SEC Fairness Opinion Requirement Has Not Slowed GP-Led Secondaries

Rising regulatory burdens contributed to the stunning growth in private equity the last two decades and private credit in recent years. PE investors ultimately require liquidity, however.

Subdued M&A and IPO markets since mid-2022 have spurred growth for private equity secondaries, which mostly consists of GP-initiated transactions for continuation funds and LP-initiated transactions for portfolio interests.

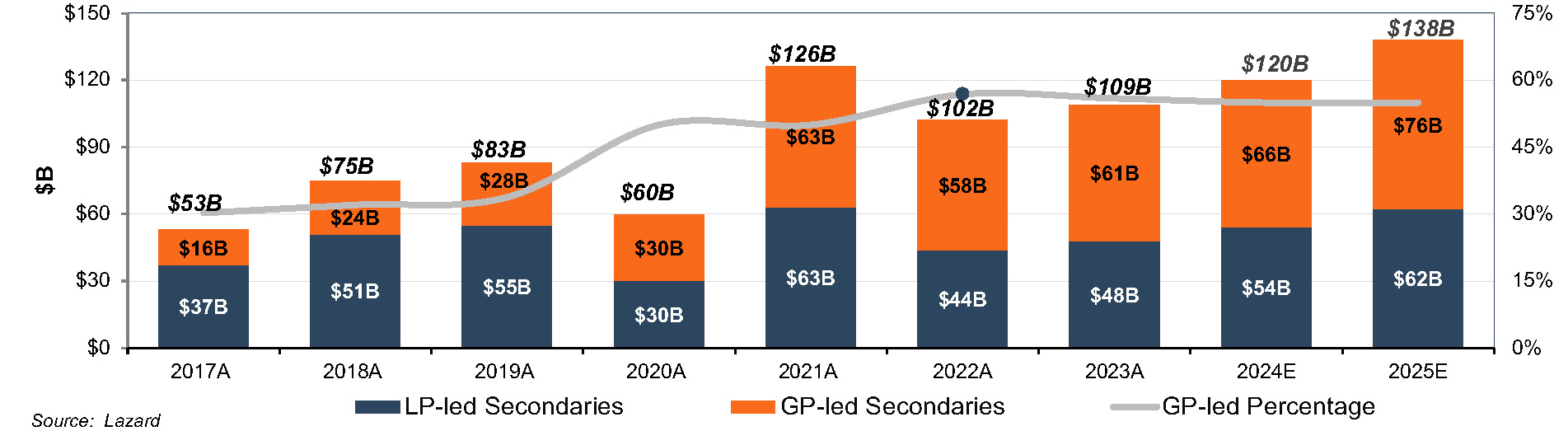

As shown in Figure 1, secondary transactions rose to $109 billion in 2023 from $102 billion in 2022 based upon data compiled by Lazard as volume soared 57% in 2H23 to $67 billion following depressed activity of about $43 billion in 2H22 and 1H23. Lazard expects secondary volume will improve further in 2024 and 2025 as the investor base for secondaries expands and buoyant markets support narrower bid-ask spreads. The need for LP liquidity also has driven the rise of NAV lending in which the GP arranges for a fund-level loan to fund distributions and/or acquisitions.

Figure 1

Lazard reports that LP secondaries of buyout funds realized ~88% of NAV whereas LPs realized only ~60% of NAV for interests in funds focused on early stage venture capital assuming NAV was not materially overestimated. LPs averaged 85% for interest in private credit funds, which is less than we would have guessed.

LP investors can decide whether it makes sense to transact at a price that is less than NAV and thereby convey to the buyer additional return from investing in an illiquid asset. The LP investor will weigh the cost against the expected return from the current investment, the need for liquidity, and the opportunity to deploy the returned capital in new ventures.

GP-led transactions for continuation funds create a corporate governance can of worms because the GP sits on both sides of the transaction as adviser to the fund that is selling an asset and as adviser to the fund that will buy it. LPs can choose liquidity on the terms offered, or they can roll their interest into the continuation fund. Whether a single asset or multi asset investment, presumably the GP is using a continuation vehicle because the exit price for an attractive asset is presently unattractive.

The SEC addressed the issue through adopting Rule 211(h)(2)-2 in August 2023 which requires the GP adviser to: (a) obtain a fairness opinion or valuation from an independent valuation firm; and (b) disclose any material business relationships between the GP and opinion provider. Given the increase in GP-led secondaries to $31 billion in 2H23 from $17 billion in 1H23, the SEC governance requirement has not slowed the market.

Although not mandated by law, fairness opinions for significant corporate transactions effectively have been required since 1985 when the Delaware Supreme Court ruled in Smith v. Van Gorkom, (Trans Union), (488 A. 2d Del. 1985) that directors were grossly negligent for approving a merger without sufficient inquiry. The Court suggested directors could have addressed their duty of care (informed decision making) by obtaining a fairness opinion.

The SEC rule takes aim at the corporate duty of loyalty, which with the duty of care and good faith form the triad that underpins the Business Judgement Rule in which courts defer to the decision making of directors provided they have not violated one of their duties. As far as we know, there has been no widespread finger pointing that GP-led transactions have intentionally disadvantaged LPs. Nonetheless, the SEC rule is a regulatory means to address the issue of loyalty.

Fairness opinions involve a review of a transaction from a financial point of view that considers value (as a range concept) and the process the board followed. Due diligence work is crucial to the development of the opinion because there is no bright line test that consideration to be received or paid is fair or not. Mercer Capital has over four decades of experience as an independent valuation and financial advisory firm in valuing illiquid equity and credit, assessing transactions and issuing fairness opinions. Please call if we can be of assistance in valuing your funds private equity and credit investments or evaluating a proposed GP-led transaction.