Trends with Independent Trust Companies

Independent trust companies are a growing segment of the trust industry. While trust divisions of banks still represent about 84% of the trust industry, there’s been a trend towards independence that parallels that seen in the wealth management industry. In this post, we highlight some of the trends impacting independent trust companies.

Fees

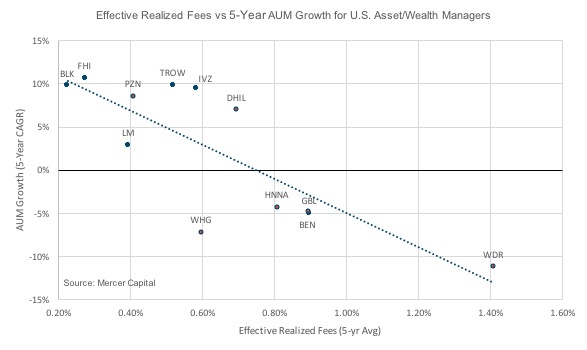

Over the last decade, there has been a broad-based decline in pricing power across the investment management industry. Assets have poured into low fee passive products, driving down effective realized fees for asset managers. Wealth managers have been more resilient, but the threat of robo-advisors remains. Virtually all discount brokerages were forced to cut trading fees to zero. Consider the relationship between effective realized fees and revenue growth over the last five years for US asset/wealth managers (shown in the chart below). The message is clear. Assets across the financial services industry are gravitating towards lower-fee products.

So how have trust companies fared in this environment? Despite the pricing pressure in the broader industry, trust companies have fared remarkably well. According to Wealth Advisor’s 2019 pricing survey, trust company fees are actually heading higher. For many of our independent trust company clients, the story has been similar. Realized fees have remained steady or even increased over the last five years, while assets under administration have grown through market growth and net inflows.

Market Movements

The recent coronavirus induced sell-off will have a significant negative impact on the top line for trust companies, as it will for all investment managers that charge a percentage of assets under management. As of the date of this post, the S&P 500 is down over 20% from its all-time high on February 19, 2020. Trust company revenue will take a big hit. The effect on trust company profitability will depend on the length and severity of the economic slowdown caused by the pandemic and containment policies. The range of likely scenarios is beyond the scope of this post, but it suffices to say that there is still significant uncertainty regarding the impact on people, markets, and economic activity.

Unlike many asset and wealth management firms, trust companies often have revenue sources that aren’t based on AUM (e.g., tax planning, estate administration fees) which should provide some protection during a market downturn. This, combined with a resilient fee structure, should help trust companies weather the pandemic.

Demographics

Trust companies primarily serve high net worth and ultra-high net worth clients, and demographic trends in these markets are favorable for the continued growth of the trust company industry. The number of high net worth individuals (net worth > $1 million) in the United States has grown significantly over the last decade. According to Credit Suisse’s Global Wealth Report 2019, there were over 18 million millionaires in the United States in 2019, nearly double the number in 2010.

Additionally, the impending wealth transfer as baby boomers age should spur growth in trust assets. Roughly $30 trillion is expected to change hands between baby boomers and younger generations during the coming years. To the extent that this wealth is transferred via trusts, trust companies stand to benefit.

Regulatory Trends

As trust law has developed, a handful of states have emerged as being particularly favorable for establishing trusts. While the trust law environment varies from state to state, leading states typically have favorable laws with respect to asset protection, taxes, trust decanting, and general flexibility in establishing and managing trusts. Opinions vary, but the following states (listed alphabetically) are often identified as states with a favorable mix of these features.

- Alaska

- Delaware

- Florida

- Nevada

- South Dakota

- Tennessee

- Texas

- Washington

- Wyoming

Over the last several decades, many states such as Delaware, Nevada, and South Dakota have modernized their trust laws to allow for perpetual trusts, directed trustee models, and self-settled spendthrift trusts (or asset protection trusts). The directed trust model in particular is a major change in the way trust companies manage assets, and it has been gaining popularity among trust companies and their clients. Under the directed trust model, the creator of the trust can delegate different functions to different parties. Most frequently, this involves directing investment management to an investment advisor other than the trust company (this could be a legacy advisor or any party the client chooses). The administrative decisions and choices related to how the trust’s assets are used to enrich the beneficiary are typically charged to the trust company.

The directed trustee model leads to a mutually beneficial relationship between the trust company, the investment advisor, and the client. The trust company avoids competition with investment advisors, who are often their best referral sources. The investment advisor’s relationship with their client is often written into the trust document. And most importantly, this model should result in better outcomes for the client because its team of advisors is ultimately doing what each does best—its trust company acts as a fiduciary, and its investment advisor is responsible for investment decisions.

The directed trustee model leads to a mutually beneficial relationship between the trust company, the investment advisor, and the client.

Technology

Trust administration is labor-intensive and requires extensive tax, accounting, legal and compliance expertise. Trust companies typically employ CPAs, estate planning attorneys, financial advisors, and trust officers, among other professionals. Many of our trust company clients have spent substantial amounts of money developing software and systems to reduce the administrative and compliance burden on these employees and enable fewer employees to manage more assets. We expect this trend to continue as trust companies seek to reduce overhead expenses and improve profitability. Trust company clients should benefit as well from reduced friction and improved client experience.

Succession

The ownership profile at independent trust companies is often similar to that seen at asset and wealth management firms. Ownership is often concentrated among the founders, with younger partners owning small pieces of the company. We’ve written in the past about buy-sell agreements for wealth management firms, and much of that discussion is applicable to independent trust companies as well. In short, the dynamic of a multi-generational, arms-length ownership base can be an opportunity for ensuring the long-term continuity of the firm, but it also runs the risk of becoming a costly distraction. As the trust company profession ages, we see transition planning as either a competitive advantage (if done well) or a competitive disadvantage (if disregarded).

Looking Forward

Many trust companies have performed remarkably well over the last decade, aided by the recently ended 11-year bull market and the trends discussed above. The current market environment is one of incredible uncertainty, and the outlook for trust companies and the economy as a whole will continue to evolve rapidly over the coming months. Beginning next week, we have planned a series of blog posts to explore the impact of the current market environment on investment managers.

RIA Valuation Insights

RIA Valuation Insights