Are Trust Companies Changing for the Better?

Trust Company Sector Update

Trust law dates back to the 12th century when landowners who left England to fight in the Crusades retitled their property to another trusted individual to manage the property until the crusader returned home. Upon returning home, however, the land title holder (the “trustee”) often refused to return the property to the crusaders (the “beneficiary”). The Lord Chancellor typically ruled in favor of the returning crusader, requiring the title holder to return ownership of the land to the original holder. Hence, the foundation for modern trust law was formed.

Trust companies are changing to meet clients’ evolving needs.

Trust law has evolved over time, most recently with modern trust laws in the 1980s and 90s established by certain states such as Delaware, Nevada, and South Dakota. Other states, such as Tennessee, have developed compelling trust statutes in more recent years. Just as trust law has changed with the regulatory environment, trust companies are changing to meet clients’ evolving needs.

As demand for trust company services increases with the generational transfer of wealth from baby boomers to their successors, trust companies are competing for new business by changing their model to better serve their clients and altering their marketing strategies to attract new assets.

A Fiduciary Minded Model

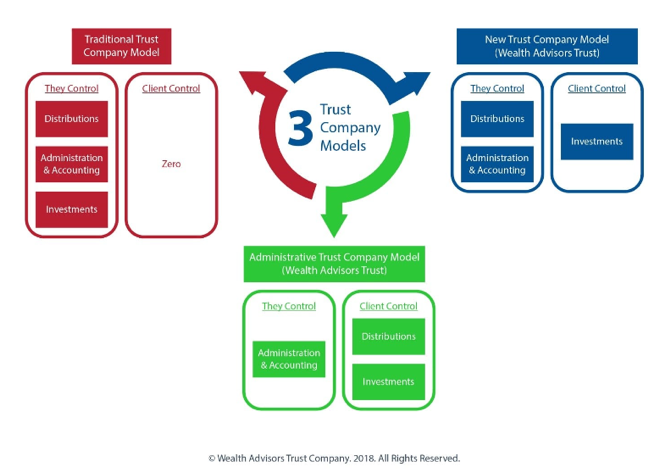

As depicted in the illustration below published by Wealth Advisors Trust Company, trust companies have traditionally managed the distribution, administration, and investment of trust assets. However, more trust companies are shifting to a directed trustee model, which allows an investment advisor to be named on the account so that investment decisions are made by the appointed advisor rather than the trust company. This allows the trust company to focus on fiduciary issues related to trust and estate administration rather than investment management.

The directed trustee model leads to a mutually beneficial relationship between the trust company, the investment advisor, and the client. The trust company avoids competition with investment advisors, who are often their best referral sources. The investment advisor’s relationship with their client is often written into the trust document. And most importantly, this model should result in better outcomes for the client because its team of advisors is ultimately doing what each does best—its trust company acts as a fiduciary, and its investment advisor is responsible for investment decisions.

Increased Marketing Efforts

Trust companies have historically relied heavily on referrals for new clients. While the directed trustee model protects these referral relationships, many referral sources have been lost to industry consolidation. This has led trust companies to increase their online marketing efforts. Many of our clients have seen a reduction in referrals from their traditional referral sources and have responded by increasing spending on website upgrades and digital marketing.

Not only do marketing efforts generate new clients, but those clients tend to stick around.According to Forbes, 80% of trust company clients keep the same trustee for the life of the trust. This makes effective marketing essential for trust companies, because trust clients are sticky, and once with another provider, a potential client has likely been lost for good.

Industry Tailwinds

Demand for trust company services has increased over the first half of 2019 as “high-net-worth families re-evaluate[d] their personal exposure to the market and follow[ed] through on any big moves they’ve been putting off.” This momentum in the industry is driving increased awareness of trusts as an important component of the financial planning process.

Additionally, industry participants generally believe that a large portion of the impending wealth transfer from baby boomers to gen X-ers and millennials will be left through real estate holdings, individual retirement accounts, and trusts; thereby providing a tailwind for the trust company industry.

Market Multiples

The market for asset and wealth management firms can offer some insight.

While there are no pure-play publicly traded trust companies, analysis of the public markets can lead to a better grasp of trust company valuations. Even though trust companies are increasingly outsourcing investment management, there are still a number of underlying similarities between the business models of trust companies and asset and wealth managers—the most notable being that revenue for all of these businesses is a function of assets under management. Because of the similarities, the market for asset and wealth management firms can offer some insight into valuation trends affecting trust companies.

Investment manager valuations have started to recover after stumbling in the first quarter following a rocky Q4 across the entire market. P/E multiples averaged approximately 15.3x LTM earnings as of the end of 2Q 2019, up from 14.1x at the end of the 1Q 2019. The positive movement in asset and wealth manager multiples is likely to translate, to some extent, to trust companies as well, given the similarities between revenue models.

Mercer Capital assists RIA clients with valuation and related consulting services for a variety of purposes. In addition to our corporate valuation services, Mercer Capital provides transaction advisory and litigation support services to the investment management industry. We have relevant experience working with independent trust companies, wealth management firms, traditional and alternative asset managers, and broker-dealers to provide timely, accurate and reliable results. Contact a Mercer Capital professional to discuss your needs in confidence.

RIA Valuation Insights

RIA Valuation Insights