About a year ago, we discussed Facebook’s impending purchase of messaging service WhatsApp. At the time, the acquisition was the subject of much debate, but the intervening period gives us a chance to see how things have shaken out. This also gives us the chance to see how the purchase price has been allocated for accounting purposes.

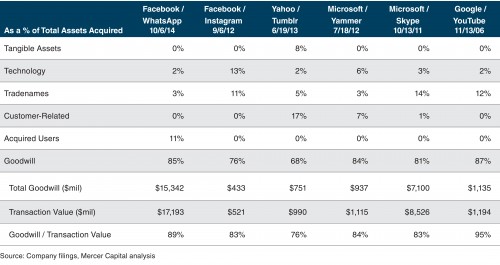

Facebook’s allocation of WhatsApp’s intangible assets is shown below, along with the purchase price allocations from several similar transactions.

At the time of the acquisition we mused about the potential assets that could be recognized as a result of the acquisition.

It’s interesting to see that Facebook allocated $2.0 billion (11% of total assets) to “acquired users.” At the transaction’s announcement date, WhatsApp had a user base in excess of 450 million people worldwide. WhatsApp’s users are not contractually bound to the company and the service costs just $0.99 per year after one year of free use. The rough math on that would suggest potential revenue of approximately $445 million annually from acquired users. A tidbit for those interested in such matters – the useful life ascribed to the “acquired users” asset is seven years.

Now that the user base has surpassed 700 million, the potential for revenue has likewise increased. However, WhatsApp’s recent revenue numbers look nothing like the potential maximum. In fiscal 2013, WhatsApp generated $10.2 million in revenue and posted a net loss in excess of $138 million. For fiscal 2014, WhatsApp revenue was just $21 million, as implied by pro forma disclosure in Facebook’s most recent Form 10-K. Facebook’s recognition of such a substantial allocation of purchase price to the user base presumably reflected the expectation of potentially enormous profit from the acquired users. Additionally, the WhatsApp user base metadata could also be independently valuable to Facebook. Although WhatsApp has not traditionally sold ads, such data could allow Facebook to refine its own processes.

In general, it appears that the goodwill allocation resulting from the acquisition is typical of similar tech/messaging transactions. Compared to the sample of deals shown above, WhatsApp’s allocation of 85% is greater than all but YouTube’s 87%. Allocations to tradename and technology (including both in-process and developed technology) are generally in line with the comparable transactions.

How does Facebook explain the 85% allocation to goodwill? Per the Company’s 2014 Form 10-K, goodwill from the WhatsApp acquisition was attributable to “expected synergies from future growth, from potential monetization opportunities, from strategic advantages provided in the mobile ecosystem, and from expansion of our mobile messaging offerings.” It remains to be seen whether these synergies will truly translate into measurable value and cash flow.

Related Links

- Facebook, WhatsApp, and Value Allocation

- Perspectives from Purchase Price Allocations: Value of Intangible Assets

- Early Purchase Price Allocation Estimates Help Avoid EPS Surprises

- New Guidance on Valuing Customer Relationships

Mercer Capital’s Financial Reporting Blog

Mercer Capital monitors the latest financial reporting news relevant to CFOs and financial managers. The Financial Reporting Blog is updated weekly. Follow us on Twitter at @MercerFairValue.