1st Quarter 2020 Oil & Gas Industry Overview

In the first quarter of 2020 oil benchmarks ended arguably their worst quarter in history with a thud. The concurrent overlapping impact of (i) discord created by the OPEC / Russian rift and resulting supply surge; and (ii) the drop in demand due to COVID-19 related issues was historic. Brent crude prices began the quarter around $67 per barrel and dropped to $50 per barrel by early March before plummeting to $19 per barrel by the end of March. WTI pricing behaved similarly although it continues to trail Brent pricing by a narrowing margin (about $5 per barrel) at the end of the quarter. In some areas of the Permian, local spot prices were as low as $7 per barrel towards the end of March. Natural gas, however, has trended downward, but has been more stable in the U.S. as its pricing has become increasingly more regionally tied and relatively less dependent on world oil price drivers. We will examine the macroeconomic factors that have affected prices in this first quarter.

Global Economics: OPEC+ Production Growth Collides With Covid-19 Demand Destruction

On March 5th OPEC and its allies (often referred to as OPEC+) held a meeting in Vienna. The result of that meeting was no agreement on additional production cuts beyond the end of March 2020. This was unexpected and immediately pushed prices downward about 10%. In the meantime, the COVID-19 outbreak has continued to escalate. Worldwide measures have been put in place such as quarantines, shut-ins, social distancing and other actions. This has slowed much economic activity to a crawl and, in a matter of weeks, has led to worldwide demand destruction for oil leading to the collapse of oil prices. Impacts and ripple effects abound, however many of them have yet to be easily observed. This development has upended nearly all prior market estimations from organizations such as the IEA, EIA, research institutions, and investment banks as to demand expectations. As of the end of Q1, worldwide consumption decline in 2020 is now very likely. New and revised estimations were still being developed as this has taken the market by surprise.

Logistical Consequences: Physical Markets and Force Majeure

One of the clear indicators that this situation is not simply a supply glut is that refinery margins and oil prices declined simultaneously. A dynamic such as this demonstrates demand decline. Another factor to consider is since COVID-19 originated in China, and China is a demand marker for oil and refined products, how was demand impacted there? In February, Chinese oil demand dropped by about 3 million barrels per day out of about 13 million barrels per day – a 20% drop.

This turn of events leads to some potential temporary logistical issues such as tanker demand and ultimately shut-ins if the price doesn’t move upwards soon. Storage capacity is very limited in most exporting nations, perhaps two to three months of storage ability at this pace, so there are not many places the excess supply can go. Therefore, producers may have to consider and analyze whether the cost to shut down is less than the cost to produce. Canadian oilsands may be one of the first to start this potential trend. However, even the lowest cost producer, Saudi Arabia, was struggling to find buyers for its excess supply by the end of March. This excess supply battle between Russian and Saudi Arabia will play out prominently in Europe, where Russia could possibly lose hundreds of thousands of barrels a day of production.

Additionally, back in January, the International Maritime Organization (IMO) began enacting the Annex VI of the International Convention for the Prevention of Pollution from Ships (MARPOL Convention), which lowers the maximum sulfur content of marine fuel oil used in ocean-going vessels from 3.5% to 0.5%. The implementation of MARPOL will see the marine fuels landscape change significantly as over 95% of the current market will be displaced. This disruption was already happening beforehand, impacting tanker supply and market share for liquids.

On the gas front, LNG import deliveries have been suffering from oversupply and a warm winter. There is no “gas-OPEC” to proffer a supply agreement either. China’s CNOOC has declared force majeure to turn away LNG shipments, even though China reached an accord with the U.S. to reduce tariffs on LNG imported from the U.S.

U.S. Production Headed Towards Decline

In September 2019, the U.S. became a net petroleum exporter, marking the first net export month ever since monthly records began in 1973. This may change soon. Capital expenditures for exploration and production companies immediately fell hard. Rystad expects this to drop by as much as $100 billion worldwide, the most in at least 13 years. With the steep decline curves of existing U.S. shale wells, production should drop in a matter of months.

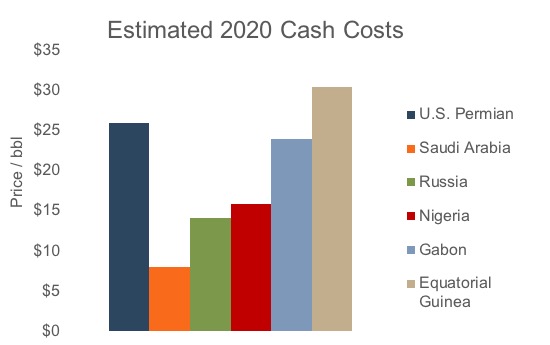

In addition to the investment decline, another historic thing happened in March. The Texas Railroad Commission began engaging with Russian Energy Minister, Alexander Novak about trimming oil output. This kind of thing hasn’t happened in Texas or the U.S. since the 1970’s. However, this is necessary for the U.S. Production costs for oil in the U.S., particularly shale oil, are higher than either Russia or Saudi Arabia. The upstream industry’s existing well base in the U.S. are underwater at low 20’s per barrel pricing. That was happening at the end of March.

Sources: Dallas Fed Energy Survey, Reuters, Seeking Alpha

However, even though Russia and Saudi Arabia can operate existing wells in this environment, it does not mean that this is sustainable for very long. No one knows how long this price war will last. That said, even a few months of this pricing environment could create chaos for the U.S. energy sector. It had already severely impacted stock prices and demonstrated even day to day volatility in public markets.

The CARES Act

In March, the President indicated that the U.S. government may become a material buyer for about 30 million barrels of U.S. produced oil in order to fill the strategic petroleum reserve. However, the funding was not authorized by congress in the CARES Act. Congressional Republicans pushed for it, but Democrats did not want to include a “bailout for big oil.” This could hasten bankruptcy acceleration for leveraged energy companies, however since this is a global event and potentially temporary, banks may table defaults and foreclosures and instead better collateralize their exposures and add more commodity price hedges according to an analyst call by UBS.

Interest Rates

The U.S. Federal Reserve cut interest rates twice in the month of March. On March 3, the Fed made an emergency decision to cut interest rates by 0.5% in response to the foreseeable economic slowdown due to the spread of the coronavirus. This cut was anticipated and largely shrugged off by the markets as interest rates continued their precipitous decline.

Benchmark rates were again cut on March 15 by a full percent to near zero. The central bank also stated that it would increase bond holdings by $700 billion on the same day. These rate cuts however failed to tame oil and gas markets as Brent fell by 10% and U.S. crude fell below $30. Lower interest rates and new bond repurchasing programs are ineffective in a weak demand environment, and prices continued to plummet through the remainder of the month.

Conclusion

The shockwave effects of these events have likely surprised even Russia and Saudi Arabia. However, even though these countries have more ability to weather low prices (see chart above), it is not in their best interest to do so. On April 2, the POTUS tweeted optimism about a 10-million-barrel production cut. This was only speculation, but markets reacted quickly and positively. Middle East, U.S. and Russian tensions will be a highlight going into the next OPEC+ meeting, which as of today has been delayed. Increased disruption could significantly affect global oil demand and price and lead to a flood of bankruptcies. In the meantime, prior expectations of U.S. production growth and exports have been tabled. The situation is dynamic, and much could change in the days and weeks to come. Stay tuned.

At Mercer Capital, we stay current with our analysis of the energy industry both on a region-by-region basis within the U.S. as well as around the globe. This is crucial in a global commodity environment where supply, demand, and geopolitical factors have varying impacts on prices. We have assisted clients with diverse valuation needs in the upstream oil and gas industry in North America and internationally. Contact a Mercer Capital professional to discuss your needs in confidence.

Energy Valuation Insights

Energy Valuation Insights