UPDATE: Analysis of the Spirit Fairness Opinions re the JetBlue Acquisition

Earlier this year, we published an analysis of the still pending acquisition of Spirit Airlines, Inc. (NYSE: SAVE) by JetBlue Airways Corporation (NASDAQGS: JBLU) focusing on the fairness opinions issued by Morgan Stanley and Barclays to the Spirit board in July 2022.

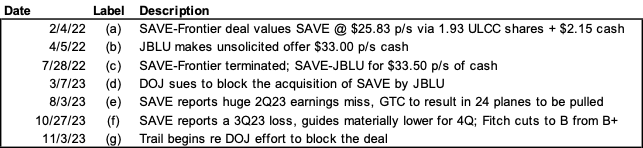

A Recap of Events:

- February 5, 2022 – Spirit agrees to be acquired by Frontier Group Holding, Inc. (NASDAQGS: ULCC) for 1.93 Frontier shares and $2.13 per share of cash for each Spirit share that at announcement equated to $25.83 per share ($2.9 billion).

- March 29, 2022 – JetBlue made an unsolicited offer of $33.00 per share of cash.

- May 2, 2022 – Spirit rejected JetBlue’s offer.

- May 16, 2022 – JetBlue commenced a $30.00 per share tender offer, noting that the tender price was less than the unsolicited offer because the Spirit board was “unwilling to negotiate in good faith with us.”

- July 27, 2022 – the Spirit-Frontier deal was terminated.

- July 28, 2022 – Spirit agreed to be acquired by JetBlue for a) $33.50 per share of cash, or $3.8 billion, with $2.50 per share payable upon approval of the deal by Spirit shareholders; b) a monthly ticking fee of $0.10 per share up to $0.65 per share commencing in January 2023; and c) $70 million termination fee if the agreement is terminated for failure to obtain regulatory approval.

As shown in the chart below, Spirit has not traded close to the $33.50 per share acquisition price since the deal was struck. The merger arbitrage community, in effect, has assigned a decreasing probability that the transaction will close, with the shares trading around $10 per share as of mid-November.

In our analysis earlier this year, we noted the valuation attributes and process the Spirit board followed made the issuance of the fairness opinions a straightforward proposition; however, we ended by asking the question if the Spirit board had adequately considered the possibility that JetBlue could close the deal.

At the time the Frontier deal was announced, some including Frontier expressed skepticism that JetBlue could obtain regulatory approval through anticompetitive considerations. While any airline transaction faces intense government scrutiny given the concentrated nature of the U.S. airline industry, a Frontier-Spirit combination was (is) viewed by many investors as more obtainable than JetBlue-Spirit, given relative market shares and routes.

To no one’s surprise, the Department of Justice sued on March 7, 2023, to block the JetBlue deal. The trial began on November 3, 2023. A ruling is expected before year-end.

In our prior post, we speculated that the Spirit board may have calculated that JetBlue was a risk worth taking because a) the offer was 30% greater than Frontier’s offer; b) JetBlue provided $400 million ($4.30 per share) of downside protection; and c) a jilted Frontier presumably would be willing to reengage Spirit if the JetBlue deal failed.

The still-pending JetBlue-Spirit deal illustrates the widely quoted maxim that time is the enemy of all deals. While the Frontier deal was not a sure thing, Spirit’s shares traded near the Frontier acquisition cash price during the first quarter of 2022; however, once the calculated risk of terminating the Frontier deal and agreeing to the JetBlue deal was accepted, the shares have traded steadily lower to around $10 per share as of mid-November 2023.

The downdraft reflects the assessment of the merger arbitrage community that the government will prevail to block the merger in its lawsuit against a backdrop of weakening industry fundamentals. Airlines in the second and third quarters of 2023 generally missed Street consensus estimates and gave downbeat assessments of operating conditions.

Spirit was not an exception, missing consensus estimates in both quarters and guiding sharply lower with the release of third quarter results. Aside from tougher industry conditions due to declining consumer (but not business) traffic, higher fuel costs, and ongoing ATC issues, Spirit warned that September results would be negatively impacted by the grounding of seven Airbus A320neo aircraft due to issues with certain Pratt & Whitney engines. With the release of third quarter results in October, the number of grounded aircraft was projected to be as high as 26.

Ironically, the grounding of aircraft by Spirit and worsening financial results may give JetBlue leverage to renegotiate a lower price or walk if the conditions are bad enough, assuming the company prevails in court by invoking the “material adverse event” clause in the merger agreement. If so, another round of litigation probably would occur.