The valuation of stock options is a complex issue that divorcing parties may face during the determination and division of the marital estate. Designed as compensation to both reward past performance and retain employees in the future, these benefits can be difficult to value, particularly at a specific point in time for the purpose of marital dissolution.

We previously wrote about the valuation models as set forth by the AICPA Quick Reference Guide. In this piece, we walk through an example of how to value a not so simple stock option situation – one in a start-up company.

Stock options ultimately derive their value from the value of the underlying business. While pricing data of publicly traded companies is readily available, that is not the case for privately owned businesses since by definition they are not traded daily on an active market.

Overview of Stock Options & Importance in Marital Dissolution

A stock option is a contract that provides the owner the right, but not the obligation, to purchase stock in the company at a specified price.

These options can be issued by publicly traded or privately held companies. In its most basic structure, an option contract consists of:

- Grant Date and number of options granted

- Vesting Date: date when the granted shares become exercisable

- Exercise (or Strike) Price: the price at which the stock can be purchased

- Expiration Date: the date the stock option expires

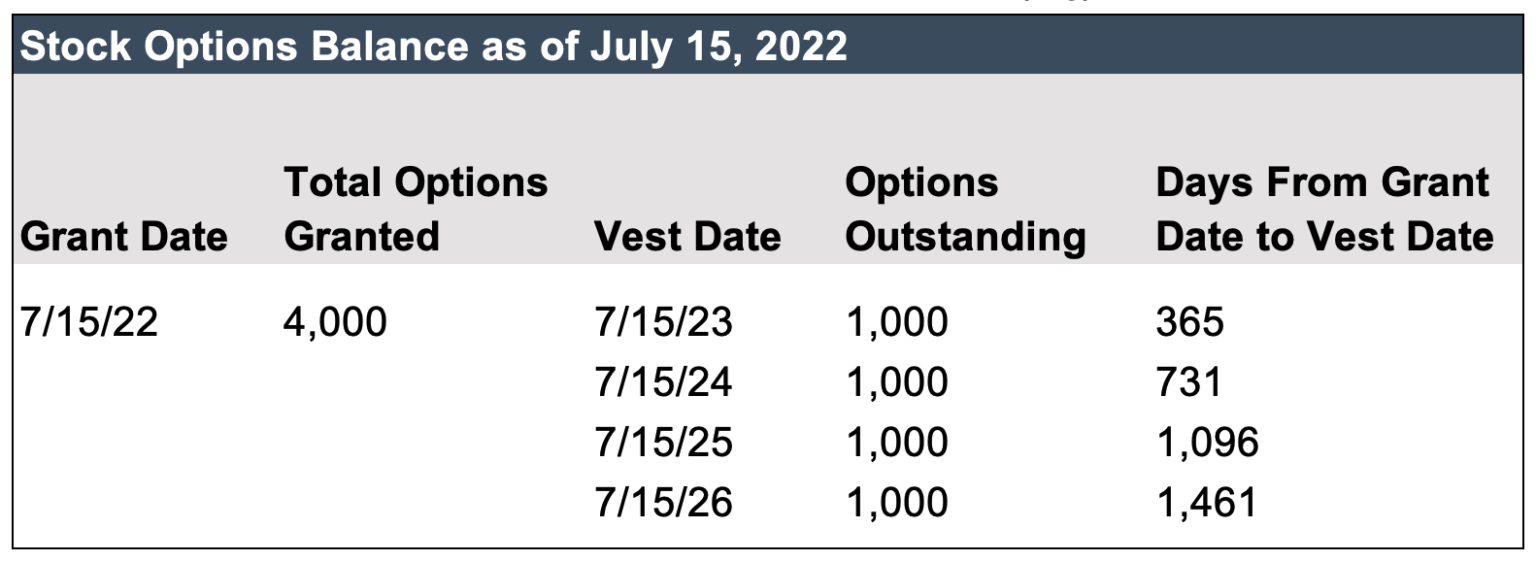

The vesting schedule is important, particularly in the context of marital dissolution, as the options may not be immediately exercisable and vest ratably over a period of time.

A vesting schedule sets out the period of time over which options vest and become exercisable. For example, a common vesting schedule may provide for an equal amount of the options of a specific grant to become exercisable each year over a certain period, perhaps four or five years. If an employee leaves the company, he or she may forfeit unvested options. The terms differ by company and sometimes even by grant, so one should carefully review the terms as specified in the plan documents.

An example of a vesting schedule over a four-year period is shown below.

In the context of marital dissolution, there are many important factors to consider relative to stock options, most notably what is marital vs. separate and what is the value of said options.

- First, what is marital versus separate may vary by state statute. This extends to stock options regarding vested and those which are still vesting as of the date under consideration which may be date of marriage, separation and/or divorce.

- Next, what is the value of the options? If the parties intend to split options based on a percentage, perhaps the value is less of a consideration, but, if the parties intend to offset the value of the stock options with another asset of the marital estate, valuing the stock options bears much more importance.

Valuing Stock Options

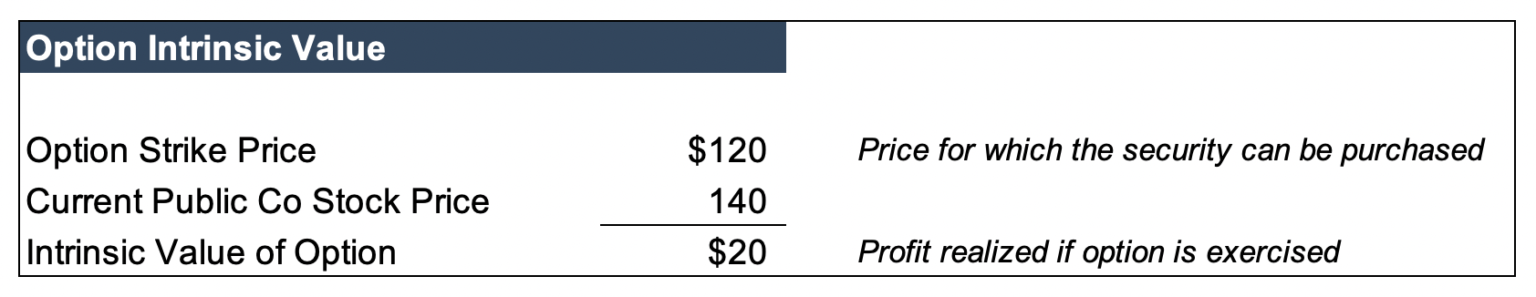

In the case of options issued by a publicly traded company, the intrinsic value can be easily determined as the value of the option if it were exercised today. Simply, intrinsic value is the option strike price relative to the share price today. The option is said to be “in-the-money” if the strike price is below the current market value.

A simple example calculation of the intrinsic value of an option to purchase stock of a hypothetical public company is shown below.

Using the example from above, if Current Public Co stock price is $120 or below, the stock option owner would likely not exercise their right to purchase the stock. The option would have little to no intrinsic value today if the current stock price were below the option strike price, but it may still have time value.

The other component of the option value is time value, which relates to the premium relative to the time remaining until an option expires. The time value represents the value of holding a stock option over time. We have previously written about stock option valuation models, such as lattice, Black-Scholes, and Monte Carlo models. These models are useful when dealing with options issued by publicly traded companies, particularly because the assumptions and inputs for the Black-Scholes model can be taken directly from the respective public company’s public filings and historical pricing data.

Unique Considerations for Valuing Start-Up Stock Options for Marital Dissolution

In many instances, start-up companies issue stock options to employees, typically as a form of compensation called incentive-based compensation. The valuation of these options can be especially difficult given the lack of an active market for the company’s shares and the uncertainty and potential volatility associated with early-stage companies with limited operating history.

While the option exercise, or strike price, is defined with the option grant, the underlying share price as of a specific date may be more complex to determine for a start-up company.

Funding rounds and respective 409A valuations can provide useful valuation information for start-up companies.

Start-ups seek to raise capital from investors such as venture capitalists and private equity funds. Capital raises are a primary indication of investors’ views and pricing activity on the company. 409A valuations are performed in conjunction with a company issuing equity or options and thus occur concurrently to funding rounds. However, funding rounds happen sporadically, and the time period between each round may vary between start-ups.

In the case of a fast-growing company, valuations can change considerably between funding rounds as different milestones are achieved. Alternatively, a valuation may be down between funding rounds due to poor performance or general downward macroeconomic trends, perhaps such as during a recessionary time.

In the context of marital dissolution, funding rounds, time since last round, and 409A valuations are important pieces of information to gather. Another possible piece of information to gather is any recent transactions or buy-sell offers for the start-up stock; one such example would occur for a departing employee who may be soliciting offers to sell his/her vested interest.

As discussed above, the considerations of marital versus separate and the vesting schedule are also important during this process unique to start-ups. However, in the following discussion, we will focus on the unique attributes of valuing start-up stock options using the information gleaned from funding rounds, 409A valuations and any recent transactions data of the underlying stock.

For marital dissolution purposes, unless stock options are divided based on percentage, the key question is what is the value as of a specific date? Perhaps the value is necessary as of multiple dates (marriage, separation and/or divorce date).

Since the price as of a specific date is necessary, hence arises the difficulty unique to start-up stock option valuations – because funding rounds are sporadic and value as of a certain date is necessary, the financial expert must have the skills to value these situations. As a clear example, it is unlikely a funding round occurred exactly on the date of marriage. Similarly, a funding round likely did not close on the exact date of divorce.

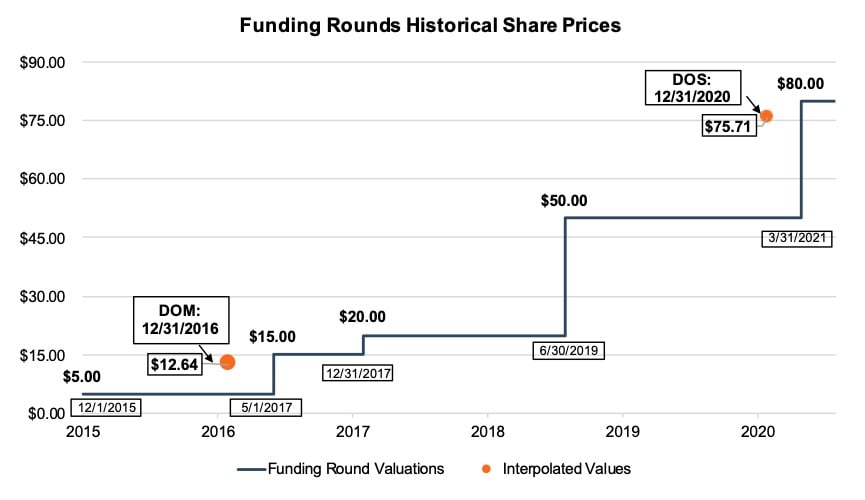

If the dates of marriage, separation and/or divorce fall on or proximate to a funding round, the financial expert could base the determination of value of the stock options on the per share value implied by the funding round. However, if the relevant dates are between two funding rounds, the financial expert must carefully evaluate the implied pricing at that point in time.

One reasonable method is the mathematical process of interpolation to determine the implied value at those dates. Interpolation determines the implied value between two dates by assuming a liner relationship between the value at the most recent funding round prior to the valuation date and the funding round most immediately following the valuation date. While early-stage companies could possibly be more volatile and have periods of exponential growth, using a linear relationship is supported by the comparison of the growth between the two funding round dates and can be understood by a layperson.

The chart below shows an example of interpolation of value implied by a series of funding rounds for a hypothetical start-up company. The x-axis represents the date, and the y-axis is the share price; to illustrate, the first funding round was on December 1, 2015 for a $5.00 share price, followed by a funding round on May 1, 2017 for a $15.00 share price and so on, with the last funding round on March 31, 2021 for an $80.00 share price. In this example, the date of marriage (“DOM”) is December 31, 2016, which falls between two funding rounds, and the date of separation (“DOS”) is December 31, 2020, also falling between two funding rounds. Neither date falls directly on or just after a funding round. The orange dots on the chart represent the interpolated values at the date of marriage and date of separation.

The magnitude of using interpolated values versus choosing a previous funding round share price can have a meaningful impact, depending on the number of shares owned.

While interpolation may be a reasonable methodology in certain situations, there may be other reasonable methodologies of determining the value of a start-up company’s share price at a point in time which falls outside of funding rounds. The financial expert may also consider an independent business valuation, during which the expert considers quantitative and qualitative elements of the company, as well as performance expectations as of the current date.

Individual Transactions of Start-Up Shares

Typically, individual seller’s shares transact at a discount to the value implied by the most recent funding round, while 409A valuations are often seen as a floor for any potential transactions or investments. However, if there is strong demand for the start-up, or other buyer motivation, a premium to the funding round is not out of the realm of possibilities, particularly if the company is growing quickly or has hit certain milestones since the last funding round.

But, let’s hone in on the possible discount – the discount relative to the share price of the most recent funding round reflects considerations such as the lack of an active market for the shares and the lack of influence available to a minority shareholder. As an example, lets say the start-up offers at-home cooking classes and the last funding round was during the pandemic; now, two years later and with the pandemic behind us (hopefully), people are back to dining at restaurants and spending disposable income on travel, pushing demand for at-home cooking classes down. Even though there is not a current funding round to support a decline in the share price valuation, one can discern a likelihood of downward trend on pricing.

Discounts (and/or premiums) can vary based on the situation, and there is no standard discount, as facts and circumstances vary tremendously between start-up companies. However, such transactions among individual stockholders or offers received by shareholders can provide potential indications of an appropriate discount, which may then be appropriate for value determination for marital dissolution as of a certain date (marriage, separation and/or divorce).

If the options are vested, or exercisable at the valuation date, a similar process of the intrinsic value calculation, presented earlier, can be used. This provides an estimate of value based on the profit that could be realized if the options were exercised on the valuation date.

Conclusion

In summary, stock options entail unique valuation considerations compared to a traditional business valuation.

A start up company’s stock options also have unique attributes that must be considered and valued carefully. In certain situations, start-up stock options may comprise a significant component of the marital balance sheet.

An experienced financial expert can accurately value these complex assets. Mercer Capital has experience in valuing stock options for private, publicly traded and start-up companies.