Tax Reform and Impairment Testing

Earlier this year, we considered the impact of the Tax Cuts and Jobs Act of 2017 (“TCJA”) on purchase price allocations. In this article, we turn our focus to the impact of the TCJA on goodwill impairment testing. Changes to the tax code will affect both the qualitative assessment (often referred to as Step Zero) and quantitative impairment test.

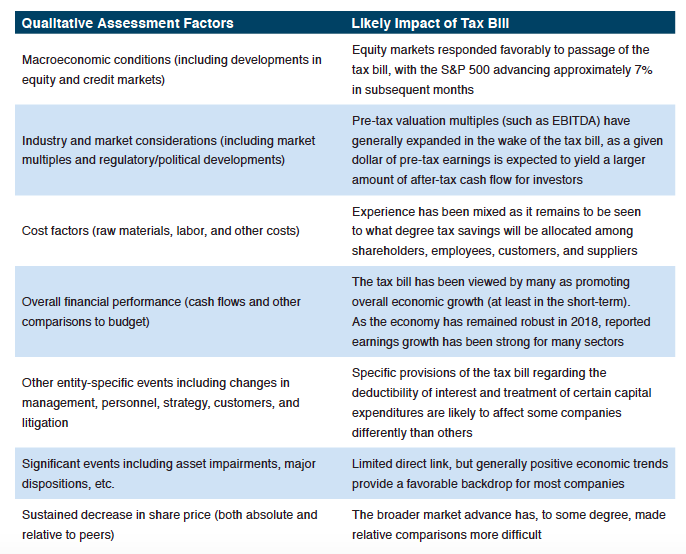

Qualitative Assessment

Companies preparing a qualitative assessment are required to assess “relevant events and circumstances” to evaluate whether it is more likely than not that goodwill is impaired. ASC 350 includes a list of eight such potential events and circumstances.

Quantitative Assessment

The same features which, on balance, have made it more likely that reporting units will garner a favorable qualitative assessment also contribute to the fair value of reporting units under the quantitative assessment.

- Reduction in income tax rate. All else equal, a reduction in the applicable federal income tax rate from 35% to 21% increases after-tax cash flows and contributes to higher fair values for reporting units.

- Bonus depreciation provisions. The tax bill allows certain capital expenditures to be deducted immediately for purposes of calculating taxable income. While the aggregate amount of depreciation deductions is unaffected, the acceleration of the timing of tax benefits can have a marginally positive effect on the fair value of some reporting units.

- Interest deduction limitations. One potentially negative effect of the tax bill on reporting unit fair values is the limitation on the amount of interest expense that is deductible for tax purposes. For some highly-leveraged businesses, the interest deduction limitation can increase the weighted

average cost of capital. We expect the interest deduction limitations to adversely affect only a small minority of companies. - Increase in after-tax cost of debt. When calculating the cost of debt as a component of the cost of capital, analysts multiply the pre-tax cost of debt by one minus the corporate tax rate. The new lower tax rate will, therefore, cause the after-tax cost of debt to increase by a small increment. All else equal, an increase to the weighted average cost of capital has a negative impact on the fair value of a reporting unit. On balance, we expect the negative effect from higher costs of capital to be smaller than the positive cash flow effect from lower tax rates.

Conclusion

The Tax Cuts and Jobs Act of 2017 is a material factor to be considered in both qualitative and quantitative assessments of goodwill impairment in 2018. While the provisions are not uniformly favorable to higher valuations, the balance of factors suggests that goodwill impairments will be less likely in the coming impairment cycle. To discuss how the new tax regime affects your company’s goodwill impairment more specifically, please give one of our professionals a call.

Originally appeared in Mercer Capital’s Financial Reporting Update: Goodwill Impairment