M&A, Reinvesting in Core Operations, or Paying Dividends

How Public and Private Dealerships Should Think About Allocating Capital Amidst Excess Liquidity

Over the past year or so, many auto dealers “outperformed” particularly as inventory shortages have raised margins on new and used vehicles in 2021. Additionally, cost cutting initiatives have dealerships running more efficiently, leading to record profitability. The question now comes for public and private auto dealerships alike: what do I do with this excess liquidity?

In last week’s blog, we looked at second quarter earnings calls from public franchised auto dealers. Several themes were present in these calls, one of which was the movement toward share repurchases in several firms’ capital allocation approach over the quarter. Many CEOs implied that high multiples and frenzied activity in the M&A market was a determinant in the decision to repurchase shares.

In this post, we consider what options are available to both public and private dealers. We look at what decisions the publics are making, and what that could mean for private dealers.

Capital Allocation Options

Auto dealers, and many other businesses more broadly, have numerous options when it comes to allocating capital, including:

- Reinvest in the business

- Expand organically (including adding rooftops to current locations or adding new locations)

- Acquire other dealerships/companies to increase revenue and earnings

- Return capital to providers of capital

- Debt repayments

- Dividends

- Share repurchases

Reinvesting in the Business

During the depths of the pandemic, M&A activity plummeted as significant uncertainty created a chasm between what buyers were willing to pay and what sellers were willing to sell for. As the operating environment stabilized and ultimately improved, deal activity picked up considerably. For the public auto dealers and larger private auto groups, acquisitions have been a clear way to reinvest in automotive retail. However, if recent earnings calls are any indication, this activity may begin too slow as sellers seek peak multiples on peak earnings, something we’ve discussed as unlikely to be palatable for acquirers for obvious reasons.

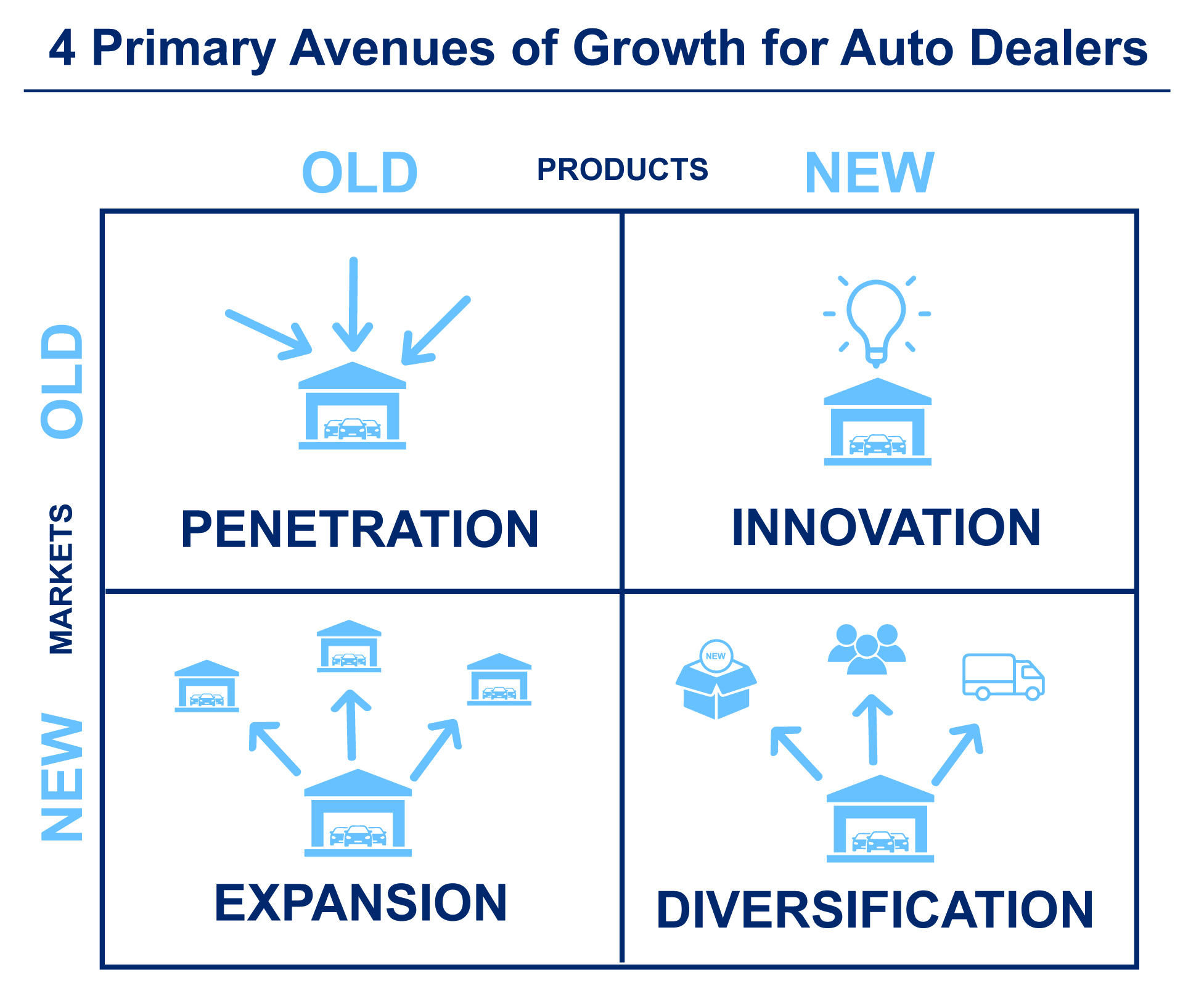

Outside of M&A, options for growth or reinvesting in the business may be limited particularly for private auto dealerships with only a few stores/rooftops. Auto dealers, like other retail businesses have four primary avenues for growth:

- Penetration (same product, same markets: increase frequency of trips or size of transactions to get an increased share of discretionary spending). Auto dealers can focus advertising spend to seek to capture more market share, particularly on fixed operations side where there are more regular interactions with consumers.

- Expansion (same product, new customers: adding new store locations in different markets to get new customers with current product offerings). Auto dealers can look to open points in adjacent markets. This can also include investing in the Company’s digital sales strategy, if we consider the digital ether as another “market” itself even if the dealership location doesn’t change.

- Innovation (new product, same customers: to offer in their existing footprint or additional sales channels). This can be somewhat limited for auto dealers as OEMs exert control over what vehicles are produced. However, dealer principals can improve their product offering by adding new rooftops, whether connected to their existing footprint, or nearby. There are also opportunities to introduce or refine the suite of F&I products offered to consumers.

- Diversification (new product, new customers: companies can seek to vertically integrate their supply chain or enter adjacent/new lines of business in order to diversify both their product offerings and customer base). Auto dealers aren’t able to vertically integrate as they are dependent on their OEM. However, entering adjacent industries that may have synergies is still possible, whether that be a heavy truck dealership, powersports dealership, or business interest entirely.

OEMs have significant power when it comes to awarding new points, which can limit Expansion. OEMs are also in charge of product innovation (what new models will be available), and OEMs and competitive market forces can leave relatively little wiggle room on vehicle pricing (part of penetration). Even capital expenditure decisions can be influenced by imaging requirements.

Dealer principals seeking growth are likely to look at adding rooftops or new locations, increasing market share, or adding new business lines. However, efficient allocators of capital seek to hit certain return thresholds. Absent attractive prospects, it may be wise to instead return capital to its providers.

Returning Capital to Debt Providers and Shareholders

Industries have been impacted by the pandemic in various ways. While some saw material declines in activity, others have performed greater than they did in 2019, which has been the case for many auto dealerships. Companies that received PPP loans are likely to have even more liquidity, which has caused business owners to contemplate what to do with the funds once they’ve been forgiven. Many have chosen to pay down debt, reducing ongoing interest costs and helping the owners of more heavily indebted companies to sleep better at night.

However, since inventory is financed by floor-plan debt and many auto dealers opt to hold the real estate in a separate entity, many do not carry material third party debt related to the core operations of the auto dealership. That leaves two options: paying dividends/distributions or share repurchases.

Private companies are much more likely to be paying distributions as there is either not an active market for their shares, or those holding minority positions in the company are not interested in selling. There’s been much talk about restrictions on share buybacks in industries that received considerable stimulus (like airlines). Since executives of the auto dealers have begun buying back shares instead of splurging on what they view as expensive M&A, we give some thoughts on stock buybacks below.

Stock Buybacks

For public companies, management teams may elect to buy back shares for a number of reasons. First, they likely will not buy back shares if they think the market is overvaluing their stock. As a corollary, buying back shares can serve to raise the stock price as it provides a signal to the market that they believe the stock is undervalued. Signaling is important in the presence of asymmetric information, which exists when corporate insiders have access to better information about the company’s prospects than outside investors.

While the company may not receive any direct benefit from an increase in the stock price (no cash received), this can lower the cost of capital for the company. If the company takes on debt to repurchase shares, this shifts the weighted average cost of capital more towards debt than equity, which can lower the cost of capital if it helps achieve a more optimal capital structure. So long as the debt does not become burdensome to the point it leads to higher interest rates or increases the equity discount rate, this can be advantageous.

Fundamentally, share buybacks are another form of distributing capital to remaining shareholders. While some investors pick companies for dividends, many investors, particularly in recent years, are investing for long-term capital appreciation. Share buybacks is a tax-advantaged way to return capital to shareholders that does not trigger dividend taxes. Instead, a company that elects to buy back shares instead of paying dividends would be expected to see higher levels of share price appreciation, and capital gains taxes are deferred until the investor decides to sell their shares.

Conclusion

At Mercer Capital, we follow the auto industry closely in order to stay current with trends in the marketplace. These trends give insight to the market that may exist for a private dealership which informs our valuation and litigation support engagements. To understand how the above themes may or may not impact your business, contact a professional at Mercer Capital to discuss your needs in confidence.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights