September 2022 SAAR

The September SAAR was 13.5 million units, up 2.3% from last month and up 9.6% from September 2021, when the industry had less than one million vehicles available for sale. While this month’s SAAR highlights a year-over-year improvement and gives us context around how low inventory managed to fall in 2021, this month’s data release does not indicate a “return to normal” by any means. The Q3 2022 SAAR averaged 13.3 million units, roughly flat with Q2 2022’s average and consistent with the last three months of the industry’s sales pace, indicating no fundamental changes. Looking at the 2022 SAAR as a whole, the previous three months of this year have displayed stability at around 13.0 million units, while the first six months of the year were significantly more volatile.

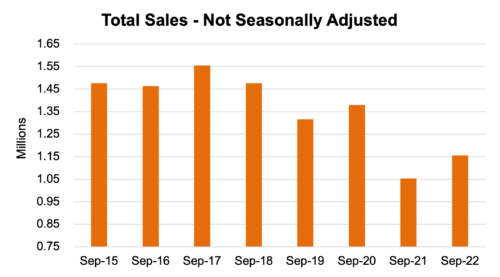

Looking at unadjusted sales numbers, September 2022 also showed a real improvement from this time last year. While this month’s unadjusted sales (1.16 million units) were certainly still limited by supply-side inventory issues and much lower than sales levels observed from 2015-2020, it is clear that September 2021 (1.05 million units) was a low point that makes the last month look good by comparison. See the chart below for unadjusted sales numbers from the previous eight September releases:

Inventory

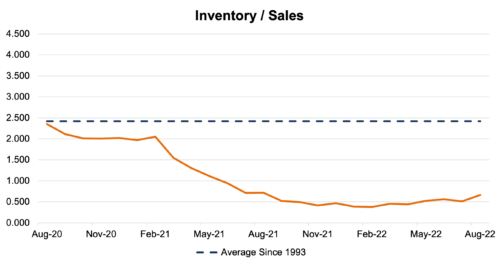

On the supply side of the vehicle sales equation, inventories have remained low but seem to be marginally improving. The industry inventory to sales (“I/S”) ratio was 0.67x in August, the most recently available month of data. August’s I/S ratio compares to 0.51x in July and an average of 0.47x from January 2022 to July 2022. For the remainder of the year, we expect industry-wide inventory levels to slowly improve. However, it is unclear how long auto manufacturers will take to bring the industry I/S ratio up to the long-run average of 2.4x. As this recovery unfolds, it will be important to keep an eye on efforts to bring more domestic semiconductor facilities online, the ongoing status of the war in eastern Europe, and the availability of key inputs from Asian markets like China. These underlying factors are key levers that would allow the domestic production of vehicles to improve in a meaningful way.

Transaction Prices, Incentive Spending, and Monthly Payments

Transaction prices remained at near-record levels in September. According to J.D. Power, the average new vehicle transaction price is projected to reach $45,622 this month, a 10.3% increase from this time last year and the fourth highest average transaction price ever. In terms of monthly payments made by consumers, rising interest rates on elevated sticker prices drive monthly payments up to an average of $667 per consumer. Incentive spending by OEMs has remained low in September. The average incentive spending per unit was $936 this month, down 47.8% from this time last year and the fifth straight month of sub-$1000 spending per unit.

Is Pent-Up Demand Still Present in the Auto Industry?

The sales pace of any industry is a function of a two-sided equation that includes both demand and supply. The first major factor in this equation is demand, which has been considered very high, even “pent-up,” over the last year and a half in most of the industry’s analytical publications (including some of our blogs). We recently tried to quantify pent-up demand in our June 2022 SAAR blog. In this June publication, we wanted to start a conversation around pent-up demand by challenging the idea that sales would suddenly return to 17 million units once the supply side of the equation normalizes. The idea that sales may not return to a 17 million unit SAAR right away is centered around the idea of cyclicality.

When supply is so restricted, it’s not a high bar for demand to be above supply

The auto industry has always been cyclical, with more vehicles sold during the “good times” and fewer vehicles sold during recessionary periods and times of general economic uncertainty. Cyclicality makes sense, as consumers are less likely to make a large purchase like a home or a vehicle during uncertain times when debt is expensive, and recessionary fears are present. Put simply, we are starting to wonder if the industry as a whole has overestimated the level of pent-up demand. When supply is so restricted, it’s not a high bar for demand to be above supply. And over the past two years, with rising vehicle prices, we’ve learned that consumer demand for personal vehicles was more inelastic than previously thought. Even accepting these two premises, we believe the cyclicality of auto sales may mean that by the time inventory issues are alleviated, consumers may be less confident in purchasing new vehicles.

Over the last month, the country has found itself anticipating a down cycle of the entire economy as interest rates and other measures of risk increase at a rapid pace. The housing market has cooled off, wage growth has also decelerated, and the market for new and used vehicles is likely cooling off as well. It doesn’t help that near-record transaction prices and the expensive cost of debt are making vehicle purchases more and more difficult to afford. On the Mercer Capital Auto Dealer team, we tend toward the idea that pent-up demand is dissipating or perhaps overstated. We believe that rising transaction prices are more of a function of supply-side constraints than high levels of consumer competition for available vehicles.

October 2022 Outlook

Mercer Capital’s outlook for the October 2022 SAAR is consistent with the status quo. Industry supply chain conditions continue to stagnate. Sales volumes will likely continue to be closely tied to production volumes as vehicles leave lots within days of arriving. Elevated profitability across the entire industry will likely continue as high prices boost margins on vehicle sales. Perhaps the October SAAR can eclipse 14 million units and signal a turning of the tide, but we predict that a 14 million unit SAAR for 2022 is unlikely in the current landscape. Stability at around 13.0 million units is a much more realistic expectation.

Mercer Capital provides business valuation and financial advisory services, and our auto team helps dealers, their partners, and family members understand the value of their business. Contact a member of the Mercer Capital auto dealer team today to learn more about the value of your dealership.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights