November 2023 SAAR

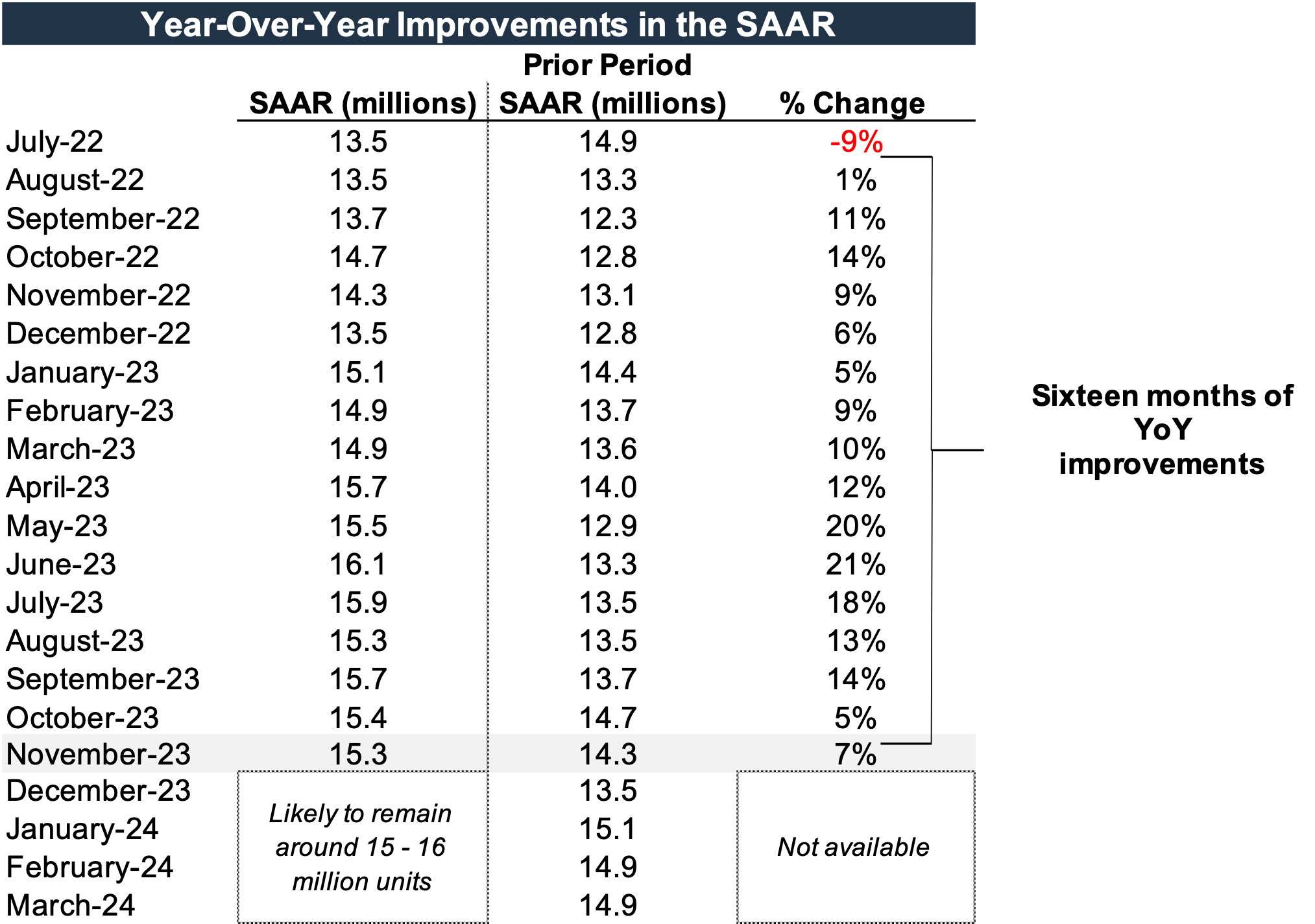

The November 2023 SAAR was 15.3 million units, down 0.7% from last month but up 7.4% compared to this time last year. As demonstrated by a second consecutive single-digit year-over-year improvement, the industry continues to grow slower than the double-digit percent increases seen from March to September.

Despite slowing growth, year-over-year improvement in the November SAAR extended the streak of consecutive year-over-year improvements to 16 months. Going forward, we expect this growth streak to extend through December 2023 and potentially through March 2024. January 2024 is the most likely month in which the streak could be broken during this time period. See the table below for a look at the last sixteen months of year-over-year improvements and the next four months of anticipated improvements.

While growth is slowing, we note the SAAR continues to be well below the 17 million level achieved in the five years preceding the pandemic. As we’ve previously discussed, 17 million may not be the “normal” level to which we expect volumes to return in the near term, and decelerating volume growth suggests that supply may still be constraining demand.

Unadjusted Sales Data

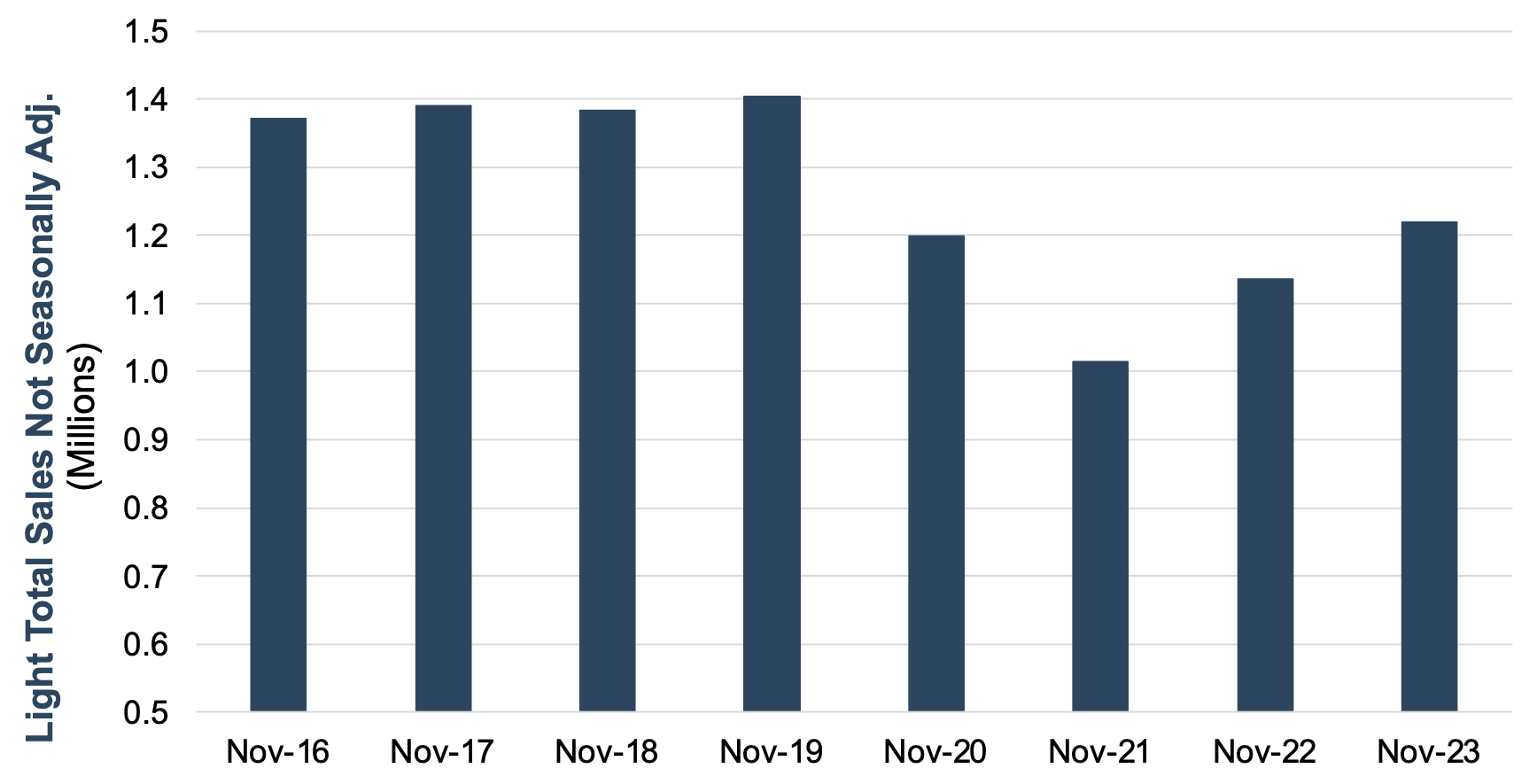

The chart below shows unadjusted total sales volumes for the last eight Novembers:

On an unadjusted basis, the industry sold 1.22 million total units last month, marking the highest level of November sales since 2019 and bringing the 2023 total to 14.0 million units. As December is typically the highest-selling month for auto dealers, total sales will likely creep up over 15.5 million for 2023. Settling around 15.5 million units would compare favorably to last year’s 14.2 million units and 2021’s 15.4 million units.

Inventory and Days’ Supply

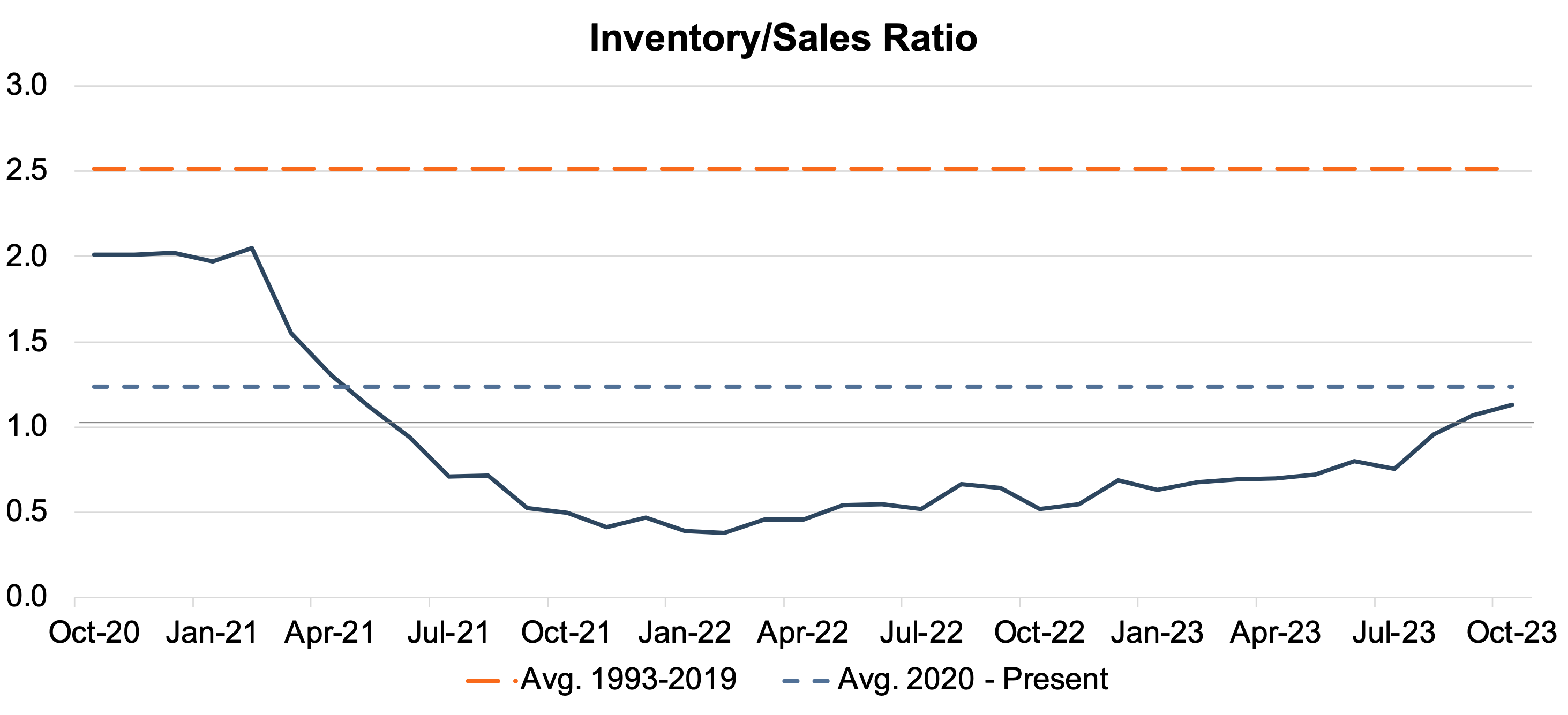

According to the NADA, new light vehicle inventory reached a twenty-month high at 2.33 million units in November, reflecting a month-over-month increase of 8.3%. Following the United Auto Workers (“UAW”) strike, OEMs do not appear to have felt the immediate impact of the associated production stoppages.

In mid-November, the UAW voted to ratify agreements proposed in October with each of the Detroit Three automakers. The ratification of the agreements carries substantial increases in UAW wages and benefits. Following the UAW deals, non-union factories, including Toyota Motor, Hyundai Motor, and Honda Motor, followed suit, announcing wage increases for U.S. factory workers.

In recent months, the industry’s inventory-to-sales ratio crossed the 1.0x threshold. October 2023 data marks the second time the ratio has been above 1.0x since May 2021, nearly two and a half years ago. For perspective, an inventory-to-sales ratio greater than 1.0x indicates that the seasonally adjusted inventory level at the end of the month was greater than reported sales. The October ratio of 1.13x signifies an expansion in nationwide inventory, contrasting with the suppressed inventory levels seen over the past few years. The chart below illustrates the industry’s inventory-to-sales ratio over the last three years.

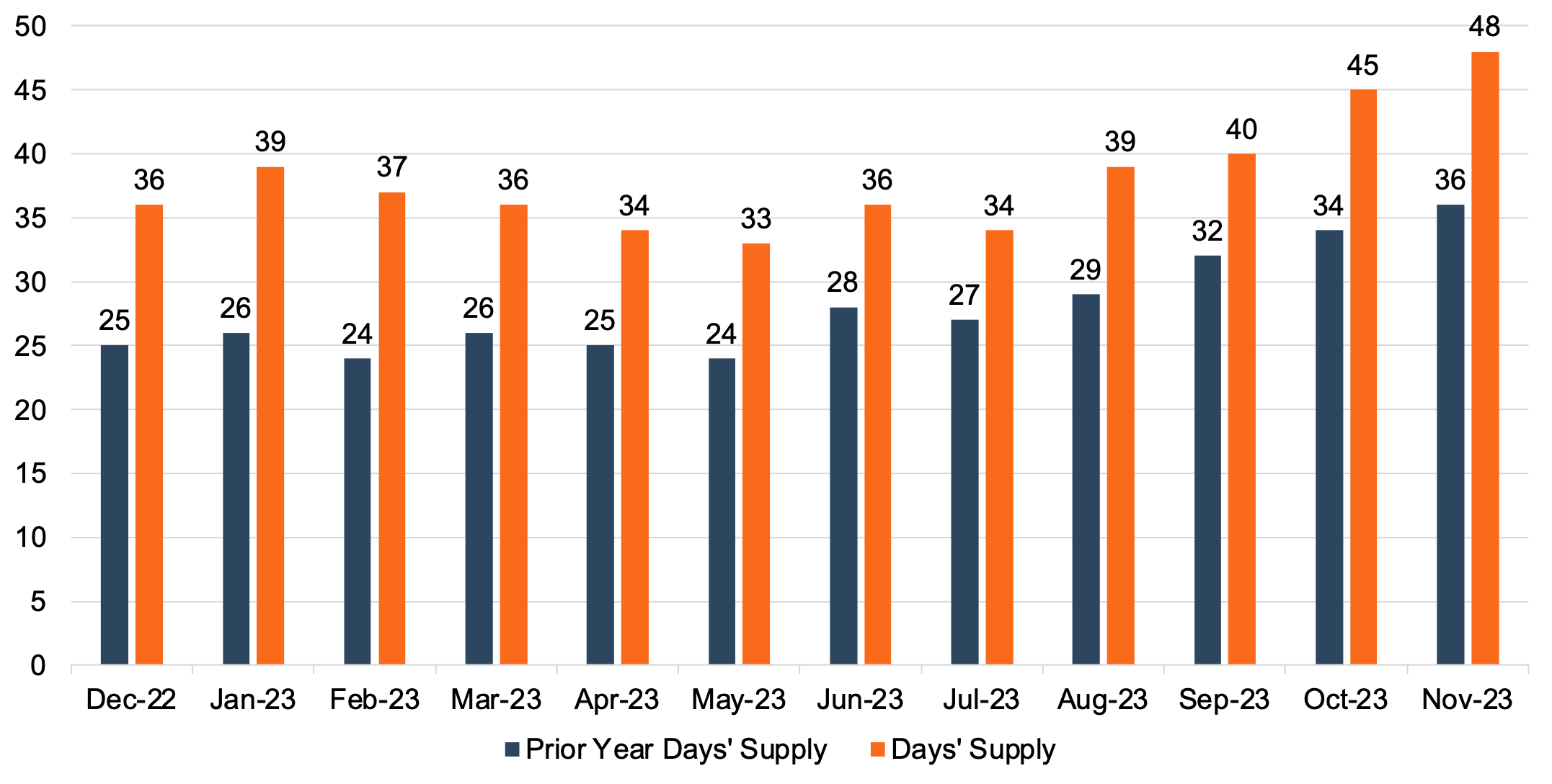

Another way to view the relationship between auto sales and inventory balances is through Days’ Supply, which has steadily increased over the past year. Days’ Supply of 48 in November 2023 marks the highest level reported by Ward’s Intelligence recently, though it remains well below pre-pandemic norms. The chart below gives a closer look at Days’ Supply for U.S. Light Vehicles over the past year (per Wards Intelligence):

Thomas King, president of data and analytics at J.D. Power, made several comments highlighting the impact of increased inventory availability on sales volumes in November:

“Sales growth is being enabled by improving vehicle availability. Despite the nearly six-week UAW work stoppage, retail inventory levels in November are expected to finish around 1.6 million units, a 7.5% increase from last month and 43.7% increase compared with November 2022, but still over 40% below pre-pandemic levels.”

“Retailers continue to pre-sell vehicles, however rising inventory levels are enabling more shoppers to buy from inventory on dealer lots. In November, 38.5% of vehicles are projected to be sold within 10 days of their arrival at the dealership, which is down from the peak of 57% in March 2022. The average time that a new vehicle spends in the dealer’s possession before being sold is expected to be 34 days, up 12 days from a year ago, but still less than half the pre-pandemic average of 70 days.”

“Now that the UAW work stoppage is in the rearview mirror, the industry can refocus on production, product launches and year-end sales promotions. The trends seen in November are poised to continue. Incremental enhancements in vehicle availability are expected to further improve the pace of new-vehicle sales, while per-unit prices and profitability are anticipated to experience measured moderation. Despite the challenges posed by rising interest rates and declining used-vehicle values, the overall health of the new-vehicle industry remains robust.”

Transaction Prices

Mr. King also discussed the downward trend in average transaction prices in November:

“As inventory and sales volumes improve, the average new-vehicle retail transaction price is declining to $45,332, down $873—or 1.9%—from November 2022. However, even with the decline in average transaction prices, consumers are on track to spend nearly $44.5 billion on new vehicles this month—the highest on record for the month of November and 9.5% higher than November 2022.”

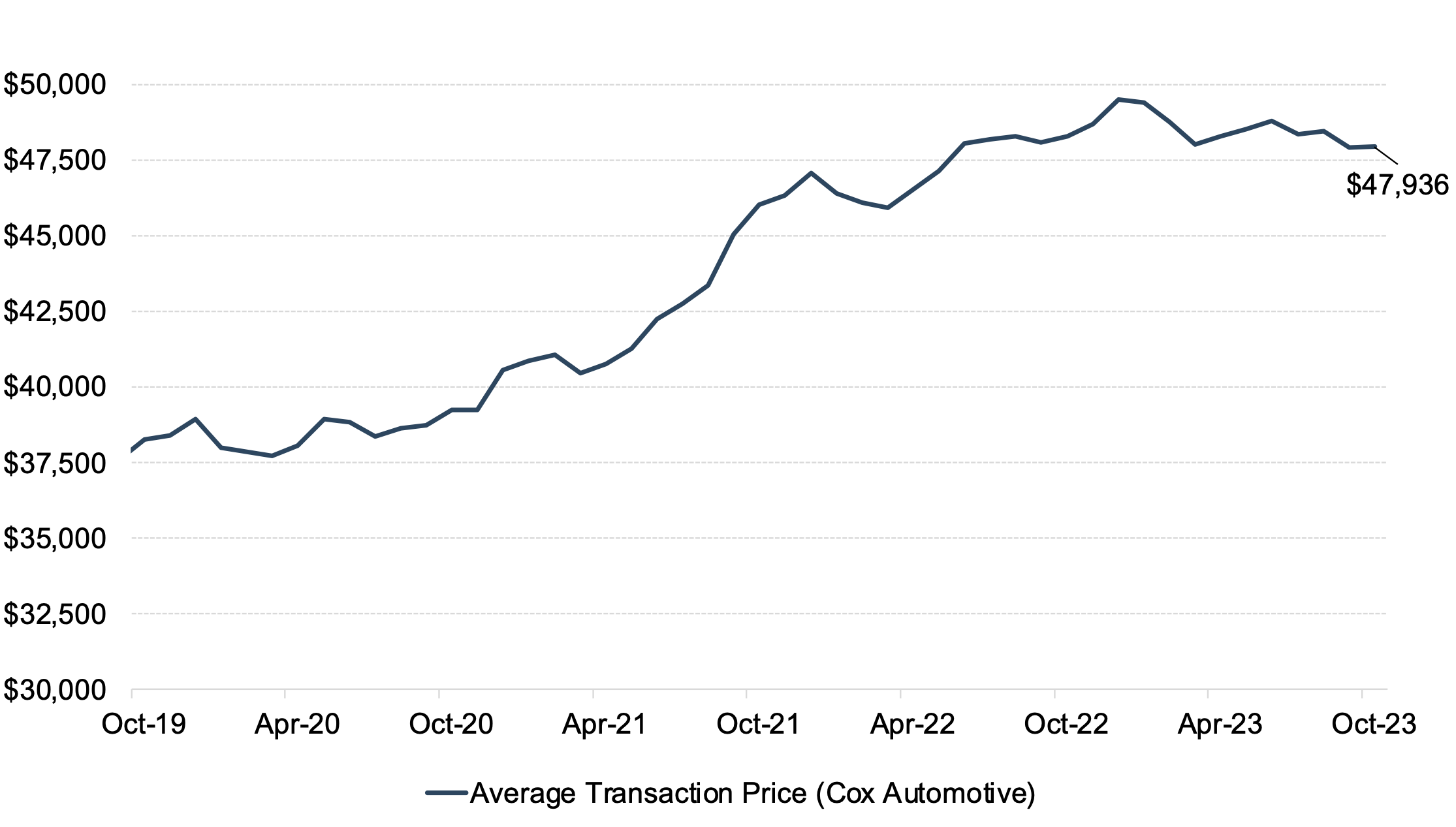

Increased supply across all models and a shifting vehicle mix are modestly dragging down the average transaction price. The chart below provides context around the monthly average transaction price (per Cox Automotive) from October 2019 to October 2023.

Incentive Spending

According to J.D. Power, average incentive spending per unit in November is expected to hit $2,247, up from $1,089 a year ago. Incentive spending as a percentage of the average MSRP is expected to reach 4.6%, reflecting an increase of 2.3 percentage points from November 2022. Average incentive spending per unit on trucks/SUVs in September is expected to be $2,391 (compared to $1,112 a year ago). While incentive spending continues to trend higher in November, it is important to note that these are average figures, and some markets and vehicle make/models are still transacting closer to MSRP.

December 2023 Outlook

Mercer Capital’s outlook for the December 2023 SAAR continues to be in the 15-16 million range. An uptick in inventory levels has driven incentives higher, which may encourage transactions despite inflated pricing and elevated interest rates. Even though the last several months of the SAAR have landed closer to 15.5 million than June’s peak of 16.1 million, we believe that sales levels will likely remain strong into the new year.

Mercer Capital provides business valuation and financial advisory services, and our auto team helps dealers, their partners, and family members understand the value of their business. Contact a member of the Mercer Capital auto dealer team today to learn more about the value of your dealership.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights