The Relationship Between AUM Multiples and RIA Performance

Rules of thumb based on a percentage of AUM are frequently cited in the RIA industry as a back-of-the-envelope way to quickly estimate a firm’s value. One reason for the prevalence of AUM multiples is purely practical—AUM for RIAs is a publicly available metric, and it’s often the only window into a firm’s financial performance available to third parties. Another reason for the popularity is simplicity—AUM can be compared across firms without regard to fee levels, margins, compensation structure, and the like.

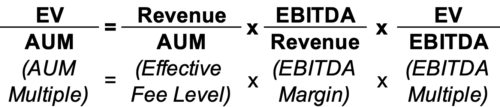

The simplicity of AUM multiples is also the greatest pitfall. AUM multiples condense a significant amount of information into a single metric. In our experience, they’re usually better thought of as an output rather than an input to valuation. To gain insight into what drives AUM multiples, we can (using a little bit of math) decompose AUM multiples like this:

From a practical standpoint, a dollar of AUM is worth more when it generates more fees, and those fees are worth more when they yield higher returns (earnings) to capital providers (all else equal). Investors will pay more for an RIA’s AUM when there’s more cash flow behind it.

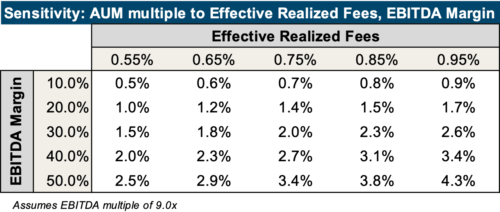

To illustrate, consider the sensitivity table below, which shows the implied AUM multiple for a given EBITDA multiple (in this case, 9.0x) as a function of effective realized fees and EBITDA margin. For sensitivity purposes, we’ve shown a wide range of effective realized fees (55 to 95 bps) and EBITDA margins (10% to 50%) which will encompass most, but not all, firms. A firm at the middle of both ranges (75 bps effective realized fee level and 30% EBITDA margin) transacting at a 9.0x EBITDA multiple would imply a 2.0% AUM multiple—in line with an often cited “2.0% of AUM” rule of thumb.

But the range in the table is wide. A firm at the low end of profitability and effective realized fees (10% margin with fees of 55 bps) transacting at the same EBITDA multiple would imply a multiple of AUM of 0.5%. In comparison, a firm at the high end of the range (50% EBITDA margin and fees of 95 bps) would imply a multiple of AUM of 4.3%—a nearly ninefold increase in the multiple.

This reality is why we see such disparity in the AUM multiples paid for investment management firms. Firms vary significantly in terms of their asset class focus or allocation, fee levels charged, client base demographics, and operational efficiency. All of these variables (and more) impact how AUM translates into profitability and thus what investors are willing to pay for a dollar of AUM. If a firm has balance sheet items such as GP interests or has non-AUM-based business lines, AUM multiples can be further skewed. When assessing AUM multiples from transactions, it’s important to keep these caveats in mind.

If you’re an RIA principal looking to improve the value of your assets under management, the levers to pull are the effective realized fee, EBITDA margin (profitability), and the EBITDA multiple. Since the EBITDA multiple is primarily a function of risk, growth, and market conditions that are largely outside your control, the path of least resistance is probably fee discipline and margin improvement. (Though we acknowledge the difficulties of enhancing your bottom line when markets and AUM are falling while inflation swells your compensation costs and overhead expenses.)

The takeaway is to focus on what you CAN control: hiring practices, new business development, incentive compensation structure, operating efficiencies, fee discipline, and cost controls. As the last year has proven, you can’t always rely on a market tailwind to lift AUM and revenue. Developing new business in a cost-efficient manner will increase margins and profitability in almost any market environment. It will also improve your AUM multiple and value by extension.

About Mercer Capital

We are a valuation firm that is organized according to industry specialization. Our Investment Management Team provides valuation, transaction, litigation, and consulting services to a client base consisting of asset managers, wealth managers, independent trust companies, broker-dealers, PE firms and alternative managers, and related investment consultancies.

RIA Valuation Insights

RIA Valuation Insights