The Inside “SCOOP”

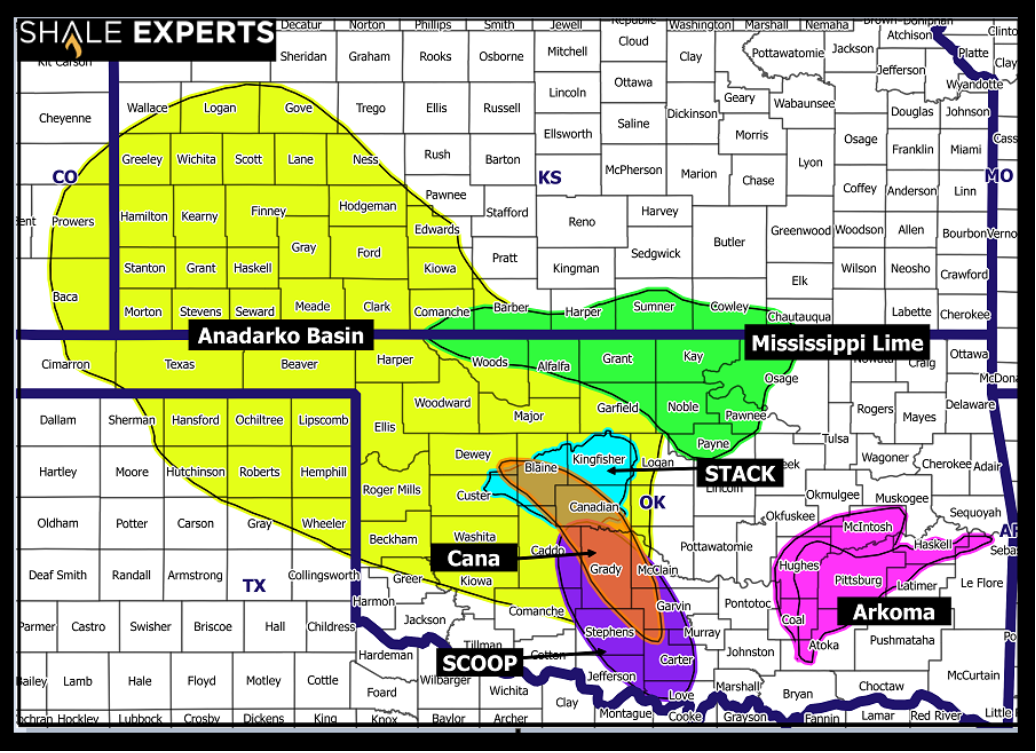

The SCOOP/STACK is a significant oil and gas play found in the Anadarko Basin of Oklahoma. The “SCOOP” part of the name refers to “South Central Oklahoma Oil Province,” and “STACK” is an abbreviated geographic description: the Sooner Trend oil field, the Anadarko basin, and the Canadian and Kingfisher counties.

Historically, the Anadarko Basin has been a prolific area for oil and gas extraction. It spans approximately 70,000 square miles across Western Oklahoma, the Texas Panhandle, and parts of Southwestern Kansas and Southeastern Colorado. The basin’s geology features some of the thickest and highest-quality shale reservoirs in the United States, making it an attractive site for drilling and production. Given that fact pattern, it might surprise some to learn that activity in the SCOOP/STACK has been sluggish, to say the least, in recent times.

Mergers and STACK-quisitions

At a time when both upstream and midstream companies are undergoing significant consolidation, there has been virtually no M&A activity in the SCOOP/STACK. In fact, per Shale Experts, there has not been a single upstream corporate transaction since Q3 of 2022, when Sitio Royalties Corporation merged with Brigham Minerals Inc. in a deal valued at $4.8 billion. Despite this combined company’s significance in the basin deal, Sitio has not had a large number of recent completions in the SCOOP/STACK as of the writing of this post.

The story is quite similar for the midstream sector in the SCOOP/STACK. The most recent transaction per Shale Experts occurred in January of 2021.

This lag in M&A is tied in with a number of economic factors that make the SCOOP/STACK a challenging play to operate in.

20% IRR? No Pressure

As shown in the table above, the SCOOP/STACK is a comparatively small play compared to the Bakken or the Eagle Ford, with a fairway size of just 3,300 square miles. In other words, there is not much room for a large number of operators compared to other plays. This is especially important because the SCOOP/STACK seems to be particularly touchy in terms of well spacing. With a small amount of room to operate, there is an increased likelihood that new wells will reduce production capacity for existing wells (while also causing the new wells to have lower production rates than initially forecasted). Additionally, the SCOOP/STACK has considerable depth, which can lead to higher extraction risks and costs that damage profitability.

One of the risks operators must contend with is geological/political instability. In 2015, legislators in Oklahoma introduced new wastewater disposal rules after they stated that water injected into the rock pores was causing earthquakes. As a result of these new regulations, the areas where operators can drill are even more limited, and operators are legally required to incur additional costs to monitor their water injection rates.

There is another confounding factor that challenges operators in the play: pressure. The reserves in the SCOOP/STACK are under relatively low amounts of pressure. As a result, operators trying to focus on oil production may find that their reservoirs contain higher amounts of natural gas instead. Since Oklahoma typically has higher gas transportation costs, some wells can be shut down early on in their lives when natural gas prices are unfavorable. Even if the operators continued drilling, some operators have found it difficult to transport that gas once it is out of the ground. Without sufficient infrastructure to transport the gas, operators could be forced to put temporary restraints on production.

The impact of these costs is significant. Per data published by Platts Analytics, as of 2020, the IRR on STACK wells was 17%, while SCOOP wells had an IRR of just 11%. That compares very unfavorably with the industry’s “rule of thumb” IRR of 20%. The reason for the discrepancy is simple: high costs.

Current E&P Activity: Costs Keep STACKing Up

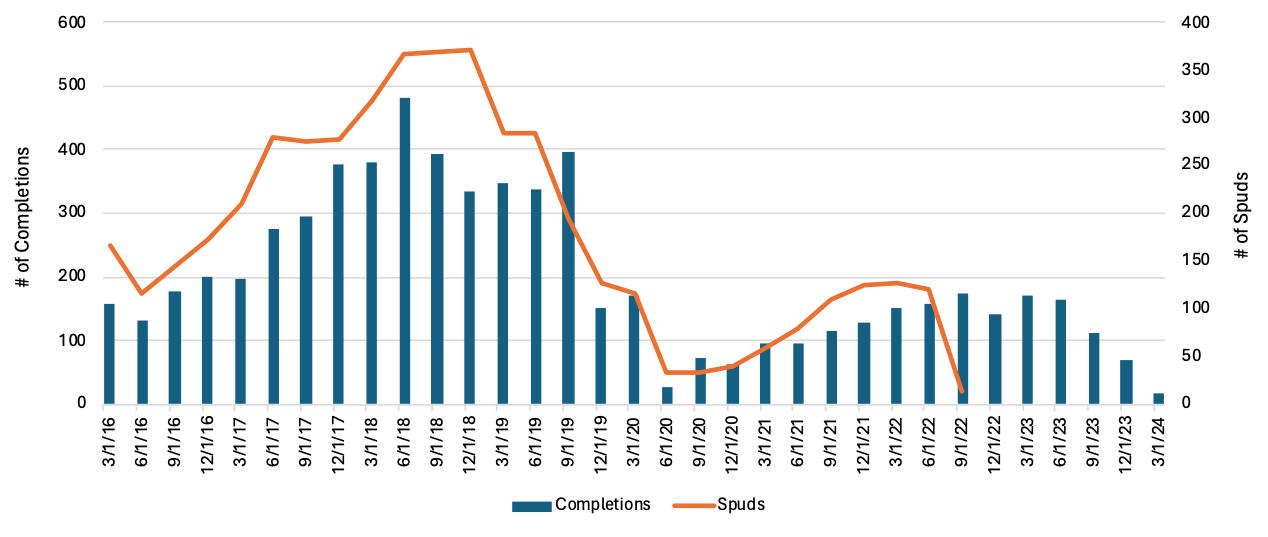

The chart below (created with data provided by Shale Experts) sheds more light on recent activity in the play.

Click here to expand the image above

Based on the table above, it appears that the buildup in activity in the late 2010s was interrupted around the time of the COVID-19 pandemic, and the play has failed to sustain its recovery.

Click here to expand the image above

Over the LTM period, we can see that there were only 29 operators with multiple completions. Overall, activity can be described as heavily segmented. With 537 completions over the last twelve months, the largest operator, BCE Mach III LLC, had only 64 completions. Even so, BCE had a little over twice as many completions as the second most productive operator, Continental Resources. Continental’s high amount of activity is unsurprising, given the geography of its asset base. Its presence in the SCOOP/STACK dates back to 2012, when it began looking for new opportunities connected to its Woodford assets. BCE-Mach III, on the other hand, is a particularly interesting player.

Bayou City Energy Management is an upstream-focused private equity firm founded in 2015. In 2018, they partnered with the privately owned Mach Resources LLC to form several subsidiary companies to acquire upstream and midstream assets. Since that time, the companies have completed a number of acquisitions that have given them access to thousands of producing wells across middle America and a self-described “extensive infrastructure portfolio including two fully integrated water transfer and disposal systems (~700 miles of water pipelines and ~45 disposal wells), three gas gathering and processing systems (~310 MMcf/d processing capacity and ~450 miles of gathering lines), an ~85,000 HP compression fleet, and a crude gathering system (108 miles of pipeline and 50,000 bbl storage facility)”. It is likely that this portfolio, sold off with low valuations due to operating difficulties in the Anadarko, can be utilized more effectively at scale by the BCE-Mach entities. Based on the high number of completions, the joint venture managers agree.

Another notable operator finding success in the STACK play is Devon Energy Corp. In their Q4 2023 earnings call, Executive VP and COO Clay Gaspar announced that their 3-rig drilling program funded by a joint venture with DOW saw 8% production growth during 2023 and that their teams kept costs 10% lower than prior operations. Based on this performance, they plan to continue drilling in the Anadarko during 2024.

Through their use of economies of scale and unique competitive advantages, especially the geographical concentration of their assets, BCE-Mach III, Continental, and Devon may have figured out a way around the prohibitive costs that other operators seem to struggle with in the SCOOP/STACK. While the total amount of activity may be decreased, it is certainly possible that there is still plenty of oil to be produced and money to be made.

Mercer Capital has assisted many clients with various valuation needs in the oil and gas industry in North America and globally. In addition to our corporate valuation services, Mercer Capital provides investment banking and transaction advisory services to a broad range of public and private companies and financial institutions. We have relevant experience working with companies in the oil and gas space and can leverage our historical valuation and investment banking experience to help you navigate a critical transaction, providing timely, accurate, and reliable results. Contact a Mercer Capital professional to discuss your needs in confidence.

Energy Valuation Insights

Energy Valuation Insights