Q1 2021 Earnings Calls

Improved Profitability, Online Tools and Market Share, and High Valuations

The earnings calls in Q1 began with a focus on many of the same trends as prior quarters: increasing or record EPS despite inventory struggles as gross margin improvement drove operating leverage. The chip shortage has taken center stage, with cloudy expectations of when inventory levels might normalize. Contrast to factory shutdowns last year, dealers are faring much better as strong demand has improved vehicle pricing, benefiting both dealers and manufacturers. OEMs have tried to mitigate the impact of the chip shortage by removing certain features requiring chips, while others have prioritized more in-demand models to maximize profits.

A couple of other trends require the proper framing of the subject to truly understand what’s happening. First, many execs talked about “pent-up demand” for parts and service work. If “pent-up demand” means parts and service revenue is expected to increase in the coming months, then that appears likely as vaccination rates increase and mandates are relaxed. However, on previous calls, many discussed the notion of consumers deferring maintenance on their vehicles since they could get by because they were driving less. Deferred maintenance has not been discussed as much, suggesting deferred maintenance activity has not meaningfully presented itself. In many instances such as the winter storms, execs noted that unit sales may have been delayed but service revenue losses would not be recovered.

We also need to appropriately frame the degree to which online sales are truly “incremental,” or not cannibalizing traditional in-person sales. Execs highlighted online sales to customers who had not previously bought from them before as evidence that online tools were incremental. Given the long life cycle of vehicles, we are less convinced this necessarily says a consumer only purchased from their company because of the online feature. While Lithia noted nearly 98% of its online sales were to first time Lithia purchasers, we believe the 43% sold to customers outside of their retail market presence is a better representation of incremental sales, which is to say the company is improving its market share. While there were technical difficulties throughout the Sonic call reducing our ability to pull meaningful quotes, their investor deck similarly noted 30% of customers of its EchoPark segment (its stand-alone Pre-Owned operations) traveled more than 30 minutes to shop their inventory.

On the other hand, Penske casts doubt on the notion that these sales were truly additional in the sense that consumers aren’t buying cars they didn’t otherwise need solely because the option to buy online now exists. While we tend to agree, it is meaningful if larger players are able to poach customers with the scale provided by their online platforms. Over the longer term, this could negatively impact unit volumes for smaller dealerships who choose to not take advantage of online options or are not able to meaningfully compete. Simply having a website may not be enough for the local Honda dealership to compete if comes up 5th on a Google search.

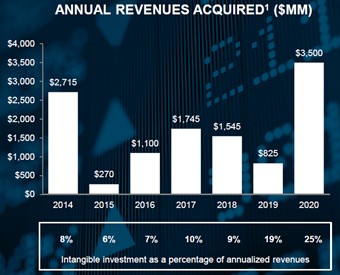

The franchised auto dealer space is fragmented by nature. As such, the few publics are frequently asked about consolidation in the industry, as they have both the experience to operate at scale and a liquid market for their equity which allows acquired dealers to achieve liquidity without necessarily losing the upside of their dealership in a transaction (either receiving stock or investing cash from the deal into that stock). However, despite plenty of transactions in the industry, public auto dealers have not typically provided much financial information on their targets aside from revenues. In a recent investor deck, Lithia took things a step further, quantifying its intangible investment as a percentage of revenues as shown below:

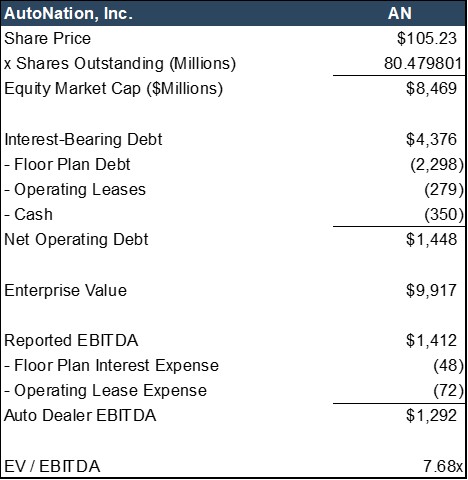

Many noted increasing valuations, and an analyst on the AutoNation call mentioned his M&A modeling at about 15% to 30% of sales. CFOs for multiple companies noted their focus on EBITDA multiples when doing deals, which are highlighted in theme #4. For perspective, the market ascribes about a 7.7x EV/EBITDA multiple for AutoNation with floor-plan interest treated as an operating expense as calculated below:

Theme I: Microchip shortages have extended longer than initially anticipated, but strong demand, in part due to stimulus funds, has supported robust sales and gross profits. The industry’s limited chip supply has led to retail customer, particularly in hot selling models, getting vehicles first.

- “As it relates to the hot selling products as you point to, the OEMs are really great at this. And while the chip shortage is there, they’ve really been shifting their production to the faster selling vehicles. […] everyone is showing high margins. We didn’t all of a sudden get that much better, it’s simplistically supply and demand. There is that point where you’re missing a lot of sales because you just don’t have the inventory. […] the industry performs well and stability exist when there’s probably a 60 to 70 days supply in the market. And right now with all the government spending that’s going on and people coming out, the demand is going to be high right now, and the fear is the inventory won’t be there to match the demand.” –David Hult, CEO, Asbury Automotive Group

- “As of the end of the quarter, we had a 41-day supply of new vehicle inventory, indicating we have well over a month’s supply of vehicles on the ground and an adequate supply of in-transit that are replenishing our on-ground inventory every day. However, new vehicle margins may remain elevated in the near term due to continued microchip and other supply chain shortages, coupled with elevated consumer demand levels driven by additional stimulus funds. While select OEMs are experiencing reduced level of inventory, we currently have sufficient inventory to balance the current supply and demand trends expected over the coming months.” – Christopher Holzshu, President, and CEO, Lithia Motors

- “There is no question that there is more demand than supply, that is the headline. On the new vehicle side, there supply is tight, but shipments and production are disrupted with the chip crisis and will be for the rest of the year. But it’s nothing like a year ago during the pandemic when we had the factory shutdowns. […] we’ve adjusted pricing to reflect that, and you’ve seen the improvement in our front-end gross. […] There is no reason to rush things out the door. You can’t easily replace it.” – Mike Jackson, Chairman & CEO, AutoNation

- “I’ve been amazed in the recent months, how we’ve continued to maintain pretty impressive sales levels with declining inventory levels. […] Also, the OEMs have adjusted. It seems that the only vehicles they’re making are the ones that sell the fastest. So when they come off the truck, they go right to a retail customer. […] we’re getting to the point where inventory is a problem, if not at this moment very soon. So ideal for us is about 45 days supply when we mix all of our different brands together. And as you saw, we ended the quarter at little over 30. And we’re actually fine in the 30s. But we’re a big truck market. When you get very far below 30 days of supply, you have trouble having many of the configurations that the truck customers want. And so that’s where it starts to get a little challenging for some of our brands.” – Earl Hesterberg, President and CEO, Group 1 Automotive

Theme 2: Service and parts continue to lag vehicle sales for many dealers, though those struggling for inventory are relying more on fixed ops. While a return to “normal” levels of miles driven should increase service demand, opinions among public dealers were mixed as to the degree there was pent-up demand from consumers deferring maintenance during the pandemic.

- “Obviously pent-up demand is a big driver. And we are starting to see that coming out of March where we actually started to finally see some real big volume increases year-over-year were great, but what we’re really trying to do is figure out when will we start to get to a normalized recovery over what was really the 2019 kind of year, if we use that as a base case. And in the quarter, we saw ourselves about 5% up over that 2019 level. And prior to the pandemic last year, we were projecting a double-digit — a low double-digit increase in our parts and service business. So we definitely see that trend continuing into April and we expect that to continue through the summer months as we kind of rally into customers coming — normalizing their lives again and getting back on the road and driving their vehicles and then needing parts and service work.” – Christopher Holzshu, President, and CEO, Lithia Motors

- “We expect good things out of parts and service for the rest of the year. We see the traffic counts building. Our gross for RO is quite good as we’ve made some adjustments during the pandemic on that better inspections, better reporting, better selling skills with customers. And we we’ve added over 300 technicians back to our dealership base in the last 12 months. Very few hourly technicians, which tend to be less productive than flat rate technicians, and that helps us be more productive as a business. And we expect good things as miles driven continue to increase. And if vehicle supplies do become an issue, people will hold on to their cars and they will be in our shops more. […] The customer pay business is extremely strong […] but warranty we don’t control, and warranty has been a bit weak. […] it’s been collision and warranty, which had been soft over recent quarters.” – Earl Hesterberg, President and CEO, Group 1 Automotive

- “Well, there is no question that miles driven have come down […] in January, we were down 16% in parts and service revenue. Now, that’s really swung around. So, people are getting out. […] So, I think we’ve got to look sequentially how we’re going to look from March to April. This year will give us probably a better picture. But, I can say that there is definitely more momentum and more interest in the shop. […] So we still have some real opportunity there and just a matter of getting people out and that’s strictly miles driven will drive that.” – Roger Penske, Chairman & CEO, Penske Automotive Group

- “March came back so strong, it was actually ahead of ’19 pace numbers. And as we sit here in April, we’re experiencing the same. So, the customers are back on the road, the service business is back. […] while we’re feeling it on the variable side with some shortages with inventory, thankfully Parts and Service is picking up on that. […] We think there’s a lot of pent-up demand.” –David Hult, CEO, Asbury Automotive Group

Theme 3: While many dealers tout incremental sales on their online platforms, it’s important to understand which sales replace would-be in-person dealership transactions and which the company would not have been able to achieve, such as sales to customers where the dealer doesn’t have a physical dealership.

- “97.8% of our Driveway customers during our first quarter were incremental and had never done business with a Lithia dealership before. […] 43% of our [Driveway] sales are out of region and our average shipping distance is 732 miles […] so we’re not really getting into that cannibalization of our existing pipeline.” –Bryan DeBoer, President and CEO, Lithia Motors

- “There is a lot of incremental [online] sales that we would not have received, and I made that comment, because looking at the information we weren’t doing business with [those customers] before.” –David Hult, CEO, Asbury Automotive Group

- “I think that to a certain extent, it’s substitutional where people have the opportunity to buy online, delivery at home, come to the dealership. […] we’re really not growing the business at this point incrementally. And I think that’s going to be the true test where we can tell the analysts in the market, we’ve actually grown our overall business by using the online tool.” – Roger Penske, Chairman & CEO, Penske Automotive Group

Theme 4: While Lithia at least reports transactions in terms of price to revenue, multiple companies specified they think in terms of EBITDA multiples. While this might not be true for smaller acquirers, it may affirm the reasonableness of correctly applied EBITDA multiples from the publics.

- “[W]e generally think more about it as a multiple of EBITDA than revenue. And it’s kind of in that high single-digit range, and returns are mid-teens.” – Joe Lower, CFO, AutoNation

- “[W]hen we evaluate an opportunity, we’re looking at EBITDA multiples and then factoring in the synergies we think we can achieve, and then we look at the IRR relative to our cost of capital. And we need to see a margin there to deliver an accretive deal.” – PJ Guido, CFO, Asbury Automotive Group

Conclusion

At Mercer Capital, we follow the auto industry closely in order to stay current with trends in the marketplace. These give insight to the market that may exist for a private dealership which informs our valuation engagements. To understand how the above themes may or may not impact your business, contact a professional at Mercer Capital to discuss your needs in confidence.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights