How is a veterinary practice or animal hospital valued? Are the valuation concepts different for change of control versus allocation of purchase price for ASC 805 compliance? Knowing which methods to apply in the valuation of a veterinary practice and which assets to recognize in a business combination can have a material impact on the value of a company and its purchase price allocation. In this post, we hope to focus more on several key elements that would directly impact or concern veterinary practices and animal hospitals.

Enterprise Value

Enterprise value refers to the valuation of the entire entity, such as when contemplating a sale of the business or a transfer of a pro rata ownership interest. Enterprise value is also the basis for testing goodwill for impairment, whether on a reporting unit or company-wide basis.

There are three general approaches to determining the enterprise value of a company. These three approaches encompass a variety of different methods to determine an estimate of value.

The most frequently used method under the asset approach is the net asset value method, which looks at the value of the company’s tangible, operating assets net of any debt. In many cases, this approach excels at capturing the value of the tangible part of the company – the inventory, desks, and computers that underlie a business but fail to capture the ongoing operations of the company.

Other commonly used methods under the income approach are the discounted cash flow method and the capitalization of ongoing earnings method. The discounted cash flow method projects a stream of future income and converts the cash flow into a value today given expectations of inflation and risk. The capitalization of earnings method uses a point estimate of expected ongoing earnings to develop a value. Both of these methods incorporate the risks of running the company and the cash flow that produces value for the owner of a company.

Methods under the market approach include the guideline transaction method and the guideline public company method. Both methods use market data and ratios to estimate the company’s value given its revenue, income, or equity. The difficulty with these approaches in the animal health industry is often the scarcity of data – the only publicly traded company focusing on animal hospitals or veterinary practices is VCA, Inc. (ticker: WOOF). With over 760 animal hospitals in 43 states as of June 30, 2016, it is hard to compare VCA to many single-location animal hospitals or veterinary practices and derive meaningful valuation inferences. Similarly, M&A transaction data can be difficult to verify, because many practice acquisitions are not public.

Both methods under the income approach require the appraiser to make an estimate of the company’s risk. For veterinary practices, these risks can include geographic risk (which reflects the dependency of a practice on the economic health of one city or suburb), key man risk (if the majority of relationships or revenue lie with a single vet), and size risk (if the business is particularly small). Other risk factors specific to the company may also be considered. For example, if the expected growth of a practice is due to the future hiring of additional staff or an expansion of the facilities, the appraiser needs to incorporate the risk of these processes taking longer than expected or not having the expected return.

Intangible Assets

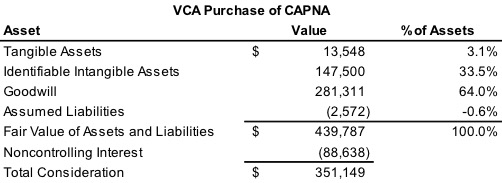

When a practice or animal hospital is sold, intangible assets may need to be valued through a purchase price allocation. This process allows for intangible assets that have been created through the operations of the company to be recorded as assets on the company’s balance sheet. Key intangible assets in the animal health industry include noncompete agreements, tradenames, and goodwill. Customer relationships can also be an important asset in a general veterinary practice; however, the different nature of animal hospitals and specialty practices reduces the relevance of this asset and may result in a referral partnership asset instead. The chart below shows the preliminary purchase price allocation for VCA’s May 1, 2016 acquisition of Companion Animal Practices (CAPNA). CAPNA operates a network of 56 free-standing animal hospitals in 18 states. The identifiable intangible assets category includes customer relationships, tradenames, and noncompete agreements.

Customer Relationships

Beyond the client data contained in the company’s files, relationships exist based on the trust fostered between customers and the company. These relationships, in turn, give rise to an expectation that a significant number of customers will continue their relationship with the company. In general, the values of customer relationships depend on the revenue and income generated by the existing customer base and some expectation of customer loss. While recurring relationships are common and expected in general veterinary practices, such a relationship is less predictable when the company is an emergency hospital or a specialist. For example, someone ceasing to visit an animal oncologist is not necessarily a sign of a degrading relationship, but could rather be due to the resolution of the underlying health issue.

Referral Partnership Networks

Referral partnerships can be key assets in some practices for hospitals or specialty practices. A referral partnership network occurs when general practice veterinarians maintain relationships with a particular specialty practice as the main practice to send clients with particular needs. Referral partnership networks, if a group of veterinarians or specialists only recommends one emergency hospital, that hospital would experience a boost in revenue that it would not have otherwise received without the intangible asset.

Noncompete Agreements

As we’ve discussed before, noncompete agreements can prevent the loss of key employees, customers, and suppliers. In the animal health industry, non-compete agreements typically prevent a key vet or the seller of the company from starting a new practice shortly after the sale of the old company. The value of a noncompete agreement is dependent on the income generated by the covered party and how likely the covered party is to compete with the company absent the noncompete agreement.

Tradenames

Valuable trademarks identify premier services in the relevant marketplace, and thus allow a company to enjoy higher prices paid for its products or services. Furthermore, securing the rights to use a given trademark in an acquisition is a valuable component of the ownership transition process because of the perception of continuity from the perspective of existing customers. The value of tradename can be reduced if the tradename is only recognized in a limited geographic area. If the acquirer does not intend to use the company’s tradename, the tradename does not have value and should therefore not be included in the purchase price allocation.

Goodwill

Goodwill can only arise through the acquisition of a company, and it is effectively the difference between the value of the company’s assets (including identifiable intangible assets) and the price that was paid. Some business combinations are driven by prospective synergies, which may include vendor discounts or a reduction in administrative costs. Business combinations can also allow access to new geographic markets, such as new parts of cities or expansion into new states. Additionally, a large portion of the company’s business may be driven by the quality of its staff. All these items would result in significant allocations of value to goodwill.

As an aside, for tax purposes, goodwill can sometimes be separated into personal and corporate components. While corporate goodwill is attributable to the business itself, personal goodwill is attributable to the professionals or owners of a company. While the classification of goodwill between the corporate and personal categories does not impact the financial statements from a financial reporting perspective, the sellers of a company may face more favorable tax treatment depending on the type of goodwill recognized in the transaction. The classification of goodwill as personal or corporate may also be complicated by the existence of a noncompete agreement.

Conclusion

So why is this important? In our experience, the majority of M&A activity in the veterinary services industry revolves around the consolidation of smaller veterinary practices. Additionally, specialists will often combine resources, with many specialists (either in the same specialty or across a variety of specialties) merging in order combine market bases or purchasing power. These consolidation trends are expected to continue through at least the next five years, resulting in potential cost efficiencies that may increase profits for the surviving companies.

The proper allocation of value to intangible assets and the calculation of fair value requires both valuation expertise and knowledge of the industry in question. Mercer Capital’s focus on the animal health industry brings this expertise and knowledge together. Give us a call to discuss your valuation needs in confidence.

Related Links

- Mercer Capital’s Animal Health Industry Newsletter

- Appraisal Foundation Releases Final Guidance on Fair Value Measurement of Customer-Related Assets

- Valuation of Customer-Related Assets

Mercer Capital’s Financial Reporting Blog

Mercer Capital monitors the latest financial reporting news relevant to CFOs and financial managers. The Financial Reporting Blog is updated weekly. Follow us on Twitter at @MercerFairValue.