RIA Aggregator Investments Trick or Treat

Are Longer Holding Periods a Viable PE Strategy or Just an Extend-and-Pretend Tactic?

Halloween is the ultimate extend-and-pretend film series. From the original 1978 Halloween to 2022’s Halloween Ends, moviegoers estimate that Michael Myers apparently died eight times but somehow appeared in all thirteen films over the series’ 44-year history. The cynical (but likely accurate) rationale for this inconsistency is that the studios recognize that it makes the most economic sense to extend the Halloween saga after each movie and pretend Michael didn’t die in the last one.

Private equity firms with investments in RIA aggregators appear to be facing a similar (though less haunting) predicament. A recent CityWire article noted that private equity firms are extending their holding periods for RIA aggregator firms to take advantage of the industry’s higher margins and long-term growth prospects. This stalling tactic shouldn’t spook their LPs since the RIA sector is renowned for its recurring revenue, above-average margins, and demonstrated ability to grow cash flows over an extended period of time. Not many industries have businesses that can sustain The Rule of 40, which posits that venture investors prefer to invest in businesses in which the profit margin plus the growth rate adds up to at least 40%. The investment management industry is a notable exception since it typically boasts EBITDA margins in the 20% to 30% range and annualized growth in revenue on the order of 10% to 15%. It’s like candy corn with a lasting sugar high to prospective investors.

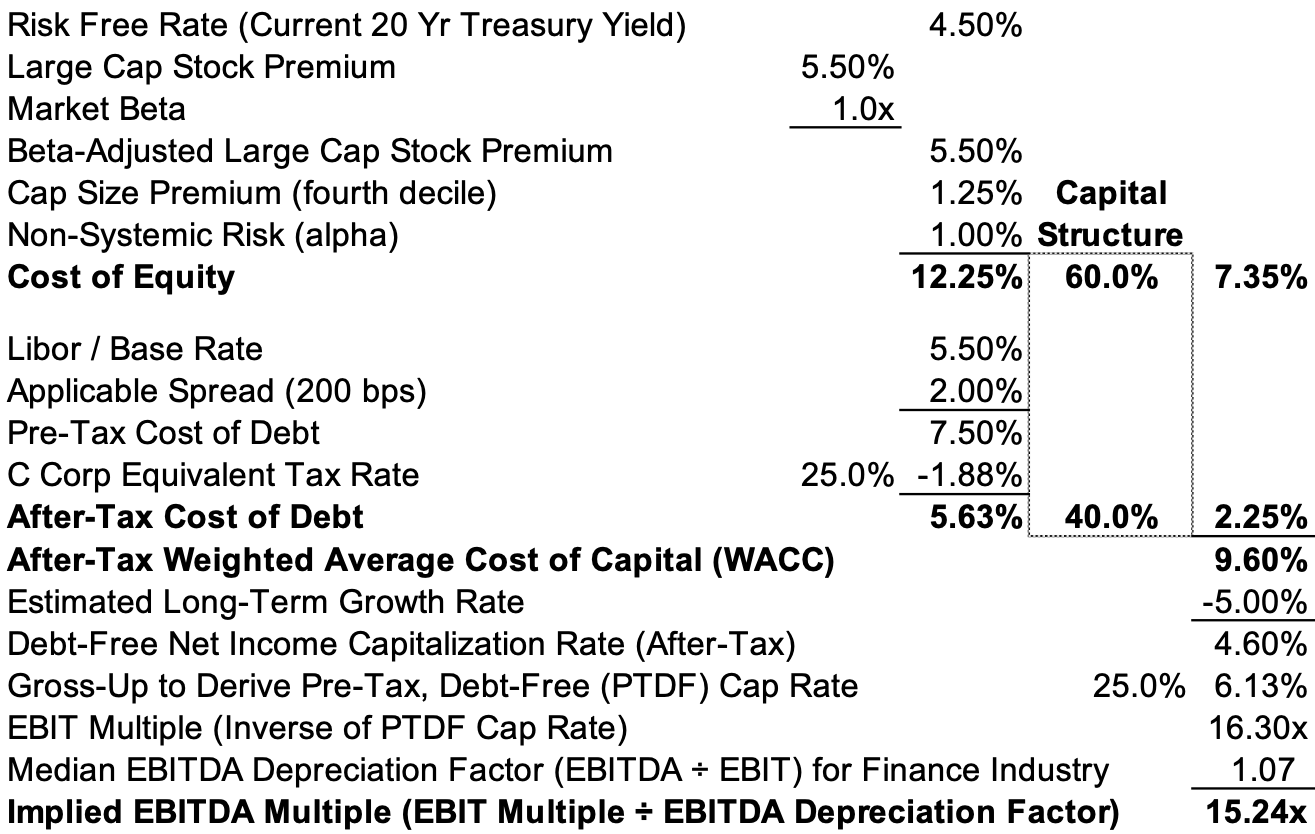

So what’s so scary about paying +15x EBITDA for these businesses? If we use the EBITDA single-period income capitalization method to build up an applicable EBITDA multiple for RIA aggregators based on their current cost of capital and expected long-term growth rates, that math probably looks something like this:

This analysis suggests that an RIA aggregator’s cost of capital and growth profile support a 15x EBITDA multiple. There’s also market evidence to affirm these valuations — Goldman is estimated to have paid ~18x EBITDA for RIA aggregator United Capital, and PE firm Clayton, Dubilier & Rice purchased Focus Financial for ~13x EBITDA last year.

Market evidence supports extending holding periods for these types of investments rather than flipping them to the next investor. PE firm GTCR purchased a 25% stake in RIA acquisitive Captrust Financial Advisors in 2020, which valued Captrust at $1.25 billion before Carlyle bought another minority stake in the business, valuing the firm at just over $3.7 billion three years later. An extended holding period for an RIA aggregator investment at a 15x EBITDA entry multiple appears very reasonable for the PE firms backing these businesses.

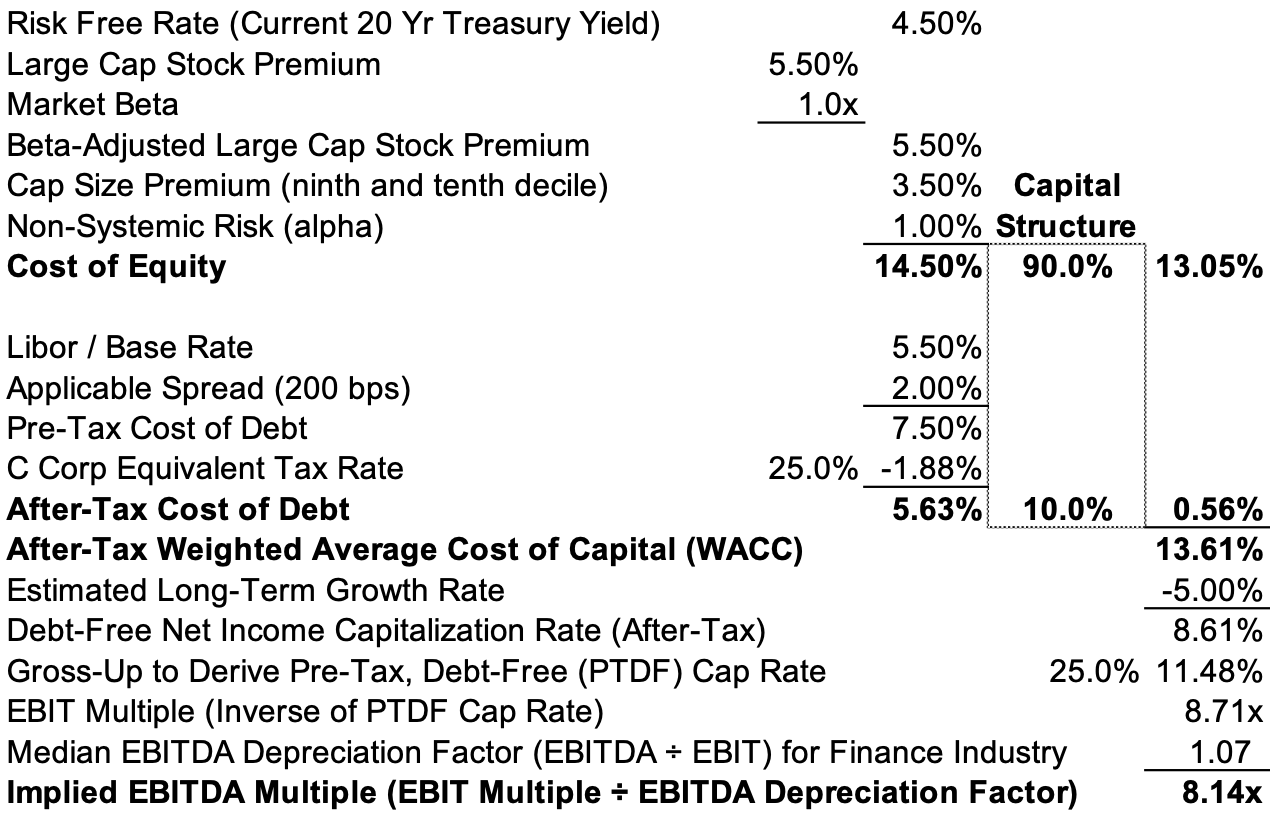

What about the multiple that these aggregator firms are paying for their underlying RIAs? That math looks a bit different since these investment management firms tend to be much smaller, riskier, and have little or no access to (cheaper) debt financing:

When we do see RIA transactions in the +15x EBITDA space, much of the total deal value is typically paid in the form of an earnout or contingent consideration payment based on the target firm’s future financial performance, usually 1-5 years out from the initial down payment. These multiples are often calculated based on the total deal value (including contingent consideration) divided by trailing twelve-month EBITDA prior to closing, even though the earnout portion is unknown at that point, and the time value of money is not factored into the calculation. Paying north of 20x EBITDA for these businesses with no buyer protection in the form of earnout payments could be more horrifying than a hayride with Michael Myers on his ninth life. We’re here to help (with the former).

About Mercer Capital

We are a valuation firm that is organized according to industry specialization. Our Investment Management Team provides valuation, transaction, litigation, and consulting services to a client base consisting of asset managers, RIAs, trust companies, broker-dealers, PE firms, and alternative managers.

RIA Valuation Insights

RIA Valuation Insights