What’s the Price of Growth?

Infrastructure Spending in the Investment Management Community

Investing for growth: 1-70 west of Denver

In the golden age of asset intensive businesses, companies made giant capital expenditures on fixed assets and research & development to fuel long term growth strategies. In those days, economies had similar opportunities. The U.S. system of interstates, launched by President Eisenhower, is a prime example of major spending in support of long-term opportunities. (I could lament the days of fresh asphalt and real yields, replaced now by potholes and QE, but that’s another blog.)

As our economy has evolved to feature more service-based, asset-light businesses, so too has the need to rethink what infrastructure means and what investing in long term growth looks like. Even businesses like investment management have a type of infrastructure, and their long-term growth opportunities require investment in that infrastructure.

The Tangible Value of an RIA’s Workforce

One common feature of RIA financial statements is the simplicity of their balance sheet. We not infrequently work with clients whose asset base consists of little more than a token amount of cash, receivables, and leasehold improvements. On the righthand side of the balance sheet, we commonly see nothing but a few payables and equity.

But as the old (pre-pandemic) saw goes, an investment management firm’s assets get on the elevator and go home each night, such that the real infrastructure of an RIA is its staff – sometimes referred to in the valuation profession as the “assembled workforce” – an intangible asset that is more-or-less measurable using a replacement cost methodology (oftentimes achieving a result that is more precise than it is accurate).

Our recent blog series has focused on the tradeoffs that RIAs make in providing returns to labor and returns to capital. Ultimately, for each dollar of revenue that an RIA brings in, the process of deriving profitability is largely a function of setting up a compensation structure. The portion of revenue devoted to expenditures other than staff and ownership is comparatively small (and less discretionary in nature).

But spending on staff isn’t simply a tradeoff with profitability, it is also a tradeoff with growth. Most growth opportunities in the RIA space involve staffing – whether it’s for new initiatives, succession, or further development of the existing business model. Staffing requires spending that may not be immediately accretive to earnings.

To the extent that spending on staff is front-loading the costs of opportunities for growth, the margin tradeoff can be rightly characterized as infrastructure spending – building the workforce needed to support more growth and profitability in the years ahead.

Most understand the tradeoff, but little has been written about what sort of tradeoff is appropriate.

The Rule of 40

Elsewhere in the business community, this issue of the tradeoff between growth and margin has been explored thoroughly. In the subscription software industry (SaaS), there is a well-known concept called the Rule of 40. The Rule of 40, or R40, holds that venture investors like to invest in businesses in which the profit margin plus the growth rate adds up to at least 40%.

So, if a growing SaaS company shows a profit margin of 30% and a growth rate of 15%, the total margin and growth (30% + 15%) is 45%, exceeding the R40 expectation. Companies with combined growth and margin rates of 50% are top performers and get lots of attention.

The R40 function is a shorthand way of determining the strength of a business model, in measuring the degree to which growth requires a tradeoff with profitability (whether through price concessions, marketing, or other customer acquisition costs). If growth plus margin equals more than 40, it indicates a business that can maintain profitability and still expand at better than average levels. Imagine a unique development stage business in a market with lots of upside and little competition – the sort of environment that promotes high growth with the pricing power to maintain substantial margins. On the contrary, a measure below 40 indicates a mature business with few expansion opportunities and increasing competitive threats.

Now, which profit margin are we speaking of, and is it unit growth, top-line growth, or profit growth that matters? As with everything, the devil is in the details. But the concept, measuring the aggregate return of growth and margin, has merit in a “growth and income” business like investment management.

Is R40 Applicable to RIAs?

The most attractive feature of investing in the RIA space is that it generates lots of distributable cash flow and has the market tailwind (recent months notwithstanding) to provide growth. But more margin and more growth is always a better thing. As with SaaS businesses, RIAs that produce more margin and more growth are going to be worth more – ceteris paribus – than those which produce less margin and less growth.

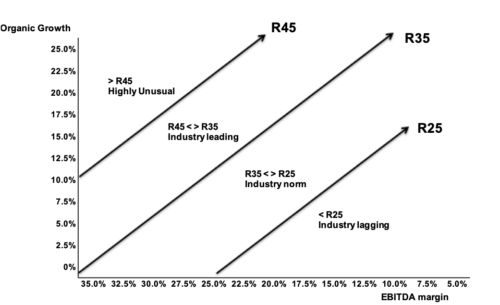

What’s a reasonable expectation of “R” for investment management? This is definitely a topic worth further study, but for the time being, let me venture out to offer a few thoughts on using this type of economic thinking to evaluate an RIA’s performance. Established wealth managers commonly produce EBITDA margins in the range of 20% to 30%. So, any measure of the efficacy of an RIA’s business model – including evaluating whether it is investing for the long term – should develop an “R” that is in excess of that level. That “excess” metric is growth – but to what extent?

Growth from market performance is always welcome, but as we’ve said many times in this blog, organic growth is the key to long term performance. Years like this are a cruel reminder that the market doesn’t always fuel AUM growth, and that a growth minded RIA needs a demonstrable and repeatable strategy to capture new assets. Without real organic growth, clients eventually spend off their assets, pass away, or take their business elsewhere.

So, we would look at organic growth. That’s new client assets and additions to existing accounts, net of client terminations and withdrawals. The net growth of AUM, absent any market activity. Organic growth is a question of how quickly one can envision doubling an RIA’s business. 15% organic growth would imply doubling the business every five years. 5% is closer to 15 years. What organic growth rate will your model sustain?

R35?

If organic growth in the 5% to 15% range can be supported by a 20% to 30% normalized EBITDA margin, the combination of these ranges, or about 35% at the midpoint, suggests that something on the order of R35 is a decent norm to observe – at least in the wealth management space. Totals that far exceed 35% would indicate a more effective business model. RIAs that produce growth plus margin much lower than 25% suggest a comparatively weak model.

We need to develop this idea further, but it’s promising as a diagnostic. R40 works in the SaaS world because the VC community investing in these companies has a cost of capital around 25%. R40 produces approximately the same present value of interim cash flows regardless of the tradeoff between margin and growth, provided they total about 40%. In the RIA space, where WACCs are more in the mid-teens, R35 appears to accomplish a similar parameter.

The New GARP

Growth at a reasonable price (margin) is an old concept in investment management, but it bears extending to practice management as well. RIAs are fortunate not to have to spend billions on factories, only to grieve them as “money furnaces” (sorry Elon). But that doesn’t mean RIAs don’t have the same imperative to invest in the people who compose their businesses.

RIA Valuation Insights

RIA Valuation Insights