The Terminal Value

The valuation of portfolio companies usually is a straight forward process; however, it is more challenging in the current bear market following a period of wide-open monetary spigots that drove rich valuations for venture-backed firms. Capital raises were outwardly easy to complete as were richly valued exits via an IPO or M&A. For traditional PE-backed companies, low-cost debt financing was readily available, too, which often supported an extra turn or two of EBITDA for acquisitions and sometimes dividend recaps.

Now the hangover is in full swing.

The valuation process is intended to determine the fair value of an asset as of the valuation date. Stated differently, it is the market clearing price, not a price target based upon an investment thesis. The accounting profession provides more formality via ASC 820 as “the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.”

Current depressed market conditions make it difficult to utilize the recent bull market capital raise data without a fundamental adjustment for market conditions as well as differences between the subject and the comp data. The same applies to M&A and IPO pricing, too. What was is no more.

Depending upon the subject company, the Guideline Public Market Company Method (i.e., public comps) may be a suitable method to develop an indication of value, though often venture-backed companies may be too early in their life cycle to compare to public comps. But virtually all valuations will consider the Discounted Cash Flow Method (“DCF”).

The DCF Method has three primary components: a) projected unlevered free cash flows that accrue to capital providers, b) a terminal value and c) weighted average cost of capital (“WACC”) to discount the cash flows and terminal value to present values, the sum of which represents the enterprise value of the firm.

Most venture-backed firms and sometimes PE-owned companies can be described as long duration equities in which the value of the firm is in the out years rather than near-term cash flows as is the case for mature businesses with high profit margins. Like any model, terminal values have their sensitivities including and especially growth.

The terminal value represents the present value of all cash flows as of the end of the discrete forecast period. In our experience, the courts—especially in Delaware—and private equity analysts tend to favor an income approach to deriving a terminal value rather than a market approach based upon public company comps and/or M&A comps. An income approach to deriving the terminal value will rely upon the capitalization of earnings or free cash flow in which the multiple reflects a “build-up” of the components of capital costs less a long-term growth rate. Such an approach to deriving the terminal value excludes market data other than some of the capital cost components. Viewed from this perspective, the DCF method is a “pure” income approach to valuation as is the single-period (earnings or cash flow) capitalization method.

On the other hand, market participants tend to favor market multiples applied to one or more of the projected performance measures at the end of the forecast period to derive the terminal value. The courts may not favor this approach as a mixing of income- and market-based approaches, but viewing exit multiples in the context of market observations is not illogical.

It is important to note that a market-derived multiple used to determine a terminal value has an implicit growth expectation. All else equal, the higher the market multiple the higher the growth rate expectation. Stated differently, one should be judicious in selecting a market-based terminal value multiple. High growth rates tend to normalize in time with once high multiples compressing toward industry averages. Market multiples observed over the past several years may overstate future growth just as today’s “low” multiples could understate future growth.

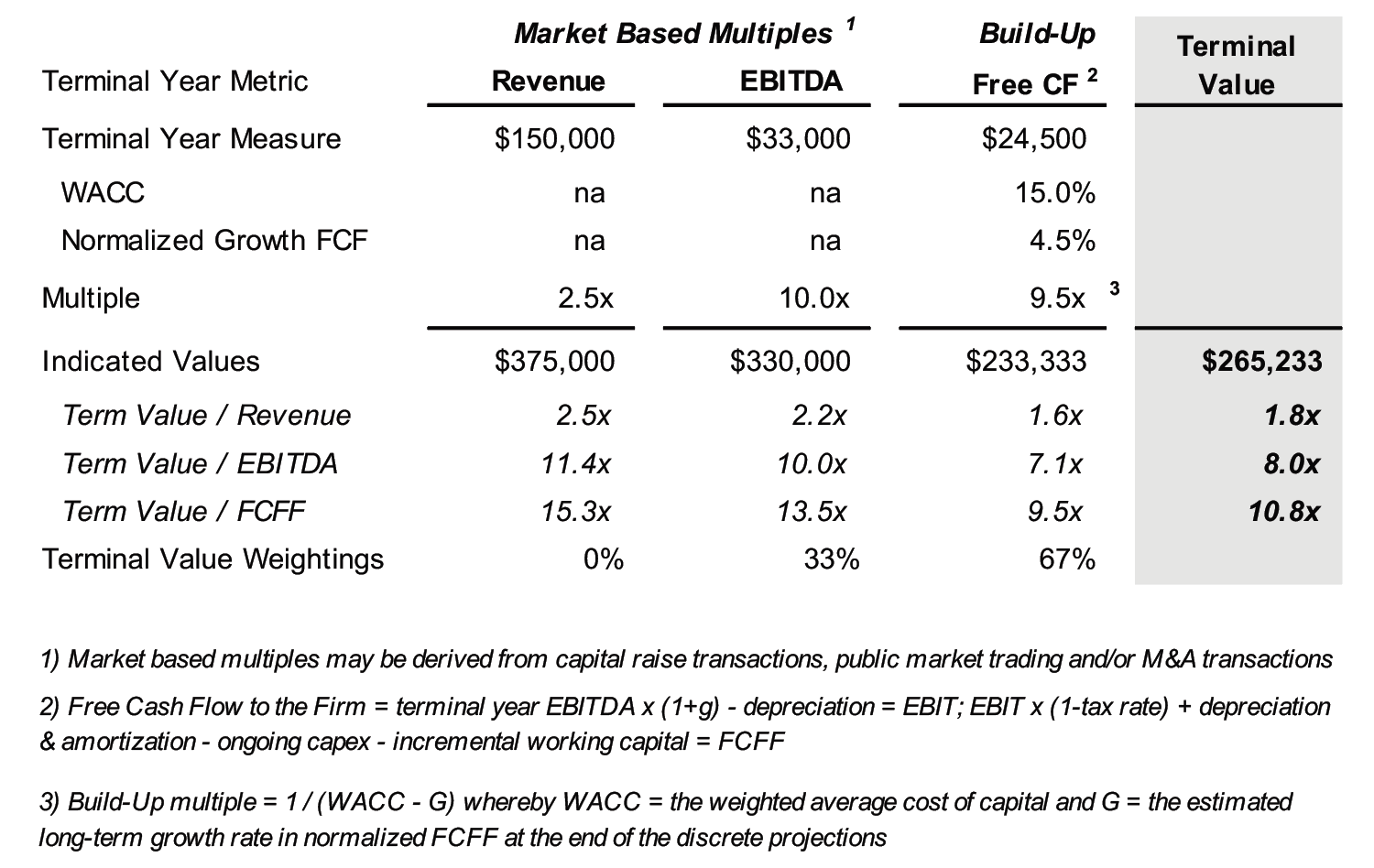

Figure 1 compares a market-based approach to determining a terminal value with a build-up approach. The illustration is intended to emphasize the delta that may exist presently between a market-based approach and a build-up. Firms that are projected to be marginally cash flow positive by the terminal year, all else equal, likely will not produce a substantial DCF value unless elevated market multiples are used to derive the terminal value. With the passing of the ultra-easy money era, that probably does not make sense unless the market observations were derived since interest rates returned to a “normal” level by late 2022.

Figure 1: Derivation of the DCF Terminal Value

An alternative to solely weighting the build-up multiple would be to weight both market-based and build-up multiples. That may make sense to bridge an evolving market, though if a court were to review the analysis it likely would solely weight the build-up multiple consistent with Delaware case law.

Another point to consider in calculating terminal values is relative valuation – does the terminal value as a multiple of earnings, revenues and whatever other metrics are relevant to the subject company’s industry make sense? The resulting multiple may make sense, but one also has to question the terminal year earnings measure. If management projections reflect a “to the moon” trajectory, then the WACC probably should too.

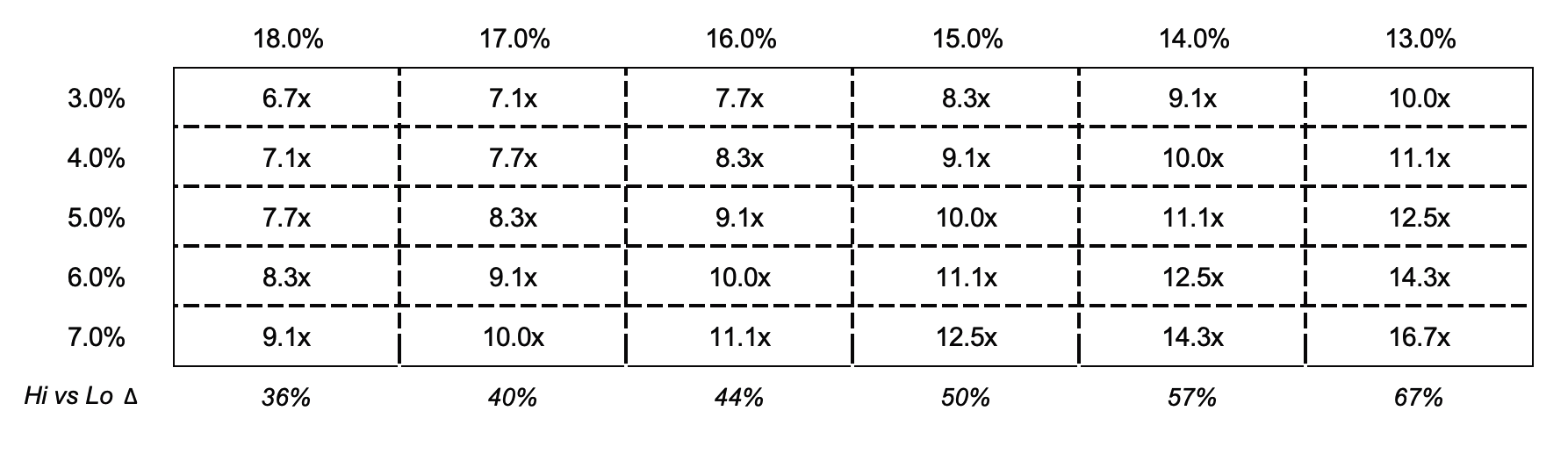

Terminal values are sensitive to the assumptions, especially the growth rate of the terminal year earnings measure that is capitalized as shown in Figure 2 as it relates to a build-up method used in the single period capitalization method. The current outlook for lower economic growth and higher rates/cost of capital implies DCF values all else equal have (or will) decline.

Figure 2: Sensitivity of the Build-Up Multiple re WACC vs Long-Term Growth

of Earning Power

About Mercer Capital

Mercer Capital is an independent valuation and transaction advisory firm that was founded in 1982. We provide valuation, fairness and solvency opinions for a broad range of clients, including private equity and private credit funds. Please call if we can assist in establishing the fair value of your private equity and credit investments, or alternatively provide assurance opinions.