Bakken Business

Companies that have maintained a presence in the Bakken since the downturn in oil prices are beginning to reap the rewards of their patience. Rising oil prices have begat increases in production, and efficiencies gained in recent years have led to higher margins and increased production. As noted in last week’s post about transaction activity in the region, while the Permian Basin has received much of the attention recently, the Bakken certainly appears to be back in business.

Efficient and Engaged Operators

Continental Resources, Hess Corporation, and Whiting Petroleum Corporation are among the biggest players in the region. Whiting has rebounded with its stock price up 141% in the past twelve months, and their related royalty trust Whiting USA Trust II has also shown improved performance. Speaking of the decline in oil prices, Continental’s CEO Harold Hamm said recently, “We would never have gained the efficiencies that we have today without going through that.” This can be further illustrated by looking at breakeven prices in the Bakken, which have dropped from about $77 in September 2014 to below $39 per barrel in the third quarter of 2018, lower than those seen in Texas.

Greg Hill, President and COO of Hess, recently emphasized the importance of the Bakken in their portfolio, saying about 43% of Hess’ capex budget would be devoted to the region over the next three years, targeting $1 billion annually. He added that production constraints seen now in the Permian are very similar to those seen in the Bakken a few years ago.

Infrastructure Issues

The United States has long trailed other countries in terms of energy production. With the leaps and bounds made in production, the question for industry executives and investors alike is now what? Increased production has led to the need for better infrastructure, a problem currently besetting the Permian basin in particular. Extreme pricing differentials have occurred and plenty of natural gas coming off as a byproduct of oil production is being flared as a result.

About 388 million cubic feet per day of natural gas was flared in June in North Dakota. Kinder Morgan, one of the largest energy infrastructure companies has proposed a $30 million natural gas pipeline that would alleviate 130 million cubic feet per day, with the project slated to begin construction mid-2019 and be finished by year-end, pending regulatory approval. Pipelines have been cast by industry executives as a safer alternative to rail transportation, though critics view this as a straw man argument. With the introduction of the Dakota Access pipeline (DAPL) in mid-2017, about half of the region’s production (470,000 barrels per day of crude oil) will travel by this pipeline. Despite the DAPL and other pipelines like the one proposed by Kinder Morgan, rail travel will still figure heavily into the equation as refiners on the East and West coast have low pipeline connectivity and much of the oil from other regions ends up with one of the numerous refiners in the Gulf of Mexico.

The Minneapolis Fed recently outlined five other projects aimed at increasing gas processing capacity, including a $100 million expansion of a natural gas processing plant near Killdeer, ND. While companies seek high levels of production to take advantage of higher oil prices, these infrastructure constraints have a negative impact. Hamm emphasized this point saying, “Instead of just producing oil, we’re going to make sure we produce shareholder return.”

Rig Counts and Production

According to Baker Hughes, rig counts in North America declined 1.0% in the last three months, but increased 11.4% over the last twelve months. The Permian Basin has led the way with an increase of 26.2% in the past year, leading them to have 46.5% of total rigs. Rig counts peaked in the Bakken in May 2018, reaching heights unseen since 2015, but the Bakken continues to trail the Eagle Ford, Permian, and Appalachia regions. While rig counts aren’t ballooning in Bakken, this may be because operators like Continental are focusing on completing wells that have already been drilled (“DUCs”), a cheaper alternative to drilling new ones.

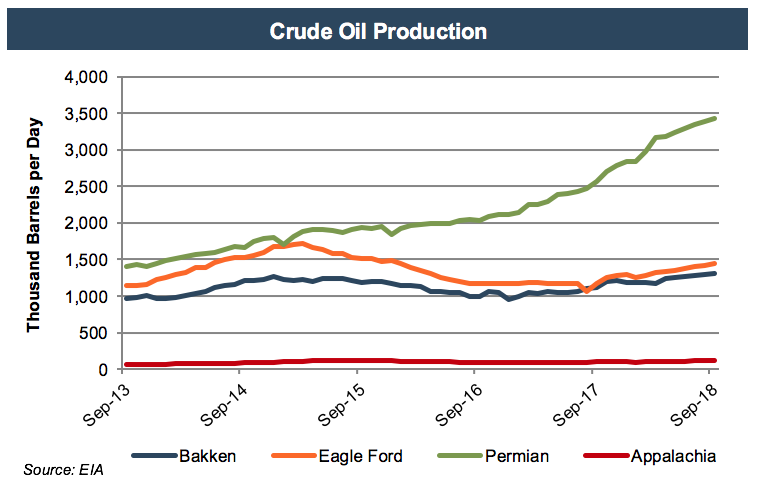

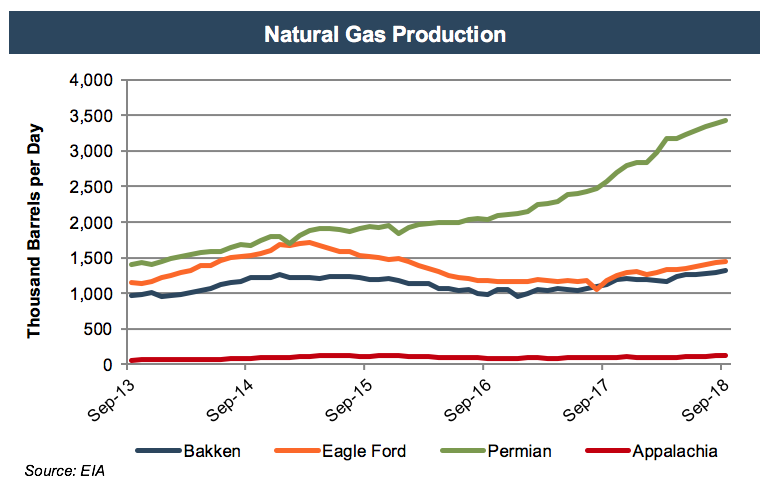

Although oil production in the Bakken has increased 9.9% in the past year, it lagged the other four regions covered with the Permian setting the pace with a 26.6% increase. Natural gas production in the Bakken increased 17.2% in that same time, again trailing the Permian’s growth of 25.5%. Given the Bakken only produces a little over a third as much crude oil and a fifth of the natural gas, it will be interesting to see if the Permian can maintain its torrid pace or if capacity constraints will allow others to close the gap.

Valuation Implications

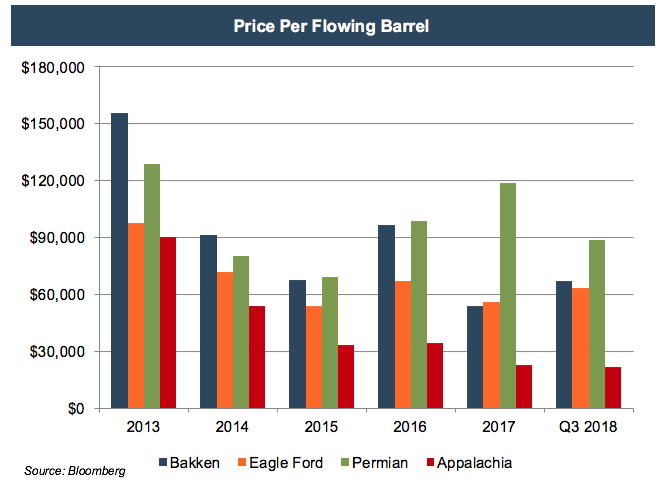

Before the crash in oil prices, the Bakken was booming with the highest EV/production multiples, also known as price per flowing barrel. The Permian took center stage in 2017, but the Bakken is closing that gap as the Permian has come back to the pack a bit in 2018.

Conclusion

A rising tide raises all boats, and a rising oil price raises production in all regions. With the efficiencies gained, operators and investors in the Bakken and elsewhere will seek higher revenue and higher returns. Soaring production has led to unintended consequences such as flaring and inadequate infrastructure constraining capacity. Increasing this capacity will allow E&P Companies to increase returns and continue to ramp up production.

We have assisted many clients with various valuation needs in the upstream oil and gas space in both conventional and unconventional plays in North America, and around the world. Contact a Mercer Capital professional to discuss your needs in confidence and learn more about how we can help you succeed.

Energy Valuation Insights

Energy Valuation Insights