Importance of an Independent Informed Valuation

In contested cases where a business interest comprises a significant portion of a divorcing couple’s net worth, it is common for one or both parties to retain a business appraiser to value the business. Post-divorce, if only one spouse retains an interest in the business, all else equal, a higher business interest value typically implies the other party will receive a greater share of the remaining marital assets, as compared to a lower business interest value. As we will discuss in this article, the facts and circumstances of the business interest being valued may reasonably support various assumptions when comparing two valuation conclusions.

As the client, attorney, or judge, it can be difficult to receive two appraisals that differ significantly in their conclusions. Which one is right? While there is not typically an absolute “right” answer, one may well be more reasonable than the other. In this article, we examine how changes to one or a few assumptions can lead to possible material changes in valuation conclusions.

Setting the Scene

Disclaimer: the following examples and narrative are for instructional purposes and do not represent absolute opinions. Facts, circumstances, and time differ thus, no two valuations are the same, even for the same company as of different dates. Facts and circumstances should support assumptions and conclusions within a range of reasonableness. The goal of this article is to illustrate differences between valuations and the drivers behind those differences, not to opine that a specific discount rate, growth rate, or methodology to analyze earnings trends is “right” or “wrong.” Always and never should generally be avoided.

Ideally, appraisers would be given the same qualitative and factual overview of the company including history, future outlook, growth and risk. Sometimes, this isn’t the case, and appraisers may receive different versions leading to variations in interpreting the risk profile and/or earning potential of the business, which can lead to differences in concluded values between appraisers. An independent, prudent valuator will be able to analyze the ebbs and flows of historical earnings, though an important step in the valuation process is discussing these trends with management. Management’s perspective behind the numbers can be helpful in understanding the trajectory of the business. In the context of litigation, it may be important for the appraiser to consider the sources of the information they are receiving.

An Illustrative Example of Valuation Math

Under the income approach, there are two general methods to value a business:

- Single period earnings capitalization

- Discounted future earnings (or benefits)

If a company/management provides the two appraisers with projections of future financial performance, these may be assessed in the multi-period discounted cash flow method. However, projections may not be available, and in such cases, the single period earnings capitalization method is more commonly employed.

To value a business under the single period income capitalization method, appraisers must specify three valuation elements:

- the expected cash flow (earnings)

- the appropriate discount rate (r), and

- the expected long-term growth rate in earnings (g)

The basic valuation equation is:

Value = Expected Cash Flow / (r – g)

The denominator is (r – g), and 1 / (r – g) is the implied multiple of earnings. (r – g) is also sometimes referred to as a capitalization rate or cap rate.

This equation is generalized. Depending on the measure of expected earnings or cash flow, the appropriate discount rates and expected growth rates must be used.

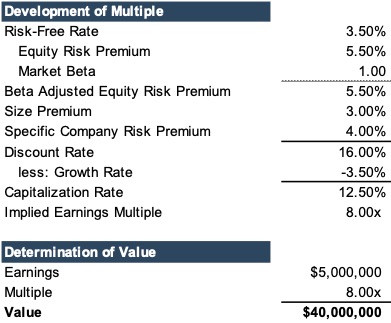

For this example, assume the following:

- Ongoing earnings is $5.0 million.

- The discount rate is 16.0%.

- The expected long-term growth rate is 3.5%, which means that ongoing earnings will grow at that rate into the future.

- Based on the valuation equation above, we determine the appropriate multiple to be 8.0x, calculated by 1 / (16.0% – 3.5%).

With our assumptions, we can develop a valuation indication using the single-period income capitalization method.

As seen in the figure above, the analysis can be synthesized into simple multiplication. Higher earnings or a higher multiple will lead to a higher value and vice-versa. The multiple is a function of a company’s discount rate (or risk profile) and growth rate. All else equal, companies that are growing slower or are deemed riskier, as compared to peers, the industry, and historical performance, typically

Both ongoing earnings and the multiple have numerous inputs and assumptions, and appraisers frequently use many of the same sources for the inputs in their analysis. For example, one of the first steps of a valuation is to request historical financials statements, to which appraisers make appropriate normalization adjustments to place the reported financial statements at market levels. Cost of capital data is used to assess risk and return, and appraisers commonly use similar sources in determining the risk of a business.

Range of Reasonableness

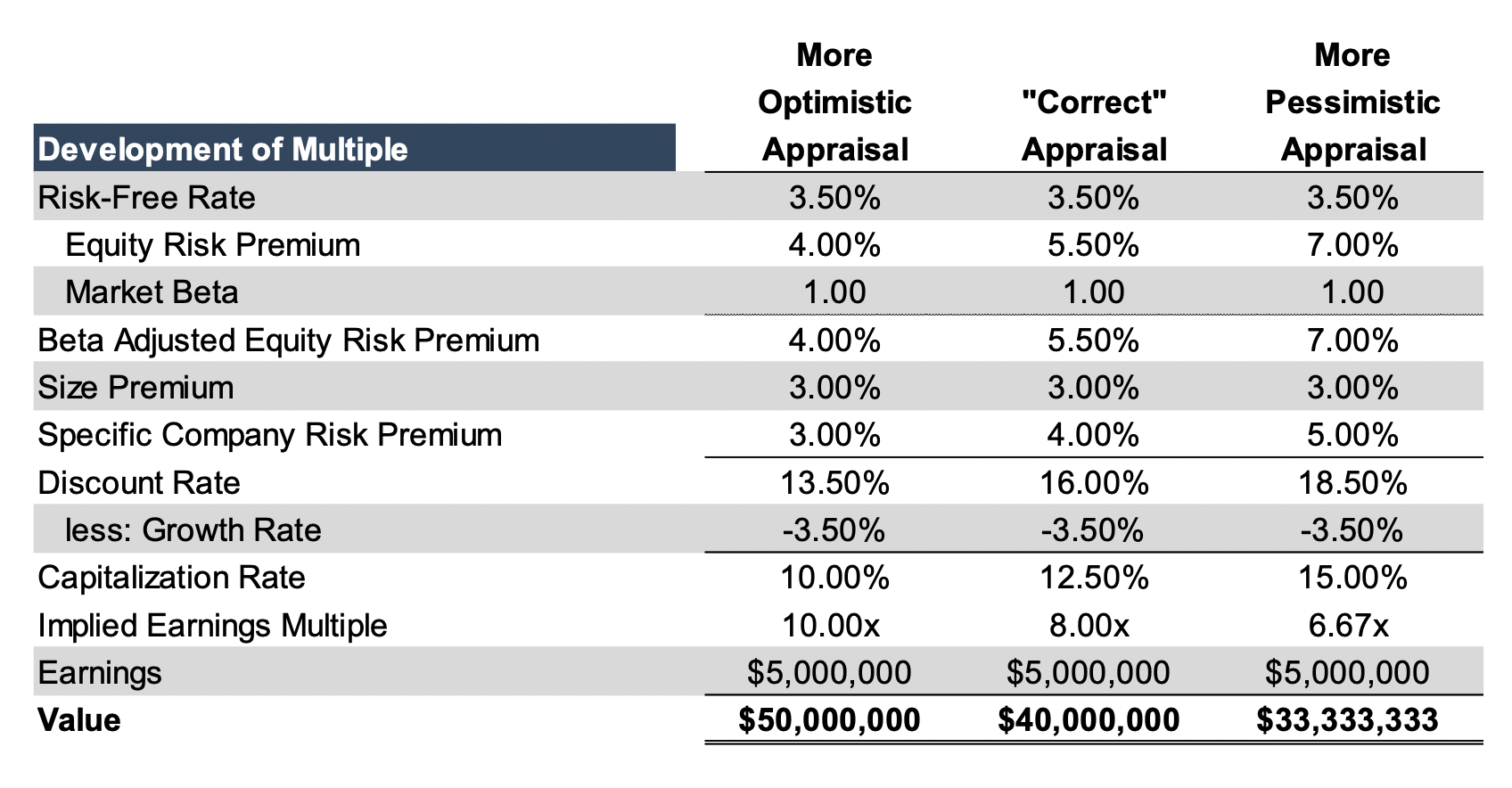

There are numerous reasons why appraisers may ultimately determine different values for the same subject business, so we won’t try list them all. Using our above example, if this valuation was the “right” answer for the purposes of this example, let’s make modest adjustments on both ends to show how much the answer might change with an optimist’s view and a pessimists’ view.

For simplicity, we will assume the appraisers used the same risk-free rate, beta, size premium, growth rate, and level of earnings (which are highlighted in the below diagram in gray). The scenarios differ in the equity risk premium and specific company risk premium.

While many of the components of the discount rate are similar, the concluded discount rates are different and range from 13.5% to 18.5%. On the surface, neither the equity risk premium nor specific company risk premium utilized by either the optimist or pessimist appear “too far” away from what we are calling the “correct” appraisal, based on the facts and circumstances of this hypothetical case.

Despite seemingly small differences, the optimist’s conclusion is 50% higher than that of the pessimist. This is where the expertise and experience of an independent appraiser is key in determining what makes the most sense within a range of reasonableness. In an ideal world, two appraisers would not be 50% apart, but, as we’ve demonstrated above, reasonable assumptions could lead appraisers to have conclusions that are significantly apart.>>>

Appraisals Bordering on Advocacy

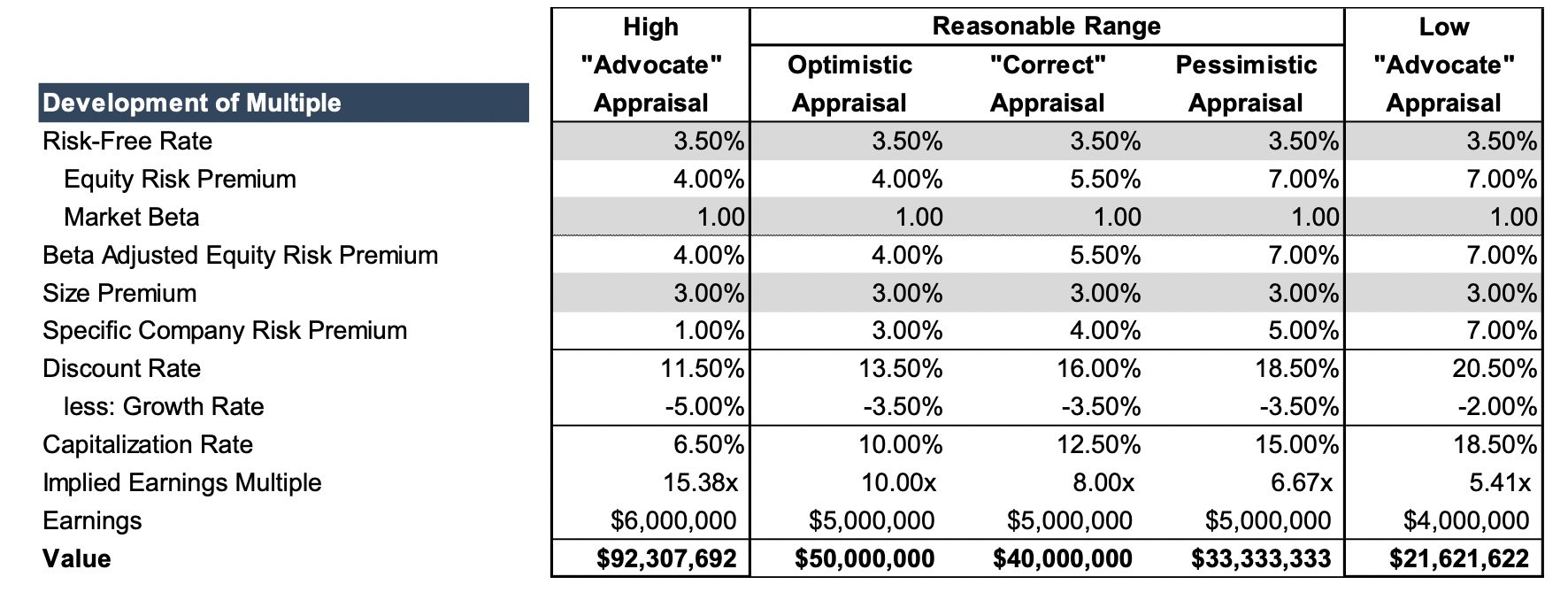

While reasonable appraisers may disagree, there comes a point at which certain assumptions border on aggressive and in the context of other assumptions, yield a conclusion that is unreasonable based on the facts and circumstances present. An appraiser might be on the high side of earnings and growth assumptions and on the low side on the corresponding risk assumption. Unless the assumptions are supported by the facts and circumstances for the specific company, the conclusion may become too aggressive and vice versa.

In the figure below, we have illustrated how different assumptions can impact value. Only the risk-free rate, beta, and size premium (all highlighted gray) are the same. For the highest and lowest indications, we use more even more divergent specific company risk premiums, growth rates, and ongoing earnings levels.

Given the assumptions in the figure, the “high” conclusion is more than quadruple the conclusion of the “low” appraisal ($92.3 million versus $21.6 million). As presented above among the scenarios, i.e., next to the more reasonable range, neither the high or low is reasonable and are examples of conclusions that are likely advocative in nature, rather than providing independent conclusions of value.

Concluding Thoughts

Many assumptions that make up an appraisal are interrelated. Risk is a function of the assessment of ongoing earnings. If earnings are assumed to be much lower than the company has recently demonstrated, it makes sense that the risk in achieving lower performance would be lower than assuming the status quo or further increases in earnings. With earnings and risk being two of the key inputs in a valuation, it is important that each are reasonable on their own and when considered together.

In the “high” example above, the appraiser uses high-end earnings and growth and low-end risk assumptions. There is likely a double counting of positive factors. In the “low” example, the appraiser uses low-end earnings and growth, and high-end risk assumptions. There is likely some double counting of negative factors there.