February 2022 SAAR

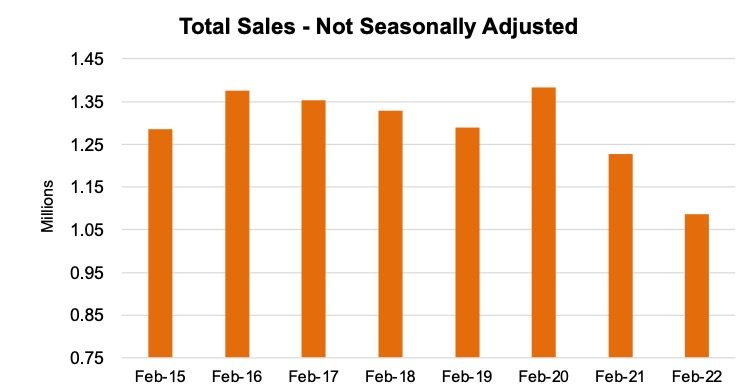

The February SAAR was 14.1 million units, down 6.4% from last month and 11.7% below this time last year. After last month’s SAAR of 15.0 million, the 2022 Q1 SAAR is expected to be the highest since Q2 2021 when the vehicle inventory shortage started to fully take hold. While the seasonally adjusted annual rate has certainly improved from the lows of late 2021, raw sales numbers tell a different story. Raw sales volumes in February were much lower than in previous years, as shown in the chart below. Seasonal adjustments in the early months of the year typically account for lower expectations in those months after lofty sales expectations in December, explaining the discrepancy between raw sales and the SAAR metric. Unadjusted figures show just how constrained inventories are.

Source: Bureau of Economic Analysis

In February, the new vehicles that were available to sell continued to fly off the lot. According to J.D. Power, the average time a new vehicle sat on dealer’s lots was 20 days, down from 54 a year ago but up from the record low of 17 days in December 2021. In response to this persistently high demand, OEMs are expected to reduce incentive spending even more in February to a per unit average of $1,246. To give some perspective, when shown as a percentage of MSRP, incentive spending is at an all time low of just 2.8%. Average transaction prices on new vehicles are expected to reach $44,460 this month, an all-time February record and an increase of 18.5% from a year ago.

Used vehicles continued to appreciate throughout February. While the intrinsic value of these vehicles might be unchanged or lower than months prior, constricted inventories continue to prop up price increases. According to J.D. Power, the average amount of trade-in equity that consumers were able to cash in on was up 93% compared to this time last year.

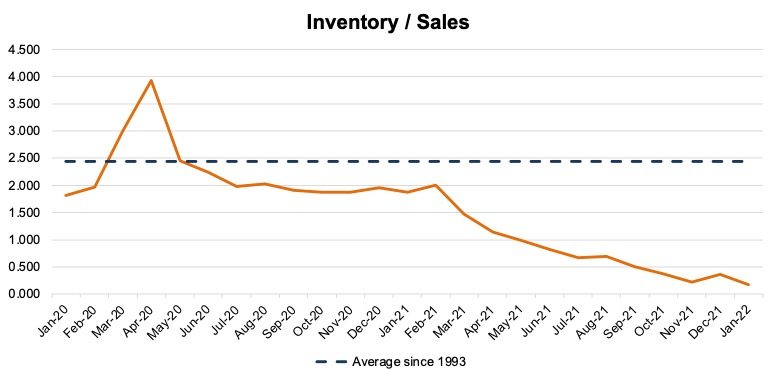

Source: Bureau of Economic Analysis

Coming as no surprise to dealers, new and used vehicle inventories remained scarce over the last month. The industry’s inventory to sales ratio was 0.171 in February, the lowest recorded value since the Bureau of Economic Analysis started tracking the metric in 1993. Inventory shortages have been present for almost a year now, and the supply chain issues that have perpetuated the shortage are here to stay until 2023 at the earliest. For more discussion on production issues, check out our January SAAR blog.

Parts and Service Outlook – Manufacturers, Competitors, and Trends

Auto dealerships have several sources of revenue, including sales of new and used vehicles, financing revenue from internal F&I departments, and parts and service revenue from on-site vehicle repairs. While all of these revenue streams are essential to a successful dealership, the margin structures of each department fundamentally differ. Most important for this blog, parts and service departments have the healthiest margins at an auto dealership, making these departments essential to profitability.

Higher fixed operations margins combined with increasingly aged vehicle populations have made parts and service departments more and more important over the last year and into the early months of 2022. Check out our recent blog for an in-depth look into the importance of fixed operations for your dealership. In this blog, we seek to provide an update on the auto parts industry, including manufacturers, competitors, and expected ramifications on dealers’ fixed operations.

Raw material increases and rising labor costs have soared for parts manufacturers around the country, leaving many operators asking themselves how they will offset increasing costs without getting price relief from OEMs.

Auto Parts Manufacturers – There are Always Losers

Lately, auto parts supply chains have been the target of headlines. While most of the discussions in our weekly blogs have focused on supply chain disruptions’ impact on the production of new vehicles, these same issues also apply to individual parts. Namely, auto parts manufacturers have been experiencing cost issues over the last year. They must feel like they are getting left out of one of the most profitable periods in the auto industry’s history.

Raw material increases and rising labor costs have soared for parts manufacturers around the country, leaving many operators asking themselves how they will offset increasing costs without getting price relief from OEMs. This relief has not materialized due to the contract structure that the industry has in place, as explained in further detail below.

Contractual agreements between OEMs and parts manufacturers set prices for the entire length of a vehicle’s production cycle and are difficult to renegotiate without both parties’ goals aligning. In the past, OEMs have not always benefitted from the fixed nature of these contracts and are now hesitant to renegotiate terms, especially when they are on the winning end of the deal. General Motors President, Mark Ruess, recently said that “passing things through is not the way to create value for customers.” While this may be true, the statement would also make sense if dealers and OEMs replaced customers.

Auto Parts Retailers – Direct Competition

Auto dealers are obligated to purchase parts for their service departments directly from OEMs. This relationship ensures that standardized replacement parts are offered to consumers and that OEMs can control the prices paid for these parts. In this framework, however, auto parts retailers like O’Reilly Auto Parts and AutoZone become direct competitors of auto dealers’ parts and service departments. The key question is: “Can these retailers get generic replacement parts cheaper than OEMs?” and “Can auto parts retailers effectively siphon off market share from parts and service departments?”

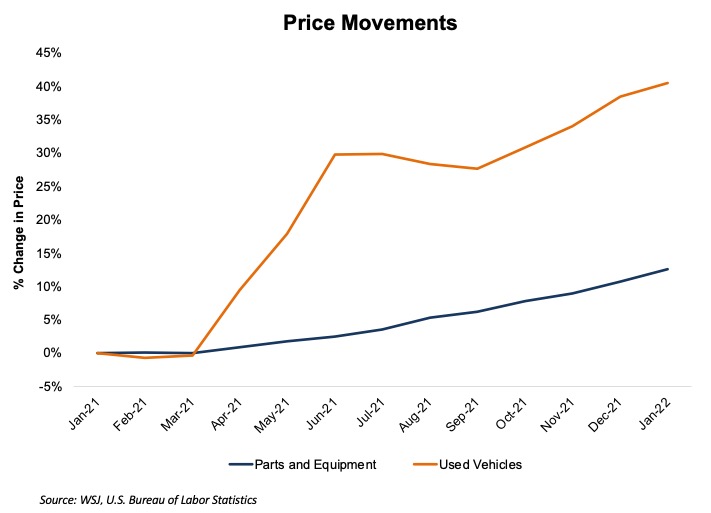

Auto parts are getting pricier, and demand for those parts is increasing, but well below the rate of vehicle prices themselves. As shown in the chart below, motor vehicle parts and equipment were 12.6% more expensive in January compared to a year earlier, while used-car prices increased 40.5% in that same time frame.

With consumer demand for parts and services high, auto parts retailers have been able to capture success. For example, in 2021, Advance Auto Parts increased its operating margin for the fourth consecutive year. Likewise, O’Reilly Auto Parts and AutoZone also experienced margin growth.

As 2022 gets into full swing, parts and service departments as well as auto parts retailers are both expected to get bigger slices of the growing auto industry pie. When it comes to your dealership’s parts and service department, it is unlikely that future competition between auto parts retailers and parts and service departments reaches the point where significant market share is at stake. However, further margin improvement is expected across the board as high auto prices keep existing vehicles on the road for longer, requiring more replacement parts with favorable margins priced in.

As 2022 gets into full swing, parts and service departments as well as auto parts retailers are both expected to get bigger slices of the growing auto industry pie.

Trends – Expectations in 2022

Like new and used vehicle departments, auto dealers’ parts and service departments are poised to thrive in 2022. Increased mileage on an aging vehicle population is expected to keep the demand for auto parts high and dealerships fixed operations are expected to remain strong enough to prevent lost market share to retailers. Increased automation, digitization, and electrification may represent a tailwind as professionals are more likely to handle increasingly difficult repairs. Also, margins should remain healthy as parts manufacturers struggle to enforce desired price increases.

On the other hand, some factors could be a drag on parts and service departments’ success over the next year. For example, increased vehicle leasing could encourage consumers to put off repairs on cars and trucks that they do not personally own. More reliable models also tend to need less work overtime, as procedures like oil changes happen less often. Electric vehicles, a growing segment, raise issues for dealerships in the short and long term as dealerships are experiencing a shortage of qualified technicians and equipment to conduct repairs on these types of vehicles.

March 2022 Outlook

Mercer Capital’s outlook for the March 2022 SAAR is pessimistic. January and February are the two months that require the largest seasonal adjustment to the SAAR metric, hiding low volumes behind low expectations that accompany any year’s first two months. Vehicle sales in March are typically higher than January and February, meaning that continued record low inventory and sales volumes are likely to rear their head in next month’s seasonally adjusted annual rate.

Mercer Capital provides business valuation and financial advisory services, and our auto team helps dealers, their partners, and family members understand the value of their business. Contact a member of the Mercer Capital auto dealer team today to learn more about the value of your dealership.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights