To the Moon?

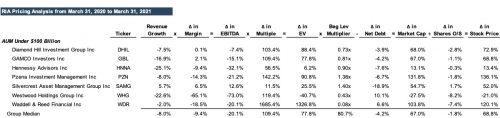

A few weeks ago we blogged about how RIA stock prices have increased over 70% on average over the last year. This rapid ascent begs the question if valuations have gotten too rich with the market run-up during this time. To answer this question, we have to analyze the source of this increase. Click here to expand the table above

Click here to expand the table above

Moving from left to right on the table above, we see that financial performance actually deteriorated over this time – revenue declined and margins compressed, leading to a 20% drop in EBITDA on average for this group of publicly traded RIAs with less than $100 billion in AUM. The increase in the EBITDA multiple more than compensated for the decline in profitability and is the primary driver of the overall increase in value from March 31, 2020 to March 31, 2021. At first glance, a 70% increase in value (when year-over-year earnings have actually declined) suggests that current pricing may be overstretched.

Back to Earth?

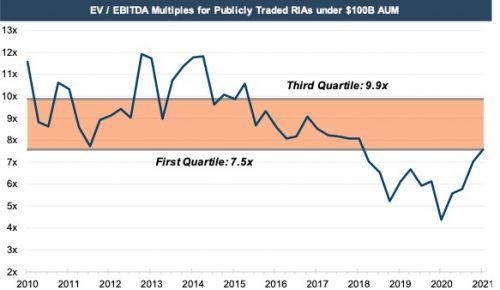

When we observe historical levels of RIA valuations, however, we get a much different perspective. Even after the recent run-up, EBITDA multiples are still at the lower end of their historical range. The multiple expansion follows an all-time low for the industry last March when these businesses were trading at 4x EBITDA during the bear market.

There’s also a logical explanation for the multiple doubling over this period. These multiples are directly related to the outlook for future revenue and profitability, which tend to fluctuate with AUM since management fees are typically charged as a percentage of client assets. AUM balances have risen with the stock market over the last year, so the outlook for future revenue and earnings has rebounded accordingly.

Trailing twelve-month (TTM) earnings in March of last year were also suppressed by the bear market’s impact on profitability during the first two quarters of 2020, so a higher TTM multiple is justified when historical earnings lag ongoing levels of profitability. This trend marks a complete reversal of what happened last March when AUM and run-rate performance declined with the market but trailing twelve-month earnings had not yet been impacted. As earnings figures lagged the abrupt price declines, multiples hit all-time lows. Because of this phenomenon, RIA multiples can be especially erratic during volatile market conditions.

There’s also a logical explanation for the multiple doubling over this period. These multiples are directly related to the outlook for future revenue and profitability, which tend to fluctuate with AUM since management fees are typically charged as a percentage of client assets. AUM balances have risen with the stock market over the last year, so the outlook for future revenue and earnings has rebounded accordingly.

Trailing twelve-month (TTM) earnings in March of last year were also suppressed by the bear market’s impact on profitability during the first two quarters of 2020, so a higher TTM multiple is justified when historical earnings lag ongoing levels of profitability. This trend marks a complete reversal of what happened last March when AUM and run-rate performance declined with the market but trailing twelve-month earnings had not yet been impacted. As earnings figures lagged the abrupt price declines, multiples hit all-time lows. Because of this phenomenon, RIA multiples can be especially erratic during volatile market conditions.

Conclusion

While the significant gains in RIA valuations over the last year is fairly alarming, the fundamentals warrant such an increase. The market’s significant rise over the last year buoyed AUM and ongoing profitability, so investors are rationally anticipating higher earnings relative to recent history. Another correction or bear market would certainly reverse this trend, but at the moment, all industry metrics are pointing to the moon.