Uncertainty Rules the Day

Oil Markets Bewildered as World Trade Patterns Shift

Oil markets and energy companies are wrestling with understanding changes in domestic and international energy markets. As company outlooks become cloudier, uncertainty is on the rise. This has been developing for several weeks now, with some early indications showing that executives and investors don’t quite know how to respond yet. The latest Dallas Fed Energy Survey reflects this with comments such as:

“The only certainty right now is uncertainty. With that in mind, we are approaching this economic cycle with heightened capital discipline and a focus on long-term resilience. I don’t believe the tariffs will have a significant effect on drilling and completion plans for 2025, although I would imagine most managers are developing contingency plans for the potential effects of deals (Russia-Ukraine deal, Gaza-Israel-Iran deal) on global crude or natural gas flows. Now, these contingency plans probably have more downside price risk baked in than initial drilling plans did for 2025.”

Oil Markets: Prices Going Down While Costs Go Up

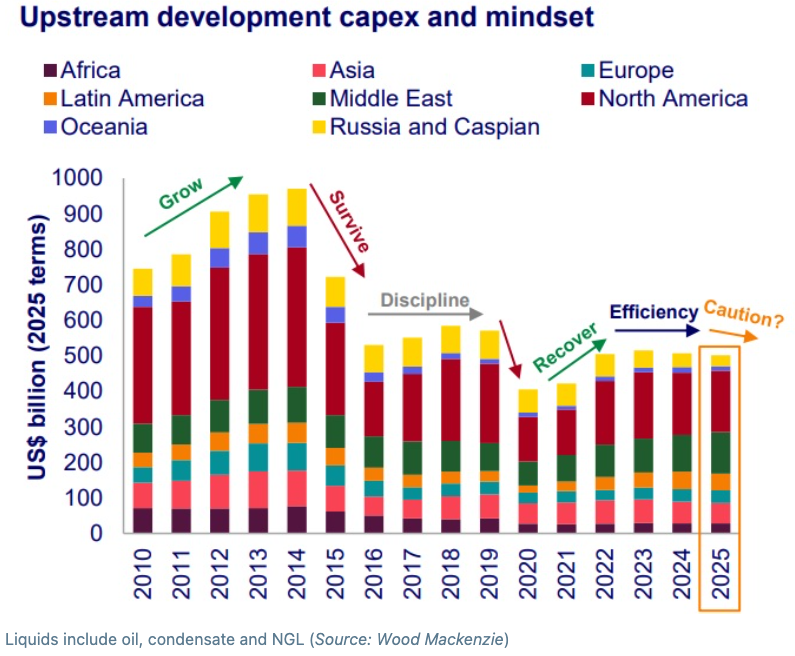

The comment above appears to reflect what is going on in Q2. Wood Mackenzie released a report emphasizing caution in capex and drilling budgets for the remainder of 2025. Fraser McKay, head of upstream analysis, reported that tariffs could increase costs for both onshore and offshore producers. In addition, OPEC+ may continue to add production to the market as well, putting further downward pressure on oil prices. The chart below from Wood Mackenzie reflects this sentiment:

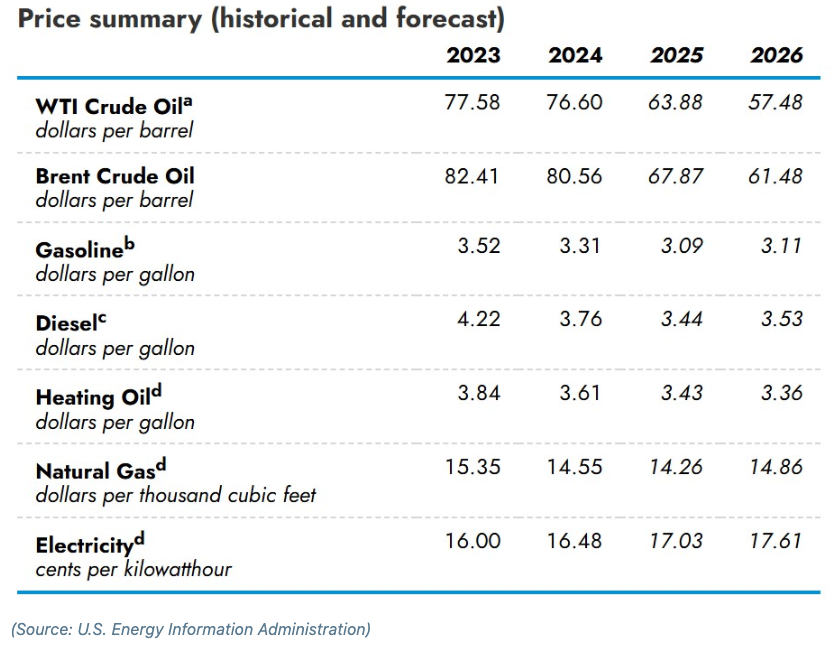

The EIA’s short-term outlook also reflects this uncertainty, as it has lowered pricing forecasts for the remainder of 2025 and beyond.

The Dallas Fed Survey estimates higher prices than the EIA for oil in 2025, $68 per barrel, but it is still down from earlier this year.

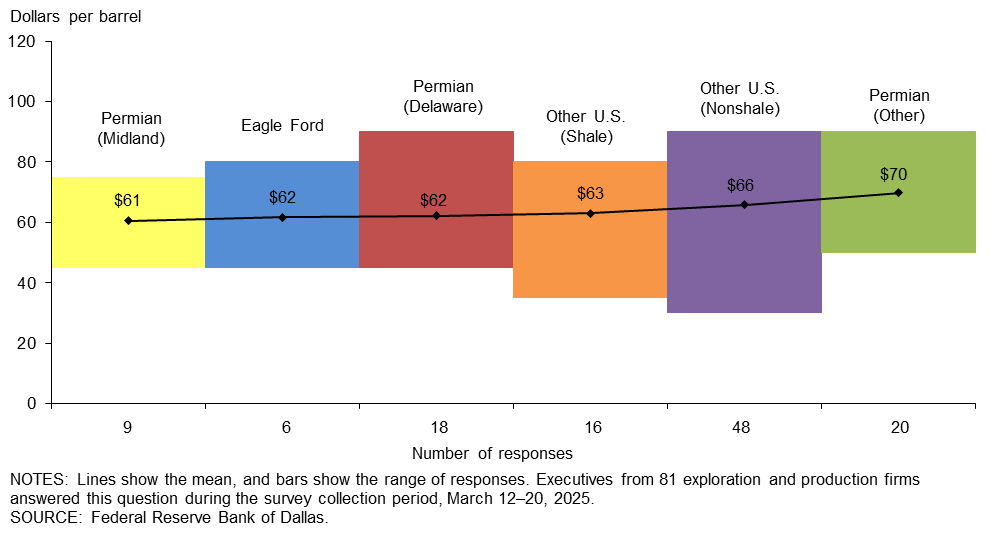

While prices go down, costs continue to increase. According to the Dallas Fed Energy Survey, both finding and development costs and lease operating costs are increasing. Breakeven costs for drilling new wells are climbing and almost parallel with current crude prices today, around $63 per barrel.

Capex Spending Pause or Pullback?

Oil executives such as Kaes Van’t Hof suggest that current crude prices could set oil markets into a period of weakness. One Dallas Fed Survey respondent said that geopolitical unrest and tariff uncertainties indicate the need to hit pause on spending. Matador is doing just that. It has recently cut its capex and production outlook for 2025 by shrinking drilling and completion plans by $100 million.

Crude oil futures are fairly flat, with December 2028 contracts priced around $62 per barrel right now. This is not the pricing environment that companies need to “drill baby drill.” Many observers feel that oil prices need to be in the $75 – $80 range to stimulate new activity. However, observers don’t know if oil will be in the $50’s or $70’s per barrel later this year either.

Planning is becoming more difficult for oil producers as steel-based products (such as tubing and well casing) are anticipated to cost more in the short term. Prices are not conducive to aggressive drilling plans, and pullback among capital plans is rising. It appears it is going to take time for oil companies to figure out what to do next.

Energy Valuation Insights

Energy Valuation Insights