Q2 2021 Earnings Calls

Public Auto Dealers Weigh Record Profits, Days’ Supply, and Capital Allocation

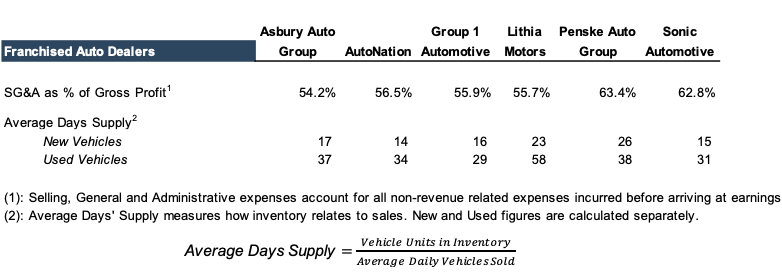

Second quarter earnings calls across the group of public auto dealers began with similar themes: record profits and earnings, record Gross Profits Per Unit (GPU) on new and used vehicles, and tightening inventory conditions. Additionally, the public franchised dealers continue to post large scale improvements in SG&A expense as a percentage of gross profit.

Executives revisited the reductions in personnel expense and their sustainability as GPUs are expected to decline at some point in the future. In a previous blog post, we discussed the prevailing industry conditions in inventory as reflected in the average days’ supply of new and used vehicles. The table below displays SG&A expense as a percentage of gross profit and the average days’ supply for the public auto companies for the second quarter:

Click here to expand the image above

The trends reported by the public franchised dealers mirror those of the industry as a whole: continued tightening on the new vehicle side, but improvements on used vehicles. Executives offered their predictions for how the OEMs and the industry might evolve to supplying new vehicles once plant production and the microchip crisis normalize. Executives also discussed the ability to leverage their dealership platforms to source used vehicles from several sources including trade-ins, lease returns and campaigns such as “We’ll Buy Your Car” by AutoNation. As a result, the public franchised dealers are less reliant on auctions for used vehicle sourcing and are seeing some improvement in their used vehicle counts.

Last week’s blog examined the investment thesis and results of used-only public retailers such as CarMax, Carvana, Shift and Vroom. With record profits and a red hot M&A market, public executives discussed the opportunities for capital allocation and how they are evaluating and prioritizing the best fit for their companies. Three of the public companies in particular, AutoNation, Sonic and Penske, have chosen to invest in their used vehicle supercenter locations branded as AutoNation USA, EchoPark, and CarShop, respectively.

Sonic provided some insight into the overall strategy of its used-only retail locations in its second quarter investor presentation. While front-end GPUs are expected to be lower (and sometimes negative) at the EchoPark locations, executives expect superior returns to be driven by the increased F&I GPU and overall volume of transactions at these platforms, compared to their franchised dealerships. These investments and strategies combined with other omnichannel investments by all of the public companies are in an attempt to capture the overall trend of an online retail experience.

A deeper dive into some of the themes listed above is provided below, including remarks from management, related to expectations moving forward.

Theme 1: The public companies continue to post improvements in SG&A as a percentage of Gross Profits driven by both sides of the equation: decreased expenses and record gross profits. While gross margins are universally expected to decline at some point, the jury is out on sustainability of cost reductions?

- “Our strong performance continues to be driven by strict cost discipline, leverage of our digital capabilities and robust vehicle margins. […] overhead decreased by 760 basis points, compensation decreased by 380 basis points, and advertising decreased by 30 basis points on a year-over-year basis […] I think for this year we will be in around the 60% range […] over 90% [of the increase in SG&A] is coming through variable cost. We are doing a very good job of keeping the fixed costs fixed, with strong discipline and leveraging the digital tools that we have”

– Joe Lower, CFO, AutoNation - “Same store SG&A to gross profit was 56.4% in the quarter, an improvement of 1,440 basis points over 2019. While we expect SG&A to gross profit to normalize [as] new vehicle supply and gross margins bounce back to historical levels […] we continue to benefit from the permanent headcount reductions of almost 20% or almost 300 basis points of SG&A and other efficiency measures implemented last year.”

– Christopher Holzshu, COO of Lithia Motors - “Obviously if growth comes down, that impacts SG&A…we’ve taken 11.5% of our workforce out […] we’re finding out we’ve got better productivity. Our mechanics are all over 120%. We see sales now per unit for a sales associate going from 9% to maybe 12% or 13%.”

– Roger Penske, CEO Penske Automotive Group - “If you look at our productivity on our sales associates […] we used to sell 12 units per month […] now we’re running 18,19. […] the other one [cost saving] is centralization of advertising […] we’re spending a lot less on advertising, and it’s even more effective.”

– Heath Byrd Chief Financial Officer, Sonic Automotive

Theme 2: Public executives boast of continued improvements in their omnichannel/digital platforms displaying that customer behaviors justify the infrastructure costs from these platforms. Advancements are illustrated in unique number of visitors, online transactions, and increased use of DocuSign and other electronic forms of signature software. Digital channels also allow the public companies to expand their footprint.

- “Our customers continue to vote yes on Acceleride […] we continued our upward trajectory in the second quarter by selling a record 5,600 vehicles through Acceleride, more than double the prior year. […] when incorporating all steps of the sales process, nearly 30% of our customers are using Acceleride. […] there’s opportunity to leverage Acceleride to expand our used vehicle business through our existing footprint […] in this quarter, we acquired almost 4,000 units through Acceleride […] and that was in a lot of markets that we’re not in today.”

– Darryl Kenningham, President of US and Brazilian Operations, Group 1 Automotive - “Driveway generated over 350,000 monthly unique visitors in June. Driveway eclipsed the 500-unit milestone with 550 transactions in June […] 98% of our Driveway customers during our second quarter were incremental and have never done business with Lithia or Driveway before […] we can now market and deliver our 57,000 vehicle inventory to the entire country under a single brand name and negotiation free experience […] 97.5% of customers in Driveway are entirely new to Lithia and Driveway […] we are delivering cars at a lot further radius […] last quarter we were at 740 miles or so […] we’re at 930 miles [because of] scarcity in vehicles.”

– Bryan DeBoer, CEO and President, Lithia Motors

Theme 3: A frenzied M&A market and heightened valuations have forced public executives to be more disciplined in their capital allocation approaches. Some of the publics (AutoNation, Group 1 and Penske) have prioritized share repurchases, others (AutoNation, Sonic) have prioritized reinvestment into their existing used vehicle platforms, while all must constantly evaluate acquisition opportunities against their individual growth, geographic and rate of return requirements.

- “A lot of different sellers that would like to work multiples off of Covid earnings. […] in the last six months [we] have walked away from $3 billion or $4 billion in business because we didn’t feel like it was priced appropriately.”

– David Hult, President and CEO, Asbury Automotive Group - “We’re investing in our existing stores […] keeping them top-notch […] but when we see that AutoNation is an attractive price, we have not hesitated to buy aggressively […] we view purchasing our own company relative to the pricing we see as other choices as the best use of that capital after having taken care of investing in our existing stores and building out [AutoNation] USA. […] I bought 9% of AutoNation rather than doing a lot of acquisitions that I thought were overpriced.”

– Mike Jackson, CEO, AutoNation - “During the second quarter, we repurchased 125,000 shares […] while the first priority for capital allocation remains M&A, we continue to be open to returning cash to our shareholders in the form of both share repurchases and an increase in our quarterly dividend. […] But the acquisition market is probably as frothy as it’s ever been […] it’s best if our acquisitions are accretive […] so we’re going to keep that as our top priority for capital allocation […] I would say it’s clear that share buybacks have been our second priority when we’re not able to find acquisitions to meet our financial hurdle.”

– Daniel McHenry, Senior VP and CFO, and Earl Hesterberg, President and CEO, Group 1 Automotive - “Despite a slightly more competitive environment, we continue to successfully target after tax returns of 15% plus, investments of 15% to 30% of revenues, and three to seven times EBITDA […] potential acquisitions that we believe are priced to meet our return thresholds […] we are expecting acquisition cadence for the remainder of 2021 to be strong.”

– Bryan DeBoer, CEO and President, Lithia Motors

Theme 4: While average days’ supply on used vehicles is beginning to improve, the supply of new vehicles still remains near record lows due to production challenges from plant shutdowns, microchip shortages and increased consumer demand. Public and private franchised dealers have navigated these conditions to record profits. Will the current levels of production and inventory supply prove transitory, or will the OEMs adapt to the current conditions that one executive compared to the aphorism “rising tides raise all boats”.

- “I’m hopeful that when things normalize, we don’t quite settle back at the 70-80 day supply, we’ve run a good 20 days below that. […] OEMs are building the inventory the consumer wants.”

– David Hult, President and CEO, and Dan Clara, SVP of Operations, Asbury Automotive Group, Inc. - “The manufacturers […] are using the chips that they do have to produce vehicles that consumers want [to] buy. […] I really don’t know if we will ever see a crossover point back to the old push system […] maybe the best path is somewhere in between. […] it’s not 14 days […] but maybe its 30-40 days […] somewhere like we run pre-owned […] I was expressing more of a hope of where the industry would see as a new goal and not going back to the 70,75,80, 90 days’ worth of inventory. […] I have never been a strong proponent or advocate of the build-to-order model […] People are getting 95%, 98% of what they really want in a relatively short period of time of 30 days to 45 days.”

– Mike Jackson, CEO, AutoNation - “With our geography, we’re very big truck retailers […] You traditionally carry a pretty high day supply of those domestic brands because of the proliferation of models on full-size pickup trucks […] so if we could run a leaner distribution system, it would really reduce our inventory carrying costs and our land requirements.”

– Earl Hesterberg, President and CEO, Group 1 Automotive - “I think there’s a big wave between 60-70 days supply and a zero-day supply […] even at a 23-day supply, customers are able to get immediate gratification […] this idea that you’re going to have 100 cars to choose from that are all quite similar, that Americans seem to like […] I think consumers will ultimately determine that by not buying cars on the lot that are run of the mill and rather get that additional individuality that maybe they’re looking for.”

– Bryan DeBoer, CEO, Lithia Motors - “The big question there is can we keep the discipline at the OEM level from the standpoint of days’ supply in the 30 to 40 days […] and see what it does for them from a profitability standpoint. And obviously it’s been key for us at the dealer level.[….][OEMs] understand that their costs are down on supporting inventories […] if they start building units to fill these plants that aren’t the ones that customers want we’re then going to see an inventory pickup of vehicles that are not ones that people want to buy and then it’s going to start bouncing back in the same direction we were before.”

– Roger Penske, CEO, Penske Automotive

Theme 5: With the proliferation of Electronic Vehicles (EVs), private franchised dealers are left wondering what their involvement will be from the retail and service side. Most of the public executives envision the continued use of the dealer franchise system for EVs as opposed to a direct to consumer model.

- “The best model of supply [EVs] to the consumer is through the dealer franchise system. These cars are very complex, people need to be able to communicate locally [….] the highest dollar spent [in the service department] on electric vehicles […] its first generation technology, there’s a lot of software glitches […] we’re already working them into our collision center […] over time […] they still need brakes, batteries….[…] we’ve made a lot of investments already and we’ll continue to make more investments both in physical training and equipment.”

– David Hult, President and CEO, Asbury Automotive Group - “The complexity of the automobile is going exponentially. And that when there are issues […] the number of entities that actually can care for it and fix it are fewer and fewer. And that we look at only the electric vehicles, the investments we are having to make in specialty equipment and technical training. Expertise is unbelievable in the connected [EV] car.”

– Mike Jackson, CEO, AutoNation - “We’re supporting our OEMs with EV. EV is going to be driven by political [forces] […] from a dealership standpoint, until we get a significant market of EVs, I don’t see a big issue from the standpoint of parts and service growth. It’s going to take a different technician…because of the technology. […] the warranty [work] will have to be done by us and we’ll also obviously have to deal with the complexity.”

– Roger Penske, CEO, Penske Automotive

Conclusion

At Mercer Capital, we follow the auto industry closely in order to stay current with trends in the marketplace. These give insight to the market that may exist for a private dealership which informs our valuation and litigation support engagements. To understand how the above themes may or may not impact your business, contact a professional at Mercer Capital to discuss your needs in confidence.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights