Valuation Implications of a 28% Corporate Tax Rate on Blue Sky Multiples

Will Dealerships Become Less Valuable if Tax Rates Rise?

2017 Tax Cuts and Jobs Act

To get an idea of how Blue Sky multiples might change with an increase in the corporate tax rate, the simplest way may be to look at what happened the last time the rate changed. Fortunately for this analysis, we don’t have to go back too far. In December 2017, former President Trump signed the Tax Cuts and Jobs Act (“TCJA”) into law. Shortly after his inauguration, President Trump indicated a goal of “15 to 20%” for the federal corporate tax rate, down from 35% at the time. Fast forward to September 2017, the Trump administration and congressional Republican leaders announced a tax framework that included a 20% federal corporate tax rate, which eventually settled at 21% when the bill was signed into law on December 22, 2017.

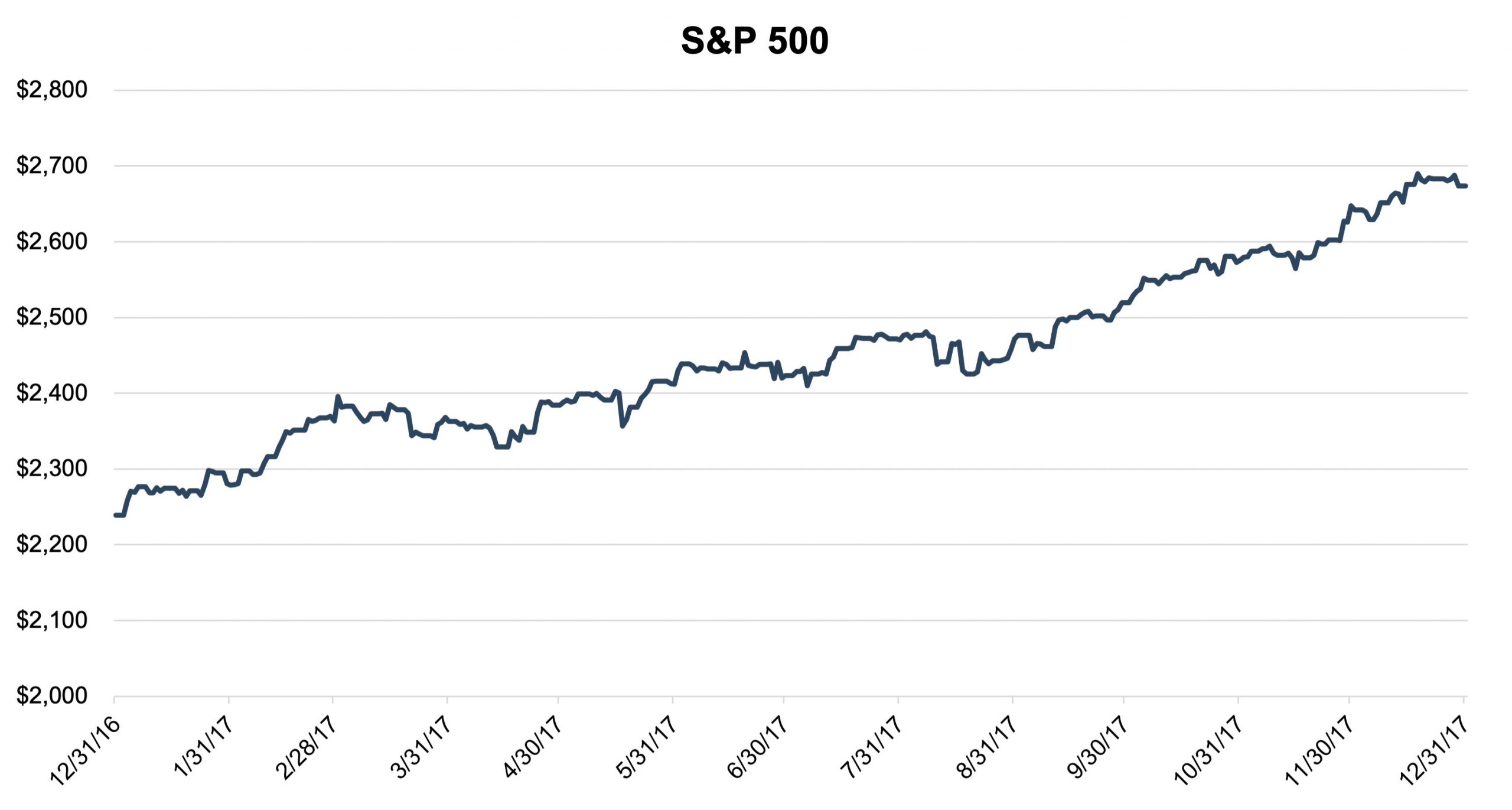

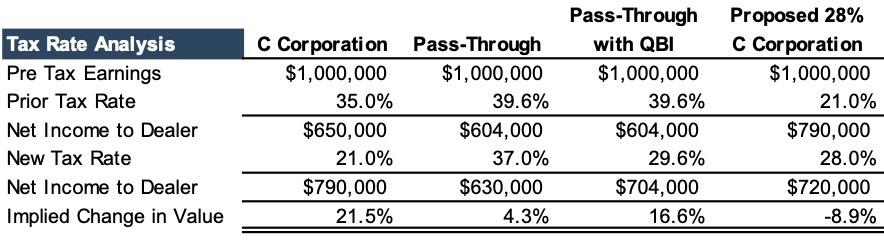

On a statutory basis, a dealer structured as a traditional C corporation making $1 million in pre-tax earnings went from net income of $650,000 to $790,000, or an increase in value of 21.5% assuming no change in the P/E multiple. While this generally comports with the returns of the S&P 500 in 2017 (which increased 19.4%), this increase happened gradually over time. While there are many other contributing factors, it is evident in the chart below that the market likely priced in any favorable tax changes gradually throughout the year.

Because the market generally trended upwards in 2017, it would be difficult to point to any one period of rapid increase related to optimism surrounding lower corporate taxes. However, because the market has historically trended upwards, it can be more difficult to attribute the rise to specific policies. While this paints with more broader strokes for the market, let’s consider Blue Sky multiples.

Blue Sky Multiples Before and After TCJA

While after-tax earnings likely rose for most dealers due to the tax law change, pre-tax profits by definition would not be impacted. Theoretically as noted above, a buyer should be willing to pay more for a higher return, so the value should increase if earnings go up. With the earnings stream utilized in Blue Sky multiples unchanged, an increase in value should be seen in higher multiples.

From Q3 2017 – Q1 2018, there were no changes in the range of multiples for any brands despite the material decrease in corporate tax rates. This begs the question: Why not?

If dealership values had increased by 21.5%, the average Blue Sky multiple would have increased from 4.85x in Q3 2017 to 5.89x in Q4 2017. This change also could have been more gradual throughout the year. However, multiples were largely unchanged.

From Q1 2017 to Q1 2018, only five brands saw a change in their Blue Sky multiples. Subaru multiples improved by one full turn of pre-tax profits in Q2 2017 (from 4x-5x to 5x-6x), while Toyota, Honda, Chevrolet, and Buick-GMC saw more modest increases in Q3 2017. From then until Q1 2018, there were no changes in the range of multiples for any brands despite this material decrease in corporate tax rates. This begs the question: Why not? Well, there are numerous potential reasons.

State of the Industry

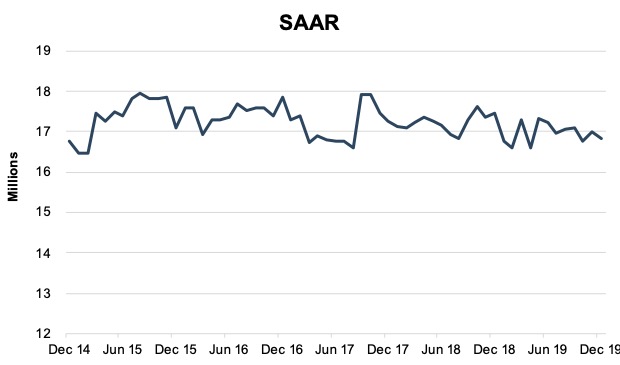

In the Q4 2017 Haig Report, private dealership values were judged to have fallen by an estimated 2.6% from the year-end 2016 due to increased expenses. Despite generally favorable macroeconomic conditions in the U.S., auto sales and gross profit per vehicle retailed were starting to trend down at the same time that dealership expenses are increasing, reducing profits. With years of annual volumes above 17 million, there were concerns about declines. While volumes in 2018 and 2019 were below the 2016 peak, they remained above 17 million. SAAR for 2015 through 2019 is shown in the below graph for perspective.

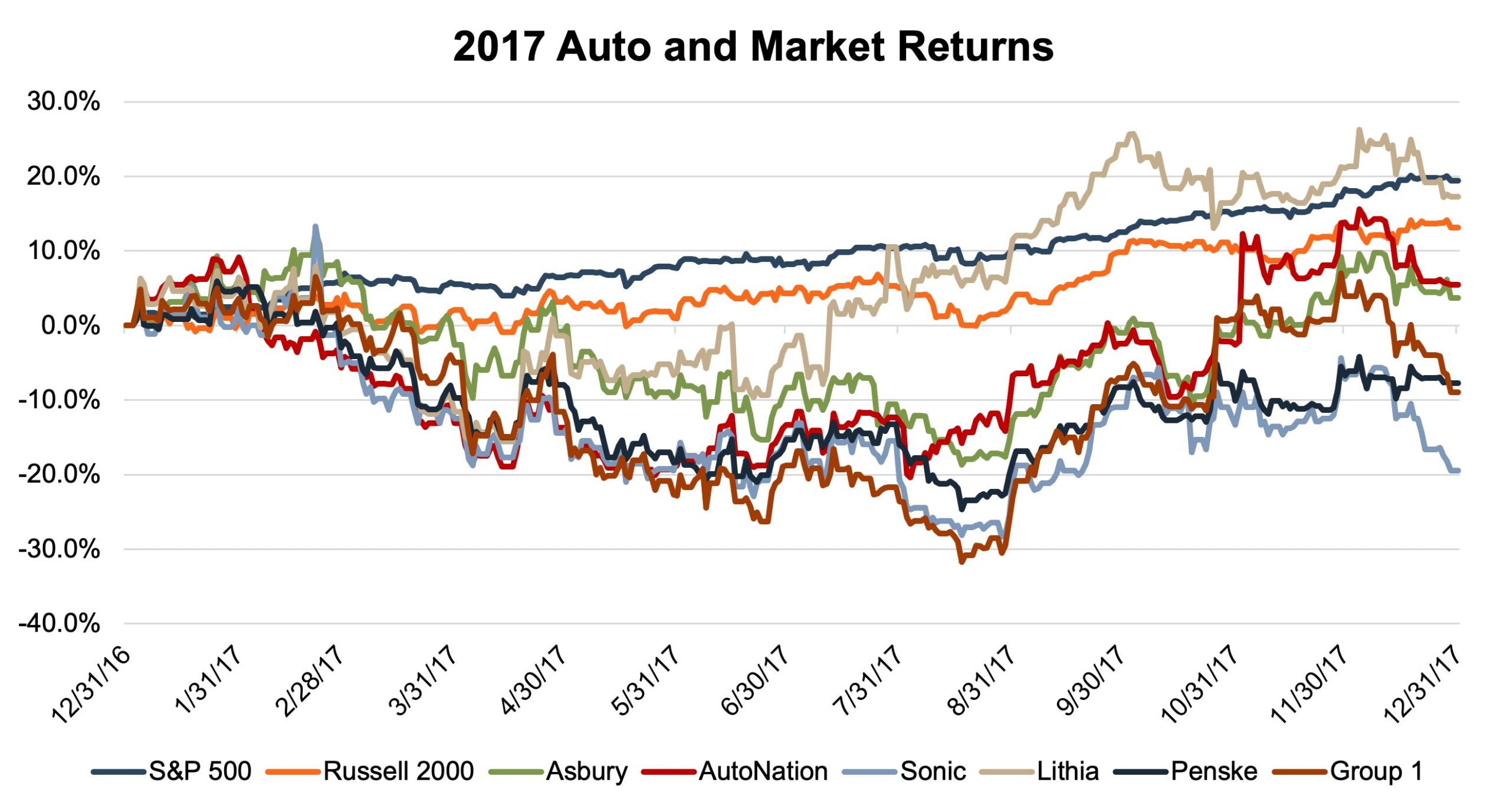

As the pandemic reminded us all, volumes do not directly correlate with profits. In order to gain a broader perspective of the auto dealer market conditions, we’ve considered the stock price returns of the S&P 500, the Russell 2000, and the publicly traded franchised dealers in 2017.

The S&P 500 paced the group with the aforementioned 19.4% return. Lithia was just behind at 17.3% as it continued to buy up dealerships which the market viewed favorably. The return on the Russell 2000 was 13.1%, well above all other auto dealer stock prices whose returns ranged from 5.5% (AutoNation) to negative 19.4% (Sonic). The trend was particularly bad through the end of August with all non-Lithia dealers down between 6.7% and 23.0%. SAAR followed this general trajectory and caught a nice bounce in September, which coupled with optimism over favorable tax treatment potentially aiding in the rebound.

Despite lower taxes increasing after-tax cash flows, it appears declining industry conditions offset gains, leading to minimal change in Blue Sky multiples

After the passage of the tax law and with some time to analyze any impacts, the Q1 2018 Haig Report noted positive and negative trends thusly:

Positive Trends: “This remarkable era in auto retailing continues. We have enjoyed many years of low interest rates, cheap gas, and rising employment. Consumer confidence remains near its 17-year high and household wealth has never been greater. It’s true that dealership profits (and values) peaked a couple of years ago, but they remain close to record levels. The much-predicted downturn in sales has not yet happened. Congress even gave dealers a nice boost by lowering taxes and walking back pressure from the CFPB.

Negative Trends: “While sales remain strong, there are some troubling vibrations coming from the disruptive influences of technology. Dealers continue to suffer from the degradation of gross profits due to the shift in pricing power from the retailer to the consumer thanks to various digital tools. And over the next five to ten years, electrification, ride sharing and autonomous vehicles loom as threats. Some well-respected industry leaders predict that the best days of auto retail are behind us, that profits will never return to current levels and that many dealerships will end up closing their doors.”

Despite lower taxes increasing after-tax cash flows, it appears declining industry conditions offset these gains, leading to minimal change in Blue Sky multiples. To take the analysis a step further, we consider the specific tax structures of privately held dealerships and transaction considerations, rather than comparing it solely to publicly traded companies which are required to be structured as C corporations.

Tax Structure of Largest Auto Groups

Blue Sky multiples are calculated on adjusted pre-tax profits. This enables comparison between dealerships subject to different income tax rates. Differences in total corporate income taxes paid are usually due to two reasons: state/local tax rates and ownership structure (C corporation vs pass-through). First, let’s address state/local tax rates. Language in the Haig report from editions before and after the tax law change note, “dealerships in states with no income tax usually bring premiums to dealerships in high tax states.” This means that for a given range, say 5x-6x, dealerships subject to lower taxes are more likely to receive a pre-tax multiple on the upper end of the range. While not all dealerships necessarily fit into this range, one can infer that local tax rate differences may not ultimately impact the multiple by more than one turn of pre-tax earnings.

Dealerships in states with no income tax usually bring premiums to dealerships in high tax states

Many dealers may also structure their companies to be taxed at individual rates (S corporation, LLC, etc.) instead of corporate rates (C corporation). The pass-through tax structure has been popular because it avoids “double taxation” when a dealer pays corporate income taxes on profits then taxes on distributions from net income to dealers after the payment of corporate taxes. For a pass-through dealer, their marginal tax rates only declined from 39.6% to 37.0%. While the initial tax framework proposed by Republicans included a maximum 25% rate on pass-throughs, the TCJA instead offered a 20% deduction for Qualified Business Income (“QBI”). For dealers in the top marginal income tax bracket, this could mean a pass-through rate as low as 29.6% (37% x [1-20%]). Implied increases in values are demonstrated below:

As noted above, Blue Sky multiples derived from private dealership transactions are applied to pre-tax earnings, enabling comparisons regardless of elected corporate structure. This is intuitive because a buyer is unlikely to be concerned with the corporate structure of the seller. While corporate taxes declined, many dealerships are structured in this way. Therefore, a negotiation between a buyer and seller is likely to balance favorable income tax treatment against other factors on pre-tax income. As discussed above, industry conditions were relatively stable if not modestly declining.

Anticipated Impact of Increasing Corporate Tax Rates

Under the Biden plan, a 28% corporate tax rate would decrease after-tax earnings for C corporations by 8.9% all else equal. However, as we saw after the TCJA, not all else is equal. The reverse may be occurring in 2021 with rising taxes being offset by more favorable industry conditions as many auto dealers finished 2020 with record profits despite a global pandemic.

In 2021, rising taxes may be offset by more favorable industry conditions

Heading into 2021, looming threats associated with scale continue to exist, though this is not exclusive to smaller dealers. With online-only used retailers attracting plenty of equity capital from the public markets, larger players in the industry are feeling the pressure to grow themselves. This levels the playing field as buyers are equally incentivized to grow as sellers might be to capitalize on high exit multiples, forgoing the need to make significant technological investments.

Conclusion

So, what does the TCJA tell us about the proposed increase in corporate tax rates under the Biden administration? The short answer is it depends. Buyers and sellers are likely more focused on determining the run-rate, or core earnings of dealerships after record profits in 2020 than what rate may or may not apply to them. Fear of rising taxes may motivate sellers to cash in, which would weigh on value if there’s excess supply of dealerships for buyers to choose from. In 2017, the opposite was likely true as bolt-on acquisitions became more costly as dealers were less motivated to cash out as more income fell to their bottom line. As we’ve demonstrated, an increasing federal corporate tax rate may impact some dealers, but for most that are structured as pass-through entities, changes in the top marginal tax bracket for individuals is more likely to impact dealer principals. And while the corporate income tax rate is important for the future earnings of a dealership, sellers are likely to be more concerned about the taxes they would need to pay after selling their business.

Mercer Capital provides business valuation and financial advisory services that consider the potential valuation implications of changes in legislation and how this impacts auto dealerships and their principals. We also help our dealer clients understand how their dealership may, or may not, fit within the published ranges of Blue Sky multiples. Contact a Mercer Capital professional today to learn more about the value of your dealership.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights