Understand the Asset Approach in a Business Valuation

What Is the Asset Approach and How Is it Utilized?

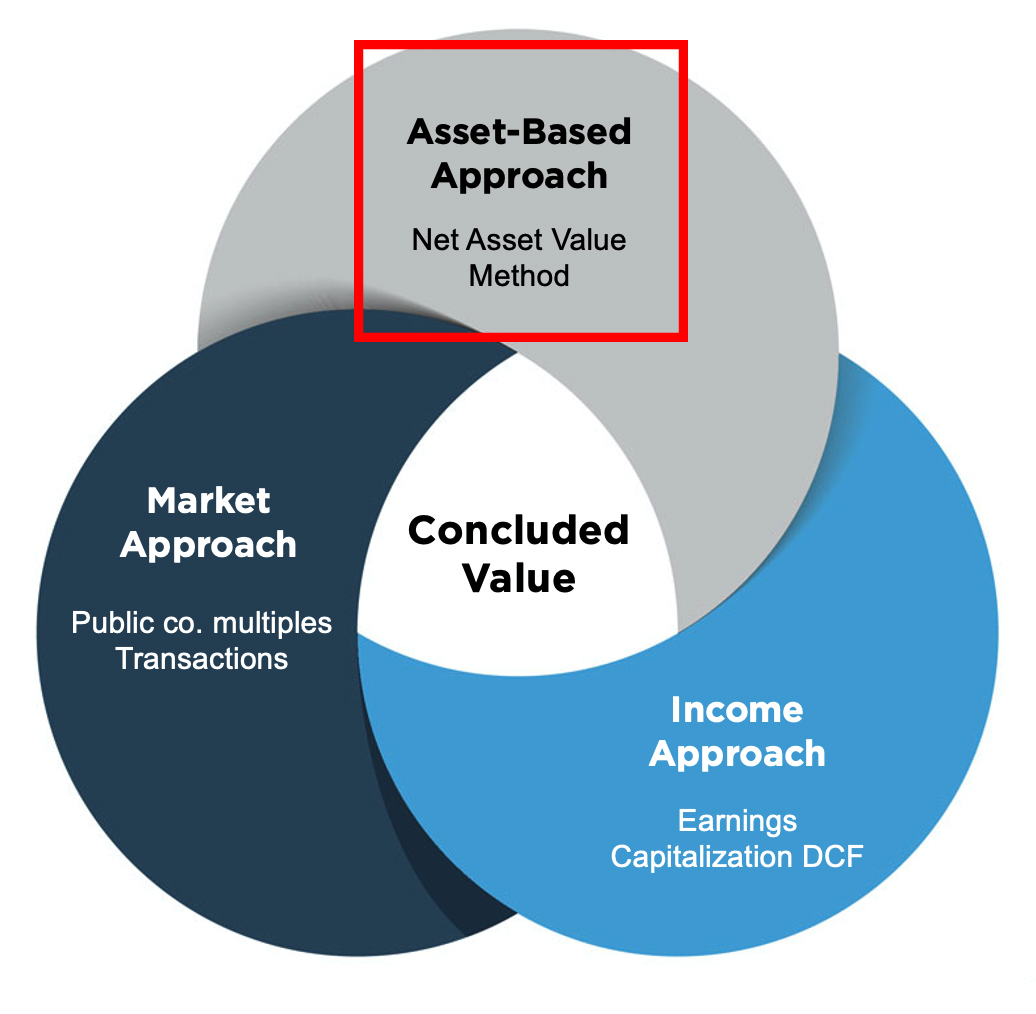

In previous posts, we wrote about the income and market approaches used in business valuations. This article presents a broad overview of the third approach, the asset approach. While each approach should be considered, the approach(es) ultimately relied upon will depend on the unique facts and circumstances of each situation.

The asset approach refers to methodologies used under the economic principle that the value of a business can be viewed as an assemblage of net assets. In practice, appraisers begin with the company’s balance sheet, which lists the assets, liabilities, and equity of the company. The values shown on a company’s balance sheet are the “book” values of the assets and liabilities, which are based on accounting standards. As such, these book values may or may not align with current market values. The appraiser will analyze each asset and liability and adjust values (as needed) to reflect market value. The market value of the company’s liabilities are then netted against the market value of the company’s assets to arrive at a Net Asset Value of the business.

The asset approach is appropriate for valuing real estate holding companies, investment holding companies, and capital-intensive operating companies. In the case of operating companies, the asset approach’s indicated value can be interpreted as the value of an assemblage of revenue-producing assets. However, sometimes the operating company is worth more than its assets, for a myriad of reasons. Understanding how well the balance sheet represents the business’s ability to generate earnings is a logical way to evaluate if the value per the asset approach is appropriate.

Asset Classes and Typical Balance Sheet Adjustments

The asset approach is applied based on the identification and discrete appraisal of the company’s assets and liabilities. The assets, if necessary, are adjusted to reflect their market values. Generally, the identifiable assets fall into five categories:

- Financial Assets

- Inventory

- Tangible Real Property

- Real Estate

- Intangible Assets

Financial Assets

Financial assets include cash and highly liquid investments like marketable securities, accounts receivable and prepaid expenses. This class of asset is typically the most straightforward to adjust, as the book values of cash and receivables usually require no adjustments to reflect market value.

Inventory

In some cases, inventory can be marked up or down based on the economic reality underlying those inventory balances. If there is identified obsolete inventory, a downward adjustment might be necessary. If the company carries its inventory at historical cost and the value of that inventory has increased or decreased, an upward or downward adjustment might be necessary. An example of this could be a company that holds commodities as inventory.

Tangible Real Property

Tangible real property includes furniture, fixtures, and equipment. The value of these assets may decrease over time through use or obsolescence. Accountants capture this effect by depreciating the book value of these assets over a period of time. If the assumptions used in the accounting depreciation of these assets are in line with the economic depreciation of these assets, the book value may be a reasonable indication of the assets’ market values. Otherwise, appraisals of the individual furniture, fixtures, and equipment may be necessary.

Sometimes, businesses may choose to take accelerated depreciation for tax benefits, while the financial statements may reflect either that same tax depreciation, or straight-line depreciation; it is important to be careful in understanding the historical depreciation methods within the financial documents.

Real Estate

The book value of real estate may reflect current market values of the underlying properties or may be dated and require a current appraisal. This can be attributed to appreciation or depreciation in value over time.

Intangible Assets

A company might have intangible assets on its balance sheet. Intangible assets are typically added to the balance sheet during the accounting process of an acquisition, and can be comprised of customer relationships, customer files, existing favorable contracts, existing workforce, tradenames, intellectual property, proprietary technology and general goodwill. In practice, Net Asset Value typically does not include value attributable to intangible assets because it is presented on a tangible, operating basis.

Conclusion

The asset approach is an intuitive approach to valuation, as it is based on the market value of a company’s equity, i.e. assets less liabilities. The asset approach can be a more insightful business valuation approach for entities which hold and manage assets, or perhaps entities which have high balances of machinery and equipment. A competent valuation expert is needed to thoroughly review a company’s balance sheet and assess the adjustments necessary to reflect market value of the underlying assets and liabilities, as well as determine if the approach best represents the value of the business at hand.