Viper-Sitio Transaction Signals Strategic Shift in U.S. Royalty Landscape

On June 3, 2025, Viper Energy (NASDAQ: VNOM), a subsidiary of Diamondback Energy, Inc. (NASDAQ: FANG), announced its plan to acquire Sitio Royalties (NYSE: STR) in an all-stock transaction valued at approximately $4.1 billion. The acquisition includes Sitio’s roughly 34,300 net royalty acres, 25,300 of which are concentrated in the Permian Basin. This move underscores the growing importance of scale and efficiency in the oil and gas royalty segment.

Deal Terms and Structure

The transaction will be completed through a share exchange: Sitio shareholders will receive 0.4855 shares of the new Viper entity for each Sitio Class A share and 0.4855 units of Viper’s current operating subsidiary for each Sitio Class C share, representing units of Sitio’s operating subsidiary. Based on market prices at the time of announcement, this implies a valuation of around $19.41 per Sitio share. The deal also includes Sitio’s net debt of approximately $1.1 billion.

Upon completion, which is expected in the third quarter of 2025, existing Viper shareholders are expected to own approximately 80% of the combined entity, with Sitio shareholders owning the remaining 20%. The boards of both companies unanimously approved the deal, and voting agreements have been signed by investors representing nearly half of Sitio’s outstanding shares, including Sitio’s largest shareholder, Kimmeridge Energy Management. Kimmeridge is no stranger to making headlines in the oilfield, as Bryce Erickson discussed just over a year ago.

Expansion in the Permian and Beyond

A central driver of the merger is the significant increase in Viper’s exposure to core Permian Basin assets, with the acquired assets overlapping with roughly half of Viper’s existing gross producing wells. Viper’s net royalty acreage in the Permian will grow by approximately 42%, from about 60,400 to 85,700 acres, according to OklahomaMinerals. Sitio also adds meaningful geographic diversification with assets in the DJ Basin, Eagle Ford, and Williston plays.

In Q1 2025, Sitio reported production of over 42,000 barrels of oil equivalent per day (BOE/d), including 19,000 barrels of oil per day. Combined production is expected to reach 64,000 – 68,000 BOE/d by Q4 2025, with modest growth projected into 2026.

Financial and Operational Implications

The acquisition is expected to be immediately accretive. Viper projects an 8% to 10% increase in cash available for distribution, driven primarily by anticipated annual cost savings exceeding $50 million. Efficiencies are expected through reductions in general and administrative costs, as well as lower financing expenses. As a result, Viper’s board approved a 10% increase in the annual base dividend, raising it to $1.32 per share.

Balance Sheet and Credit Position

Following the merger, Viper expects to maintain investment-grade financial metrics. Under a $60 WTI oil price scenario, the company estimates a debt-to-EBITDA ratio of 1.2x by year-end 2025, potentially falling below 1.0x. Net debt is projected to settle around $1.5 billion, allowing continued capital discipline without jeopardizing the enhanced dividend.

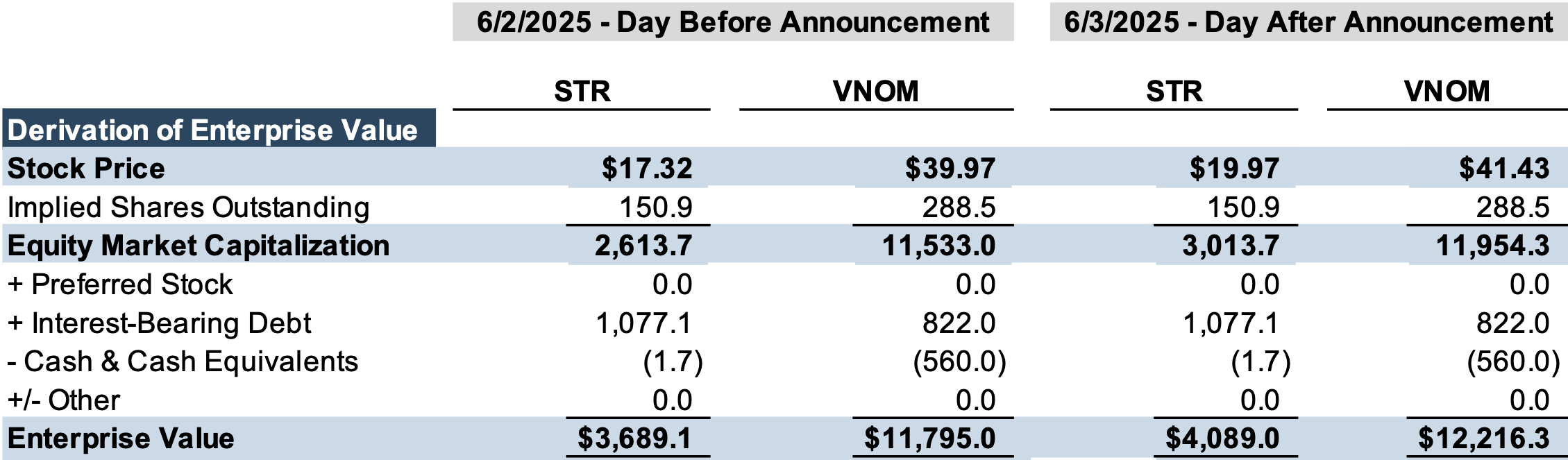

Market Context and Reaction

Market response to the announcement was largely positive. Sitio’s stock closed about 15% higher on the day of the announcement compared to the day before (see chart below). Viper’s stock price received a bump of about four percent from the day prior to the announcement. Analysts have noted that the transaction is only the second of its kind involving two publicly traded mineral and royalty companies, the first being Sitio’s 2022 $5.4 billion merger with Brigham Minerals in September 2022.

This transaction also represents a significant share of recent mineral and royalty M&A activity. By mid-2025, Viper had accounted for about 70% of all public mineral acquisitions since 2023, with over $8 billion in executed deals.

Competitive Positioning

Following the Sitio merger, Viper’s market capitalization is expected to approach $15 billion, making it one of the largest publicly traded mineral and royalty companies, second only to Texas Pacific Land, which had a market capitalization of approximately $24 billion as of June 24, 2025. While Diamondback’s ownership will be diluted to around 41%, it will retain a meaningful influence over Viper’s strategic direction.

The merger enhances Viper’s geographic diversification while preserving its strong alignment with Diamondback’s drilling schedule, offering continued visibility into future development across its expanded asset base.

Outlook

The Viper-Sitio merger represents a notable shift in strategy within a traditionally fragmented sector. It signals a move toward greater scale, operational leverage, and investor confidence in the royalty business model.

Energy Valuation Insights

Energy Valuation Insights