Video: Corporate Finance Basics for Directors and Shareholders

Below is the transcript of the above video, Corporate Finance Basics for Directors and Shareholders. In this video, Travis W. Harms, CFA, CPA/ABV, senior vice president of Mercer Capital, offers a short, yet thorough, overview of corporate finance fundamentals for closely held and family business directors and shareholders.

Hi, my name is Travis Harms, and I lead Mercer Capital’s Family Business Advisory practice. I welcome and thank you for taking a few minutes to listen to our discussion, “Corporate Finance Basics for Directors and Shareholders.”

Corporate finance does not need to be a mystery. In this short presentation, I will give you the tools and vocabulary to help you think about some of the most important long-term decisions facing your company.

To do this, we review the foundational concepts of finance, identify the three key questions of corporate finance, and then leverage those three questions to help think strategically about the future of your company.

Let’s start with the fundamentals of finance: return and risk.

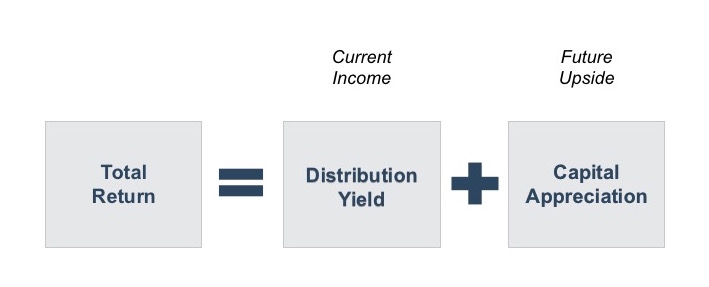

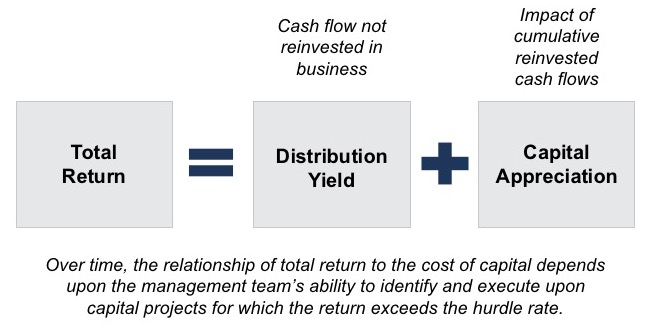

Return measures the reward for making an investment. Investment returns come in two different forms: the first, distribution yield, is a measure of the annual distributions generated by an investment. The second, capital appreciation, measures the change in the value of an investment over time. Total return is the sum of these two components.

This is important because two investments may generate the same total return, although in very different forms. Some investments, like bonds, emphasize current income, while others, like venture capital, are all about capital appreciation. Many investments promise a mix of current income and future upside.

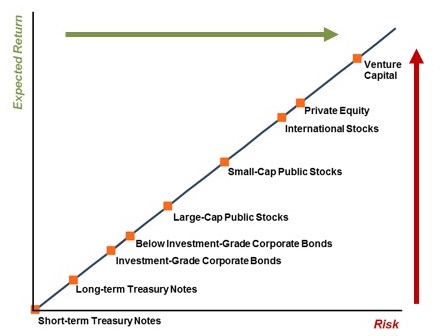

The most basic law of corporate finance is that return follows risk.

The above chart compares the expected return required by investors and the risk of different investments. Since investment markets are generally efficient, higher returns are available only by accepting greater risk.

But what is risk?

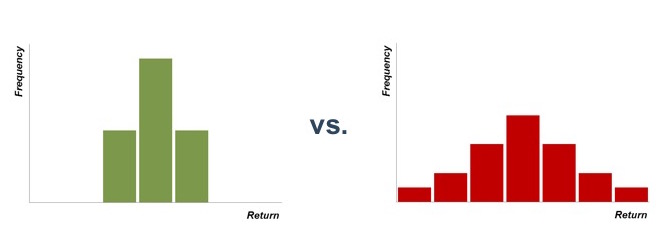

Simply put, risk is the fact that future investment outcomes are unknown. The wider the distribution of potential outcomes, the greater the risk.

While both investments represented above are risky, the dispersion of outcomes for the investment on the right is wider than that on the left, so the investment on the right is riskier. Because it is riskier, it will have a higher expected return. Now, whether that higher return actually materializes is unknown when the investment is made – that’s what makes it risky.

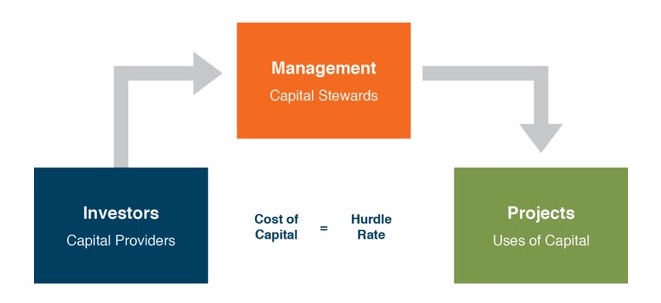

For a particular company, the expected return is referred to as the company’s cost of capital. From a corporate finance perspective, the company stands between investors (who are potential providers of capital) and investment projects (which are potential uses of the capital provided by investors). The cost of capital is the price paid to attract capital from investors to fund investment projects.

When evaluating potential investment projects, corporate managers use the cost of capital as the hurdle rate to measure the attractiveness of the project.

Next, we will move on to the three essential questions of corporate finance.

Corporate managers and directors should always be thinking about three fundamental corporate finance questions:

- First, what is the most efficient mix of capital? This the capital structure question – what is the mix of debt and equity capital that minimizes the company’s overall cost of capital?

- Second, what projects merit investment? This is the capital budgeting question – how does the company identify investment projects that will deliver returns in excess of the hurdle rate?

- And third, what mix of returns do shareholders desire? This is the distribution policy question – what is the appropriate mix of current income and future upside for the company’s investors?

Let’s start with the first question: what is the most efficient mix of capital?

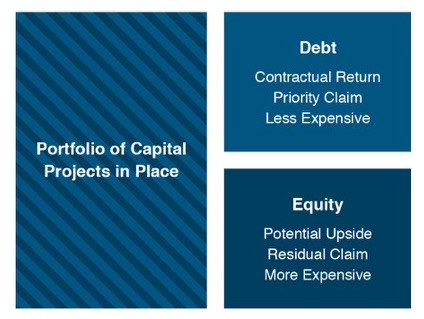

You can think of the company’s assets as a portfolio of individual capital projects – that is the left side of the balance sheet. The right side of the balance sheet tells us how the company has paid for those investments. The only two funding options are debt and equity. Because debt holders are promised a contractual return and have a priority claim on the assets and cash flows of the company, debt is less expensive than equity, which has only a residual claim on the company.

You can think of the company’s assets as a portfolio of individual capital projects – that is the left side of the balance sheet. The right side of the balance sheet tells us how the company has paid for those investments. The only two funding options are debt and equity. Because debt holders are promised a contractual return and have a priority claim on the assets and cash flows of the company, debt is less expensive than equity, which has only a residual claim on the company.

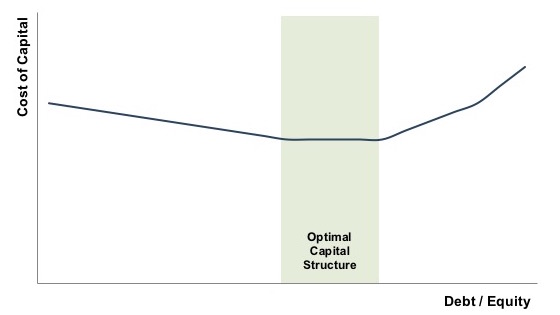

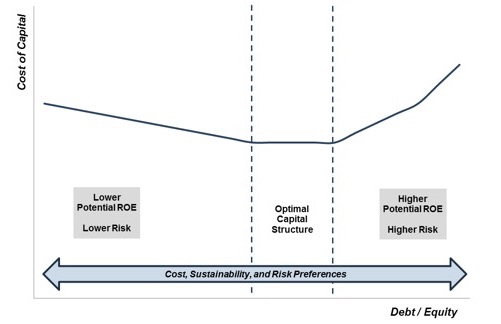

If debt is cheaper than equity, you might assume that a company could reduce its cost of capital by simply issuing more and more debt. That is not the case, however. As the company uses more debt, the risk of both the debt and the equity increase. And, as we said earlier, greater risk will cause both debt and equity investors to demand higher returns.

Eventually, because the cost of both components is increasing, the overall blended (or weighted average) cost of capital increases with increasing reliance on debt. The goal of capital structure analysis is to identify the optimal capital structure, or the mix of debt and equity that minimizes the company’s cost of capital.

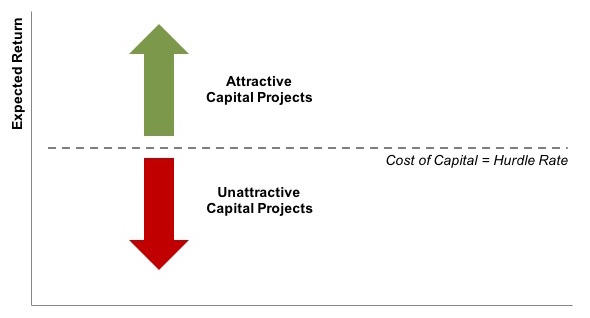

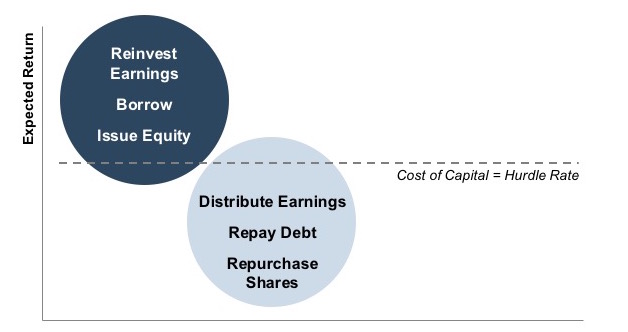

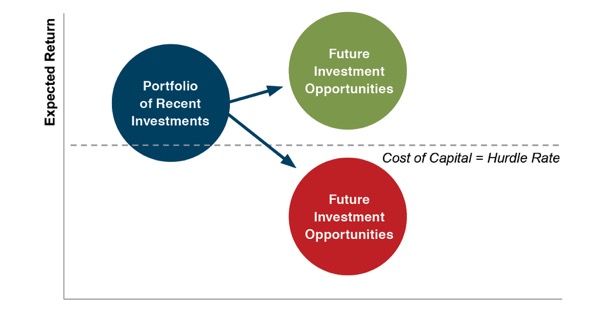

Now let’s move on to the second question: what investment projects should the company devote capital to? At the strategic level, management’s job is to survey the landscape of potential investment projects, choosing those that are strategically compelling and financially favorable.

From a financial perspective, a potential investment project is attractive if the return from the expected cash flows meets or exceeds the hurdle rate, which is the cost of capital.

The appropriate pace of investment for a company is therefore related to the availability of attractive investment projects.

If attractive investment projects are abundant, the company should reinvest earnings into new projects, and, if yet more attractive projects are available, borrow money and/or issue new equity to fund the investment. If attractive investment projects are scarce, however, the company should return capital to investors through debt repayment, distribution of earnings, or share repurchase. We can now begin to see how the three questions are related to one another. Capital structure decisions are always made relative to the need for investment capital.

This inter-relationship is illustrated above within the context of the two components of total return we discussed earlier. Distribution yield provides a current return to shareholders from cash flow not reinvested in the business, while the cumulative impact of reinvested cash flows is manifest in the capital appreciation component of total return.

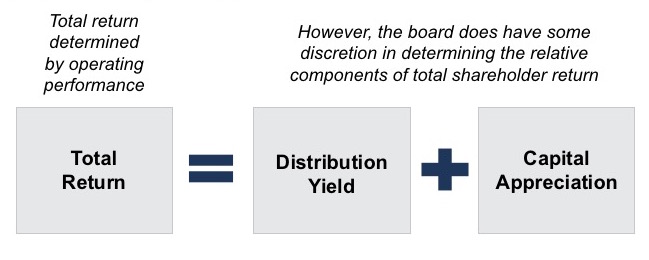

This leads us to the final corporate finance question, which relates to distribution policy: what mix of returns do shareholders desire?

While the operating performance of the business ultimately determines total return, the board can tailor the components of that return to fit shareholder preferences better.

We’ve primarily been looking through the rearview mirror to assess what the company has done in the past; now it’s time to look through the windshield and think prospectively about capital structure, capital budgeting, and distribution policy going forward.

First, capital structure. In the long-run, the optimal capital structure will balance the cost of funds, flexibility, availability, and the risk preferences of the shareholders. Now, that last factor – shareholder preferences – should not be overlooked. Family businesses should not be managed for some abstract textbook shareholder, but rather for the actual family members that own the business.

For example, while an under-leveraged capital structure reduces potential return on equity, it also reduces the risk of bankruptcy. Some shareholders may view this tradeoff favorably even if it can be demonstrated to be “sub-optimal” from a textbook standpoint.

Second, capital budgeting. The attractiveness of investment opportunities should be evaluated with reference to future – and not past – returns. Beyond the threshold question of whether such opportunities are in fact available, managers and directors should also consider financial and management constraints under which the company is operating and the desire of shareholders for diversification.

Since family business shareholders lack ready liquidity for their shares, they may have a greater desire to diversify their investment holdings away from the family business. In other words, they may favor foregoing some otherwise attractive investment opportunities in order to increase distributions that would help shareholders diversify.

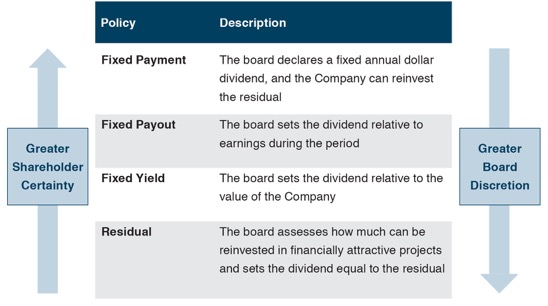

Third, distribution policy. The appropriate form and amount of distributions should reflect shareholder preferences within the context of capital budgeting and capital structure decisions. Perhaps most importantly, a clearly communicated distribution policy enhances predictability for shareholders, and shareholders like predictability.

Family business shareholders should know which of the four basic options describes their company’s distribution policy.

Family business shareholders should know which of the four basic options describes their company’s distribution policy.

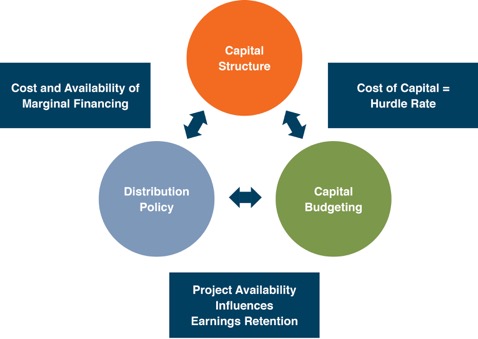

Finally, to recap, each of the three questions relates to one another.

The company’s capital structure influences the cost of capital, which serves as the hurdle rate in capital budgeting decisions. The availability of attractive investment projects, in turn, determines whether earnings should be retained or distributed. Lastly, distribution policy affects, and is affected by, the cost and availability of marginal financing sources.

For a deeper dive into some of the topics we talked about, we have several whitepapers and other resources that you can download from our website.

The good news is that you do not have to have an advanced degree in finance to be an informed director or shareholder. With the concepts from this presentation, you can make relevant and meaningful contributions to your company’s strategic financial decisions. In fact, we suspect that a roomful of finance “experts” can actually be an obstacle to the sort of multi-disciplinary, collaborative decision-making that promotes the long-term health and sustainability of the company. Our family business advisory practice gives directors and shareholders a vocabulary and conceptual framework for thinking about and making strategic corporate finance decisions.

Again, my name is Travis Harms and I thank you for listening. If you’d like to continue the discussion further or have any questions about how we may help you, please give us a call.

Travis W. Harms, CFA, CPA/ABV

(901) 322-9760