Large Acquisitions Dominate the Permian M&A Landscape

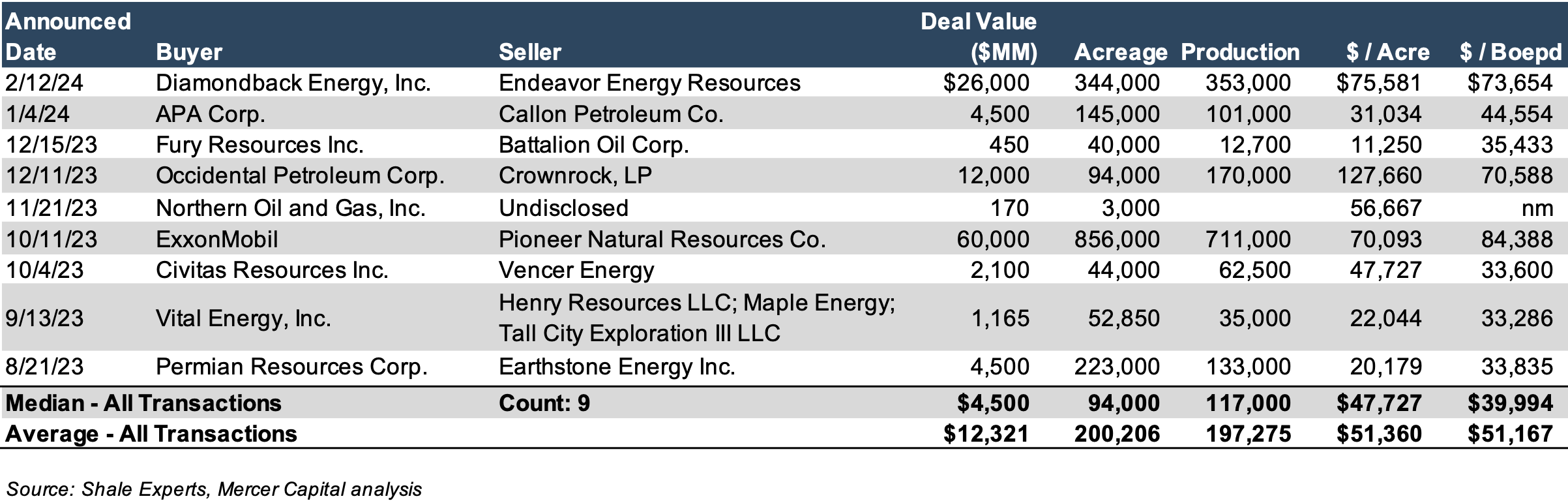

Transaction activity in the Permian Basin declined over the past 12 months, with the transaction count decreasing 53% to nine deals, a decline from the 19 deals that occurred over the prior 12-month period. This level is also well below the 21 deals that occurred in the 12-month period ended mid-June 2022 and the 27 transactions that closed during the same time period in 2021. The trophy transaction over the past 12 months was ExxonMobil’s $60 billion acquisition of Pioneer Resources, announced in October 2023 and closed in May 2024.

Relative to 2022-2023, the median deal size over the past 12 months was approximately $4.5 billion, approximately 9.5x larger than the median deal size of $475 million in the prior 12-month period. The median acreage purchased over the past year was 94,000 net acres, nearly 5.0x higher than the 16,000 acres among the deals in the previous year. When looking at acquired production, the median production among transactions over the past year was 117,000 barrel-oil-equivalent per day (“Boepd”), a monstrous 800% increase from the 13,000 Boepd metric from the prior year.

The obvious observation is that companies are paying more per acre than one year prior, with the median price per net acre up 58% period-over-period, while the median transaction value per Boepd fell 27% – from $54,878 in the prior 12 months preceding June 2023 to $39,994 in the latest 12-month period. One year ago, this jumped 43% from $49,143 in 2021 to $54,878 in 2022.

Click here to expand the image above

Notably, the observations were skewed by the ExxonMobil-Pioneer deal, but Diamondback Energy’s $26 billion acquisition of Endeavor Energy Resources also impacted the statistics. And while not the largest deal, Warren Buffet-backed Occidental Petroleum’s acquisition of Crownrock, LP was not too shabby at $12 billion (the deal is currently being evaluated by the FTC and is expected to close in August 2024).

It is worth noting that large deals have not been limited to the Permian Basin. Chevron closed on its $53 billion acquisition of Hess on May 28th. One day later, Conoco Phillips announced it would purchase Marathon Oil for $22.5 billion.

With a number of recent significant deals announced or closed, what is the future of Permian M&A activity? PB Oil and Gas magazine recently proposed this question to Emily Head, Senior Geology Associate on the Permian Team at Enverus Intelligence research. Head is of the opinion that few large targets remain given $100 billion of activity occurred in 2023. However, acquisitions will continue as bigger companies seek to replace diminishing tier-one drilling opportunities.

ExxonMobil: “I’m Kind of a Big Deal”

Lest anyone forget that Exxon acquired Mobil in 1998 for $81 billion, ExxonMobil reminded the world of its Ron Burgundy stature with its $60 billion acquisition of Pioneer Resources in October 2023. The merger between ExxonMobil and Pioneer has created an unconventional business with significant development potential in the Permian Basin. The combined company holds over 1.4 million net acres in the Delaware and Midland basins, estimated to contain 16 billion barrels of oil-equivalent resources. ExxonMobil’s Permian production volume is set to more than double, reaching 1.3 million barrels of oil equivalent per day (MOEBD) based on 2023 volumes. Projections indicate that this production could increase to approximately 2.0 MOEBD by 2027.

ExxonMobil Chairman and CEO Darren Woods noted,

“Pioneer is a clear leader in the Permian with a unique asset base and people with deep industry knowledge. The combined capabilities of our two companies will provide long-term value creation well in excess of what either company is capable of doing on a standalone basis. Their tier-one acreage is highly contiguous, allowing for greater opportunities to deploy our technologies, delivering operating and capital efficiency as well as significantly increasing production. As importantly, as we look to combine our companies, we bring together environmental best-practices that will lower our environmental footprint and plan to accelerate Pioneer’s net-zero plan from 2050 to 2035.”

Pioneer Chief Executive Officer Scott Sheffield commented,

“The combination of ExxonMobil and Pioneer creates a diversified energy company with the largest footprint of high-return wells in the Permian Basin. As part of a global enterprise, Pioneer, our shareholders, and our employees will be better positioned for long-term success through a size and scale that spans the globe and offers diversity through product and exposure to the full energy value chain. The consolidated company will maintain its leadership position, driving further efficiencies through the combination of our adjacent, contiguous acreage in the Midland Basin and our highly talented employee base, with the improved ability to deliver durable returns, creating tangible value for shareholders for decades to come.”

Diamondback Energy Endeavors to Maximize Shareholder Value

Diamondback Energy’s acquisition of Endeavor Energy Resources creates a premier Permian pure play well-positioned to deliver a low-cost operating structure on a world-class asset.

Deal highlights include:

- Combined pro forma scale of approximately 831,000 net acres and 816 Mboe/d of net production

- Best-in-class inventory depth and quality with approximately 6,100 pro forma core locations with break evens <$40 WTI

- Annual synergies of $550 million representing over $3 billion in PV10 value over the next decade

- Substantial near- and long-term financial accretion with approximately 10% free cash flow per share accretion expected in 2025

Travis Stice, Chairman and Chief Executive Officer of Diamondback, noted,

“This is a combination of two strong, established companies merging to create a ‘must own’ North American independent oil company. The combined company’s inventory will have industry-leading depth and quality that will be converted into cash flow with the industry’s lowest cost structure, creating a differentiated value proposition for our stockholders. This combination meets all the required criteria for a successful combination: sound industrial logic with tangible synergies, improved combined capital allocation, and significant near and long-term financial accretion. With this combination, Diamondback not only gets bigger, it gets better. This combination offers significant, tangible synergies that will accrue to the pro forma stockholder base. Diamondback has proven itself to be a premier low-cost operator in the Permian Basin over the last twelve years, and this combination allows us to bring this cost structure to a larger asset and allocate capital to a stronger pro forma inventory position. We expect both teams will learn from each other and implement best practices to improve combined capital efficiency for years to come.”

Lance Robertson, President and Chief Executive Officer of Endeavor, commented,

“As we look toward the future, we are confident joining with Diamondback is a transformational opportunity for us. Our success up to this point is attributable to the dedication and hard work of Endeavor employees, and today’s announcement is recognition by Diamondback of the significant efforts from our team over the past seven years, driving production growth, improving safety performance, and building a more sustainable company. We look forward to working together to scale our combined business, unlock value for all of our stakeholders, and ensure our new company is positioned for long-term success as we build the premier Permian-focused company in Midland.”

Conclusion

While the pace of M&A activity in the Permian has waned relative to prior years, deal size made up for lower deal volume. Despite fewer “big game” targets remaining, the Permian Basin still offers resources to companies seeking to maintain high-quality reserve inventory. We have assisted many clients with various valuation needs in the oil and gas industry in North America and globally. In addition to our corporate valuation services, Mercer Capital provides investment banking and transaction advisory services to a broad range of public and private companies and financial institutions. We have relevant experience working with companies in the oil and gas space and can leverage our historical valuation and investment banking experience to help you navigate a critical transaction, providing timely, accurate, and reliable results. Contact a Mercer Capital professional to discuss your needs in confidence.

Energy Valuation Insights

Energy Valuation Insights