M&A in the Permian

Acquisition Growth Flat Ahead of Expected Surge

Transaction activity in the Permian Basin remained flat over the past 12 months. The transaction count decreased slightly to 19 deals, a decline of two from the 21 deals that occurred over the prior 12-month period. This level is in line with the 22 transactions that occurred in the 12 months ended mid-June 2020 but well off the pace of the 27 transactions that closed during the same time period in 2021. While deal activity has remained flat year-over-year, three deals have closed since the beginning of May, including two deals valued at over $2.0 billion each (discussed in detail below), as producers are showing concern that “Grade-A” drilling sites are becoming scarce. The most likely targets are expected to be publics with market capitalizations of less than $10 billion. Ryan Lance, CEO of ConocoPhillips, recently suggested that M&A in the Permian Basin is a necessity for exploration and production to remain a healthy business.

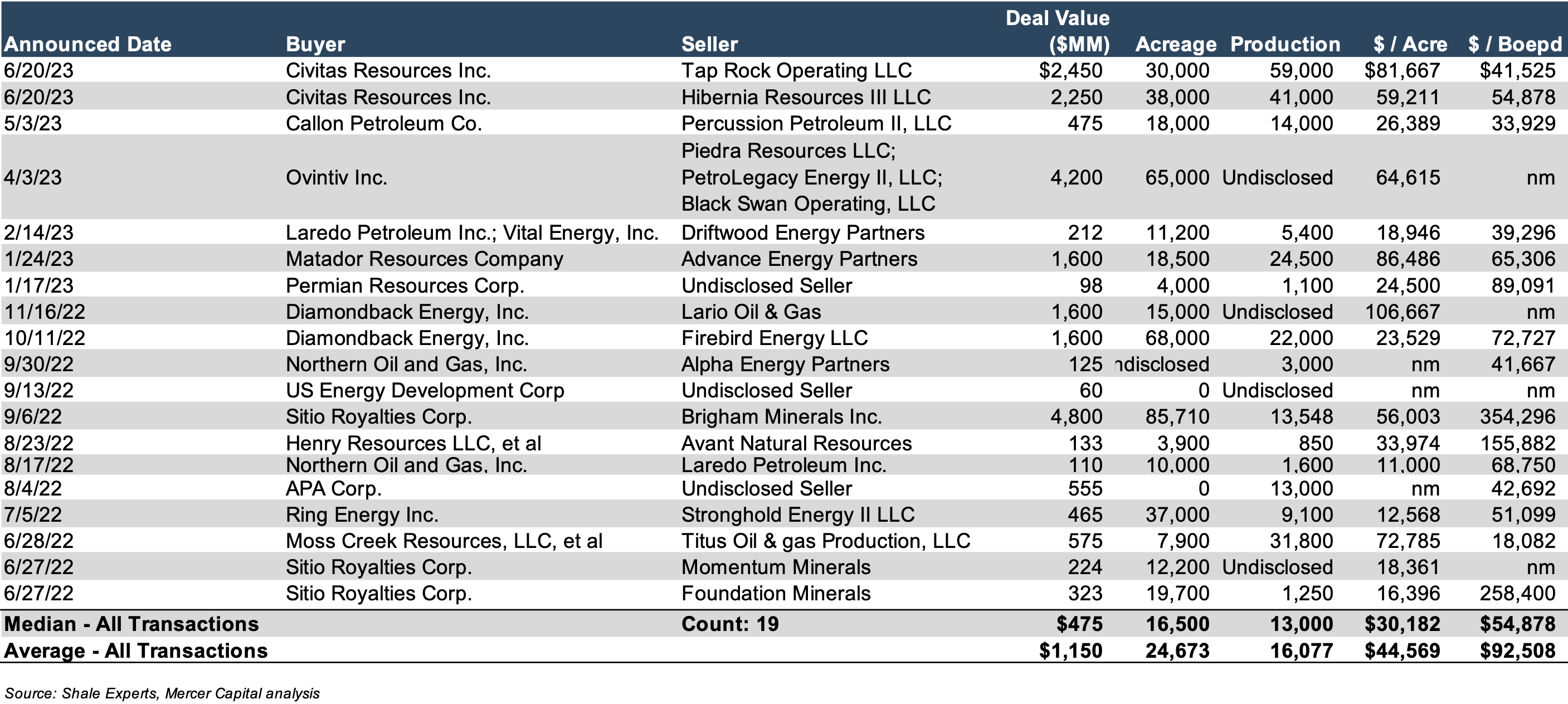

A table detailing E&P transaction activity in the Permian over the last 12 months is shown below. Relative to 2021-2022, the median deal size was approximately $475 million, 23% higher than the $387 million median deal size in the prior 12-month period. However, the median acreage purchased over the past year was 16,500 net acres, over 21% lower than the 20,000 acres in the previous year. The theme is flipped upside down, however, when looking at acquired production, as the median production among transactions over the past year was 13,000 barrel-oil-equivalent per day (“Boepd”), a whopping 136% increase from the 5,500 Boepd metric from the prior year.

The obvious observation is that companies are paying more per acre than one year prior, with the median price per net acre up 43% period-over-period. While the median transaction value per Boepd jumped 12% (from $49,143 in the prior 12 months preceding June 2022 to $54,878 in the latest 12-month period), one year ago, this jump was 54%, from $31,886 in 2020 to $49,143 in 2021. This tempered willingness to pay more per Boepd than one year prior could suggest that the underlying economics of the targets are increasingly less attractive. However, the marginal costs of these acquisitions may have breached the perceived marginal returns projected for these properties, as evidenced by the relatively flat transaction count compared to last year.

Click here to expand the image above

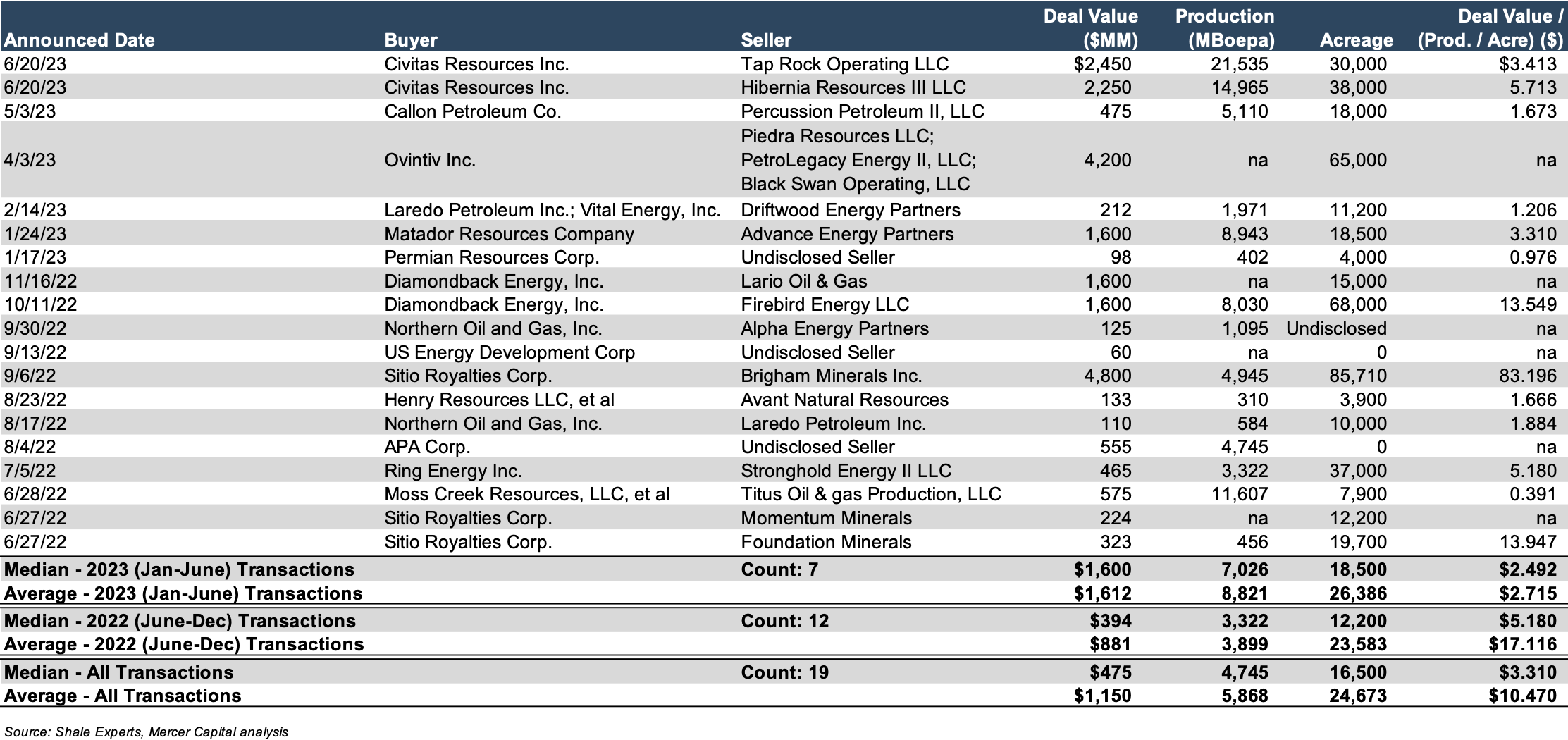

The approach to the marginal “equilibrium” appears to have been a pretty short runway to land on. Of the 19 completed transactions, 12 occurred from June to December, with the remaining seven from January 2023 to the present. Based on the deal value per production (annualized) per acre, one metric we analyzed indicates a sharp increase in the “bang for the buck” exhibited by the transactions before and after year-end 2022. As presented below, the median cost per production acre for the 12 transactions from June to December 2022 was $5.18. In contrast, the median metric for the seven transactions from January to June 2023 was $2.492, indicating an approximate 50% decrease in the cost per production acre. A deeper dive into the details of each transaction would be needed to discern any common causes for this movement, but it could indicate a shift in focus from developed-producing reserves towards undeveloped acreage. In other words, acquirers may be putting increased value on the potential optionality for greater-but-yet-proven production presented by these targets. This observation ties in nicely with the prior observation of increased deal value per acre.

Click here to expand the image above

Civitas Resources Sitting on One Decade’s Worth of Permian Inventory

On June 20, 2023, Civitas Resources announced the completion of two separate asset transactions: the purchase of oil-producing assets in the Midland and Delaware Basins from Tap Rock Resources and Hibernia Resources III, both of which are portfolio companies of funds managed by NGP Energy Capital Management. The combined transaction value of the two deals was approximately $4.7 billion ($2.45 billion for the Tap Rock Resources assets and $2.25 billion for the Hibernia Resources assets). Transaction highlights include:

- Permian Basin entry with immediate scale: The combined transactions will add approximately 68,000 net acres (90% held by production) in the Midland and Delaware basins. The transactions will increase Civitas’ existing production by 60%, adding approximately 100 MBoe/d (54% oil) of current production, with the acquired assets expected to average approximately 105 Mboe/d from close through year-end 2023.

- Adds premium, low breakeven oil inventory, enhances oil-weighting and margins: Combined, the acquisitions will add about 800 gross locations, with approximately two-thirds having an estimated IRR of more than 40% at $70/Bbl WTI and $3.50/MMBtu Henry Hub NYMEX pricing.

- Attractively priced, immediately accretive to key financial metrics: The acquisitions are attractively priced at 3.0x 2024 estimated Adjusted EBITDAX (after taking into account the consummation of the transactions). The transactions are expected to deliver an estimated 35% uplift to 2024 free cash flow per share. Civitas expects to generate approximately $1.1 billion of pro forma free cash flow in 2024 at $70/Bbl WTI and $3.50/MMBtu Henry Hub NYMEX pricing.

- Balanced portfolio maximizes capital allocation flexibility: Post close, Civitas will have a more balanced asset portfolio with basin and commodity diversity. The transactions will provide flexibility in future capital allocation and optimize returns.

Civitas President & CEO Chris Doyle commented,

“These accretive and transformative transactions will immediately create a stronger, more balanced and sustainable Civitas. By acquiring attractively priced, scaled assets in the heart of the Permian Basin, we advance our strategic pillars through increased free cash flow and enhanced shareholder returns. We will soon have nearly a decade of price-resilient, high-return drilling inventory. Our strong capital structure allowed us to capture these transformational assets, and, importantly, behind the strength of the pro forma business, we have a clear path to reduce leverage and maintain long-term balance sheet strength.”

Civitas plans to fund the two transactions by issuing approximately $2.7 billion of unsecured senior debt, 13.5 million shares of Civitas common stock valued at $950 million, $600 million in borrowings under the Company’s undrawn credit facility, and $400 million of cash-on-hand.

Conclusion

M&A transaction volume in the Permian declined during the first half of 2023 (seven deals) relative to the back half of 2022 (12 deals). Still, a late push of four deals from April through June 2023 could be the start of increased M&A activity as producers scramble to add quality assets to their portfolios. From a deal value perspective, these four deals account for approximately 43% of the total deal value from all 19 deals since the end of June 2022.

We have assisted many clients with various valuation needs in North America’s oil and gas industry and globally. In addition to our corporate valuation services, Mercer Capital provides investment banking and transaction advisory services to a broad range of public and private companies and financial institutions. We have relevant experience working with companies in the oil and gas space and can leverage our historical valuation and investment banking experience to help you navigate a critical transaction, providing timely, accurate, and reliable results. Contact a Mercer Capital professional to discuss your needs in confidence.

Energy Valuation Insights

Energy Valuation Insights