September 2023 SAAR

The September 2023 SAAR was 15.7 million units, up 2.1% from last month and up 14.9% compared to this time last year. This month’s data holds true to the ongoing trend of double-digit year-over-year improvements. Altogether, this month marks the fourteenth straight month of year-over-year improvements in the SAAR.

Fourteen consecutive months of annual improvements is no easy task, especially for the automotive industry. Common sense and history tell us that, at some point, the double-digit improvements will slow down. In fact, we believe that next month’s data will be the inflection point when the industry breaks the streak and returns to sub-double-digit annual SAAR improvements.

To contextualize this, the SAAR was 13.6 million units in September 2022 and had averaged 13.6 million units since the beginning of 2022. Seasonally adjusted, annualized sales during the year were still very depressed compared to the long-term average (since 1976) of 14.8 million at that time. However, October 2022 was the month when sales began to bounce back. The industry posted a 15.3-million-unit SAAR during that month, averaging 15.2 million units from that day forward. This leads us to believe that while the months ahead could contain annual improvements, stagnation, or decrements in the SAAR, the streak of double-digit year-over-year improvements will likely end next month.

Unadjusted Sales Data

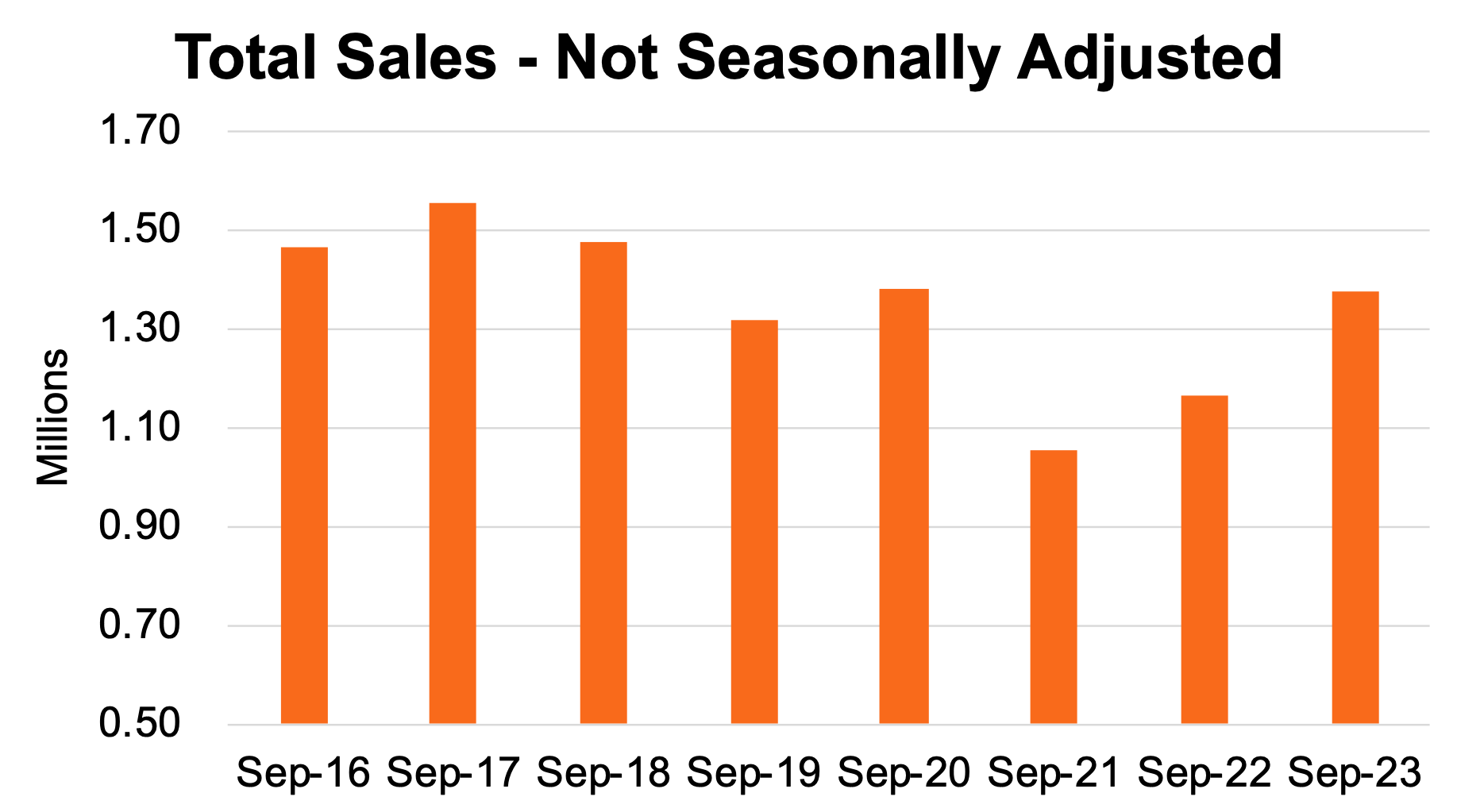

The chart below shows unadjusted sales volumes for the last eight Septembers:

On an unadjusted basis, the industry sold 1.38 million units last month, marking the highest level of September sales in three years and bringing the 2023 total to 12.0 million units. Within the context of total 2023 performance, total sales of 15.5 – 16.0 million units seem inevitable at this point. Unadjusted monthly sales only need to average 1.17 – 1.34 million units through the end of the year to reach these milestones. When you also consider that December is typically the highest-selling month of the year, it will likely come down to December’s results for us to confirm which end of the expected range we will fall into.

Inventory and Days’ Supply

According to the NADA, new light vehicle inventory on the ground and in transit is expected to total 1.93 million units at the end of September 2023, roughly flat with the last few months’ reported figures. Consistent inventory availability has been a crucial factor in increased sales and falling transaction prices, as auto dealers and consumers alike have been able to act with more confidence in their inventory management and purchasing decisions, respectively.

According to Wards Auto, the total U.S. supply of unsold new vehicles hit a fresh two-year high in October of 2.21 million units. This measure of unsold inventory includes vehicles that have not yet been delivered to dealerships and is a leading indicator of inventory on dealer lots in the coming months. That being said, this month’s total supply of unsold new vehicles is 60% higher than this time last year.

However, the ongoing United Auto Workers strike is a short-term concern for inventory availability. See our blog from last week for more information concerning this strike and the implications it may have on the auto industry.

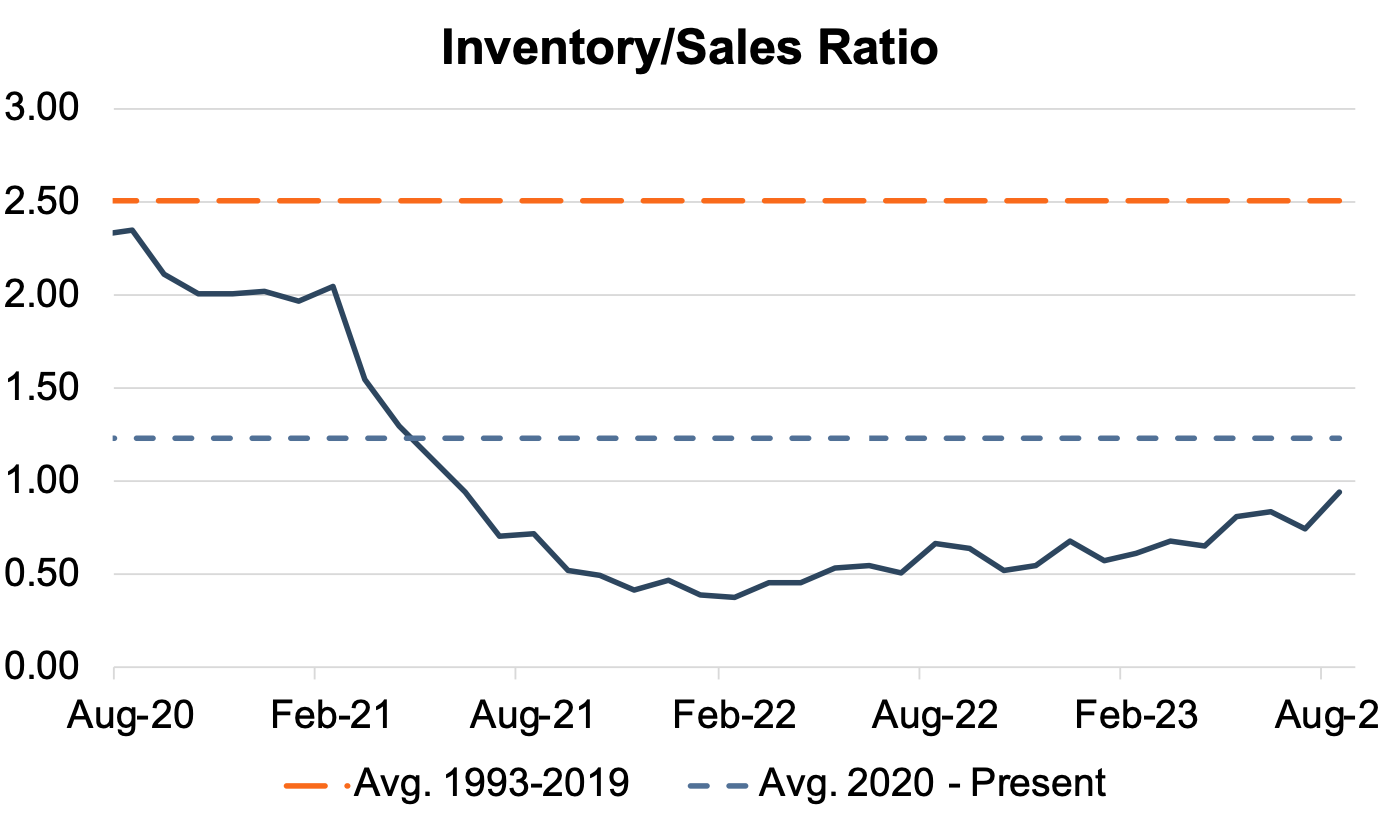

The chart below shows that the industry-wide inventory-to-sales ratio was 0.95x in August 2023. We have seen a steady ascension of this ratio since the beginning of 2022, and it looks like a ratio in excess of 1.0x may not be very far away. As a reminder, the last time this ratio was greater than 1.0x was in May 2021.

While it is clear that production volumes are still improving, elevated sales volumes have limited inventory buildup over the last year due to pent-up demand from fleet customers and retail consumers on the margins who had been waiting to purchase a vehicle. NADA reported that 16.1% of total sales were fleet sales in September, supporting the notion that pent-up demand is persisting. This proportion compares to pre-pandemic levels of fleet sales, which were between 17-19% from 2012 to 2019. During 2020 and 2021, fleet sales fell due to tight inventory and elevated pricing.

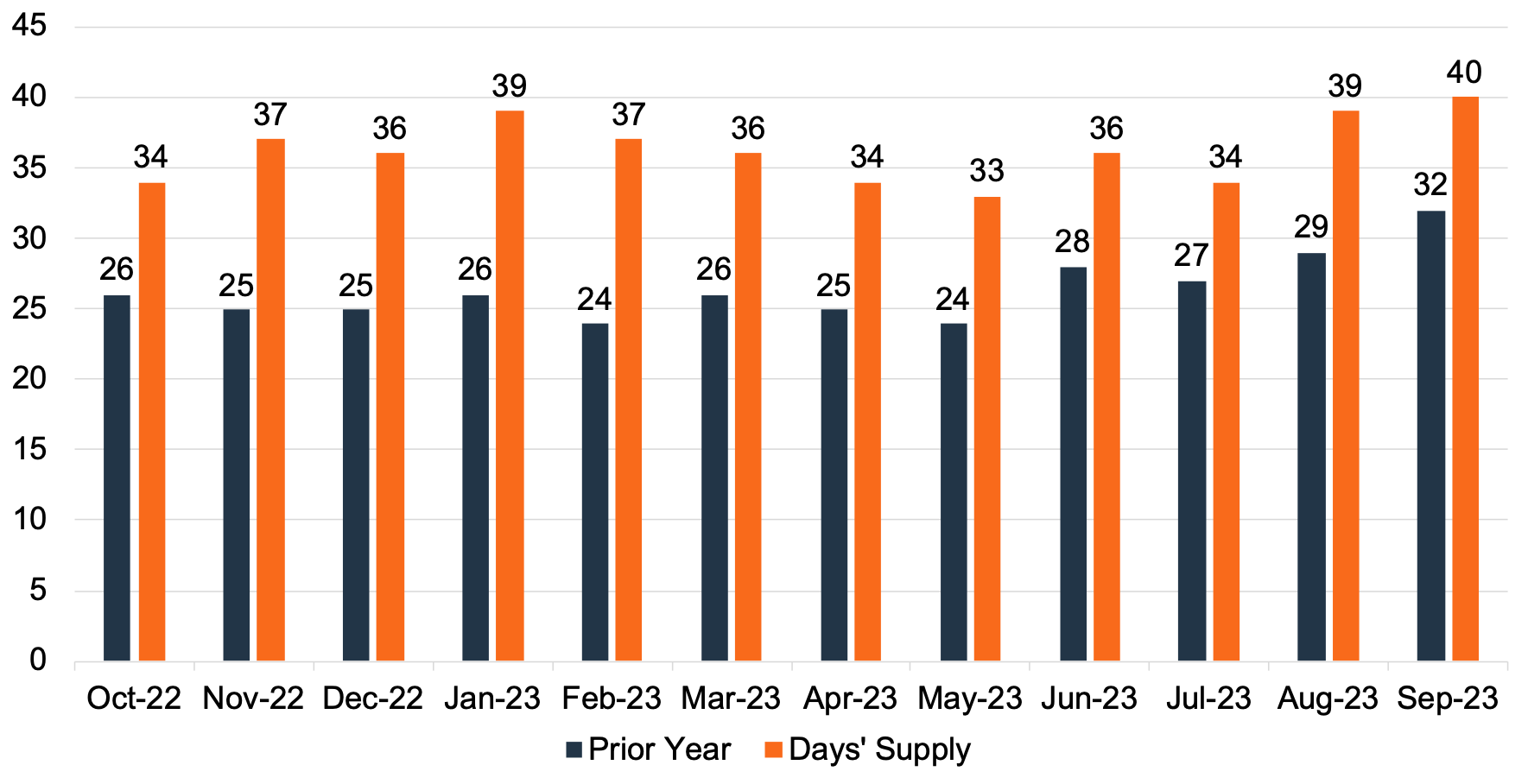

Another way to view the relationship between auto sales and inventory balances is through Days’ Supply, which has steadily increased over the past year. See the chart below for a close look at Days’ Supply for the entire industry (per Wards Intelligence):

Transaction Prices

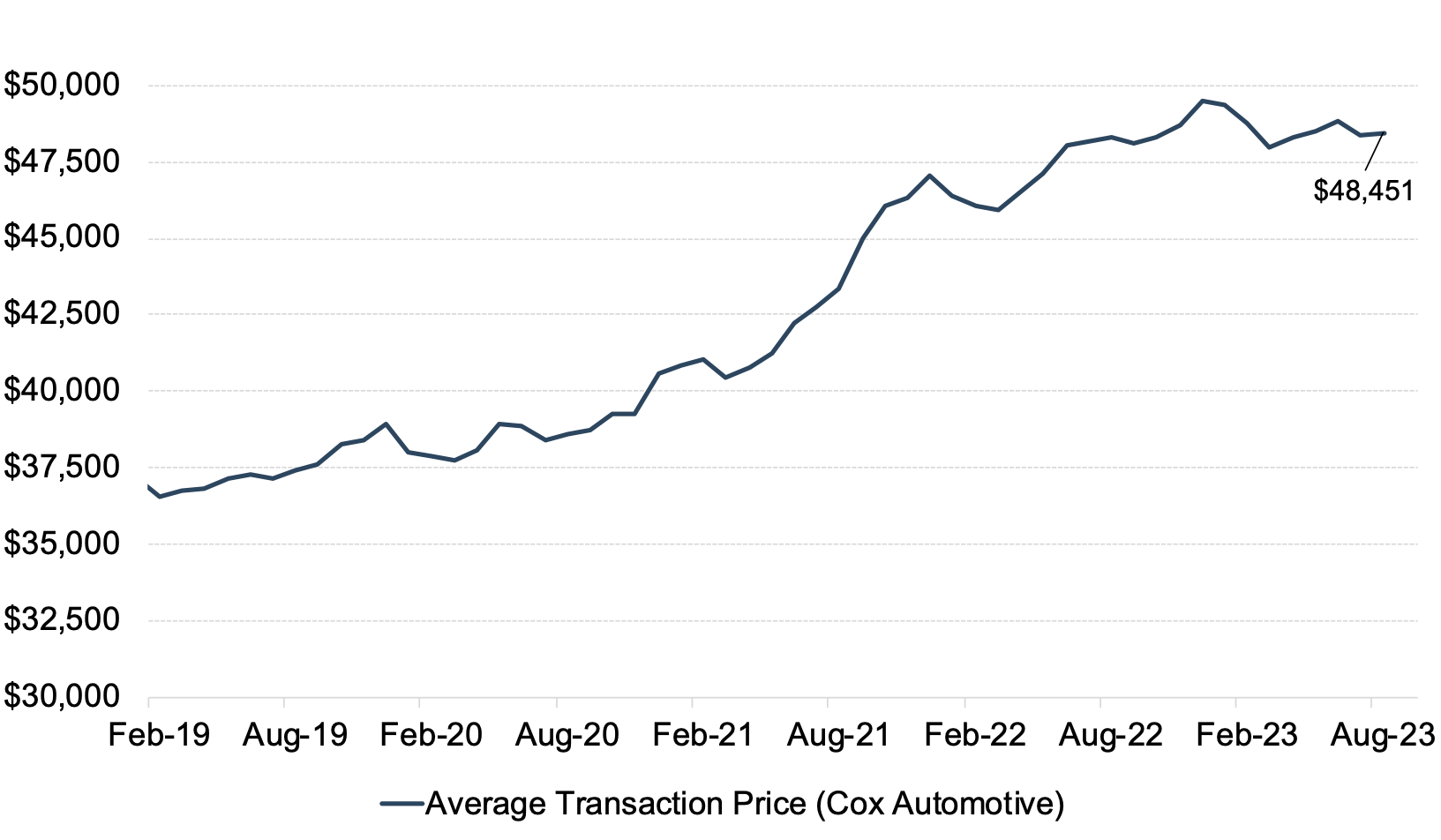

Thomas King, president of data and analytics at J.D. Power, had this to say about the average transaction price in August:

“As sales volumes improve, the average new-vehicle retail transaction price is declining very modestly […] even with the decline in average transaction prices, consumers are on track to spend nearly $46.8 billion on new vehicles this month—the highest on record for the month of September and 10.7% higher than September 2022.”

Increased supply across all models and a shifting vehicle mix are modestly dragging down the average transaction price. Persistent economy-wide inflation and the ongoing United Auto Workers strike are factors that could turn pricing momentum in the other direction. In particular, the United Auto Workers strike could grind production to a halt for General Motors, Stellantis, and Ford’s domestic production facilities. See the chart below for context around the monthly average transaction price from January 2019 to August 2023:

Incentive Spending

According to J.D. Power, average incentive spending per unit in September is expected to reach $1,806, up from $999 a year ago. Incentive spending as a percentage of the average MSRP is expected to increase to 3.7%, up 1.6 percentage points from September 2022. Average incentive spending per unit on trucks/SUVs in September is expected to be $1,921, up from $1,032 a year ago, while the average spending on cars is expected to be $1,340, up from $870 a year ago.

October 2023 Outlook

Mercer Capital’s outlook for the October 2023 SAAR continues to be optimistic. Industry supply chain conditions have improved but face new challenges like strikes and input pricing inflation. Sales volumes have continued to improve as dealers are seeing better inventory availability. However, it will be important to monitor consumer activity, which may begin to cool off as affordability becomes an issue, as evidenced by falling transaction prices and rising incentives.

Mercer Capital provides business valuation and financial advisory services, and our auto team helps dealers, their partners, and family members understand the value of their business. Contact a member of the Mercer Capital auto dealer team today to learn more about the value of your dealership.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights