The Impact of the One Big Beautiful Bill Act on Tax and Estate Valuations

During the first Trump administration, the Tax Cuts and Jobs Act (“TCJA”) introduced substantial modifications to the tax code, including significant reductions to estate tax liabilities. These reductions, however, were designed to sunset at the end of 2025, and addressing the expiring provisions became a priority for the current Trump administration. These were addressed in the One Big Beautiful Bill Act (“OBBBA”), an extensive legislative package touching on a variety of tax and spending policies. After a series of late-stage amendments, the OBBBA passed both chambers of Congress and was signed into law on July 4.

In this issue of Value Matters, we examine the OBBBA’s provisions from a valuation perspective, focusing on implications pertinent to tax and estate planning professionals.

Valuation Perspective

One of the key determinants of value of an interest in a company – be it a family-owned operating company or a real estate holding company – is the cash flow generated by the company and available to the shareholders for either distribution or reinvestment. The cash flow generated by a company directly impacts its valuation and the level of distributions made to shareholders impacts the magnitude of discounts applicable to nonmarketable minority interests in companies.

Impact of OBBBA on Valuation

The OBBBA directly impacts cash flows in several key ways.

- Permanency of TCJA Provisions: The OBBBA makes permanent various TCJA provisions that were scheduled to sunset at the end of 2025. These provisions include:

- 37% top individual income tax rate

- 21% corporate income tax rate

- The Section 199A Qualified Business Income (“QBI”) deduction allowing tax pass-through entities to deduct up to 20% of their QBI. The QBI applied to entities that fall under the IRS’s definition of a “specified service trade or business” and includes entities in health, legal, accounting, and consulting fields. Reducing the tax burden owed by owners of S Corporations or members of partnerships increases the economic dividend received. All things equal, this reduces the costs of holding the asset during a nonmarketable period, reducing applicable discounts.

- Bonus depreciation was also made permanent under OBBBA and expanded to include buildings. Bonus depreciation can impact the timing of fixed asset purchases and allows a company to take advantage of a large upfront expense write-off, as opposed to trickling out the depreciation over the asset’s service life.

- The OBBBA also changed the definition of adjusted taxable income used to calculate tax loss carryforwards. The changes will ultimately allow businesses to deduct more interest upfront, reducing carryforwards and increasing cash flow in the short term. At the end of the day, asset-heavy pass-through companies are the big winners from these provisions.

Changes to Capital Gains Tax Treatment

The exclusion permitted related to sales of Qualified Small Business Stock (“QSBS”) has also been expanded. For qualified five-year holdings, 100% of the capital gains up to $15 million is exempted from capital gains taxes. The exclusion cap is indexed to inflation beginning in 2026.

The OBBBA also introduced partial exclusions for QSBS shares held for shorter holding periods – 50% of gains are exempted for three-year holdings and 75% of gains are exempted for four-year holdings.

The QSBS rules apply only to C corporations in non-service industries (for example, tech or retail) but can be advantageous to those planning to transfer shares across generations.

Estate Tax Provisions

Of most immediate relevance to estate planners is the substantial revision of estate tax exemption thresholds. The lifetime exclusion amount – the amount under which estate and gift taxes are not owed – was increased to $15 million for single filers and $30 million for joint filers beginning in 2026. This amount is indexed to inflation and will increase in future years.

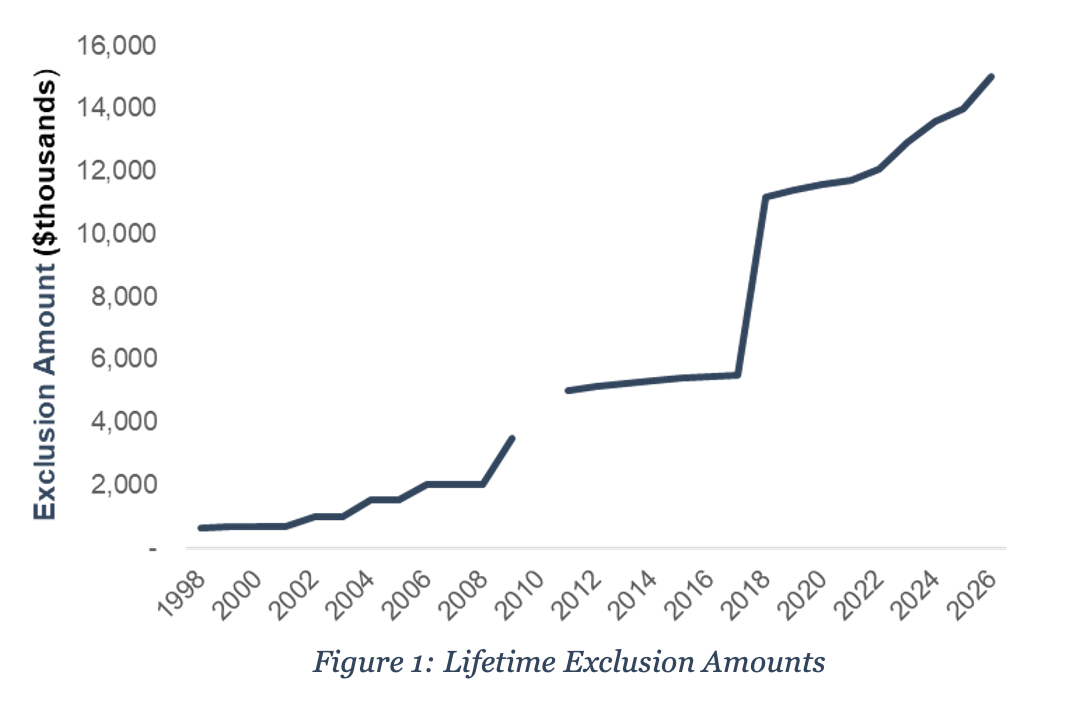

As shown in Figure 1, the lifetime exclusion amount has varied over time. The TCJA doubled the inflation-indexed exclusion amount from a base of $5 million to $10 million (or $5.49 million in 2017 to $11.18 million in 2018, after the inflation adjustment).

Figure 1: Lifetime Exclusion Amounts

Absent the passage of the OBBBA, the expiration of TCJA in December 2025 would have resulted in the exclusion reverting back to the $5 million base level (which would have been just over $7 million in 2026 after the inflation adjustment).

It is also important to note that the estate exclusion amount is lifetime amount – gifts, estate, and generation-skipping transfers all work off of the same $15 million “pool” of exemption value. The actual rates applicable to gift and estate taxes are unchanged and portability between spouses remains.

Importantly, unlike the TCJA provisions, the OBBBA’s estate tax thresholds do not include sunset provisions, offering greater predictability. Nonetheless, future legislative changes remain a possibility, underscoring the importance of sustained, proactive planning.

Additionally, the OBBBA only impacts federal estate tax obligations; individual states may have their own estate tax rates and exemption levels. Taxpayers who maintain a course of consistent and vigilant estate planning will be best positioned to achieve their planning objectives and successfully thwart future challenges once the pendulum of enforcement activity and tax policies inevitably swing in the opposite direction.

Conclusion

As Ben Franklin observed over two hundred years ago, “in this world nothing can be said to be certain, except death and taxes.” In navigating these certainties, collaboration with experienced estate planners and valuation professionals is critical.

Feel free to reach out to us if you have any questions about the OBBBA’s impact on gift and estate tax valuations or to discuss a valuation issue in confidence.