August 2023 SAAR

The August 2023 SAAR was 15.0 million units, down 4.5% from last month but 13.6% higher than August 2022’s figure. This month’s data holds true to the ongoing trend of considerable year-over-year improvements that have remained strong throughout the year. In fact, this month marks the thirteenth straight month of year-over-year improvements in the SAAR.

The magnitude of year-over-year improvements has been decreasing over the last several months. For example, the May 2023 and June 2023 SAARs saw 19.6% and 20.2% year-over-year improvements, respectively. Last month’s year-over-year improvement was slightly lower at 18.2%, and this month has come in at 13.6%. Narrowing year-over-year improvements were expected due to the context of the 2022 industry (outlined below), and we expect continued narrowing as the next several months play out.

To remind our readers of recent history, the SAAR reported three straight months below 13.3 million units during June, July, and August of 2022. Inventory balances started to improve during August, and sales volumes followed suit in September, sending the industry on a long-awaited path to recovery. With this context in mind, we expect to see a significant year-over-year increase in the SAAR for at least one more month, with subsequent improvements of a lesser magnitude over the next four or five months.

Unadjusted Sales Data

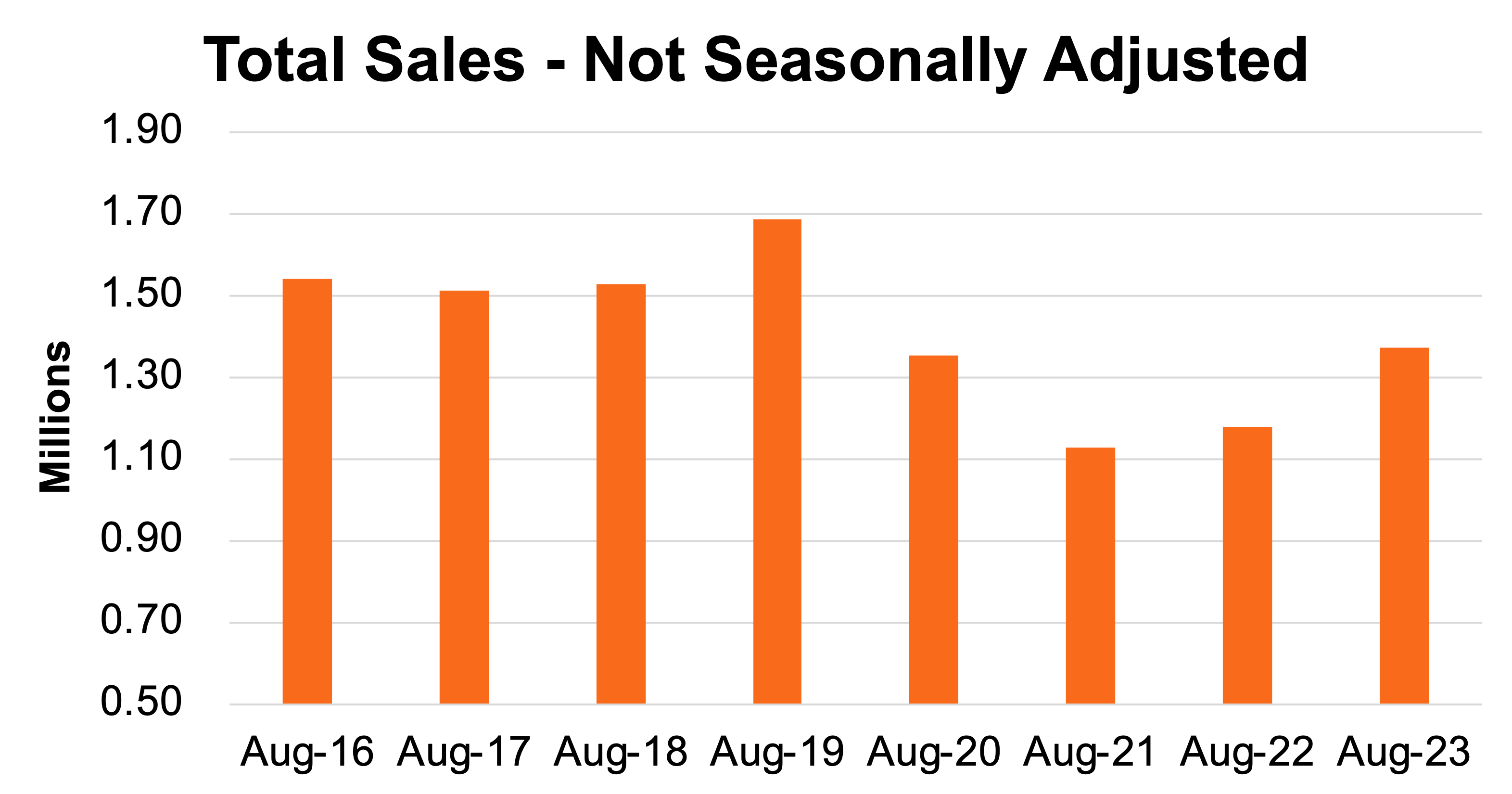

Take a look at the chart below that shows unadjusted sales volumes for the last eight Augusts:

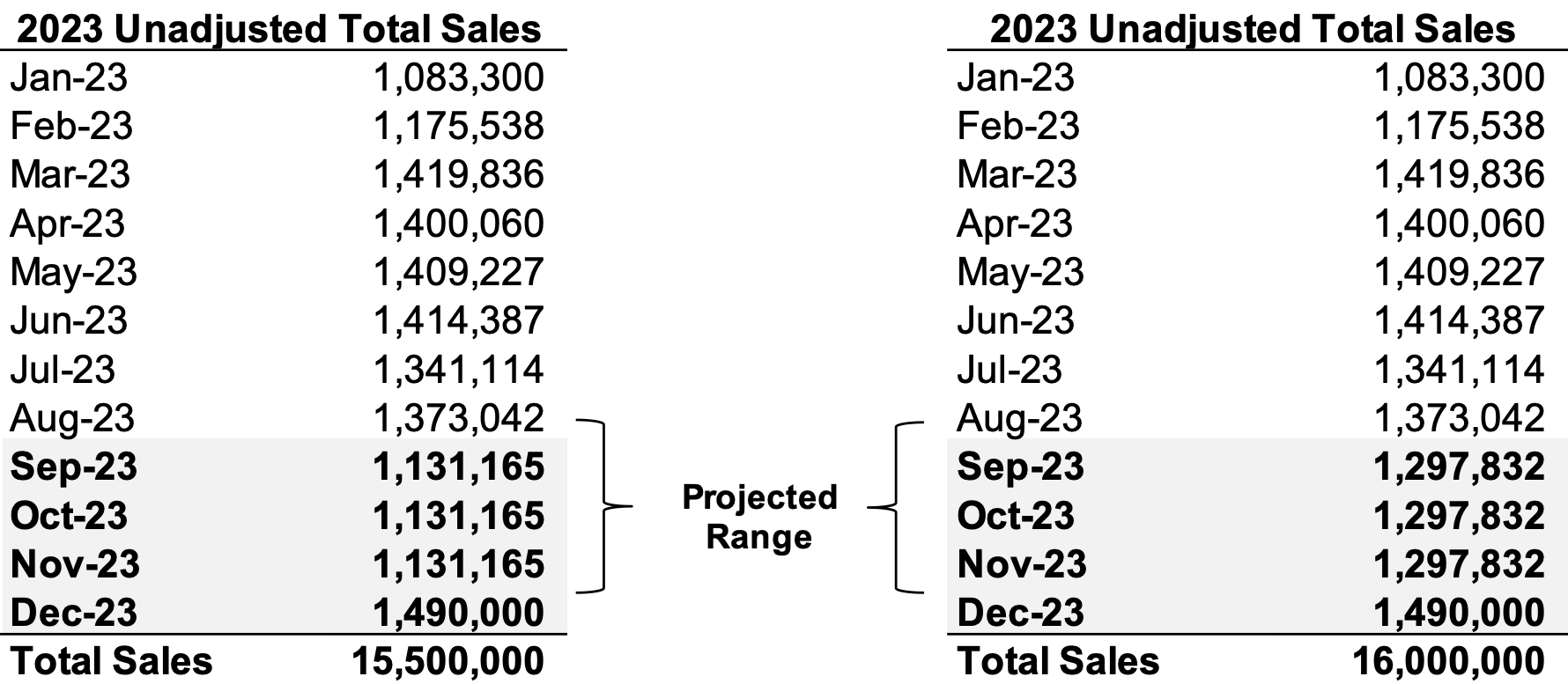

On an unadjusted basis, the industry sold 1.37 million units last month, marking the highest level of August sales since 2019. Within the context of total 2023 performance and outlined in last month’s blog, August falls in line with our “high-end” scenario of 16 million total units by the end of the year. See below for updated projections that would result in 2023 total sales of 15.5 – 16.0 million units.

December is typically the highest-selling month of the year and has not yet contributed to the 2023 total. Reported sales in December 2022 were 1.32 million units, but the last five Decembers have averaged 1.49 million units per month. The tables above indicate average unadjusted projected monthly sales for September to November if total sales reach 15.5 – 16.0 million units and December reverts to historical averages.

Inventory and Days’ Supply

According to NADA, new light vehicle inventory on the ground and in transit is expected to total 1.9 million units at the end of August 2023, roughly flat with the last few months’ reported figures. Consistency in inventory availability has been a very important factor in increased sales and falling transaction prices, as auto dealers and consumers alike have been able to act with more confidence in their inventory management and purchasing decisions, respectively.

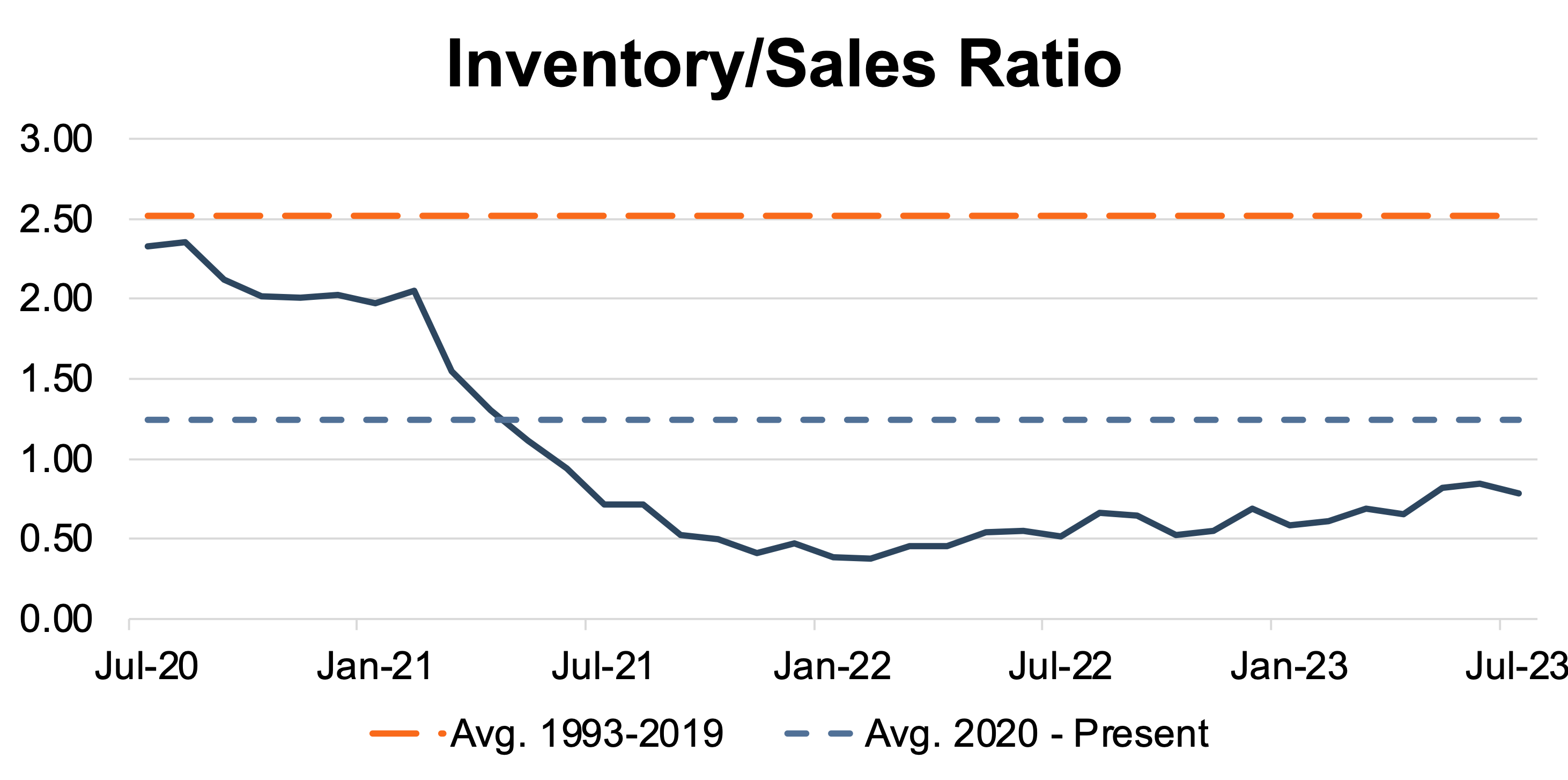

See the chart below for a look at the industry-wide inventory-to-sales ratio. While it is clear that production volumes are still improving, elevated sales volumes have pressured inventory balances over the last year due to 1.) pent-up demand from fleet customers and 2.) retail consumers on the margins waiting to purchase a vehicle. NADA reported that 15.1% of total sales were fleet sales in August, supporting the notion that pent-up demand is persisting. If the demand side of the equation meaningfully cools off sometime soon, we may see an industry inventory-to-sales ratio in excess of 1.0x.

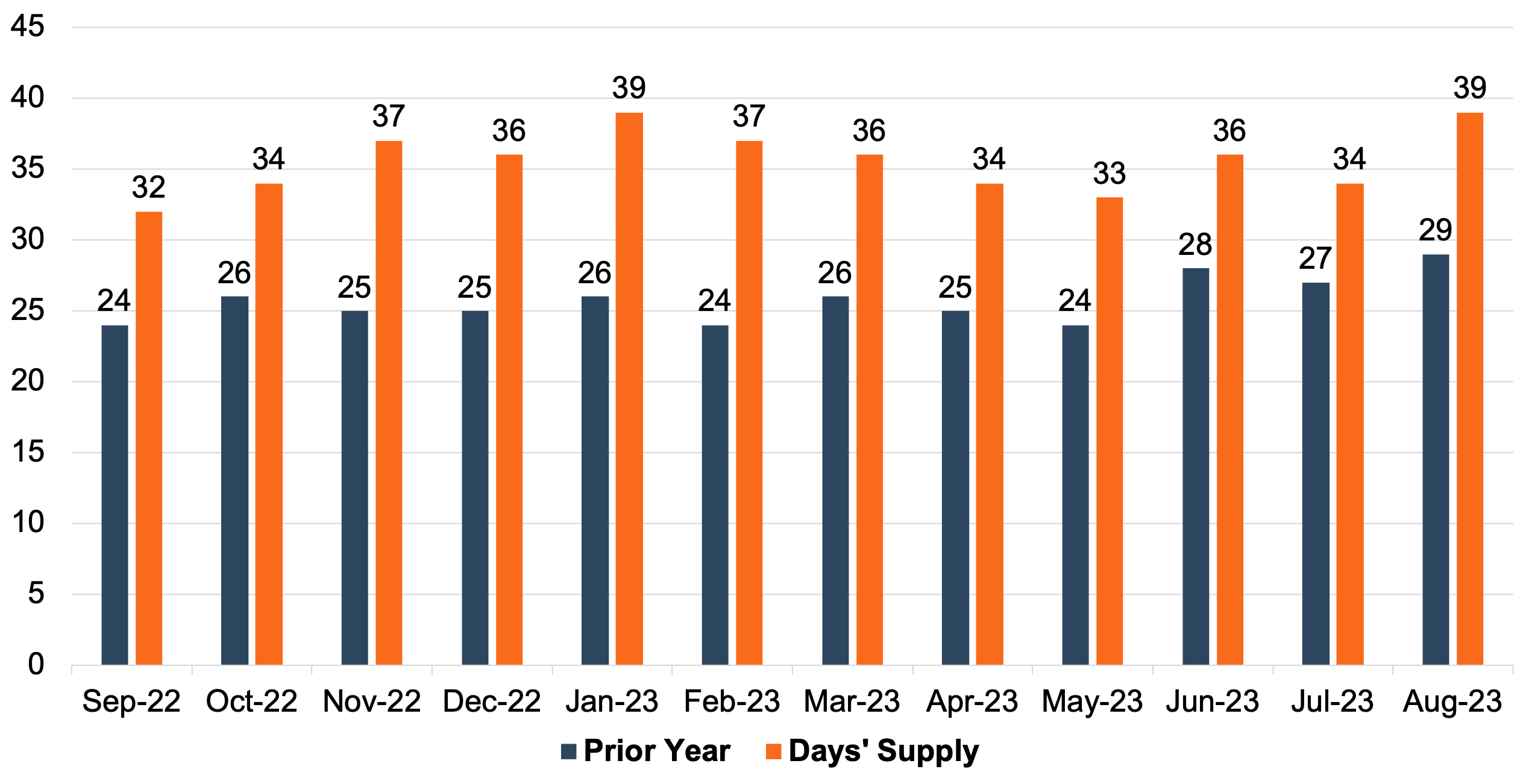

Another way to view the relationship between auto sales and inventory balances is through the Days’ Supply metric. See the chart below for a close look at Days’ Supply for the entire industry (per Wards Intelligence):

Transaction Prices

There has been a lag in the release of August 2023’s average transaction price data (see Cox Automotive for the release later this month), but expectations have remained consistent over the last several months. Namely, transaction prices, while still elevated, have continued to cool off and are expected to fall again modestly in August 2023.

Thomas King, president of data and analytics at J.D. Power, posited that “the decline [in the industry’s average transaction price] is mostly due to an increase in sales of smaller vehicle segments that have inherently lower transaction prices.”

During most of 2021 and the first half of 2022, restricted inventory inputs forced manufacturers to make hard decisions when deciding what models to prioritize. Once it was all said and done, trucks and SUVs were consumers’ most desired models, and OEMs decided to weigh these models more heavily in their production plans. As sedans and crossovers are finally catching up in production facilities worldwide, it makes sense that this relationship would negatively affect the average transaction price.

However, while increased supply across all models and a shifting vehicle mix are dragging down the average transaction price, persistent economy-wide inflation and a brewing United Auto Workers (“UAW”) strike are factors that could turn pricing momentum in the other direction. In particular, the UAW strike could grind production to a halt for General Motors, Stellantis, and Ford’s domestic production facilities. Stellantis appears to be preparing for the strike as Days’ Supply is highest among its brands compared to the rest of the industry.

Incentive Spending

According to J.D. Power, average incentive spending per unit in August is expected to reach $1,902, up from $953 in August 2022. Incentive spending as a percentage of the average MSRP is expected to increase to 4%, up 1.9 percentage points from August 2022. Average incentive spending per unit on trucks/SUVs in August is expected to be $1,971, up $831 from a year ago, while the average spending on cars is expected to be $1,627, up $638 from a year ago.

September 2023 Outlook

Mercer Capital’s outlook for the September 2023 SAAR continues to be optimistic. Industry supply chain conditions have improved but face new challenges like strikes and input pricing inflation. Sales volumes have continued to improve as dealers are seeing better inventory availability. However, with concerns of a recession looming, it will be important to monitor consumer activity, which may begin to cool off as affordability becomes an issue, as evidenced by falling transaction prices and rising incentives.

Mercer Capital provides business valuation and financial advisory services, and our auto team helps dealers, their partners, and family members understand the value of their business. Contact a member of the Mercer Capital auto dealer team today to learn more about the value of your dealership.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights