Public Auto Dealer Profiles: Sonic Automotive

Sonic Automotive sign on their headquarters building in Charlotte, North Carolina.

As we discussed in the first installment of this blog series, there are six primary publicly traded companies that own approximately 923 new vehicle franchised dealerships as of Q2 2021, or 5.6% of the total number of dealerships in the U.S. (16,623 at year-end 2020 per NADA). This demonstrates how fragmented the industry continues to be, despite recent consolidation.

The total number of dealerships has remained largely the same, though the number of dealers is dwindling as big shifts towards e-commerce accelerated by the pandemic require heavier investment for smaller operations to compete.

This issue of consolidation is not limited to just mom and pop stores.

According to the Wall Street Journal, Suburban Collection of Michigan sold to Lithia this year in part due to the need for outside capital. David Fischer Jr. and his father sought a strategic partner to update their business to the new digital retailing environment despite having 56 franchises across 34 stores. In 2020, Suburban Collection was the 21st ranked auto group in terms of size, retailing just under 30 thousand new vehicle units.

Given current blue sky values, the size of the deal and Lithia’s aggressive acquisition strategy, we realize premium pricing may have ultimately won the day in the Fischers’ decision to divest. Still, for an auto group of that size to be seeking a minority partner, prior to eventually being acquired, is noteworthy. We’ve also heard concerns from our clients that the potential for rising taxes and tweaks to the supply chain (with OEMs considering a model that reduces the autonomy of dealers) could lead to further consolidation.

Our goal with these posts is to serve as a reference point for private dealers who may be less familiar with the public players, particularly if they don’t operate in the same market. Larger dealers may benefit in benchmarking to public auto dealers. Smaller or single point franchises may find better peers in the average information reported in NADA’s dealership financial profiles or more regional 20 Group reports. Public auto dealers also give dealers insight to how the market prices their earnings, the environment for M&A, and trends in the industry.

Sonic Automotive Locations and Brands

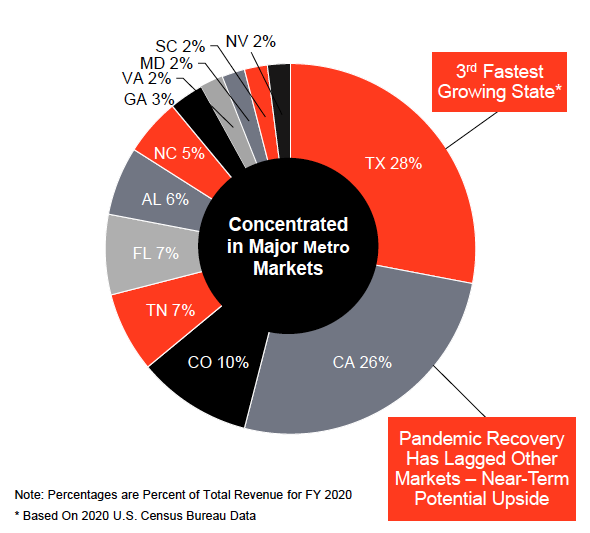

Based in Charlotte, North Carolina, Sonic has 84 franchised dealerships, the lowest of any publicly traded company that operates principally as a new vehicle dealer. As seen below, the company earned over 50% of its revenue in Texas and California, with another 30% of 2020 revenue coming from Colorado, Tennessee, Florida, and Alabama. By year-end 2021, the company projects 25% population coverage.

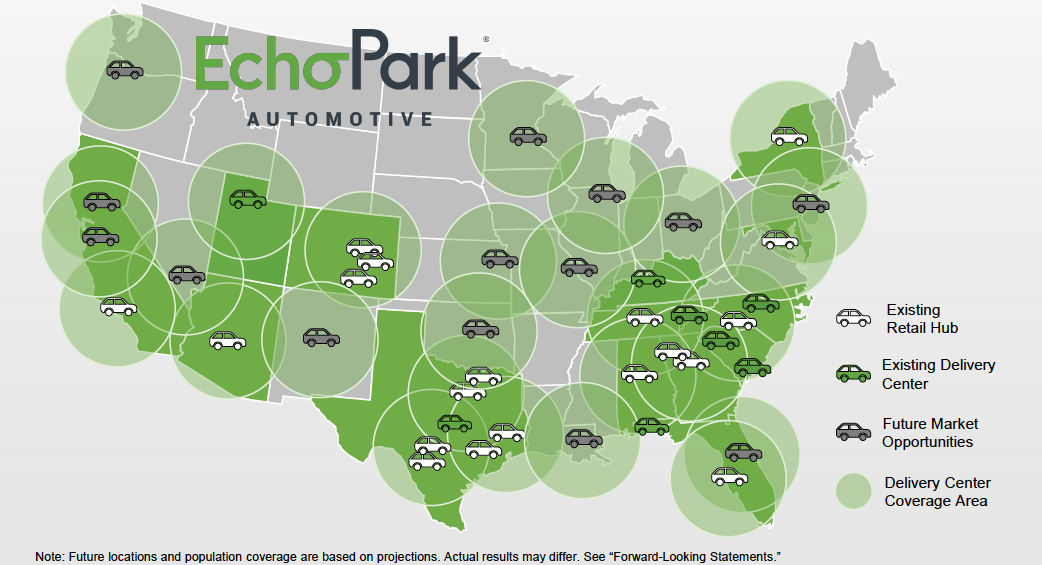

While the company is smaller and relatively concentrated in terms of its footprint compared to its public peers, Sonic is targeting 90% population coverage by 2025 (see projection below in recent investor materials). This growth will largely come from its EchoPark segment comprised of physical locations selling pre-owned “nearly new” vehicles with many having remaining OEM warranty.

According to the Automotive News Top 150, Sonic sold the seventh most new retail units in 2020, at just over 93 thousand, trailing the other public dealers and Hendrick Automotive Group, the largest private auto group, also based in Charlotte.

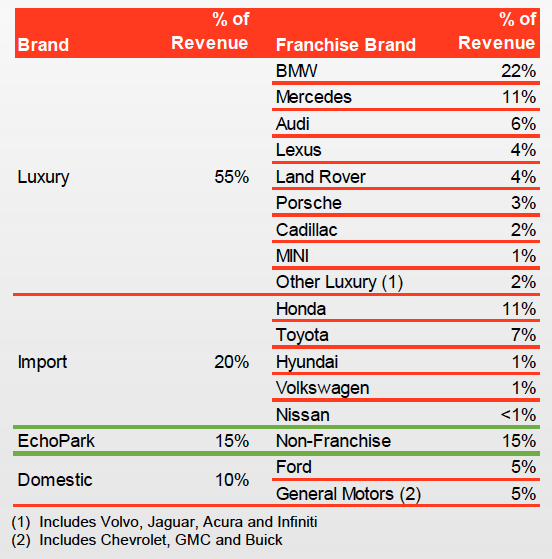

As seen in the table below, 55% of Sonic’s 2020 revenues came from Luxury brands, particularly BMW and Mercedes. This is more than double the company’s combined sales from domestic (10%) and EchoPark (15%), which are assumed to target a lower price point. Assuming continued growth in EchoPark, Sonic appears to be targeting consumers at various income levels which should provide balance in any market environment.

Historical Financial Performance

As we’ve discussed frequently, there are numerous hurdles to clear when comparing a privately held dealership to a publicly traded retailer. Scale and access to capital make the business models different, even if store and unit-level economics remain similar. Sonic’s 10K’s and Q’s look different than the dealer financial statements produced by our dealer clients. For example, “Other income” items such as doc fees and dealer incentives can significantly impact profitability for privately held dealers. For dealers that sacrifice upfront gross margins to get volume based incentive fees, operating income can be negative for dealers before accounting for these profits.

Due to differences in reporting, Sonic captures other income along with F&I as a revenue item with no corresponding cost of sales line item. The minimal amount of reported other income/expense not included as revenue if added to gross profit, would not change its reported gross margin of 14.85% by one basis point.

Interestingly, its gross margin through the first half of 2021 was down immaterially from 14.89% in 2020. This comes despite industry-wide improvement in gross margins and a pickup in margin for new vehicles, whole vehicles, and parts, service and collision operations. That means Sonic has been negatively impacted by its declining margins on used vehicles (2.8% compared to 3.6%) and/or the contribution of gross profit (relatively less high margin fixed operations and/or more used vehicles).

While EchoPark likely explains this, it is interesting to contrast to the average dealership as reported by NADA which saw gross margin improve from 11.8% to 13.4% in the first half of 2021. While this appears lower than the figures reported by Sonic, we note the difference between operating profit and pre-tax profits (largely aforementioned back-end profits) was 2.3% of revenues, which added to gross margin, would be 15.7%.

Implied Blue Sky Multiple

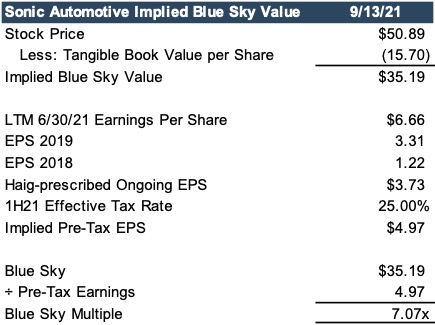

In prior blogs, we’ve discussed how blue sky multiples reported by Haig Partners and Kerrigan Advisors represent one way to consider the market for private dealerships. Below, we attempt to quantify the implied blue sky multiple investors place on Sonic Automotive. If we assume that the difference between stock price and tangible book value per share is made up exclusively by franchise rights, then Sonic’s Blue Sky value per share is approximately $35.19.

Given recent outperformance, Haig Partners prescribes a 3-year average be taken in determining ongoing pre-tax income (2018, 2019, and LTM June 30, 2021). Using this methodology and applying the 25% tax rate implied by Sonic’s financials, its ongoing pre-tax earnings per share would be $4.97 or just over 7.0x Blue Sky.

While this is lower than all of its public counterparts besides Group 1 Automotive, it is relatively high compared to import or domestic dealerships likely due to its size and growth potential as well as its tilt towards luxury brands.

Conclusion

At first glance, Sonic may appear to be a close comparable for private auto groups. Unlike other public auto dealers, it does not have other business lines (Penske) or international operations (Group 1). It’s not rapidly acquiring other dealerships (Lithia) and its franchised dealership count is about a third of AutoNation. However, like Asbury, it is tilted towards luxury with very little domestic sales, and still has significantly more dealerships than most groups.

Sonic also has meaningful used-only operations in EchoPark, which is where the company is allocating much of its capital. Geographic diversification and access to capital markets can also materially impact comparisons, particularly for smaller dealerships. Still, management commentary on the macro environment in the auto dealer space is valuable and appropriate benchmarking comparisons are still possible if you know what you’re looking for.

At Mercer Capital, we follow the auto industry closely in order to stay current with trends in the marketplace. Surveying the operating performance, strategic investment initiatives, market pricing of the public new vehicle retailers, gives us insight to the market that may exist for a private dealership. To understand how the above themes may or may not impact your business, contact a professional at Mercer Capital to discuss your needs in confidence.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights