The Devil in the Details

Diving into the CI US/Bain Transaction

On May 11, CI Financial announced a transaction through which it will sell a 20% interest (a convertible preferred stake) in its U.S. wealth management division (CI US) for $1.0 billion to a group of institutional investors led by Bain.

The capital injection was posed as a substitute for a planned IPO, first announced in 2022, of CI’s rapidly growing US wealth management division. Fueled by M&A and cheap debt, CI US grew from virtually zero assets at the end of 2019 to $140 billion in AUM on March 31, 2023. Offering attention-grabbing multiples, CI successfully strung together deal after deal in a very competitive market for RIAs, frustrating rivals like Focus Financial, whose CEO lashed out at CI US on more than one occasion.

Despite CI’s growth trajectory and the attractive valuations commanded by RIAs in the private market, CI’s own stock languished, often trading at a multiple far below the headline multiples reported for private wealth manager transactions. CEO Kurt MacAlpine lamented this on an earnings call in February last year: “We’re criminally undervalued the way we’re trading today… We’re not getting credit for the shift of our business to the U.S. nor the rapid growth of our wealth management business.”

CI developed an IPO plan last year in hopes that public markets would value a pure-play wealth management firm differently than their combined wealth management and legacy asset management business, allowing legacy CI to “unlock” the value of its U.S. wealth business while also raising funds to deleverage at a time when debt costs were soaring in tandem with concerns about CI’s burgeoning debt balance. In the three years preceding March 31, 2023, CI’s net leverage ratio grew from 1.9x to 4.0x as the firm levered up to buy U.S. wealth management firms. Perhaps to avoid another layer of public scrutiny, CI de-rated their debt, asking S&P to put their pencils down earlier this month. S&P obliged, but not before pushing CI’s debt into junk territory.

We first wrote about the planned IPO of CI Financial’s wealth management business late last year. At the time, we doubted their ability to take CI US public in a tough market for IPOs, not to mention a market that often priced publicly traded firms below privates.

As predicted, the IPO route was abandoned (for now) and replaced by a sale of convertible preferred stock representing (initially, more on that later…) a 20% interest in CI US (the same percentage that CI had sought to sell through the planned IPO). CI raised $1.0 billion through the transaction, which, along with another recent asset sale, brings CI closer to its stated leverage target of 1.5x-2.0x by reducing its pro forma net leverage ratio to 2.7x from 4.0x as of March 31, 2023.

When the deal was announced, it looked (at first glance) like a home run. Several trade press headlines suggested CI would receive a 25.6x EBITDA multiple—well above where it was trading—and significant cash for deleveraging. The bullet points from CI’s initial press release describe the deal as follows:¹

Click here to expand the image above

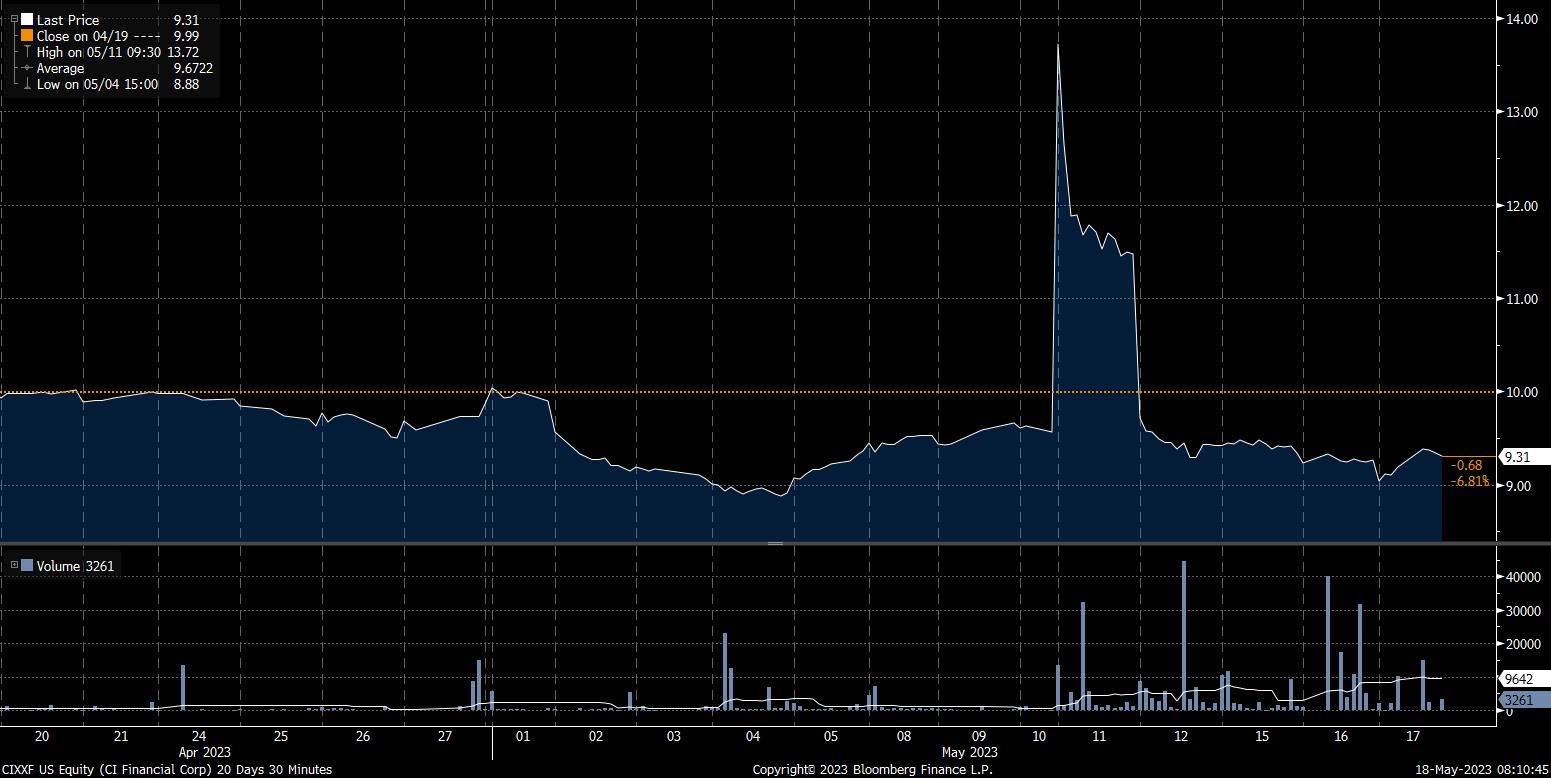

The market liked the press release, but not the deal: CI’s U.S. tracking stock (CIXXF) popped over 40% after the announcement on May 11 but almost immediately gave up those gains as investors dug into the preferred stock purchase agreement terms. Since the announcement, three analysts have downgraded CI’s stock: Barclays downgraded to equal weight, BMO downgraded to market perform, and CIBC downgraded to neutral.

Click here to expand the image above

If It Sounds Too Good to Be True…

Under the hood, the deal is far less glamorous for CI than the press release suggests. As it turns out, the 25.6x EBITDA multiple touted by CI comes with some onerous terms, most notably the following:

- At the third anniversary of closing, the preferred liquidation preference jumps to 1.5x the original issue price and increases to a maximum of 2.25x the original issue price at the sixth anniversary of closing. This works out to an implied PIK rate of about 14.5% annually. Compared to the weighted average interest rate of 4.2% on CI’s debt, it’s expensive capital – making the recap harder to understand.

- Beginning five years and nine months after closing, the preferred investors have the right to cause the company to pursue a sale or IPO process, and, in the event such process fails to produce an exit, the preferred have drag-along rights that force all other shareholders to sell concurrently to a buyer chosen by the preferred holders. These exit provisions put the preferred in the driver’s seat, allowing them to force an exit at a time (and valuation) that may or may not be advantageous to the common.

Does this make any sense? The minority transaction is a stop-gap measure that buys CI some breathing room until a more accommodative IPO market appears. If CI can complete an IPO that meets certain criteria before the step up in liquidation preference after three years, they can avoid the worst of the dilution.

But if a qualifying IPO isn’t achieved to force conversion in that time period, the liquidation preference jumps to $1.5 billion and grows from there. To put that in perspective, after the 1.5x step up, the liquidation preference is about 7.4x CI US’s annualized adjusted Q1 2023 EBITDA of $204 million. Time will tell how the common will fare, but the liquidation preference features create the possibility that the preferred could own materially more of the business than the initial 20%. The flip side is that the current common holders would own materially less than they currently do.

Takeaways for RIAs

The CI transaction offers a few takeaways for RIAs:

- Know your buyer. RIA transactions are rarely structured as “hand over the keys and walk away” deals. Chances are, if you sell your RIA, the buyer will be your new business partner for the foreseeable future. And if you’re taking stock as all or part of the consideration, you’re not just selling your RIA, you’re buying your acquirer. Diligence on the acquiring firm is important, as is an understanding that selling your firm means giving up a certain level of control over the future. For firms that sold to CI and took stock as part of their consideration, they’re now subordinated to a preferred stock that threatens to squeeze the common if the firm isn’t able to outrun the double-digit implied PIK rate. Focus Financial’s recent take-private announcement offers another example: firms that sold to Focus must now contend with a new private equity backer and an uncertain future business model.

- Be skeptical of “headline” multiples. As the saying goes: “You name the price, I’ll name the terms.” At face value, the CI deal offers an attractive price: a mid-20s EBITDA multiple for a minority interest in the business. But that attractive price comes with some onerous terms, essentially giving the preferred investors equity-like upside but debt-like downside protection. Headline multiples only tell part of the story, but for many private transactions, it’s the only part of the story that gets told. When you hear that “so-and-so” sold their firm for 15x, it’s worth asking about the terms that accompanied that multiple.

- The M&A landscape is changing. The CI deal underscores many of the shifting dynamics of RIA dealmaking: with AUM down, inflation high, and cost of capital rising, many aggregators are shifting from completing transactions to deleveraging and integrating the firms they’ve acquired. M&A volume has held up, but we suspect that the list of top acquirers this year will look different than in years past. For deals that are getting done, buyers and sellers must bridge the gap between current market realities and seller expectations formed during a bull market and era of (virtually) free money. We often hear that buyers and sellers are “getting creative” to get deals done in the current environment. What that usually means is that sellers are sacrificing on terms to maintain a certain price.

About Mercer Capital

We are a valuation firm that is organized according to industry specialization. Our Investment Management Team provides valuation, transaction, litigation, and consulting services to a client base consisting of asset managers, wealth managers, independent trust companies, broker-dealers, PE firms and alternative managers, and related investment consultancies.

¹ Press release figures in Canadian dollars

RIA Valuation Insights

RIA Valuation Insights