Public Auto Dealer Profiles: Lithia Motors

From 1996 to 2002, six new vehicle retailers became publicly traded companies. While these companies have expanded their footprint, there have not been any more publicly traded new vehicle retailers since. Online used vehicle retailers have recently IPO’d and EV startups have used SPACs to come to market during the pandemic, but these are not comparable to privately held franchised dealerships that can sell new vehicles.

This is the first in a series of profiles of these six public new vehicle dealerships. The goal of these profiles is to provide a reference point for private dealers.

Dealers may benefit in benchmarking to public players, particularly those that are significantly larger with numerous rooftops. Smaller or single point franchises will find better peers in the average information reported by NADA in their dealership financial profiles. Public auto dealers also provide insight as to how the market prices their earnings.

We’re starting with Lithia Motors (LAD) because of their targeted annual acquisitions of $3-5 billion in revenue, which will require plenty of deals with private dealerships, representing a potential exit strategy. Lithia has also already reported their 2020 earnings, so the early bird gets the worm.

Lithia Motors Locations and Brands

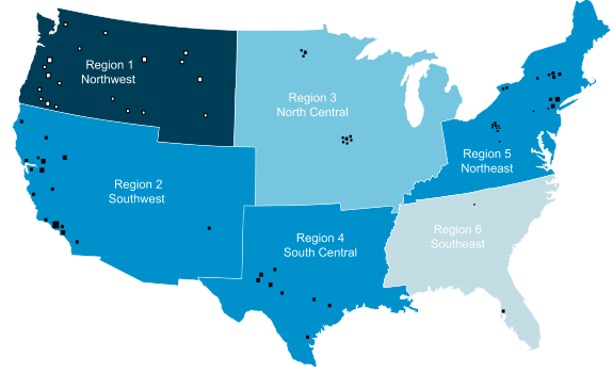

Based in Medford, Oregon, Lithia has over 200 locations throughout the U.S. largely focused on the West Coast, Texas, and the Northeast. Management indicated 100% of consumers in the U.S. were within a 400-mile radius of the company’s fulfillment network, with this density shrinking to 100 miles in the northwest and 200 miles in the Southwest, South Central, and Northeast.

According to the Automotive News Top 150, Lithia sold the third most new retail units in 2019 at just over 180 thousand, trailing only AutoNation and Penske Automotive Group. Lithia added seven dealerships in 2019, making it the most acquisitive dealership in the country that year, a trend they carried into 2020 and is anticipated to go forward.

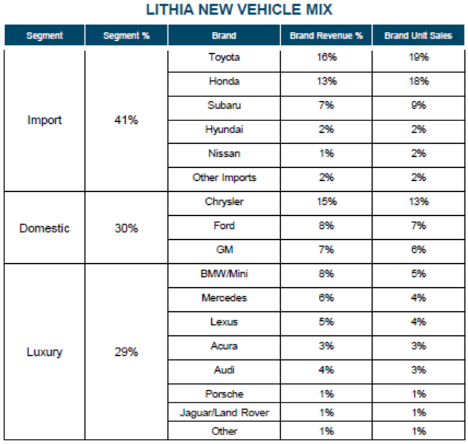

As seen in the table below, nearly 45% of Lithia’s revenues in the last quarter came from Toyota, Honda, and Chrysler. While just under 30% of the company’s revenue came from luxury vehicles (8% BMW/Mini), luxury volumes made up only about 22% of unit sales. Lithia is relatively balanced, seemingly agnostic to brand and segment.

Historical Financial Performance

As we’ve discussed frequently, there are numerous hurdles to clear when comparing a privately held dealership to a publicly traded retailer. Scale and access to capital make the business models different, even if store and unit-level economics remain similar. With numerous acquisitions and industry-wide improving gross margins in 2020, Lithia’s revenue and gross profit have grown at an annualized rate of 9.2% and 13.7% in the past three years. Lithia’s 10K’s and Q’s look different than the dealer financial statements produced by our dealer clients. For example, “Other income” items such as doc fees and dealer incentives can significantly impact profitability for privately held dealers. For dealers that sacrifice upfront gross margins to get volume-based incentive fees, operating income can be negative for dealers before accounting for these profits. For Lithia, other income (excluding interest expense) amounts to only 7.4% of pre-tax profits due in part to differences in reporting.

Implied Blue Sky Multiple

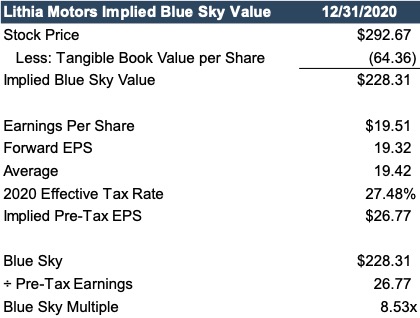

In this blog, we’ve discussed how Blue Sky multiples reported by Haig Partners and Kerrigan Advisors represent one way to consider the market for private dealerships. Below, we attempt to quantify the implied Blue Sky multiple investors place on Lithia Motors. If we assume that the difference between stock price and tangible book value per share is made up exclusively by franchise rights, then Lithia’s Blue Sky value per share is approximately $228. With pre-tax earnings per share of approximately $26.8, Lithia’s implied Blue Sky multiple is 8.53x.

Luxury franchises trade for multiples in this ballpark, but luxury makes up only approximately 30% of Lithia’s sales. For comparison, domestic brands make up a similar percentage for Lithia with multiples closer to 4x. Still, the scale of Lithia’s operations and significant growth profile lend it to higher multiples, and there would certainly be intangible assets other than franchise values.

Primary Pitch to Investors: Growth and “Driveway”

Seeking to meet the market’s insatiable demand for growth, Lithia unveiled its five year growth plan halfway through 2020. The company is targeting annualized revenue growth of 31% for the next five years with a goal of $50 billion in revenue (from $13 billion in 2020). Lithia describes itself as the largest participant in a fragmented $2 trillion revenue industry, combining both the traditional new franchise retailers and the used-only auto retailers.

Lithia has emphasized and invested in its omnichannel efforts called “Driveway.” This is an eCommerce solution the company compares to Carvana and Carmax. Lithia notes a higher gross margin than Carvana, and the company’s long-term strategic advantage lies in the combination of an eCommerce option for consumers supported by a larger network of traditional retail locations, which increases options for online shoppers in adjacent markets. Lithia sources 60% of its inventory from trade-ins, giving it robust offerings in the online used vehicle space.

In 2018, Lithia also invested $54 million in a partnership with Shift Technologies, which competes with Driveway, Carvana, Carmax, and Vroom. According to the most recently available filing, Lithia owns 13.8 million shares of Shift, which went public via SPAC in October, worth approximately $140 million based on last close.

The company’s recent investor presentation showed the company added $3.5 billion in annualized steady-state revenue, though it does not specify the impact of the pandemic on this estimate. Lithia’s acquisitions also required an intangible investment of 25% of annualized revenues indicating the company may have paid greater Blue Sky values in 2020 as Haig Partners and Kerrigan Advisors each indicated market multiples increased in 2020 despite declining revenues.

Seeking to acquire strong brands and grow profits, Lithia highlights five keys when acquiring dealerships:

- New Vehicle Market Share: Lithia looks to improve dealerships that are underachieving the OEM’s market share performance goals. They target improvement from 75% of the OEM target to 125%.

- Used Vehicle Units: The company seeks to triple the number of used vehicles sold per store per month.

- F&I Profit: By focusing on cross-selling F&I, Lithia seeks to improve GPUs from $700 to over $1,450.

- Service & Parts: Similar to improving market share targets, the company seeks to improve CSI scores. In addition to improving relations with customers, this focus positively influences relationships with manufacturers.

- SG&A Reduction: Lithia seeks to use its scale to reduce SG&A expense to below 65% from approximately 90% for its targets pre-acquisition.

In summation, Lithia aims to improve pre-tax margins of its targets from under 1% of revenues to above 3%. To quote the CEO, Bryan DeBoer, on the recent earnings call, “Lithia’s model has always been to buy value-based investments that underperform.” Targeting dealerships with thin profit margins also allows Lithia to grow revenues and increase its distribution network while potentially reducing the amount of Blue Sky paid. However, as noted in the Haig report, lower margin dealerships can often attain higher Blue Sky multiples, resulting in favorable returns for sellers as well.

Conclusion

Lithia’s aggressive growth strategy may pay off if they don’t overspend on dealerships over the next five years. Depending on which markets they target, they’ll also need to be strategic to avoid cannibalizing their current sales as they expand. Investors may well reward them if they hit their growth targets, but private dealerships also stand to benefit from an aggressive buyer in the market. This will be particularly true if Lithia falls behind its growth targets, as private dealers looking to exit may be able to extract more blue sky value out of the deal. Dealers in markets competing with Lithia may also see a shift in their pricing strategy, as the company touts 43% of its transactions with customers as “negotiation free,” potentially implying more competitive (read: lower) prices.

At Mercer Capital, we follow the auto industry closely in order to stay current with trends in the marketplace. Surveying the operating performance and strategic investment initiatives of the public new vehicle retailers gives us insight into the market that may exist for a private dealership. To understand how the above themes may or may not impact your business, contact a professional at Mercer Capital to discuss your needs in confidence.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights