Complex Valuation Issues in Auto Dealer Litigation

Solving the Puzzle

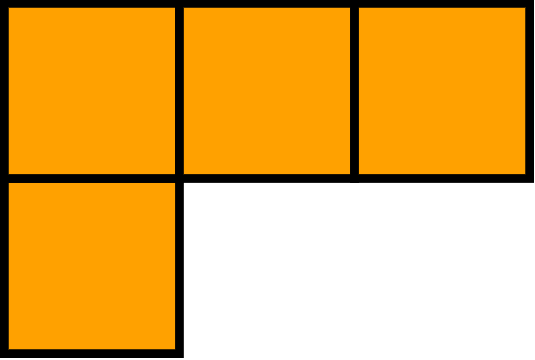

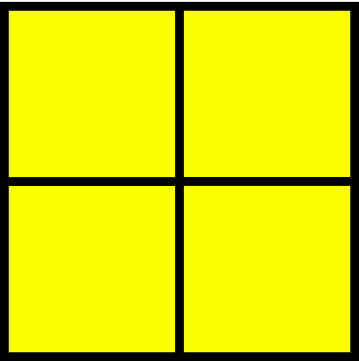

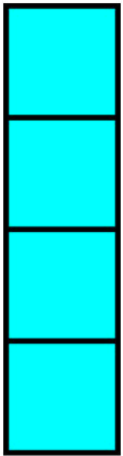

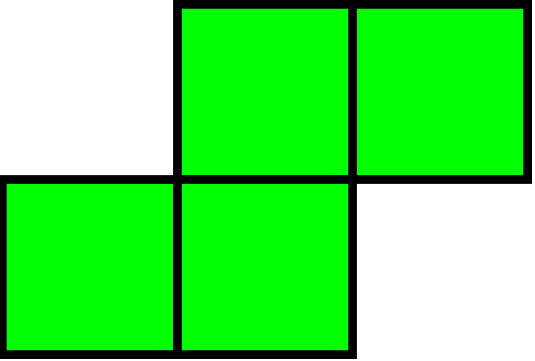

Litigation engagements are generally very complex, consisting of many moving parts. The analogy that comes to mind is the nostalgic game of Tetris. While invented in 1984 by a Russian named Alexey Pajitnov, most of us remember the iconic version popularized through the Nintendo Gameboy in the 1990s. The game featured seven game pieces cascading down at increasing speed forcing the game player to manipulate them by rotating and placing them, trying to create a flat surface. As anyone that has played can attest, the game creates more anxiety and stress as the pieces cascade faster and begin to pile up.

Like the game, many clients involved in auto dealer valuation disputes also experience anxiety and stress as problems begin to pile up. When assisting these clients in our family law and commercial litigation practices, we strive to help alleviate the pain points, or “clear the blocks.”

We hope you never find yourself a party to a legal dispute; however, we offer the following words of wisdom based upon our experience working in these valuation-related disputes.

The following topics, posed as questions, have been points of contention or common issues that have arisen in recent litigation engagements. We present them here so that if you are ever party to a dispute, you will be a more informed user of valuation and expert witness services.

We begin with seven questions to represent each of the original Tetris pieces, and we’ve added two questions to consider additional issues raised during the COVID-19 crisis.

Should Your Expert Witness Be a Valuation or an Industry Expert?

Oftentimes, the financial and business valuation portion of a litigation is referred to as a “battle of the experts” because you have at least two valuation experts – one for the plaintiff and one for the defendant. In the auto dealer world, you are hopefully combining valuation expertise with a highly-specialized industry.

Oftentimes, the financial and business valuation portion of a litigation is referred to as a “battle of the experts” because you have at least two valuation experts – one for the plaintiff and one for the defendant. In the auto dealer world, you are hopefully combining valuation expertise with a highly-specialized industry.

It is critical to engage an expert who is both a valuation expert and an industry expert – one who holds valuation credentials and has deep valuation knowledge and also understands and employs accepted industry-specific valuation techniques. Look with caution upon valuation experts with minimal industry experience who utilize general valuation methodologies often reserved for other industries (for example, Discounted Cash Flow (DCF)1 or multiples of Earnings Before Interest, Taxes and Depreciation (EBITDA)) with no discussion of Blue Sky multiples.

Does the Appraisal Discuss Local Economic Conditions and Competition Adequately?

The auto industry, like most industries, is dependent on the climate of the national economy. Additionally, auto dealers can be dependent or affected by conditions that are unique to their local economy. The type of franchise relative to the local demographics can also have a direct impact on the success/profitability of a particular auto dealer. For example, a luxury or high-line franchise in a smaller or rural market would not be expected to fare as well as one in a market that has a larger and wealthier demographic.

The auto industry, like most industries, is dependent on the climate of the national economy. Additionally, auto dealers can be dependent or affected by conditions that are unique to their local economy. The type of franchise relative to the local demographics can also have a direct impact on the success/profitability of a particular auto dealer. For example, a luxury or high-line franchise in a smaller or rural market would not be expected to fare as well as one in a market that has a larger and wealthier demographic.

In certain markets, an understanding of the local economy/industry is more important than an understanding of the overall auto dealer industry and national economy. Common examples are local markets that are home to a military base, oil & gas markets in Western Texas or natural gas in Pennsylvania, or fishing industries in coastal areas. There’s also a balance between understanding and acknowledging the impact of that local economy without overstating it. Often some of the risks of the local economy are already reflected in the historical operating results of the dealership.

If There Are Governing Corporate Documents, What Do They Say About Value, and Should They Be Relied Upon?

Many of the corporate entities involved in litigation have sophisticated governance documents that include operating agreements, buy-sell agreements, and the like. These documents often contain provisions to value the stock or entity through the use of a formula or process. Whether or not these agreements are to be relied upon in whole or in part in a litigated matter is not always clear. In litigation, the focus will be placed on whether the value concluded from a governance document represents fair market value, fair value, or some other standard of value. However, the formulas contained in these agreements are not always specific to the industry and may not include accepted valuation methodology for auto dealers.

Many of the corporate entities involved in litigation have sophisticated governance documents that include operating agreements, buy-sell agreements, and the like. These documents often contain provisions to value the stock or entity through the use of a formula or process. Whether or not these agreements are to be relied upon in whole or in part in a litigated matter is not always clear. In litigation, the focus will be placed on whether the value concluded from a governance document represents fair market value, fair value, or some other standard of value. However, the formulas contained in these agreements are not always specific to the industry and may not include accepted valuation methodology for auto dealers.

Two common questions that arise concerning these agreements are 1) has an indication of value ever been concluded using the governance document in the dealership’s history (in other words, has the dealership been valued using the methodology set out in the document)?; and 2) have there been any transactions, buy-ins or redemptions utilizing the values concluded in a governance document? These are important questions to consider when determining the appropriate weight to place on a value indication from a governance document. If they’ve never been used, and don’t conform to accepted valuation methodologies for auto dealers, then how reliable can these be?

Additionally, some litigation matters (such as divorce) state that the non-business party to the litigation is not bound by the value indicated by the governance document since they were not a signed party to that particular agreement. It is always important to discuss this issue with your attorney.

Have There Been Prior Internal Transactions of Company Stock and at What Price?

Similar to governance documents, another possible data point(s) in valuing an automotive dealership are internal transactions. A good appraiser will always ask if there have been prior transactions of company stock and, if so, how many have occurred, when did they occur, and at what terms did they occur? There is no magic number, but as with most statistics, more transactions closer to the date of valuation can often be considered as better indicators of value than fewer transactions further from the date of valuation.

Similar to governance documents, another possible data point(s) in valuing an automotive dealership are internal transactions. A good appraiser will always ask if there have been prior transactions of company stock and, if so, how many have occurred, when did they occur, and at what terms did they occur? There is no magic number, but as with most statistics, more transactions closer to the date of valuation can often be considered as better indicators of value than fewer transactions further from the date of valuation.

An important consideration is the motivation of the buyer and seller in these internal transactions. Motivations may not always be known, but it’s important for the financial expert to try to obtain that information. If there have been multiple internal transactions, appraisers have to determine the appropriateness of which transactions to possibly include and which to possibly exclude in their determination of value. Without an understanding of the motivation of the parties and specific facts of the transactions, it becomes trickier to include some, but exclude others. The more logical conclusion would be to include all of the transactions or exclude all of the transactions with a stated explanation.

What Do the Owner’s Personal Financial Statements Say and Are They Important?

Most owners of an auto dealership have to submit personal financial statements as part of the guarantee on the floor plan and other financing. The personal financial statement includes a listing of all of the dealer’s assets and liabilities, typically including some value assigned to the value of the dealership. In litigated matters, the stated value by the dealer principal on their personal financial statement provides another data point to valuation.

Most owners of an auto dealership have to submit personal financial statements as part of the guarantee on the floor plan and other financing. The personal financial statement includes a listing of all of the dealer’s assets and liabilities, typically including some value assigned to the value of the dealership. In litigated matters, the stated value by the dealer principal on their personal financial statement provides another data point to valuation.

One view of a personal financial statement is that no formal valuation process was used; so at best, it’s a thumb in the air, blind estimate of value of the business. The opposing view would say the individual submitting the personal financial statement is attesting to the accuracy and reliability of the financial figures contained in a document under penalty of perjury. Further, some would say that the business owner is the most informed person regarding the business, its future growth opportunities, competition, and the impact of economic and industry factors on the business. While they are not business appraisers, they are instrumental to a valuation expert’s understanding of risk and growth in their business.

It’s never a good situation to be surprised by the existence of these documents. A good business appraiser will always ask for them. The value indicated in a personal financial statement should be viewed in the light of value indications under other methodologies and sources of information. At a minimum, personal financial statements may require the expert to ask more questions or use other factors, such as national and local economy to explain the difference and changes in values over time. If an expert opines the value is X, but the personal financial statements says 3X or 1/3X, an expert must be prepared to explain the difference.

Does the Appraiser Understand the Industry and How to Use Comparable Industry Profitability Data?

The auto dealer industry is highly specialized and unique and should not be compared to general retail or manufacturing industries. As such, any sole comparison to general industry profitability data should be avoided. If your appraiser solely uses the Annual Statement Studies provided by the Risk Management Association (RMA) as a source of comparison for the balance sheet and income statement of your dealership to the industry, this could be problematic. RMA’s studies are organized by the North American Industry Classification System (NAICS). Typical new and used retail auto dealers would fall under NAICS #441110 or #441120. This general data may do the trick in certain industries, but most dealers sell both new and used vehicles. Further, RMA does not distinguish between different franchises.

The National Automobile Dealers Association (NADA) publishes monthly Dealership Financial Profiles broken down by Average Dealerships, which would be comparable to RMA data. However, NADA drills down further, segmenting the industry into the four following categories: Domestic Dealerships, Import Dealerships, Luxury Dealerships, and Mass Market Dealerships.

While no single comparison is perfect, an appraiser should know to consult more specific industry profitability data when available.

Do You Understand Actual Profitability vs. Expected Profitability and Why It’s Important?

Either through an income or Blue Sky approach, auto dealers are typically valued based upon expected profitability rather than actual profitability of the business.

Either through an income or Blue Sky approach, auto dealers are typically valued based upon expected profitability rather than actual profitability of the business.

The difference between actual and expected profitability generally consists of normalization adjustments. Normalization adjustments are made for any unusual or non-recurring items that do not reflect normal business operations. During the due diligence interview with management, an appraiser should ask does the dealership have non-recurring or personal expenses of the owner being paid by the business? Comparing the dealership to industry profitability data as discussed earlier can help the appraiser understand the degree to which the dealership may be underperforming.

If a dealership has historically reported 2% earnings before taxes (EBT) and the NADA data suggests 5%, the financial expert must analyze why there is a difference between these two data points and determine if there are normalizing adjustments to be applied. Let’s use some numbers to illustrate this point. For a dealership with revenue of $25 million, historical profitability at 2% would suggest EBT of $500,000. At 5%, expected EBT would be $1,250,000, or an increase of $750,000. In this case, the financial expert should analyze the financial statements and the dealership to determine if normalization adjustments are appropriate which, when made, will reflect a more realistic figure of the expected profitability of the dealership without non-recurring or personal owner expenses. This is important because, hypothetically, a new owner could optimize the business and eliminate some of these expenses; therefore, even dealerships with a history of negative or lower earnings can receive higher Blue Sky multiples because a buyer believes they can improve the performance of the dealership. However, as noted earlier, the dealership may be affected by the local economy and other issues that cannot be fixed so the lower historical EBT may be justified.

For more information on normalizing adjustments, see our article Automobile Dealership Valuation 101.

What Is the Date of Valuation and Why Does It Matter?

Depending on the state, family law matters might require the date of valuation to be the date of filing, the date of separation, the date of the trial (current), or some other date. Commercial litigation can require the date of valuation to be the date of a certain event, the date of trial (current), or some other date. Why does the date matter? In addition to the standard of value (generally fair market value or fair value), a business valuation contemplates a premise of value – often a going-concern business. The business appraiser must use the relevant known and knowable facts at the date of valuation to incorporate into a valuation conclusion. These facts reflected in historical financial performance, anticipated future operations, and industry/economic conditions can differ depending on the proper date of valuation.

As we are all experiencing during COVID-19, the conditions of March/April 2020 are vastly different than year-end 2019. It would be incorrect, however, to consider the impact of COVID-19 for a valuation date prior to Spring 2020.

How Have Auto Dealer Valuations Been Affected by COVID-19?

Valuations of auto dealers involve many factors. We also try to avoid absolutes in valuation such as “always” and “never.” The true answer to the question of how auto dealer valuations have been affected by COVID-19 is “It Depends.”

As a general benchmark, the overall performance of the stock market from the beginning of 2020 until now can serve as a barometer. Depending on the day, the stock market has declined anywhere between 20-30% during that time from previous highs. Specific indicators of each auto dealer, such as actual performance and the economic/industry conditions relative to their geographic footprint, also govern the impact of any potential change in valuation.

The litigation environment is already rife with doom and gloom expectations and we’ve previously written about the phenomenon referred to as divorce recession in family law engagements. While some auto dealers may go out of business as a result of COVID-19, the valuation of most may be deflated from prior indications of value, but generally, the conclusion is not zero. As always, it depends on the specific facts and circumstances of each particular auto dealer under examination.

Putting It All Together

As with all litigation engagements, the valuation of automobile dealerships can also be complex. A deep knowledge of the industry along with valuation expertise is the optimal combination for general valuation needs and certainly for valuation-related disputes. Understanding how these components fit together is important to a successful resolution, just like the assembly and combination of pieces in a game of Tetris. If you have a valuation issue, feel free to contact us to discuss it in confidence.

1 DCF methodology might have to be considered in the early stages of a Company’s lifecycle where the presence of historical financials either does not exist or are limited.

Images by DevinCook via Wikimedia Commons

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights