Don’t Turn a Blind Eye to Fixed Operations

A Look at the Importance and Stability of Fixed Operations

The phrase, “don’t turn a blind eye,” refers to the idea that one should not ignore something they know to be real and significant. The phrase is said to originate from an 1801 English naval battle – the Siege of Copenhagen – where two admirals disagreed over battle plans. Legend has it that the second admiral in charge, Horatio Nelson, was ordered to withdraw but pretended not to see the flagship signals of the ranking admiral because he put his looking glass up to his eye that had been blinded in an earlier battle.

As auto dealer headlines continue to be dominated by shortages of new and used inventory and record profitability, it’s easy to focus on the variable side of operations, including the sale of new and used vehicles. But, auto dealers and their trusted advisors should not turn a blind eye to the fixed operations of the dealership, which generally includes service, parts, and the body shop.

While fixed operations may not be grabbing any of the current headlines, auto dealers should remain focused on their importance and stability to the overall success and profitability of a dealership. In this blog post, we analyze the recent historical contribution of fixed operations to overall dealership metrics, analyze several key indicators of future performance, and explore several myths and the changing landscape of the service department and customer relationship.

Recent Historical Performance of Fixed Operations

Like all aspects and departments of an auto dealership, fixed operations or “fixed ops” have been impacted by COVID-19 and the initial lockdowns, plant shutdowns, chip shortages, and changing consumer behavior. Nonetheless, fixed operations have always provided a high margin portion of the business to an auto dealer while also connecting the customer to that particular dealership over the life of the existing vehicle and hopefully future vehicles to come.

To gain a historical and current perspective on the impact of fixed operations on the total dealership operations, we have analyzed the Dealership Financial Profiles for an Average Dealership historically published by NADA. Specifically, we have analyzed year-end data from 2019 and 2020, along with the most recently published data from October 2021. This time period provides some insight into the impact and trends caused by the pandemic and indicates signs of recovery.

In 2020, the average dealership had approximately $7.06 million in fixed ops sales, down 7.8% from the $7.65 million achieved in 2019. Through the first ten months of 2021, this figure was $6.41 million, which, if we annualize to twelve months, would be about $7.70 million, or just above 2019 levels. While this appears to be a full recovery, fixed operations pales compared to the performance dealers have achieved in variable operations as new and used vehicle sales, and margins have exploded despite/due to inventory shortages.

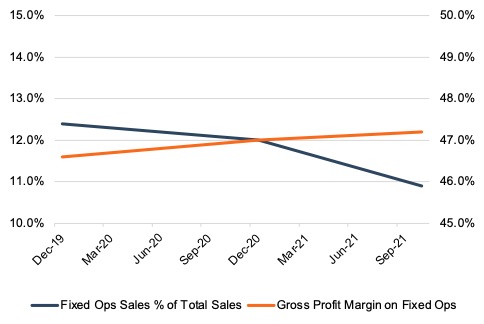

As seen in the graph below, the gross profit margin on fixed operations has steadily improved, from 46.6% of fixed operations sales in 2019 to 47.0% in 2020 and 47.2% in the first ten months of 2021. Over this same time period, fixed operations sales as a percentage of average total dealership sales have steadily declined from 12.4% to 12.0% to 10.9%.

Gross Profit Margin on Fixed Operations

Source: NADA

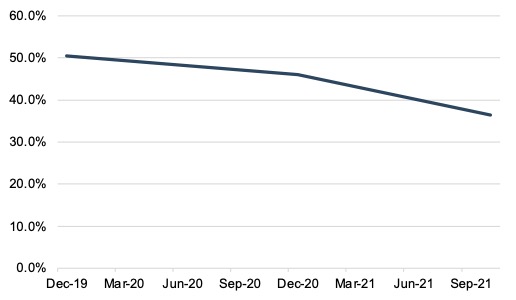

Despite modestly improving pricing power in fixed operations (orange line in the graph above), it appears to be declining modestly in importance to dealerships from a revenue standpoint (blue line). While fixed operations have always contributed less revenue to dealerships than variable operations (due to the high sticker price of vehicles), fixed operations have typically contributed a significant portion of total dealership gross profit. In 2019, fixed operations contributed 12.4% of sales but 50.5% of total dealership gross profit. This is because gross profit margins on new and used vehicles were 5.5% and 11.3%, respectively, compared to the previously noted 46.6% gross margin on fixed ops sales.

In 2020 and 2021, this historical norm has been flipped on its head. In 2020, fixed operations only contributed 46.1% of total dealership gross profit. Through the first ten months of 2021, fixed ops contribution to total gross profit declined all the way to 36.5%.

Fixed Ops Contribution to Total Gross Profit

Source:NADA

Two of the primary causes of these trends are the huge increase in margins from variable operations and the lack of vehicle miles driven, which we have covered in a prior blog and will re-examine later in this blog. What may not be clear from these figures: fixed operations provide consistent, high margins to the dealership as evidenced by the departmental gross profit margin steadily, albeit modestly improving over this period. While it may not get all the headlines of variable operations, fixed operations continue to support dealerships and will continue to do so once vehicle margins normalize.

Key Indicators of Future Performance

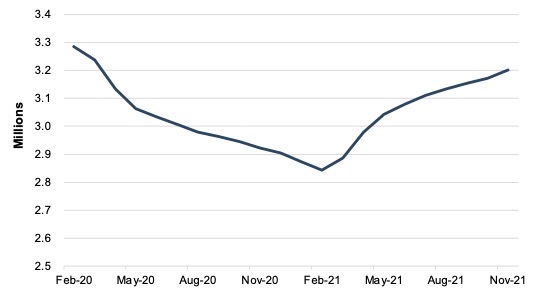

Vehicle miles traveled (“VMT”) is defined as the number of miles driven and has been tracked since 1971. The rolling 12-month average identifies the current run rate of this metric at any given point in time. An increase in VMT indicates more cars are on the road logging more miles, which eventually will require parts and service and eventually purchase a new vehicle either from new or used vehicle inventory. The rolling 12-month VMT drastically reduced at the start and during the early months of the pandemic due to temporary lockdowns and staying at home. In fact, the VMT dropped below 3.2 trillion miles in March 2020, and the rolling 12-month VMT declined every month before finally starting to rebound in March 2021.

VMT has enjoyed a gradual monthly increase and returned above the 3.2 trillion figure for the first time in November 2021. It will be interesting to monitor whether the rolling 12-month VMT will continue to rise each month, just as it did pre-pandemic. The metric and the graph below indicate that consumers are traveling by car at rates not seen since before the pandemic.

Moving 12-Month Total Vehicle Miles Traveled

Source: FRED Economic Data

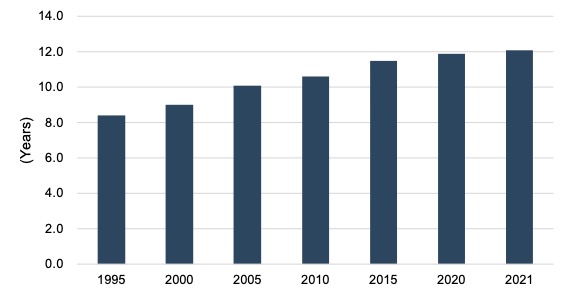

A second metric that serves as a key indicator for the future performance of fixed operations is the average age of a car on the road in the United States. Like VMT, as the average age of a car increases, the need for service and eventually the purchase of a new vehicle alternative increases. According to IHS Markit and the Bureau of Transportation Statistics, the average age of cars on the road has generally increased from 1995 until 2021. Specifically, the average age of a car on the road has climbed from 8.4 years to 12.1 years.

Average Age of Cars on the Road – U.S.

Source: IHS Markit and Bureau of Transportation Statistics

Coupled with the actual age, the average mileage of these cars is much higher than in prior years. While it wasn’t that uncommon for cars to have over 100,000 miles in years past, now many cars in service have 200,000 miles or greater. Based on a survey performed by iSeeCars, nearly 16% of Toyota Land Cruisers on the road have at least 200,000 miles on them.

Fixed Operations Myths and Changing landscape

Myth 1: Auto Dealers make more money in Variable Operations than Fixed Operations

In order to assess the validity of this statement, we must clarify a few parameters. Variable operations have always generated more gross or raw sales dollars than fixed operations for most dealers. The adage of making money usually centers around the profitability or margins provided by certain segments of the total auto dealership. Prior to the conditions of the last twelve months caused by inventory and chip shortages, fixed operations have provided a greater, or at least equal, contribution to total gross margin for a dealership as detailed earlier in the blog. Further, the specific gross margin on fixed operation sales has always been greater than the gross margins on new and used vehicles. While the transitory conditions have shifted more of the overall contribution of total gross margin to variable operations, fixed operations remain a vital, high-margin component of dealership operations.

Myth 2: There is not much value in a service customer to my Dealership

As we just examined, the service customer is certainly valuable to a dealership if merely analyzed for the financial impact of their existing service requirements. In reality, fixed operations allow for ongoing touchpoints between a dealership and a customer. Touchpoints have been a common term used by executives of publicly-traded auto dealerships. Not only does that customer relationship have value during the life of the current vehicle, but the hope is that there will be future loyalty to that dealership in the decision to purchase the next vehicle. For these reasons, dealers should improve the overall customer experience, including efficiency and technology.

2 out of every 3 service visits do not occur at a dealership.

We have demonstrated both the financial and behavioral benefits of fixed operations to the dealership. Despite these gains, dealers have ample opportunities to improve the focus and market share of this element of the dealership. According to a 2021 survey conducted by Cox Automotive, only 34% of consumers prefer dealership service centers to general repair shops. While this figure represents a 1% gain in market share by auto dealers over the last three years of the survey, it still leaves 2 out of every 3 service visits that do not occur at a dealership. These overall figures mask the early years of a new vehicle’s lifespan, where most service visits that fall underneath the warranty almost certainly occur at the dealership where the vehicle was purchased.

The survey cites several reasons why consumers choose general service centers over dealership service departments: costs and location. Dealers must fight against the perception that dealership service costs are overpriced compared to similar services at a general service center. Additionally, consumers choose service centers closer to home than the original dealership. As we’ve discussed in prior posts, the future of the auto retailing landscape is changing. If fewer vehicles are kept on lots for the long-term, this may enable dealers to invest in real estate that is more proximate to consumers, which could increase market share for fixed operations.

An additional component for the service department to monitor in the future will be the ability to service electric vehicles.

An additional component for the service department to monitor in the future will be the ability to service electric vehicles (EVs). In last week’s blog, we discussed the future of auto dealerships and the impact of EVs on shaping the future of automotive retail. The Cox Automotive Survey cited that 66% of their current survey responders offer some level of EV service work. Additionally, 30% of responders plan to service EVs within the next year.

Conclusion

Fixed operations have always provided stable, and high margin returns to an auto dealership’s overall profitability and success. Particularly for single-point dealers with only one brand, dealers can see lagging sales if product offerings from the OEM don’t engage consumers, oftentimes for numerous years. However, fixed operations can get these dealers through the ebbs and flows of the business or product cycle.

While recent trends have shifted the contribution and focus to variable operations, fixed operations continue to benefit dealers in the form of financial performance and bolster the customer relationship and loyalty to the dealership. Auto dealers must stay focused and adapt to these trends regarding their fixed operations despite persisting obstacles of consumer behavior and retail preferences. While 2022 may result in declining trends to the high wave of variable operations over the last twelve months, the future looks bright for the fixed operations of auto dealers. With fewer vehicles being put on the road than in years past, the average age of vehicles should increase and lead to more service work. Now it’s up to the dealers to pull in their share of these opportunities.

Mercer Capital provides business valuation and financial advisory services, and our auto team helps dealers, their partners, and family members understand the value of their business. Contact a member of the Mercer Capital auto dealer team today to learn more about the value of your dealership.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights