Forward Air Corporation to Acquire Omni Logistics, LLC?

Another tough call for the merger arb community – acquirer and target sue each other in Delaware Court of Chancery to respectively terminate the merger agreement or force consummation of the merger

In past issues of the Transaction News Advisor, we have noted that deals sometimes can be tough to close. Often this involves a regulatory obstacle as has occurred in the JetBlue-Spirit saga and the TD-First Horizon deal that was terminated in May 2023. Occasionally circumstances will change – another suitor emerges willing to pay the break-up fee; the target’s financial performance materially deteriorates; or the buyer has an inability to meet its obligations. And sometimes human emotion becomes a factor when the buyer or seller has remorse as seen with Twitter when Elon Musk sought to terminate the deal but was forced to close in October 2022 when it became apparent his legal bid to walk away would fail in the Delaware Court of Chancery.

The pending acquisition of Omni Logistics, LLC by Forward Air Corporation (NASDAQGS: FWRD) is another recent deal that has iffy prospects of closing. FWRD management and the board apparently did not appreciate the visceral reaction the terms of the deal would trigger among some of its institutional shareholders, which is surprising given its advisors included Morgan Stanley, Citigroup and Cravath, Saine & Moore.

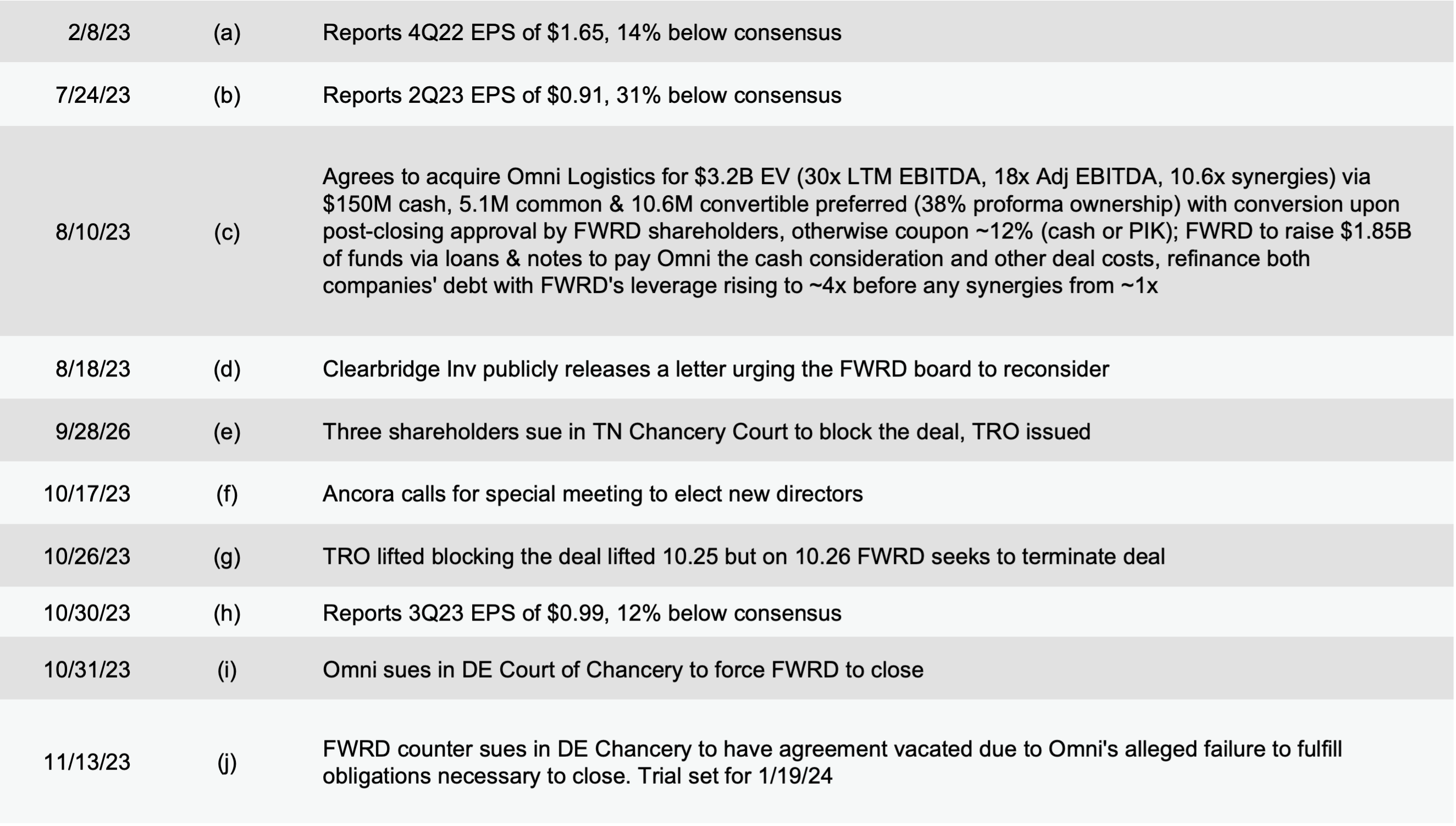

On August 10, 2023, FWRD announced that it would acquire the heavily indebted Omni for an enterprise valuation of $3.2 billion. Consideration to be paid to Omni’s shareholders includes $150 million in cash, 5.1 million common shares and 10.6 million convertible preferred shares that was valued at ~$1.8 billion based upon FWRD’s August 9 closing price of $110 per share. The enterprise valuation at announcement equated to 18x LTM adjusted EBITDA and about 11x with projected synergies.

Omni shareholders would own 38% of FWRD upon conversion of the preferred shares provided that FWRD shareholders approve the deal after it closes; otherwise, the preferred shares will be entitled to a ~13% dividend. Under Tennessee law and most state business corporation acts, shareholders of the acquirer vote to approve a transaction when the consideration entails common shares that exceed 20% of the outstanding shares. In the case of the FWRD-Omni deal, the 5.1 million common shares to be issued at closing represent 19.9% of FWRD’s existing 25.7 million common shares; hence, FWRD shareholders will not have the opportunity to vote the deal down before it closes.

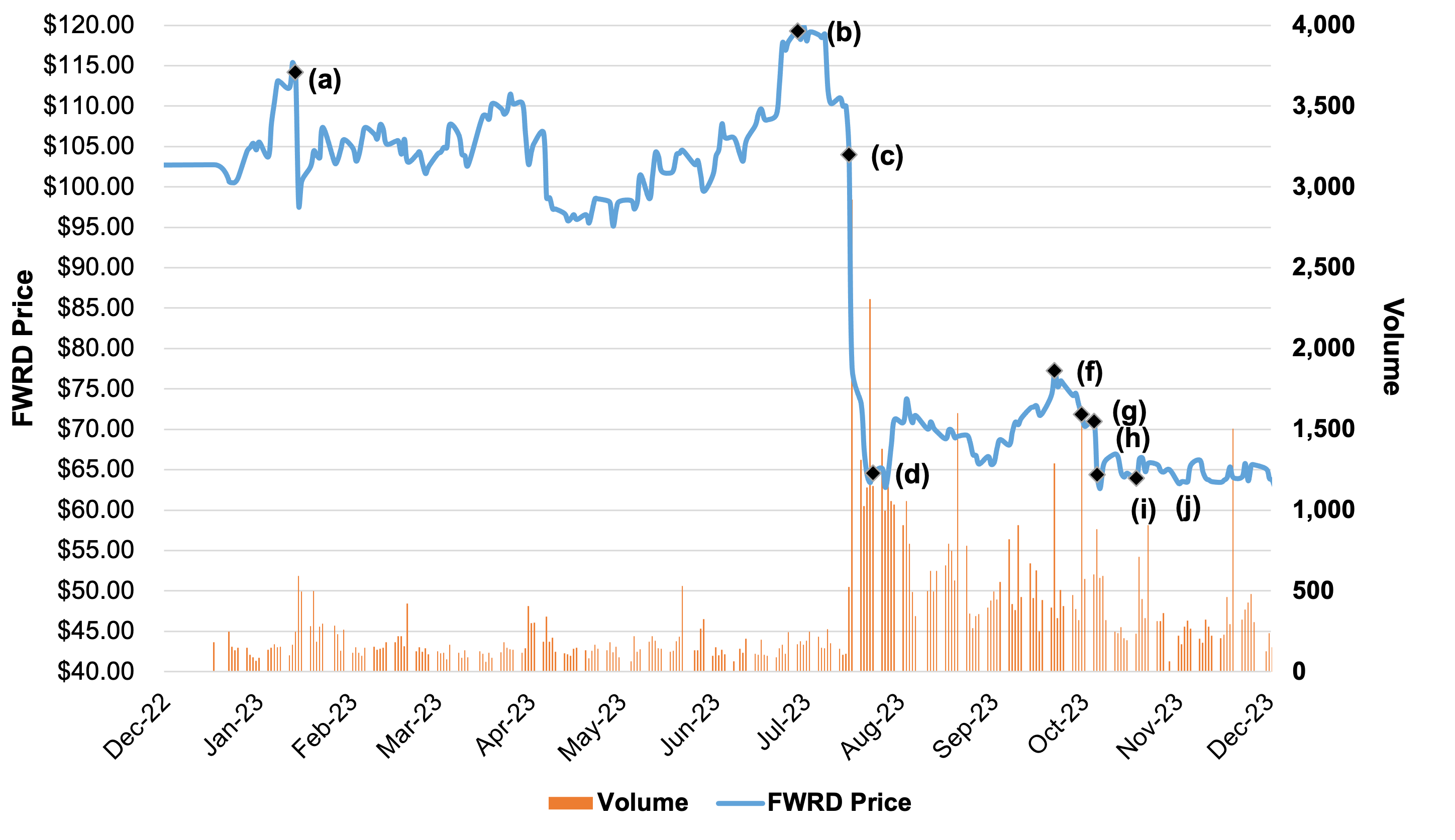

Investors punished FWRD shares, which fell from $110 per share on August 9 to the low $60s within a week as certain institutional shareholders urged the board to reconsider. Since then, the shares have drifted lower to $53 per share as of January 16, 2024, as shown on the charts below.

During late September, three shareholders including the x-CFO filed suit in Tennessee’s Third District Chancery Court seeking to block the transaction, which prompted the court to issue a temporary restraining order (TRO). On October 17, shareholder Ancora Alternatives announced its opposition to the deal and called for a special shareholder meeting to elect new FWRD directors who would terminate the deal and pursue a different plan to create value.

On October 25, the TRO blocking the deal was lifted; however, on October 26, FWRD notified Omni that it had failed to satisfy certain obligations specified in the agreement and therefore FWRD would exercise its right to terminate the agreement. Among the issues that FWRD has raised is Omni’s 2023 EBITDA forecast that apparently has deteriorated since the deal was negotiated.

On October 31, Omni filed suit in the Delaware Court of Chancery to force FWRD to close, while FWRD counter sued on November 13 that it is not obligated to close. The Court hearing, scheduled to begin January 19, was delayed at least several days due to weather.