2022: How Is the Auto Industry Doing and What Does the Future Hold?

Status Quo or Winds of Change?

The first half of 2022 is behind us, and with school about to start, report cards will be here before we know it. In that same light, the auto industry has published its statistics for the first six months. This post reviews predictions by industry analysts (and us) made at the beginning of the year by analyzing several key metrics. Additionally, we discuss threats that arose during the first half of 2022 and their impact on the auto industry for the remainder of the year and perhaps longer. Finally, we offer a few predictions for the second half of 2022.

Review of 2022 Predictions

Most analysts predicted vehicle sales would continue to improve in 2022 due to pent-up demand from vehicle deficits caused by production shortfalls in the last two years. While demand would continue to outpace supply, analysts believed the tight supply of new vehicles would gradually improve in 2022. Finally, analysts predicted that the production of microchips would begin to see some improvement this year.

In terms of predicting the annual SAAR, or estimate of new vehicle sales in 2022, most early estimates ranged between 15-16 million units.

Recall the original causes of the microchip shortage stemmed from the following events: 1) OEMs canceled orders of microchips in the early days of COVID-19 as the production of new vehicles waned in the aftermath of shutdown orders for OEM plants and dealerships alike; 2) there was a huge increase in the demand of consumer electronics; and 3) supply chain disruption from the production and plant shutdowns of the microchip factories themselves.

Mercer Capital’s predicted a similar bounce back in the production of new vehicles stemming from the vehicle deficit of the last two years. We also predicted there would be fewer incentives offered by the manufacturers, fewer models available, and fewer features on vehicles.

We revisit how industry analysts and Mercer Capital fared in these predictions later in this blog.

New Threats in 2022

Through the first six months of the year, new threats to the auto industry and the general economy have emerged. Headlines have been dominated by inflation (at the highest levels in 40 years), rising interest rates, and rising gas prices. The auto industry is impacted directly or indirectly because these economic headwinds affect a consumer’s ability to purchase and finance a new or used vehicle as well as the total vehicle miles traveled.

Also contributing to these threats is the Russian invasion of Ukraine and its impact on the production shortage of microchips. Raw materials, such as neon gas that have been compromised during this war, are a key component in the manufacturing of microchips. Additionally, the war has caused production plant shutdowns and further supply chain disruptions for OEM and microchip plants located in/or adjacent to the area.

OEMs and the United States are trying to mitigate the impact of the microchip crisis and our dependence on importing these components by opening microchip production facilities domestically, but these will take some time to develop and begin production. Analysts, ourselves included, may have been too optimistic as to how quickly this industry could scale supply to meet increasing demand. (Stay tuned for a microchip update in next week’s SAAR blog).

If the current market conditions of inflation, rising interest rates, and rising gas prices lead to a recession, there could be further impacts on the overall auto industry. Yet, depending on your definition, we may already be in a recession. U.S. auto sales declined by 40% during the Great Recession and fell nearly 15% for the first two months of COVID-19, compared to those same two months in 2019.

New Vehicle Profitability

With high demand, tight supply, and less incentives offered by the manufacturer, it’s not a surprise that the average transaction prices of new vehicles have been at record levels in 2022. One interesting trend has been the increased shift towards crossovers and light trucks compared to smaller cars which are more fuel efficient. It remains to be seen whether rising gas prices will swing this pendulum back.

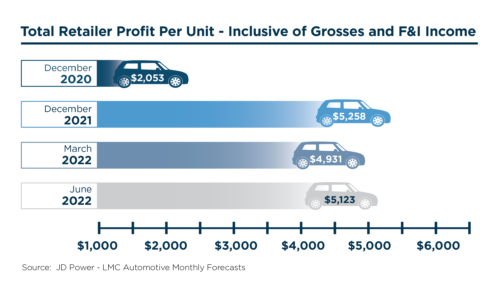

In addition to high vehicle prices, the total retailer profit per unit realized by auto dealers has also reached record levels. According to the monthly forecasts from JD Power and LMC Automotive, profitability from this metric have been between $4,900 and $5,300 per unit since December 2021. As a point of comparison, this same metric totaled only $2,053 per unit in December 2020, as seen in the graphic below:

While the monthly totals in the first and second quarters of 2022 have fluctuated slightly, there doesn’t seem to be any indications yet of this trend changing.

Supply of New Vehicles

Evidence of the tight supply of new vehicles in the last few years can also be seen in the lack of inventory on auto dealer lots across the country. It’s not uncommon to see more empty spots on the lot than spots filled with new inventory.

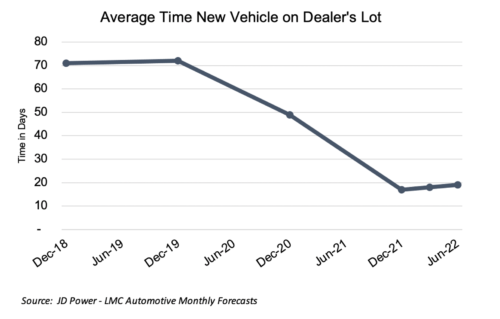

Another similar measurement of the lack of inventory is the average time in days that a new vehicle sits on the lot before it is purchased. The monthly forecasts provided by JD Power and LMC Automotive report these figures between 19 and 20 days for each month in 2022, a slight uptick in the December 2021 figure of 17 days. As a point of comparison, this metric totaled 72 and 71 days for December 2018 and December 2019, respectively, as seen in the graphic below:

In our discussion with auto dealer clients, they continue to indicate that they are operating on a selling volume of 50-75% of pre-COVID years, but at 2-3X greater gross profit – a further reflection of these first two metrics. Dealers and industry analysts both predict the OEMs will increase the supply of new vehicles above current levels when they are able to try and reclaim some of their lost profitability on these units.

Trying to predict when supply issues will be resolved feels like predicting when Tom Brady will retire.

While most analysts and dealers do not predict the average day’s supply will reach pre-COVID levels, there is certainly room between current and prior-year levels. Based on this statistic and overall industry conditions, any improvement in supply seems to be minimal and gradual through the first half of the year. Trying to predict when supply issues will be resolved feels like predicting when Tom Brady will retire.

Average Age of Cars

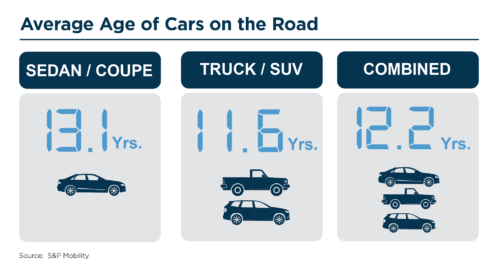

S&P Mobility recently released its annual study on the average age of cars on the road in the U.S. As the graphic below indicates, the overall combined average is 12.2 years:

This figure shows a slight increase over last year’s study, which concluded the average age to 12.1 years. In fact, this combined figure has grown every year for over a decade. These figures show no signs of decline and could be easily predicted to continue to rise, especially if a recession hits. At some point, conventional wisdom says the average age of cars will peak and begin to decline as consumers have to trade in for a more recent model. However, improvements from OEMs may structurally improve vehicle life cycles just as many hot new features have quickly become standard.

The average age of cars also highlights the continued opportunity for auto dealers in terms of fixed operations (service department and parts). Aging cars will require more service than newer vehicles. This opportunity could be mitigated somewhat during a recession, as consumers could be apt to drive fewer miles due to rising costs or lack of employment. In fact, another statistic affected by a recession is total vehicle miles driven. This figure declined sharply for the two years during the Great Recession and also declined rapidly from the effects of COVID-19.

The rolling twelve-month average for total vehicle miles driven has finally climbed back to near pre-pandemic levels as of May 2022 (most recently published data). A market recession could easily reverse that trend for the remainder of the year and the length of the recession.

Average Trade-In Equity Value of Used Cars

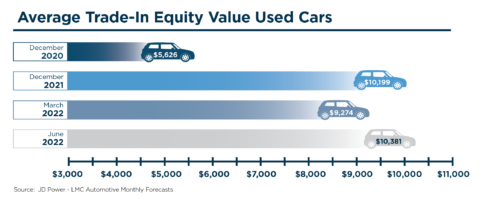

Like new vehicles, used vehicle transaction prices also reached record highs in 2022. While the supply of used vehicles has improved gradually, like its new vehicle counterparts, it has not returned to pre-COVID levels. Since fewer new units are available for sale, fewer used vehicles are traded to the dealer. However, the average trade-in equity value for used cars has followed the same trends as profitability on new and used vehicles. According to the monthly forecasts from JD Power and LMC Automotive, the average trade-in equity value has ranged between $9,300 and $10,400 since December 2021, compared to $5,626 just one year prior in December 2020:

Rising trade-in values and, perhaps more importantly, equity are key components of rising vehicle prices. Through the first six months of 2022, there is no sign of trade-in values cooling, although those could be impacted in the coming months by the emerging new threats or the onset of a recession. Consumers tend to be more focused on their monthly payment, so a $5,000 increase on vehicles purchased and traded in are a wash to the consumer. If this metric begins to stumble, we expect it to impact transaction prices similarly.

Fleet Sales

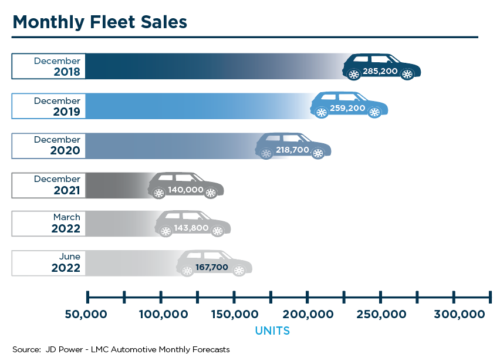

Finally, we examine fleet sales in recent months. In more robust times of new vehicle production, dealers are able to sell off excess inventory in high volumes to rental car companies, government agencies, and corporations, albeit at much lower margins. Fleet sales were also greatly impacted by COVID-19 as rental car companies sold off large portions of their fleet to conserve cash as consumers were no longer traveling during stay-at-home orders.

Fast forward two years, rental car companies and others have not been able to replenish their fleets as the entire industry has been operating at a new vehicle deficit. Anyone that has tried to rent a car in the last few years has experienced the lack of availability and heightened prices. We have a friend who recently rented a U-Haul truck on a vacation because the price was half of a rental car. While these conditions have improved recently, fleet sales and corporate fleet sizes still represent a distressed industry segment.

As reported by JD Power and LMC Automotive, monthly fleet sales have rebounded some in 2022, but their monthly unit sales are still down almost 50% from prior levels depending on the month, as seen in the graphic below:

Another view of fleet volumes can be measured by the percentage of sales of fleet vehicles vs. the overall sales of all new vehicles. According to Cox Automotive, fleet sales have comprised approximately 13-14% of overall new vehicle sales for 2020, 2021, and year-to-date 2022, compared to nearly 19% in 2019. It should also be noted that those reduced percentages representing fleet share are also on greatly reduced overall new unit sales from the same time periods.

Conclusions

So how did industry analysts and Mercer Capital do on their beginning of the year predictions, and where are we headed? Jonathan Smoke from Cox Automotive originally predicted 2022 SAAR at 16 million units. He lowered that prediction to 14.4 million units in the last two months. The predicted trends of high demand, tight supply, and increased profitability have all held through the first six months, although there are signs of softening in new vehicle sales with continued production shortages and rising interest rates. While optimism remains, we’re simply running out of time in 2022 to revert to higher levels, so we expect these predictions to continue to be revised towards where performance has been.

How did Mercer Capital do with some of our predictions? While we were correct on fewer incentives from the manufacturer and fewer models available with fewer features offered on those vehicles, we were incorrect in predicting a higher SAAR in 2022.

While some of these metrics remained strong, the emerging threats and the onset of a recession could trigger a reversal of fortune for the auto industry and the profitability of auto dealers sooner than most would have predicted at the start of the year.

At Mercer Capital, we follow the auto industry closely to stay current with trends in the marketplace. These give insight into the market that may exist for a private dealership which informs our valuation and litigation support engagements. To understand how the above themes may or may not impact your business, contact a professional at Mercer Capital to discuss your needs in confidence.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights