Calibrating or Reconciling Valuation Models to Transactions in a Company’s Equity

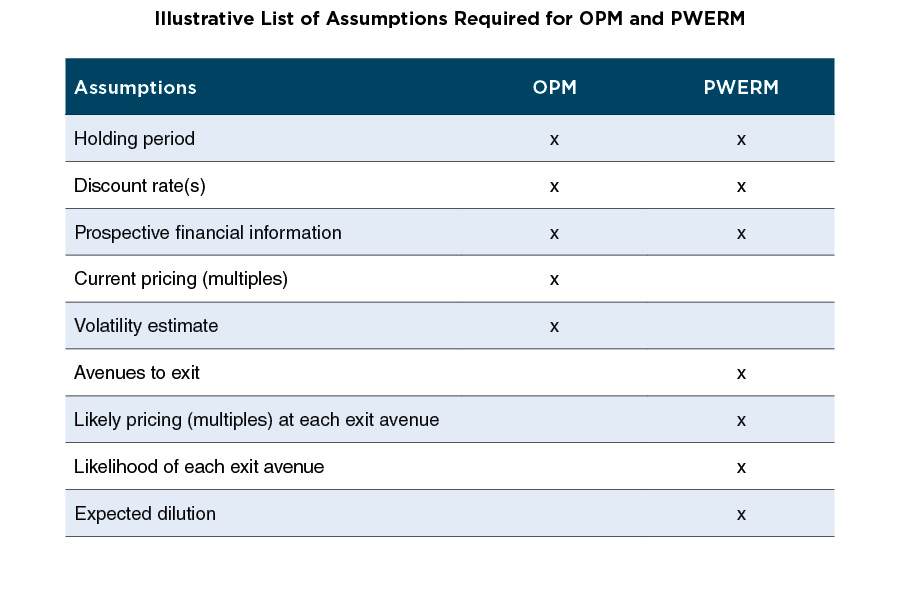

When an exit event is not imminent, the appropriate models to measure the fair value of a company with a complex capital stack are the Probability Weighted Expected Return Method (PWERM), the Option Pricing Method (OPM), or some combination of the two. While the choice of the model(s) is often dictated by facts and circumstances – for example, the company’s stage of development, visibility into exit avenues, etc. – using either the PWERM or the OPM requires a number of key assumptions that may be difficult to source or support for pre-public, often pre-profitable, companies. In this context, primary or secondary transactions involving the company’s equity instruments, which may or may not be identical to common shares, can be useful in measuring fair value or evaluating overall reasonableness of valuation conclusions.

For companies granting equity-based compensation, transactions are likely to take the form of either issuances of preferred shares as part of fundraising rounds or secondary transactions of equity instruments (preferred or common shares, as part of a fundraising round or on a standalone basis). Fundraising rounds usually do not provide pricing indications for common shares (or options on common) directly. However, a backsolve exercise that calibrates the PWERM and/or the OPM to the price of the new-issue preferred shares can provide value indications for the entire enterprise and common shares. While standalone secondary transactions may involve common shares, facts and circumstances around those transactions may determine the usefulness of related pricing information for any calibration or reconciliation exercise. Calibration, when viable, provides not only comfort around the overall soundness of valuation models and assumptions, but also a platform on which future value measurements can be based.

This article presents a brief discussion on evaluating observed or prospective transactions. Not all transactions are created equal – a fair value analysis should consider the facts and circumstances around the transactions to assess whether (and the degree to which) they are useful and relevant, or not.1

Fair Value

ASC 718 Compensation-Stock Compensation defines fair value as “the amount at which an asset (or liability) could be bought (or incurred) or sold (or settled) in a current transaction between willing parties, that is, other than in a forced or liquidation sale.” ASC 820 Fair Value Measurement defines fair value as “the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.” While some of the finer nuances may differ slightly, both definitions make reference to the concepts of i) willing and informed buyers and sellers, and ii) orderly transactions.

Notably, ASC 820 includes the directive that “valuation techniques used to measure fair value shall maximize the use of relevant observable inputsÉand minimize the use of unobservable inputs.” We take this to mean that pricing information from transactions should be used in the measurement (valuation) process as long as they are relevant from a fair value perspective.

Willing and Informed Parties

A fundraising round involving new investors, assuming the company is not in financial distress, tends to involve negotiations between sophisticated buyers (investors) and informed sellers (issuing companies). As such, these transactions are relevant in measuring the fair value of equity instruments, including those granted as compensation.

When a fundraising round does not involve new investors, the parties to the transaction are not necessarily independent of each other. However, such a round may still be relevant from a fair value perspective if pricing resulted from robust negotiations or was otherwise reflective of market pricing.

Secondary Transactions – Orderly Transactions?

As they give rise to observable inputs, secondary transactions can be relevant in the measurement process if the pricing information is reflective of fair value. Pricing from transactions in an active market for an identical equity instrument would generally reflect fair value. In other cases, orderly transactions Ð those that have received adequate exposure to the appropriate market, allowed sufficient marketing activities, and were not forced or distressed Ð can give rise to transaction prices that are reconcilable with fair value. Orderly secondary transactions that are relatively larger and those that involve equity instruments similar to the subject interests are more relevant.

Strategic Elements

Some fundraising rounds involve strategic investors who may receive economic benefits beyond just the ownership interest in the company. The strategic benefits could be codified in explicit contracts like a licensing arrangement. Consideration paid for equity interests acquired in such transactions may exceed the price a market participant (with no strategic interests) would consider reasonable. However, even as the pricing indication from such a transaction may not be directly relevant, it can be a useful reference or benchmark in measuring fair value. For example, it may be possible to estimate the excess economic benefits accruing to the strategic investors. Any fair value indication obtained separately could then be compared and reconciled to the price from the strategic fundraising rounds.

In other instances, strategic rounds may result in the company and investors sharing equally in the excess economic benefits. The transaction price could then be reflective of fair value, and a backsolve analysis to calibrate to the transaction price would be viable.

More Complex Structures

A tranched preferred investment may segment the purchase of equity interests into multiple installments. Pricing for such a round is usually set before the transaction and is identical across the installments, but future cash infusions may be contingent on specified milestones. Value of a company usually increases upon achieving technical, regulatory, or financial milestones. Even when future installments are not contingent on specified milestones, value may increase over time as the company makes progress on its business plan. Pricing set before the first installment tends to reflect a premium to the value of the company at the initial transaction date as it likely includes some expectation of potential economic upside from future installments. On the other hand, the same price may reflect a discount from the value of the company at future installment dates as the investments are (only) made once the economic upside is realized. Accordingly, a reconciliation to pricing information from these fundraising rounds may require separate estimates of the expectation of future upside (for the initial transaction date) and future values implied by the initial terms of the transaction (for later installment dates).

Some fundraising rounds involve purchases of a mix of equity instruments across the capital stack (i.e. different vintages of preferred and/or common) for the same or similar stated price per share. Usually, common shares involved in mixed purchases represent secondary transactions. From a fair value perspective, the transaction could be relevant in the aggregate and provide a basis to discern prices for each class of equity involved (considering the differences in rights and preferences among the classes). In other instances, either the company or the investor may have entered into a transaction for additional strategic benefits beyond just the economics reflected in the share prices. Depending on whether the buyer or the seller expects the additional strategic benefits, reported pricing may exceed the fair value of common shares or understate the value of the preferred shares. In yet other instances, mixed purchases at the same or similar prices may indicate a high likelihood of an initial public offering (IPO) in the near future. Typically, preferred shares convert into common at IPO and only one class of share exists subsequently.

Timing of Transactions and Other Events

Perhaps obviously, for both secondary and primary transactions, more proximate pricing indications are generally more directly useful for fair value measurement. Older, orderly transactions involving willing and informed parties would have been reflective of fair value at the time they occurred. If a more recent pricing observation is not available, current value indications could still be reconciled with the older transactions by considering changes at the company (and general market conditions) since the transaction date.

Planned future fundraising rounds could also provide useful information. In addition to the factors already addressed, a fair value analysis at the measurement date would need to consider the risk around the closing of the transaction.

Besides the usual transactions, other events that occur subsequent to the measurement date could still have a bearing on fair value. Future events that were known or knowable to market participants at the valuation date should be considered in measuring fair value. Events that were not known or knowable, but were still quite significant, may require separate disclosures.

Special Case – IPOs

An example of a special event on the horizon is an impending IPO. An IPO is usually a complex process that is executed over a relatively long period. At various points during the process, the company’s board or management, or the underwriter (investment banker) may project or estimate the IPO price. These estimates may change frequently or significantly until the actual IPO price is finalized. Even the actual IPO price may be subject to specific supply and demand conditions in the market at or near the date of final pricing. Subsequent trading often occurs at prices that vary (sometimes drastically) from the IPO price. For these reasons, estimates or actual IPO prices are unlikely to be reflective of fair value for pre-IPO companies.

Setting aside the uncertainties and idiosyncrasies around the process, an IPO provides ready liquidity for investors and access to public capital markets for the company. The act of going public ameliorates the risks associated with the lack of marketability of investments in a company. Easier access to public markets generally lowers the cost of capital, which would engender higher enterprise values. Accordingly, fair value of a minority equity interest prior to an IPO is generally perceived to be meaningfully different from (estimates of) the IPO price.

Conclusion

Incorporating information from observed or prospective transactions can help calibrate the PWERM or the OPM (or other valuation methods), along with the underlying assumptions. However, a valuation analysis should evaluate the transactions to assess whether they are relevant. Even when they are not directly relevant, transactions can help gauge the reasonableness of valuation conclusions.

Valuation specialists are fond of thinking their craft involves a blend of technique and judgment. The specific mechanics of models and methods, and related computations, represent the technical aspect. There is certainly some judgment involved in developing or selecting the assumptions that feed into the models. Judgment plays a bigger role, perhaps, in weaving together the models, assumptions, valuation conclusions, and other facts and circumstances, including transactions, into a coherent and compelling narrative.

Contact Mercer Capital with your valuation needs. We combine technical knowledge and judgment developed over decades of practice to serve our clients.

1 The discussion presented in this article is a summary of our reading of the relevant sections in the following:

Valuation of Privately-Held-Company Equity Securities Issued as Compensation, AICPA Accounting & Valuation Guide, 2013

Valuation of Portfolio Company Investments of Venture Capital and Private Equity Funds and Other Investment Companies, Working Draft of AICPA Accounting & Valuation Guide, 2018

Originally published in the Financial Reporting Update: Equity Compensation, June 2019.