Where Have All the Eagle Ford Deals Gone?

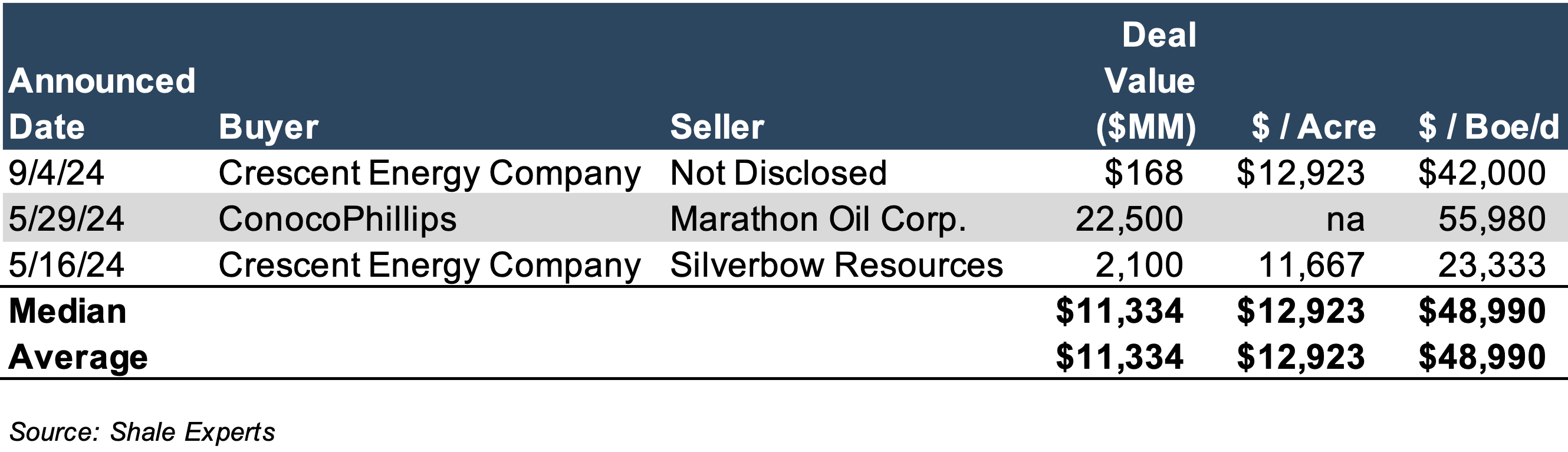

Over the past 12 months, deal activity in the Eagle Ford remained stagnant, with only two pure Eagle Ford Shale deals closing compared to two transactions closed in the prior 12-month period, according to Shale Experts. A third deal, ConocoPhillips’ $22.2 billion acquisition of Marathon Oil Corp., was spread across Marathon’s entire portfolio, which included assets in the Eagle Ford, but also the Permian Basin, the SCOOP STACK, and the Bakken Shale in the U.S., and on- and offshore Equatorial Guinea in western Africa, making a meaningful comparison to the pure Eagle Ford deals difficult.

Recent Transactions in the Eagle Ford

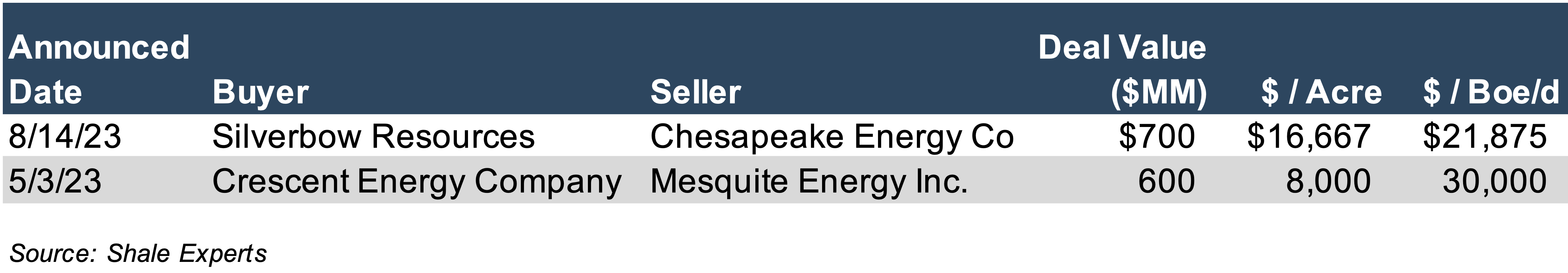

Announced on May 16, 2024, Crescent Energy purchased Silverbow Resources in an all-stock transaction for $2.1 billion, gaining 180,000 acres in the Eagle Ford, representing a purchase price of $11,667/acre. This deal created the second-largest operator in the Eagle Ford Shale and comes on the heels of Silverbow’s purchase of 42,000 acres from Chesapeake Energy for $700 million, or $16,667/acre, in 2023.

Crescent Energy was also active prior to its purchase of Silverbow, purchasing 75,000 acres from Mesquite Energy for $600 million in May 2023, or $8,000 acre. One observation from recent activity is Silverbow’s apparent “buy high, sell low” acquisition process, buying Chesapeake’s assets at $16,667/acre in August 2023 while selling its acreage to Crescent Energy at $11,667/acre. Excluding the Silverbow acquisition, Crescent, on the other hand, has made two other deals over the past two years below Silverbow’s acquisition price of Chesapeake, at $/acre values of $12,923 and $8,000.

When $2.1 Billion Does Not Equal $2.1 Billion

Crescent Energy’s announcement of its purchase of Silverbow was favorably accepted by industry observers. Andrew Dittmar, a Principal Analyst at Enverus Intelligence Research, noted that “The Eagle Ford is the most fragmented among the major unconventional plays and provides substantial opportunity to build a large and relevant company, something the Crescent team is on their way to achieving.” Tying this deal to the generally positive outlook for LNG, Dittmar further noted that “The increased scale near the coast and ability to more efficiently source pipeline capacity and coordinate on bottlenecks should also help the combined company capture value by providing gas to LNG facilities.”

Crescent Energy’s acquisition was welcomed by Silverbow shareholders (except for Kimmeridge Energy, of course), which had been engaged in fending off the private alternative asset manager and dissident Silverbow shareholder’s attempt to buy the company for two years. Silverbow, in fact, rejected Kimmeridge’s most recent offer, which valued the company at $2.1 billion, to accept Crescent Energy’s $2.1 billion. Rejecting one $2.1 billion deal for another $2.1 billion demonstrates that not all deals are created equal, even if the value on paper is the same.

Conclusion

The slowdown in M&A activity in the Eagle Ford over the past two years might be ahead of a global slowdown in upstream M&A activity. According to Rystad Energy, global M&A activity this year is expected to fall short of the highs seen over the past two years, as the major wave of consolidation in the U.S. shale sector has largely run its course. Additionally, ongoing geopolitical tensions in the Middle East and an uncertain fiscal climate in the UK will likely further dampen dealmaking. On the upside, a potential rebound in U.S. shale gas deals could provide some support—particularly if favorable Henry Hub prices align with President Donald Trump’s renewed approval of LNG export permits.

Mercer Capital has assisted many clients with various valuation needs in the upstream oil and gas industry in North America and around the world. In addition to corporate valuation services, Mercer Capital provides investment banking and transaction advisory services to a broad range of public and private companies and financial institutions. We have relevant experience working with companies in the oil and gas space and can leverage our historical valuation and investment banking experience to help you navigate a critical transaction, providing timely, accurate, and reliable results. Contact a Mercer Capital professional to discuss your needs in confidence.

Energy Valuation Insights

Energy Valuation Insights