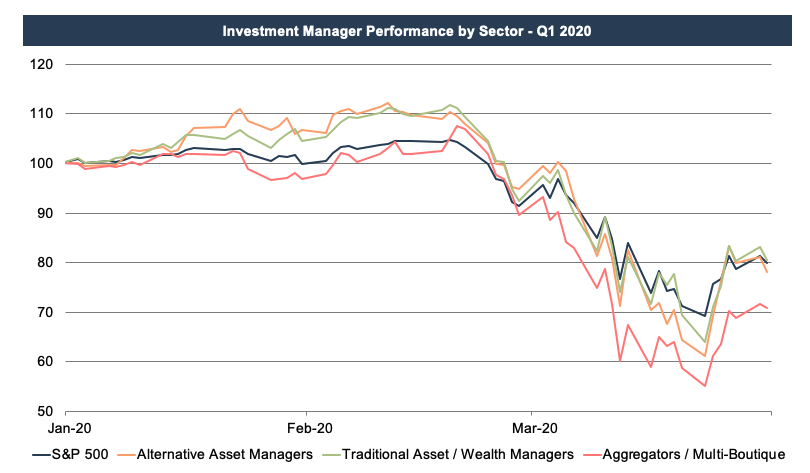

The chart below shows there was nowhere to hide last quarter, as all four components of the RIA industry dipped into bear market territory. The primary driver behind the decline was the decline in the market itself, as most of these businesses are primarily invested in equities, and the S&P was down 20% over the quarter. The aggregators are down a bit more since their models rely on debt financing, which exacerbates losses during times of financial strain.

Pre-COVID, the industry was already facing numerous headwinds including fee pressure, asset outflows, and the rising popularity of passive investment products. The 11-year bull market run masked these issues (at least ostensibly) as AUM balances largely rose with equities over this time. Finally faced with a market headwind, the bull market for the RIA industry came to a grinding halt last month.

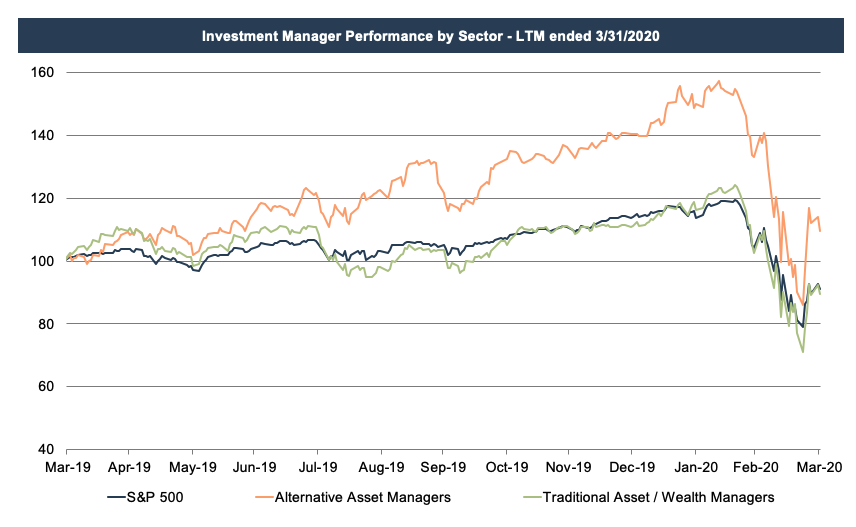

Regardless, this bear market has to be placed in proper context. It’s hard to believe, but the industry (excluding the consolidators) is pretty much right where it was a year ago in terms of market caps. We basically just gave up the gains made in the back half of last year though the decline was far more rapid.

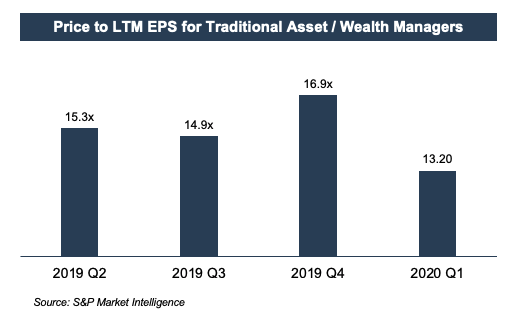

As valuation analysts, we’re typically more concerned with how earnings multiples have changed over this time since we often apply these cap factors to our subject company’s profitability metrics (after any necessary adjustments) to derive an indicated value. These multiples show a similar decline in Q1 after a sizeable increase in the fourth quarter of last year.

There are a number of explanations for this variation. Earnings multiples are primarily a function of risk and growth, and risk has undoubtedly risen in the last couple of months while growth prospects have diminished. Specifically, future earnings are likely to decline with AUM and revenue, so the multiple has pulled back accordingly. Conversely, the run-up in Q4 reflected the market’s anticipation of higher earnings with rising AUM and management fees. The multiple usually follows ongoing revenue, which is simply a function of current AUM and effective fee percentages, as discussed in last week’s post.

Implications for Your RIA

Year-to-date, the value of your RIA is most likely down; the question is how much. Some of our clients are asking us to update our year-end appraisals to reflect the current market conditions. There are several factors we look at in determining an appropriate level of impairment.

One is the overall market for RIA stocks, which is down 20% in the first quarter (see chart above). The P/E multiple is another reference point, which has declined 22% so far this year. We apply this multiple to a subject RIA’s earnings, so we also have to assess how much that company’s annual AUM, revenue, and cash flow have diminished over the quarter while being careful not to count bad news twice.

We also evaluate how our subject company is performing relative to the industry as a whole. Fixed income managers, for instance, have held up reasonably well compared to their equity counterparts. We also look at how much a subject company’s change in AUM is due to market conditions versus new business development net of lost accounts. Investment performance and the pipeline for new customers are also key differentiators that we keep a close eye on.

Diminishing Outlook

The outlook for RIAs depends on a number of factors. Investor demand for a particular manager’s asset class, fee pressure, rising costs and regulatory overhang can all impact RIA valuations to varying extents. The one commonality, though, is that RIAs are all impacted by the market. Their product is, after all, the market.

The impact of market movements varies by sector, however. Alternative asset managers tend to be more idiosyncratic but are still influenced by investor sentiment regarding their hard-to-value assets. Wealth manager valuations are tied to the demand from consolidators while traditional asset managers are more vulnerable to trends in asset flows and fee pressure. Aggregators and multi-boutiques are in the business of buying RIAs, and their success depends on their ability to string together deals at attractive valuations with cheap financing.

On balance, the outlook for RIAs has generally diminished with market conditions over the last couple of months. AUM is down with the market, and it’s likely that industry-wide revenue and earnings declined with it. April has been kinder, but volatility remains.

If the bid-ask spread between you and your partners has been too high to get a deal done, it may time to re-examine your price expectations. The next generation of ownership may be enticed by more attractive valuations and return to the negotiating table, so knowing your firm’s worth may be more important than ever. We’re happy to walk you through that.

RIA Valuation Insights

RIA Valuation Insights