Creating Value at Your Community Bank Through Developing a FinTech Framework

This discussion is adapted from Section III of the new book Creating Strategic Value Through Financial Technology by Jay D. Wilson, Jr., CFA, ASA, CBA.

I enjoyed some interesting discussions between bankers, FinTech executives, and consultants at the FinXTech event in NYC in late April. One dominant theme at the event was a growing desire of both banks and FinTech companies to find ways to work together. Whether through partnerships or potential investments and acquisitions, both banks and FinTech companies are coming to the conclusion that they need each other. Banks control the majority of customer relationships, have a stark funding advantage and know how to navigate the maze of regulations, while FinTechs represent a means to achieve low-cost scaling of new and traditional bank services. So one key question emerging from these discussions is: Who will survive and thrive in the digital age? As one recent Tearsheet article that I was quoted in asked: Should fintech startups buy banks? Or as another article discussed: Will banks be able to compete against an army of Fintech startups?

Build, Partner, or Acquire

Banks face a conundrum of whether they should build their own FinTech applications, partner, or acquire. FinTech companies face similar questions, though the questions are viewed through the prism of customer acquisition rather than applications. Non-control investments of FinTech companies by banks represent a hybrid strategy. Regulatory hurdles limit the ability of FinTech companies to make anything more than a modest investment in banks absent bypassing voting common stock for non-voting common and/or convertible preferred.

While these strategic decisions will vary from company to company, the stakes are incredibly high for all. We can help both sides navigate the decision process.

As I noted in my recently published book, community banks collectively remain the largest lenders to both small business and agricultural businesses, and individually, they are often the lifeblood for economic development within their local communities. Yet the number of community banks declines each year through M&A, while some risk loosened deposit relationships as children who no longer reside in a community where the bank is located inherit the financial assets of deceased parents. FinTech can loosen those bonds further, or it can be used to strengthen relationships while providing a means to deliver services at a lower cost.

Where to Start

In my view, it is increasingly important for bankers to develop a FinTech framework and be able to adequately assess potential returns from FinTech partnerships. Similar to other business endeavors, the difference between success and failure in the FinTech realm is often not found in the ideas themselves, but rather, in the execution.

Banks face a conundrum of whether they should build their own FinTech applications, partner, or acquire.

While a bank’s FinTech framework may evolve over time, it will be important to provide a strategic roadmap for the bank to optimize chances of success. Within this framework, there are a number of important steps:

- Determining which FinTech niche to pursue;

- Identifying potential FinTech companies/partners;

- Developing a business case for those potential partners and their solutions; and

- Executing the chosen strategy.

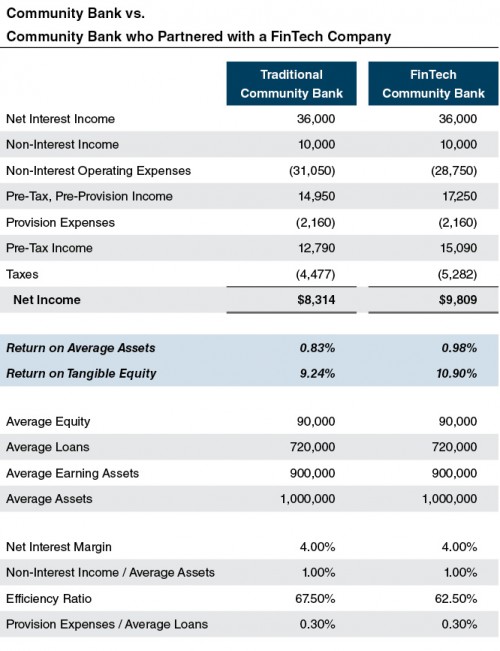

For a number of banks, the use of FinTech and other enhanced digital offerings represents a potential investment that uses capital but may be deemed to have more attractive returns than other traditional bank growth strategies. Community banks typically underperform their larger brethren (as measured by ROE and ROA) because fee income is lower and expenses are higher as measured by efficiency ratios. Both areas can be enhanced through deployment of a number of FinTech offerings/solutions.

The Importance of a Detailed IRR Analysis

The decision process for whether to build, partner, or acquire requires the bank to establish a rate of return threshold, which arguably may be higher than the institution’s base cost of capital given the risk that can be associated with FinTech investments. The range of returns for each strategy (build, partner, or acquire) for a targeted niche (such as payments or wealth management) provides a framework to help answer the question how to proceed just as is the case with the question of how to deploy capital for organic growth, acquisitions, and shareholder distributions. The same applies for FinTech companies, though often the decision is in the context of whether to accept dilutive equity capital.

A detailed analysis, including an IRR analysis, helps a bank determine the financial impact of each strategic decision and informs the optimal course.

While each option presents a unique set of considerations and execution issues/risks, a detailed analysis, including an IRR analysis, helps a bank determine the financial impact of each strategic decision and informs the optimal course. A detailed analysis also allows the bank to compare its FinTech strategy to the bank’s more traditional growth strategies, strategic plan, and cost of capital. See the table to the right for an example of a traditional community bank compared to a bank who has partnered with a FinTech company.

Questions Regarding Partnering

Beyond the strategic decisions and return analyses, some additional questions remain for community banks that consider FinTech partners, including:

- Is the bank comfortable with the FinTech company’s risk profile?

- What will the regulatory reaction be?

- Who will maintain the primary relationship with the customer?

- Is the FinTech partnership consistent with the bank’s long-term strategic plan (a key topic noted in the OCC’s whitepaper on supporting innovation)?

Questions Regarding Acquiring

Should the community bank ultimately decide to invest in a FinTech partner a number of other key questions emerge, such as:

- What is the valuation of the FinTech company?

- How should the investment be structured?

- What preferences or terms should be included in the shares purchased from the FinTech company?

- Should the bank obtain board seats or some control over the direction of the FinTech Company’s operations?

How Mercer Capital Can Help

To help both banks and FinTech companies execute their optimal strategies and create maximum value for their shareholders, we have a number of solutions here at Mercer Capital. We have a book that provides greater detail on the history and outlook for the FinTech industry, as well as containing targeted information to help bankers answer some of the key questions discussed here.

Mercer Capital has a long history of working with banks. We are aware of the challenges facing community banks. With ROEs for the majority below 10% and their cost of capital, it has become increasingly difficult for many banks to deliver adequate returns to shareholders even though credit costs today, are low. Being both a great company that delivers benefits to your local community, as well as one that delivers strong returns to shareholders is a difficult challenge. Confronting the challenge requires a solid mix of the right strategy as well as the right team to execute that strategy.

No one understands community banks and FinTech as well as Mercer Capital.

Mercer Capital can help your bank craft a comprehensive value creation strategy that properly aligns your business, financial, and investor strategy. Given the growing importance of FinTech solutions to the banking sector, a sound value creation strategy needs to incorporate FinTech into it and Mercer Capital can help.

- We provide board/management retreats to educate you about the opportunities and challenges of FinTech for your institution.

- We can identify which FinTech niches may be most appropriate for your bank given your existing market opportunities.

- We can identify which FinTech companies may offer the greatest potential as partners for your bank.

- We can provide assistance with valuations should your bank elect to consider investments or acquisitions of FinTech companies.

No one understands community banks and FinTech as well as Mercer Capital. We are happy to help. Contact me to discuss your needs.

This article first appeared in Mercer Capital’s Bank Watch, June 2017.