Royalty Consolidation Accelerates Amid Broader E&P M&A Wave

While upstream corporate consolidation has dominated the energy M&A narrative over the past 12 months, the mineral and royalty segment has seen sustained momentum, driven by a mix of corporate mergers, strategic bolt-ons, and capital recycling among institutional holders.

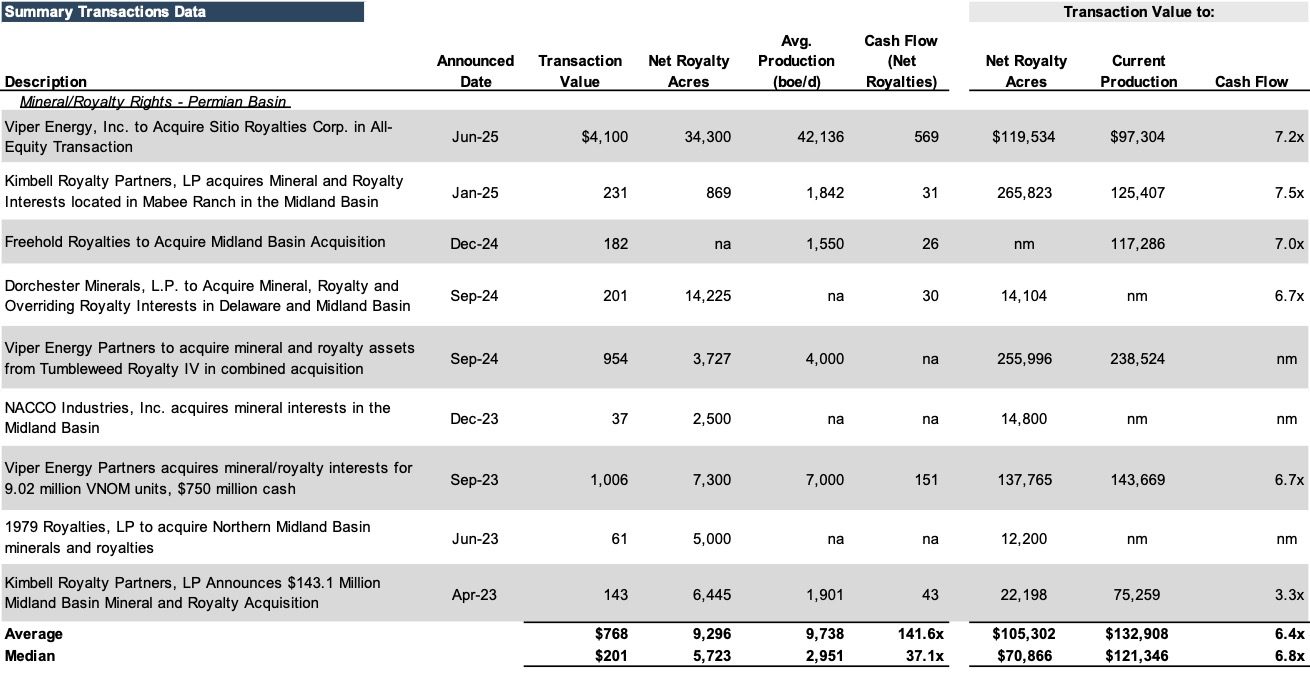

As indicated in the following table, activity in the Permian Basin remains particularly strong, with publicly traded royalty aggregators leveraging both equity and credit to consolidate top-tier positions.

Click here to expand the image above

Key Royalty Transactions (June 2024 – July 2025)

Viper Energy and Sitio Royalties Merger (June 2025)

On June 24, 2025, Viper Energy, Inc. (NASDAQ: VNOM) and Sitio Royalties Corp. (NYSE: STR) announced a definitive agreement to merge in an all-stock transaction, creating the second-largest public mineral and royalty company in the U.S. The deal implies an enterprise value of approximately $4.1 billion.

- Sitio shareholders will receive 0.4855 shares of the new Viper entity for each Sitio Class A share and 0.4855 units of Viper’s current operating subsidiary for each Sitio Class C share.

- The pro forma entity will operate under the Viper Energy name and ticker.

- Combined footprint includes over 34,000 net royalty acres and more than 100 active rigs.

Kimbell Royalty Partners – Mabee Ranch Deal (January 2025)

Kimbell Royalty Partners, LP (NYSE: KRP) acquired mineral and royalty interests in the Mabee Ranch area for $231 million, funded via a combination of equity issuance and borrowings under its credit facility. The acquired assets are located in one of the most actively developed regions of the Midland Basin, with immediate production and operator overlap.

Freehold Royalties Midland Basin Acquisition (December 2024)

Freehold Royalties Ltd. (TSX: FRU) completed a $182 million acquisition of mineral and royalty interests in the Midland Basin. The deal was financed through a CAD 125 million equity raise and expanded credit facilities. The company cited long-term cash flow visibility and development potential as key drivers of its decision.

NACCO Industries – Midland Basin Acquisition (Late 2024)

NACCO Industries, Inc. (NYSE: NC) acquired ~2,500 net royalty acres in the Midland Basin for $37 million, per year-end 2024 disclosures. While not publicly announced via press release, the transaction was confirmed in 10-K filings and aligns with NACCO’s strategy of expanding its energy portfolio selectively.

Dorchester Minerals, L.P. Acquisition (September 2024)

Dorchester Minerals, L.P. (NASDAQ: DMLP) acquired 14,529 net royalty acres in New Mexico and Texas from a group of private sellers, including Carrollton Mineral Partners. The $201 million transaction was entirely equity-funded, utilizing 6.72 million common units. Closed in late Q3 2024, the transaction reflects Dorchester’s continued focus on scaling in Tier 1 locations through non-cash structures.

Viper Energy – Tumbleweed Royalty IV Acquisition (September 2024)

Preceding the Sitio merger, Viper also announced a $954 million acquisition of 3,727 net royalty acres from Tumbleweed Royalty IV in September 2024. The transaction was funded through a blend of cash, equity, and a contingent earnout, showcasing increased flexibility in deal structuring under volatile commodity pricing.

Emerging Themes in the Royalty Market

- Corporate Consolidation Is Now a Factor. The VNOM–STR merger marks a shift from pure asset aggregation toward platform consolidation. The pro forma entity will have enhanced access to capital markets and index eligibility, setting a potential precedent for further public company combinations in the mineral space.

- Equity as an Accepted Currency. Equity issuance played a central role in transactions by Dorchester, Viper, and Kimbell, indicating broader market acceptance when assets are production-linked and accretive. This trend supports capital efficiency while preserving debt capacity.

- Structured Flexibility in Transaction Design. Earnouts, equity blends, and seller participation are increasingly common, especially in deals involving private equity or family office sellers. These tools help bridge valuation gaps and mitigate exposure to near-term price volatility.

- Focus on Core Inventory and Operator Visibility. Buyers remain concentrated in Tier 1 Permian acreage with active development schedules and strong operator overlap. Transactions involving legacy assets or fringe locations are seeing lower velocity and valuations.

- Liquidity Options for Private Holders. Private equity sponsors and non-institutional holders (e.g., Carrollton, Tumbleweed) are increasingly utilizing the public mineral entities as exit paths, whether via cash or equity-based consideration.

Valuation Implications

- Tier 1 Permian mineral deals continue to price between $30,000 and $60,000 per net royalty acre, with premiums driven by current development activity and proximity to operated rigs.

- Deal structure materially impacts pricing. Earnouts, carve-outs, and seller financing reduce headline valuations but can improve NPV for buyers.

- Consolidation premiums may begin to emerge at the corporate level, particularly where scale enables G&A rationalization and capital market benefits.

Conclusion

The mineral and royalty sector remains active beneath the surface of headline E&P consolidation. Public mineral aggregators are executing both asset-level and corporate-scale transactions, using a disciplined mix of equity, credit, and structured consideration. As private holders seek exits and public platforms scale, the market continues to offer valuable signals on underlying acreage economics, operator activity, and long-term basin development trends.

Energy Valuation Insights

Energy Valuation Insights