Navigating Tax Returns: Tips and Key Focus Areas for Family Law Attorneys and Divorcing Individuals/Business Owners – Part III

Part III of III- Schedule K-1 and Relevant Business-Related Schedules

This is the third of the three-part series where we focus on key areas to assist family lawyers and divorcing parties. Part III concentrates on Schedule K-1 (Form 1065 or Form 11-20-S) and additional business-related schedules which can be useful in divorce proceedings. Part I discusses Form 1040 and can be found here, and Part II discusses Schedule A (Itemized Deductions) and can be found here.

Entities taxed as general partnerships, limited partnerships, limited liability partnerships, limited liability corporations, and S corporations prepare a Schedule K-1 (“K-1”) for each of its owners. The Schedule K-1 identifies the owners of the business and specifies the percentage of equity, profits, and losses that will be attributed to each for tax purposes, among other information. K-1s must be distributed to each owner and filed with the entity’s tax return. Owners then utilize the K-1 when preparing their personal tax returns to substantiate the profits and/or losses they are claiming.

Why Would Schedule K-1 Be Important in Divorce Proceedings?

Schedule K-1 provides information regarding the business, the individual partner (or member or shareholder), as well as the portion of taxable income or loss that is attributable to each owner. A business owner may not receive a salary and therefore, might not get a Form W-2 Wage and Tax Statement. Schedule K-1 provides the details on profit and loss allocated to the individual from the business. Sometimes other agreements are in place for bonus sharing, etc. and the K-1 reflects each business owner’s proportionate share of taxable income or loss.

The K-1 provides evidence of ownership in a business, details the percentage of ownership, and shows business gains and losses for the year allocated to the specific owner, among other information. The business ownership (whether 100% or an interest in the business) may be divisible within the marital estate. If multiple business interests exist, each entity would generate a separate K-1 per owner. The Schedule K-1 can also be used in conjunction with other documents for income determination purposes.

Key Areas of Focus for Family Law Attorneys and Divorcing Parties

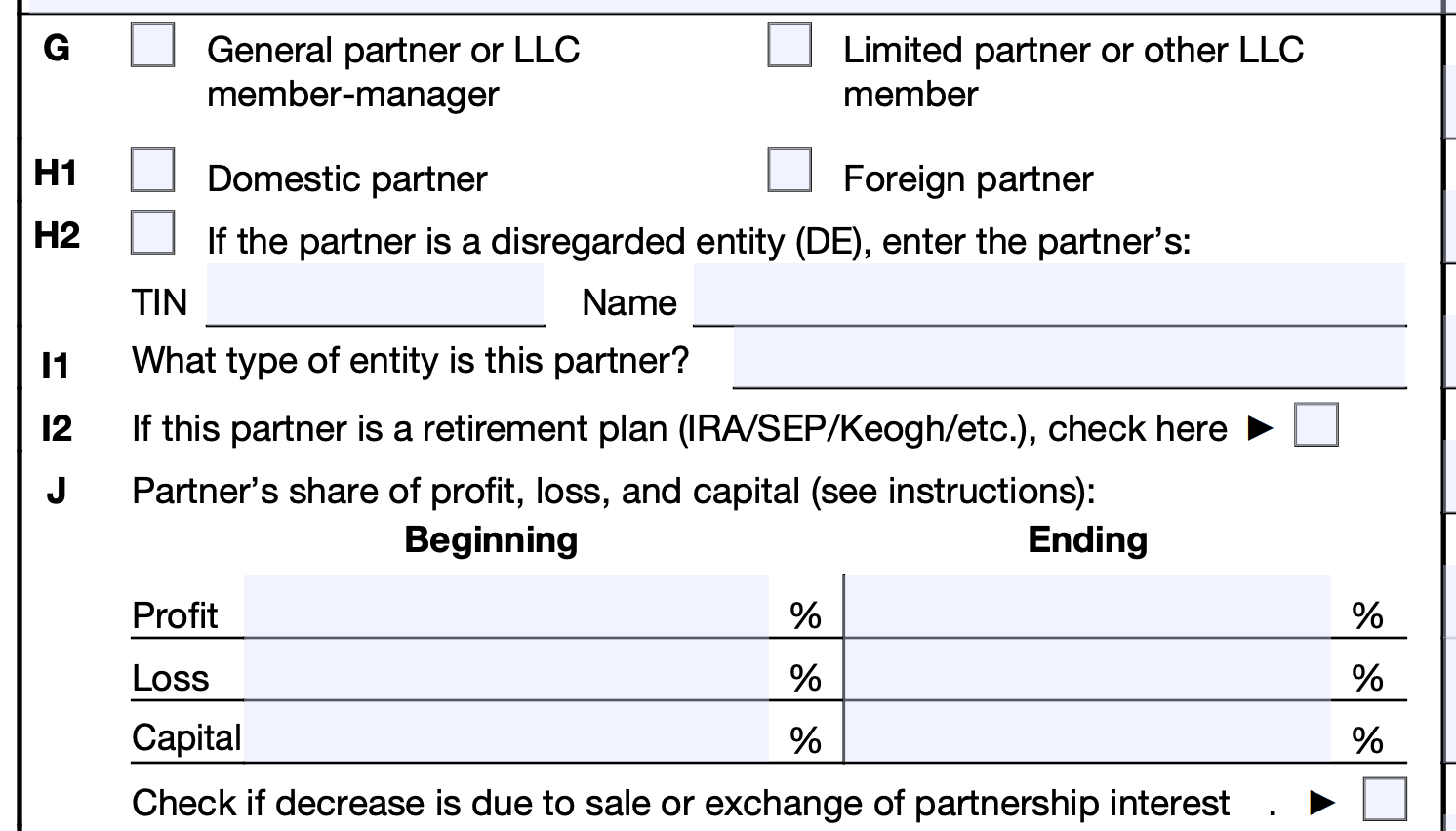

Part II of Schedule K-1, Information about the Partner –provides details on each individual partner such as the type of entity, partner’s share (beginning and ending) of profit, loss, capital and liabilities, and the beginning and ending capital account of the individual. Box G will indicate if the taxpayer is a general, limited, or other type of partner. Another item to pay close attention to is Box J which is the line that states: “Check if decrease is due to sale or exchange of partnership interest.” If checked, more information may need to be requested to understand the transaction, amended agreement, or other type of sale or exchange.

While the K-1 offers helpful information on business ownership percentages and annual profit or loss, additional documentation of the business entity should be requested when performing a business evaluation and/or in conjunction with other forensic services such as income determination.

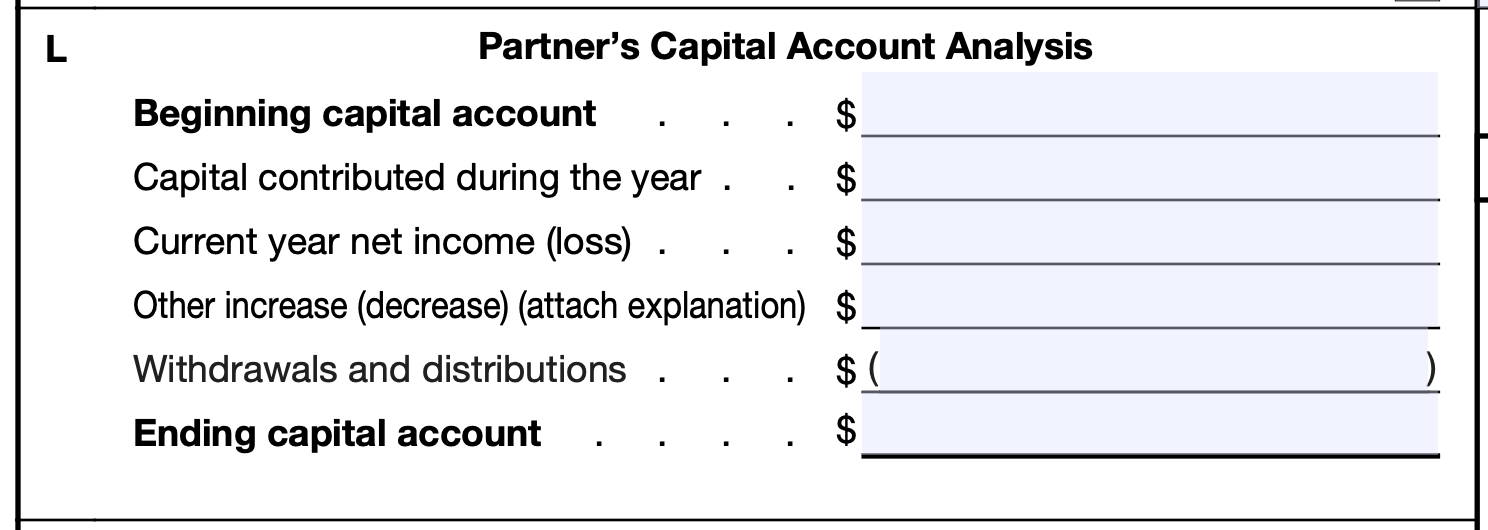

Box L – titled Partner’s Capital Account Analysis presents the ending capital account for the individual partner by showing the following: the beginning capital account, plus capital contributed and current year net income (loss) for the year, less withdrawals and distributions, if any.

One should pay attention to the information presented on the Partner’s Capital Account Analysis because it may be a starting point for evidencing distributions (which may or may not be included in W-2 salary), and investments into a business such as a capital call.

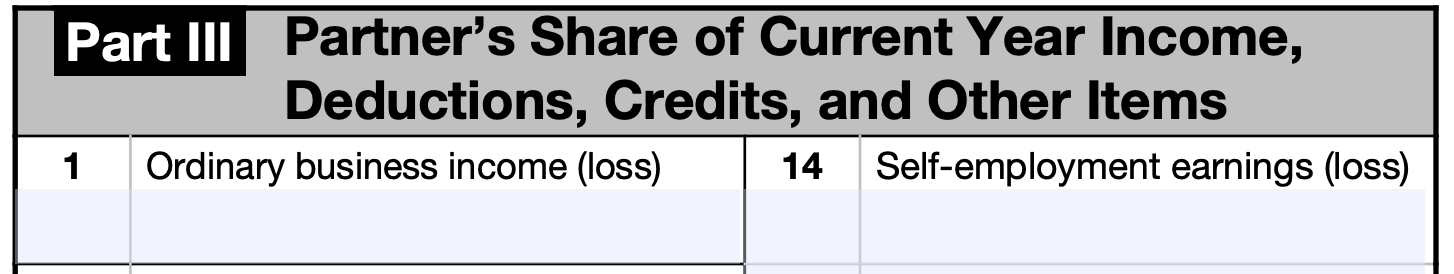

Part III of Schedule K-1 – is Partner’s share of current year income, deductions, credits, and other income. A few of the individual boxes are explained below.

Box 1 – represents the taxpayer’s share of Ordinary Business Income, or Loss, from the corporation. The individual’s income amount is further categorized within Form 1040 depending on whether the income is deemed active or passive. Passive income includes money earned from interest, dividends, and rental property. Active income includes pass-through income or loss, wages and salaries (these may also be included on an individual W-2) or supplemental income. Refer to Schedule E – Supplemental Income and Loss for information on the income; specifically Line 28, which includes column (H) for passive income and column (K) for active or nonpassive income.

Box 12 – Section 179 Deduction – is an immediate expense deduction that business owners have the option to utilize for purchases of depreciable business equipment rather than capitalizing and depreciating the asset over a period of time (referred to as straight-line depreciation). This allows businesses to lower their current-year tax liability rather than capitalizing an asset and depreciating it over time in future tax years, i.e., the tax reduction is taken in full versus in smaller amounts over a period of time. The Section 179 deduction is offered as an incentive for small business owners to grow their business with the purchase of new equipment. To qualify, the property is limited to items such as cars, office equipment, business machinery, and computers; this property also must be used for business purposes more than 50% of the time to qualify. This deduction election will also be reported for the individual taxpayer on Form 4562 – Depreciation and Amortization.

Information on the K-1 can guide questions to ask and subsequent documents to request in order to understand and evaluate business interest(s).

Additional Relevant Business-Related Schedules and Why Each Could Be Important in Divorce Proceedings

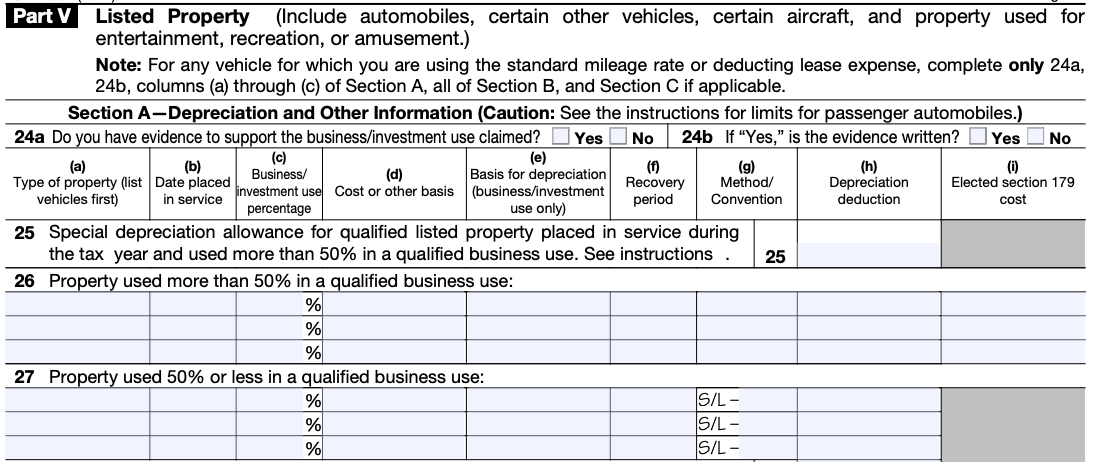

Form 4562 – Depreciation and Amortization is used to claim deductions for the depreciation or amortization for tax purposes. Other uses include making an election under Section 179 to expense certain property, and to provide information on the business/investment use of automobiles and other assets. Individuals and businesses can claim deductions for tangible assets, such as a building, and intangible assets, such as a patent. Section 179 property does not include property held for investment, property used outside of the United States, or property used by a tax-exempt organization.

The Depreciation & Amortization Schedule can assist the divorce process by providing a listing of depreciable assets. While the form refers to all as “property,” the term stems from an accounting identification of “property, plant & equipment.” These types of assets typically qualify for depreciation, while intangible assets are typically those that qualify for amortization. Amortization is similar to the straight-line method of depreciation in that an annual deduction to taxable income may be allowed over a fixed time period. The taxpayer can amortize such items as costs of starting a business, goodwill, and certain other intangible assets. Part VI – Amortization is the last section of Form 4562, where the business amortization costs are described and listed to calculate amortization for the year for the individual taxpayer.

Depreciation and amortization can be found on both the balance sheet and the income statement. Annual and accumulated depreciation/amortization are contra-assets to the respective underlying asset on the balance sheet. On the income statement (also referred to as the profit and loss statement), depreciation and amortization are expense items.

One other focus area for divorcing parties is Part V – Listed Property – specifically, Section A – Depreciation and Other Information – Lines 26 and 27. These lines are used to determine depreciation for property used more or less than 50% in a qualified business use, respectively. Generally, a qualified business use is any use in trade or business; however, it does not include investment use, leasing to a 5% or less owner, or the use of property as a compensation for services performed. Column (C) – Business/investment use percentage is where this will be displayed.

Schedule L – Balance Sheet per Books, Schedule M-1 – Reconciliation of Net Income/(Loss), and Schedule M-2 – Analysis of Partner’s Capital Account are also worthy schedules to review in conjunction with individuals who own business(es) or interest(s) in business(es). These schedules within Form 1065 or Form 1120-S for S corporations present the financial statements of the business and the activity on a capital account. If business financial statements, such as an income statement and balance sheet, are obtained, these schedules can be used in conjunction with the review of the financial records. Schedule C Profit or Loss from Business can also be helpful if the business owner is a Sole Proprietor, as this schedule is specific to sole proprietorships. As the name implies, this Schedule C provides income, expenses, cost of goods sold, and other expenses during the respective tax year.

Schedule L provides the beginning and ending balances on the items on the balance sheet. Schedule M-1, as its name implies, provides the reconciliation of income or loss. The reconciliation occurs because some items are allowed, disallowed, or capped for tax purposes, which may be present on the income statement of the business – travel and entertainment and depreciation are two examples included within Schedule M-1. As we previously discussed, the business may take all of its depreciation in one year for tax purposes, while using straight-line depreciation in accordance with GAAP (generally accepted accounting principles). Depending on the current tax laws, a maximum dollar threshold may be allowed for expensing travel and entertainment for tax purposes, while the business may choose to expense more for internal financial purposes.

A review of Schedule M-1 can provide information about potential differences between profits or losses prepared for tax purposes versus internal financial reporting purposes.

Some small businesses may not maintain financial statements beyond the information presented in the tax return schedules; hence, it is important to understand which schedules and sections to review if your client owns an interest(s) in a business. However, for businesses that have financial statements, one should request multiple years of financial statements in addition to multiple years of tax returns and understand how to review the documents in conjunction with one another.

Reviewing the items listed in these schedules can provide useful information and lead to further document requests in order to review and evaluate business assets, business ownership(s), and active and passive income, among other information.

Conclusion

Understanding how to navigate key areas of Schedule K-1 and supporting schedules is often necessary in divorce proceedings. While we provided background on Form 4562, Schedule C, Schedule E, Schedule L, Schedule M-1, and Schedule M-2, there may be further supporting schedules with helpful information or indicators to request further information. Remember that each case presents different facts and circumstances, and tax returns may vary (specifically which schedules are included).

Information within the tax return and supporting schedules can provide support for marital assets and liabilities (specifically those associated with business ownership and/or other types of assets), sources of income, and potential further analyses. Reviewing multiple years of Schedule K-1s and accompanying supplemental schedules may provide helpful information on trends and/or changes and could indicate the need for potential forensic investigations.

While we do not provide tax advice, Mercer Capital is a national business valuation and financial advisory firm and we provide expertise in the areas of financial, valuation, and forensic services.